稳定币法规的批准将加密货币作为一种金融工具规范化,为全球最大的机构发行稳定币并将其用于支付铺平了道路。

撰文:Matt Hougan,Bitwise 首席投资官

编译:AIMan@金色财经

华盛顿的政客们做了正确的事。

我已经有一段时间没有机会写下这句话了,但今天我终于有机会写下它了。

周一,美国参议院以 66 票赞成、32 票反对的结果通过了《GENIUS 法案》的终结辩论,其中 16 名民主党议员跨越党派界限投了赞成票。该法案为美国的稳定币提供了坚实的监管框架。

我不想打如意算盘,但看起来我们将在今年夏天在美国通过第一部成熟的加密立法。

这是一件大事。

除了 2024 年 1 月批准的比特币现货 ETF 之外,这是加密货币历史上最重要的监管进展,甚至可能比这更重要。

我相信这为比特币以外的加密资产的长期持续上涨奠定了基础。最大的受益者是以太坊 (ETH)、Solana (SOL) 以及各种去中心化金融 (DeFi) 资产,例如 Uniswap (UNI) 和 Aave (AAVE)。

在我解释原因之前,让我们先简单讨论一下这到底是怎么回事。

什么是 GENIUS 法案?

稳定币是加密货币的杀手级应用之一。它们是美元的数字代表,可以在以太坊等区块链上流通。银行电汇需要 24 小时,而稳定币只需几秒钟即可完成结算——就像短信或电子邮件一样。

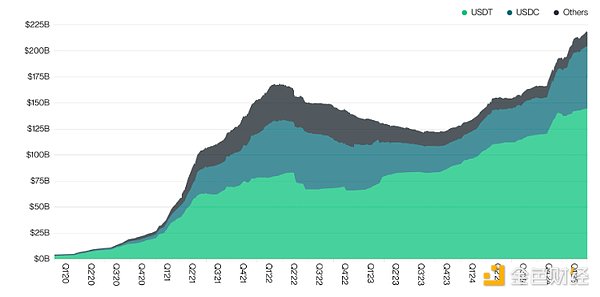

稳定币在 2019 年几乎不存在;如今其全球市值已超过 2000 亿美元。

稳定币市值,资料来源:Bitwise Asset Management,数据来自 The Block、Coin Metrics 和 CoinGecko。数据范围为 2020 年第一季度至 2025 年第一季度。

注:「其他」包括 BUSD、crvUSD、DAI、FDUSD、FEI、FRAX、GHO、GUSD、HUSD、LUSD、MIM、PYUSD、TUSD、USDD、USDP 和 USDS。

但稳定币长期以来一直处于监管灰色地带。像 Circle 这样的稳定币发行商必须遵守诸多法规,但目前并没有一个总体的联邦框架。《GENIUS 法案》提供了这一框架。

该法案保证:

- 稳定币将以 1 比 1 的比例由美国国债和美元等价物支持;

- 大型稳定币发行商将向联邦银行监管机构注册;

- 这些发行人将接受定期审计,以确保其稳健性;并且

- 稳定币发行者将对其代币实施反洗钱限制。

换句话说,该法案赋予联邦政府对稳定币的支持,允许大银行发行稳定币并允许商家接受它们。

令我惊讶的是,在没有世界上最大的金融机构参与的情况下,稳定币的资产规模增长到超过 2000 亿美元,而且消费者也无法轻松地区分 USDC 等「好的稳定币」和 TerraUSD 等「坏的稳定币」。

有了这些保护措施,我预计这个市场很快就会达到 2.5 万亿美元。闭上眼睛,想象一下这样一个世界:摩根大通和美国银行发行稳定币;如果你用稳定币而不是 Visa 卡购物,亚马逊会给你 2% 的折扣;接受稳定币就像接受 Venmo 或 PayPal 一样普遍。

这就是我们即将生活的世界。

仅仅是开始

尽管我对稳定币本身感到兴奋,但我认为这仅仅是个开始。一旦我们实现了美元在区块链网络上的正常转移——而且全球最大的金融机构都参与其中——那么在同一轨道上转移股票、债券和其他金融资产就只是一小步了。

这是投资以太坊、Solana 等非比特币加密资产的基本论点:超过 100 万亿美元的金融资产最终将转移到区块链上。这项法案的通过,将使这一趋势进一步恶化。

我怀疑这里的影响将类似于比特币 ETF 的影响。

现货比特币 ETF 的批准使加密货币作为一种投资方式规范化,现在全球一些最大的机构也发行了比特币 ETF 并将其纳入投资组合。我认为稳定币法规的批准将加密货币作为一种金融工具规范化,为全球最大的机构发行稳定币并将其用于支付铺平了道路。

真是天才之举。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。