Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

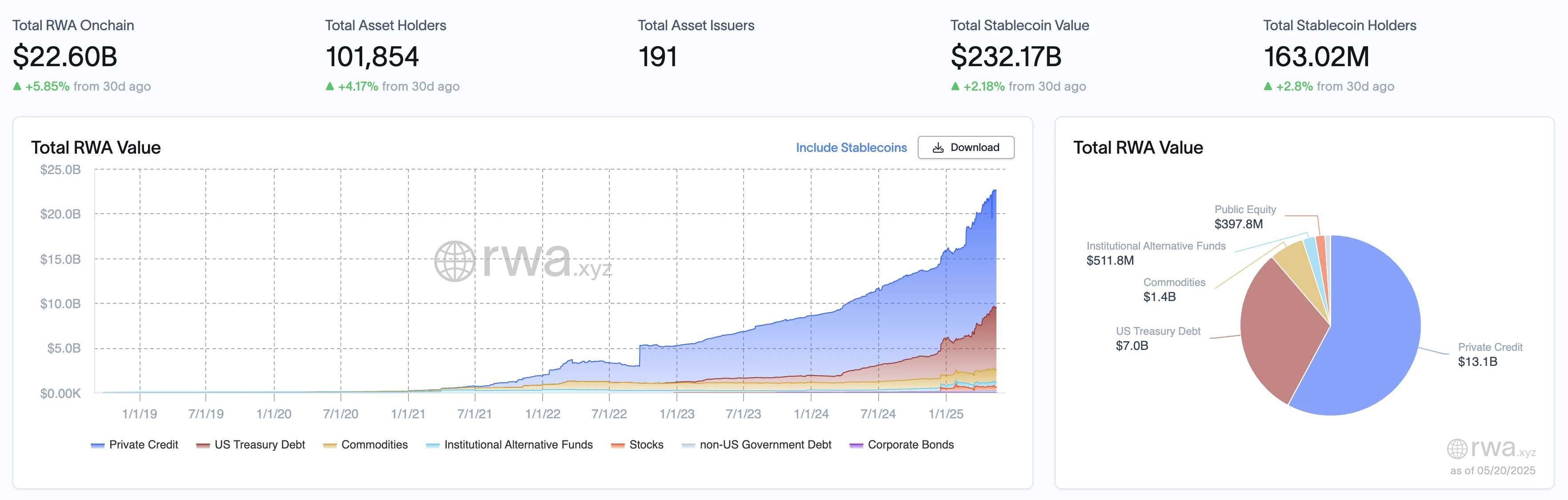

According to RWA.xyz data, as of May 20, 2025, the total on-chain value of RWA reached $22.6 billion, an increase of 5.85% compared to 30 days ago. The total number of on-chain asset holders was 101,854, an increase of 4.17% from 30 days ago, with a total of 191 asset issuances. The total value of stablecoins was $232.17 billion, an increase of 2.18% from 30 days ago, while the number of stablecoin holders was 163.02 million, up 2.8% from 30 days ago.

Historically, the total on-chain value of RWA has shown significant growth since 2019, particularly accelerating after 2023, peaking in early 2025, indicating the rapid adoption of tokenized assets. In terms of asset class distribution, private credit dominates with a value of $13.1 billion, accounting for 57.96% of the total value; US Treasury Debt is valued at $7 billion, making up 30.97%; commodities are at $1.4 billion, accounting for 6.19%; and international alternative funds are at $511.8 million, representing 2.26%. Stocks, non-US government debt, and corporate bonds have relatively small proportions.

Comparing with last week's data, this week's asset class distribution changes are still minor but show some noteworthy trends.

The value of private credit increased slightly from $13 billion to $13.1 billion, but its proportion slightly decreased from 58.09% to 57.96%, indicating that despite the total growth, its dominant position in the overall assets has been slightly diluted. Meanwhile, the value of US Treasury Debt increased from $6.8 billion to $7 billion, with its proportion rising from 30.38% to 30.97%, reflecting an increasing market demand for Treasury allocations.

