美国在周五失去了其完美的信用评级,评级机构穆迪将美国债务从“Aaa”下调至“ Aa1”,理由是对该国不断膨胀的36.87万亿美元主权债务的担忧,具体内容见该公司的发布。

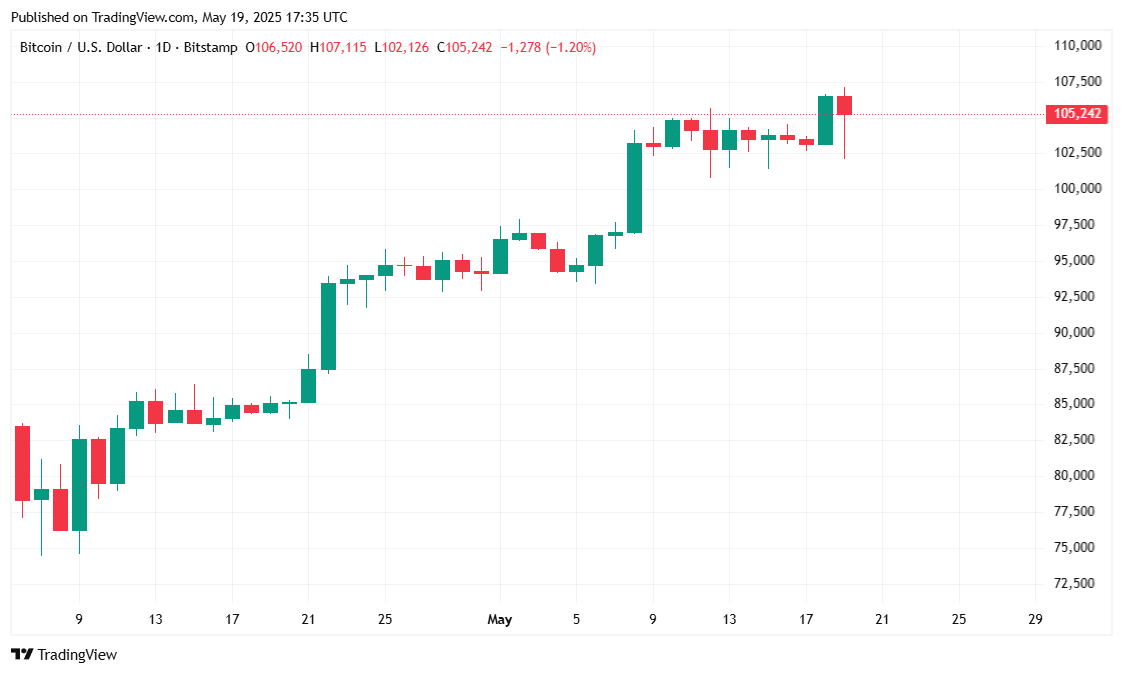

根据雅虎财经的报道,周一股市下跌,标准普尔500指数下跌0.13%,纳斯达克指数下跌0.31%,道琼斯指数在报道时微涨0.19%。Coinmarketcap的数据表明,加密货币市场也下跌了1.87%,比特币在经历了一个波动的周末后重新夺回了10.5万美元,尽管在周末期间一度下跌了5000美元,仅在5小时内。

