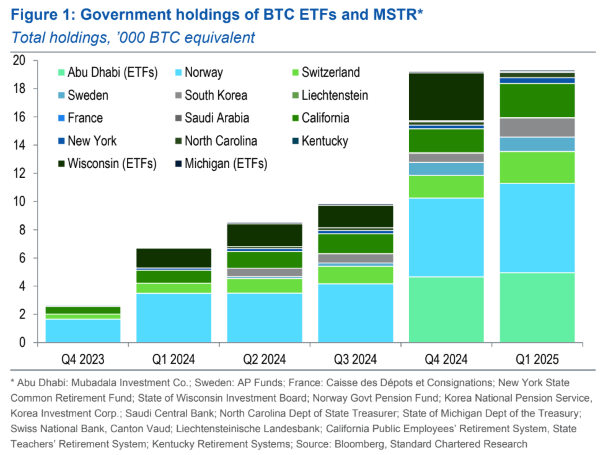

London-based Standard Chartered Bank published research on Tuesday showing that bitcoin ( BTC) has piqued the interest of an increasingly diverse group of institutions, according to recently filed 13-F documents.

The U.S. Securities and Exchange Commission (SEC) requires institutional investment firms that manage $100 million or more to report their holdings every quarter by submitting a 13-F form. The submitted forms are publicly available and provide detailed insights on the assets that large institutions such as public pension funds are investing in.

Standard Chartered reviewed 13-F data for the first quarter of 2025 and noticed an increase in the number of companies seeking bitcoin exposure via Strategy (Nasdaq: MSTR) stock. Previous data shows that Blackrock’s spot bitcoin exchange-traded fund (ETF) or Ishares Bitcoin Trust (IBIT) has been the most popular route for exposure to the cryptocurrency. But as interest in bitcoin ETFs subsided in Q1, MSTR, which has long been considered a bitcoin proxy, saw a surge in popularity; enough for Standard Chartered to forecast a $500,000 BTC price by January 2029.

(13-F data showing public entities that held bitcoin spot ETFs and/or MSTR in Q1 2025 / Standard Chartered Research)

“The latest 13F data from the U.S. Securities and Exchange Commission (SEC) supports our core thesis that bitcoin ( BTC) will reach the USD 500,000 level before Trump leaves office, as it attracts a wider range of institutional buyers,” the firm explained in its research paper. “As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in BTC.”