The total value of commodities slightly declined from $1.5 billion to $1.4 billion, with its proportion dropping from 6.7% to 6.19%. On the other hand, institutional alternative funds grew from $478.5 million to $511.8 million, with a slight increase in proportion to 2.26%. Smaller asset classes such as stocks, non-US government debt, and corporate bonds have not shown significant expansion, maintaining a low proportion with limited market attention.

Summary:

This week, the allocation ratio of US Treasury bonds has slightly increased, which may indicate that some funds are leaning towards returning to stable assets in the current market environment; while private credit continues to grow, its growth rate has slowed. Overall, the coexistence of high-yield assets and low-volatility assets remains the main theme of RWA allocation. It is recommended that investors continue to pay attention to private credit opportunities while moderately increasing allocations to stable assets like US Treasury bonds to optimize the risk-return structure while being cautious about the still under-allocated stocks and corporate bonds.

Key Events Review

US Senate Passes Procedural Motion, GENIUS Stablecoin Bill Enters Formal Review Stage

According to Eleanor Terrett, the US Senate passed the procedural motion for the "GENIUS Act" with a vote of 66 in favor and 32 against, clearing the way for final legislation. The bill aims to establish a federal regulatory framework for stablecoins and their issuers. The previous version was stalled on May 8 due to disputes over consumer protection and national security clauses, but revisions to the text prompted several Democratic senators to switch to support. Senator Bill Hagerty, who is leading the bill, called it a "historic opportunity" to advance the first digital asset legislation.

US SEC Releases New Guidelines for Cryptocurrency Broker Regulation

The US Securities and Exchange Commission (SEC) recently released the latest Q&A guidelines regarding the regulatory rules for cryptocurrency brokers, clarifying that brokers holding non-securities crypto assets are not subject to securities capital rules (such as Rule 15c3-3), and non-securities crypto assets are not protected under the Securities Investor Protection Act (SIPA). Additionally, the SEC has provided regulatory guidance for transfer agents using distributed ledger technology for the first time and stated that more detailed regulations will be released in the future.

Asset Management Giant VanEck Launches Tokenized US Treasury Fund VBILL

Asset management company VanEck announced the launch of its first tokenized fund, VBILL, in collaboration with Securitize, providing on-chain investment channels for short-term US Treasury bonds. The fund is now live on Avalanche, BNB Chain, Ethereum, and Solana networks. Except for a minimum investment of $1 million on the Ethereum network, the investment threshold for other networks is $100,000. The fund's assets are custodied by State Street Bank and priced daily using the Redstone oracle.

Gnosis Acquires HQ.xyz for $14.9 Million, Accelerating Entry into Asian Market

German blockchain infrastructure project Gnosis has acquired Singapore-based on-chain business account platform HQ.xyz for $14.9 million, marking its largest acquisition to date. HQ has been renamed Gnosis HQ, supporting stablecoin payments, Visa card expenditures, traditional bank withdrawals, and financial management tools. This acquisition will propel Gnosis from infrastructure to application layers, officially entering the Asian Web3 financial services market.

Galaxy Digital in Talks with SEC About Stock Tokenization Plan

According to Bloomberg, Galaxy Digital is in discussions with the US Securities and Exchange Commission (SEC) regarding its stock tokenization plan. The plan aims to tokenize Galaxy Digital's stock and other stock assets to achieve higher trading efficiency and liquidity.

The New York Fed's Innovation Center and the Bank for International Settlements (BIS) Innovation Hub have jointly developed "Project Pine," creating a smart contract toolkit for central bank operations suitable for a tokenized financial system. This toolkit supports functions such as interest payments, open market operations, and collateral management, enhancing central banks' crisis response efficiency. The project is developed based on Ethereum-compatible Hyperledger Besu, emphasizing technological neutrality, aiming to prepare for a 24/7 operational future financial system.

Cryptocurrency payment platform MoonPay announced a partnership with Mastercard to launch a Mastercard-branded virtual card that supports stablecoin payments. Users can use stablecoins like USDC and USDT for transactions, which are automatically converted to fiat currency at the time of the transaction, usable at over 1.5 million Mastercard-accepting merchants worldwide. This collaboration is based on the API technology from Iron, a stablecoin payment infrastructure company acquired by MoonPay in March, aiming to simplify cross-border payment processes and enhance the real-world payment application of stablecoins.

Hot Project Updates

Ondo Finance (ONDO)

Official Website: https://ondo.finance/

Introduction: Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application scope within the DeFi ecosystem.

Recent Updates: On May 14, it was announced that Ondo completed its first cross-chain, atomic delivery versus payment (DvP) settlement transaction on the Ondo Chain testnet in collaboration with JPMorgan's Kinexys digital payment network and Chainlink, using Ondo's tokenized US Treasury bond fund OUSG.

On May 17, Ondo announced that its RWA product (primarily USDY) on the Solana network surpassed a total TVL of $250 million, accounting for over 99% of tokenized Treasury bond holders on the Solana network.

Plume Network

Official Website: https://plumenetwork.xyz/

Introduction: Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering investment barriers and increasing asset liquidity. Plume provides a customizable framework that supports developers in building RWA-related decentralized applications (dApps) and integrates DeFi with traditional finance through its ecosystem. Plume Network emphasizes compliance and security, dedicated to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Latest Updates: On May 16, Plume tweeted detailed information about the upcoming Plume Genesis phase (a key milestone for the mainnet) and its three core assets:

PLUME: The native token used for paying gas fees, governance, and staking.

pUSD: A stablecoin supported by RWA, used for payments and yield generation.

pETH: Tokenized Ethereum assets that support composability within the ecosystem.

On May 18, Plume announced that BTC interoperability features are set to launch soon, supporting the integration of Bitcoin assets with the Plume ecosystem. Specific details have not yet been disclosed, but it is expected to be achieved through cross-chain bridges or wrapped assets.

Recommended Related Articles

RWA Weekly Report: Summarizing the latest insights and market data in the industry.

《Hong Kong's On-Chain Race Heats Up, Major Players Accelerate RWA Implementation in Hong Kong》

As the global wave of asset tokenization sweeps through, Hong Kong is becoming a key testing ground for on-chain asset layouts. Recent developments in on-chain layouts are also experiencing a rapid evolution: on one hand, the Hong Kong government has launched multiple measures to promote tokenization experiments; on the other hand, several internet and traditional financial companies, including JD Technology, Futu Securities, Ant Group, and Guotai Junan, are actively advancing RWA layouts.

According to PANews, many domestic companies holding physical assets are also seeking to tokenize their assets on-chain for financing. The most common compliance solution is to confirm domestic assets on a consortium chain, then establish a holding entity in Hong Kong to control the domestic assets before conducting token financing. These companies span agriculture, new energy, and real estate, and the essence of exploring RWA (real asset tokenization) is still for financing, but the RWA industry in Hong Kong is still feeling its way forward.

《Web3 Lawyers Decode: What Kind of RWA Do We Understand?》

This article is written by the Web3 lawyer team "Crypto Law," providing a legal compliance perspective to systematically clarify the definitions, classifications, regulatory frameworks, and practical paths of RWA (real-world asset tokenization) in response to market discrepancies and compliance disputes regarding the concept.

《Ondo: Analysis of the Product Line, Competitors, and Token Valuation of RWA Leader》

Mint Venture research partner Alex Xu analyzes Ondo Finance, a representative project in the RWA (real-world asset tokenization) sector, from the perspective of an industry researcher, focusing on business logic, product layout, competitive landscape, and market valuation, combining insights from traditional finance and the intersection with cryptocurrency (Web3).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。