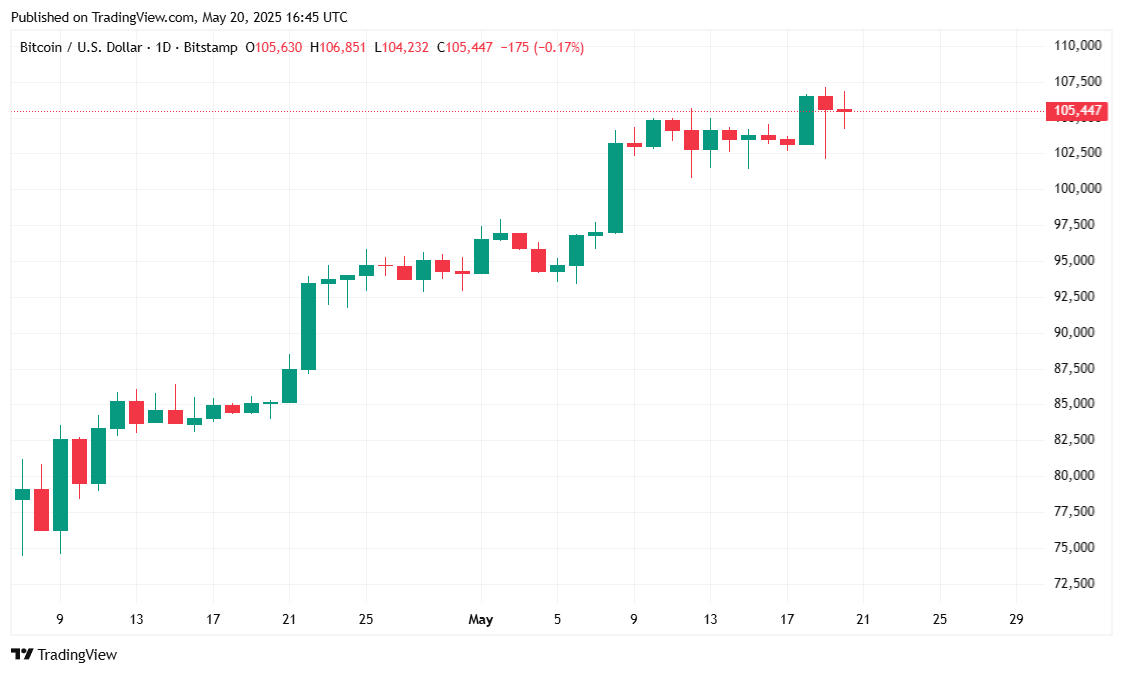

Bitcoin has been trading mostly sideways and is currently priced at $106,070.90, a 0.95% gain over the past 24 hours and a 2.15% increase since last week, according to data from Coinmarketcap. The cryptocurrency traded within a 24-hour range of $104,206.52 to $106,814.18, suggesting relatively stable price action. Market capitalization also saw a modest uptick of 0.26%, bringing BTC’s total valuation to $2.09 trillion.

( BTC price / Trading View)

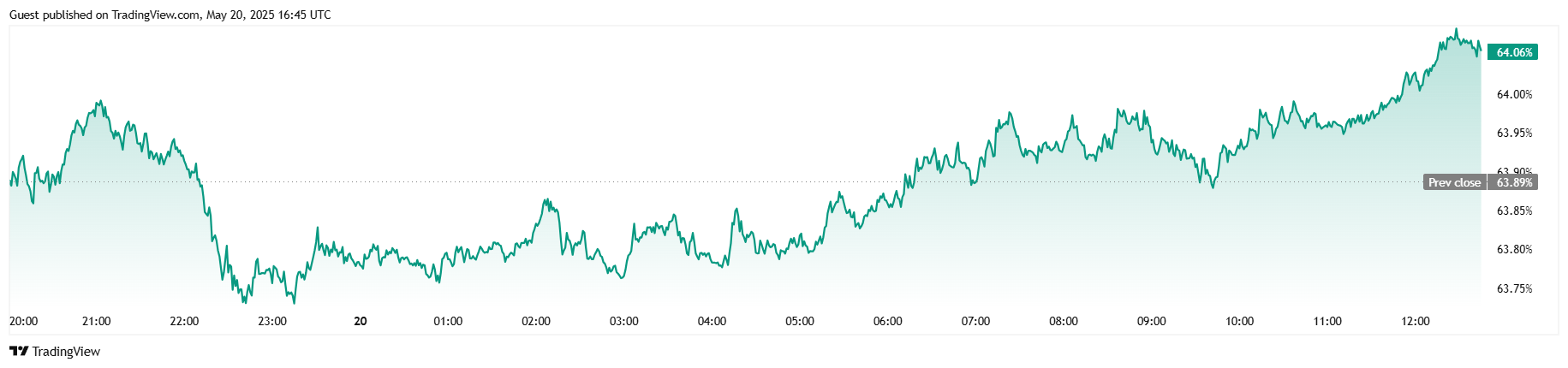

Despite the stability, trading volume cooled considerably, falling 23.14% to $51.32 billion in the past 24 hours. However, BTC’s dominance in the crypto market rose slightly to 64.05%, up by 0.26 percentage points, indicating a mild shift of capital back into the cryptocurrency despite somewhat subdued market activity. Futures open interest remained nearly flat, with a minor increase of 0.05% to $71.20 billion, showing that traders are still cautiously engaged.

( BTC dominance / Trading View)

Data from Coinglass reveals that today, much like yesterday, bears bet the wrong way. Of the $1.53 million in total liquidations over the past 24 hours, $1.52 million, almost all liquidations, came from short positions, compared to just $10,040 in long liquidations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。