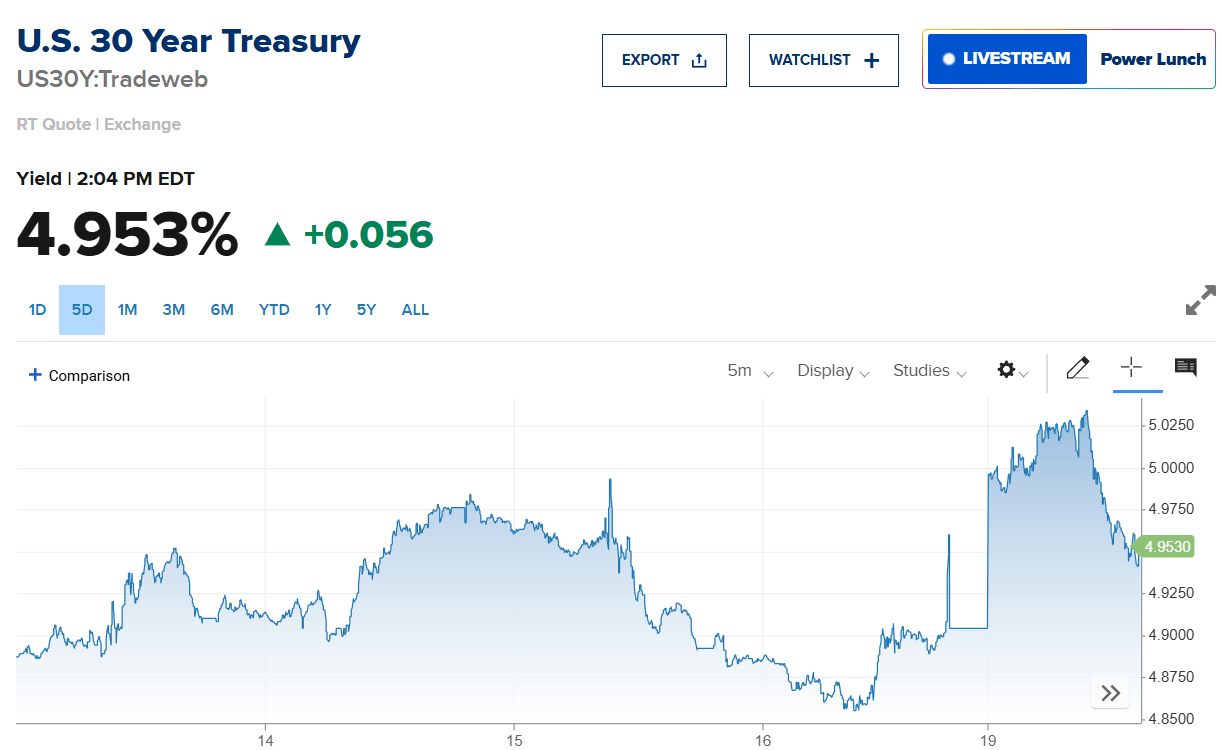

穆迪是最后一家下调美国债务评级的“三大”信用评级机构。其他两家,标准普尔和惠誉,分别在2011年和2023年下调了评级。穆迪的降级导致周一债券价格暴跌,收益率因此飙升。30年期国债收益率在报道时超过5%,随后回落至4.9%。债券收益率影响消费者借贷成本,周五的降级可能意味着汽车贷款和抵押贷款等零售产品的利率将上升。

(美国30年期国债收益率在穆迪降级后超过5% / CNBC)

比特币七天的价格上涨可能表明投资者正在押注这种加密货币,并放弃美元,因为政府可能被迫印更多的钱来偿还不断增加的债务。

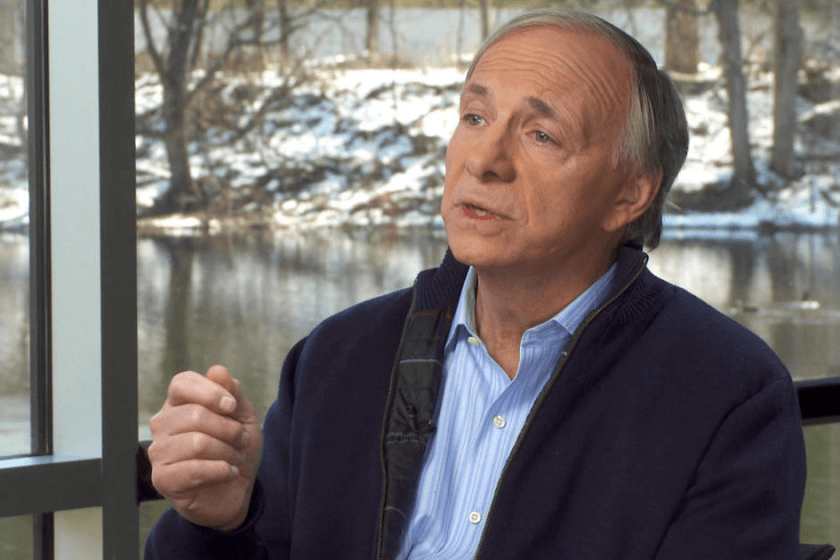

“你应该知道,信用评级低估了信用风险,因为它们只评估政府不偿还债务的风险,”亿万富翁对冲基金创始人瑞·达里奥在Linkedin上发文表示。“它们没有考虑到更大的风险,即负债国家将印钞偿还债务,从而导致债券持有者因所获得货币的贬值而遭受损失。”

(亿万富翁对冲基金创始人瑞·达里奥 / 布里奇沃特公司)

尽管在过去24小时内略微回落0.48%,比特币仍然回升至10.5万美元以上,目前交易价格为105,166.72美元,依据Coinmarketcap的数据。该加密货币的日内价格波动在102,112.69美元和107,068.72美元之间,周涨幅扩大至2.10%。最新的回调似乎是近期上涨势头后的轻微降温。

(比特币价格 / Trading View)

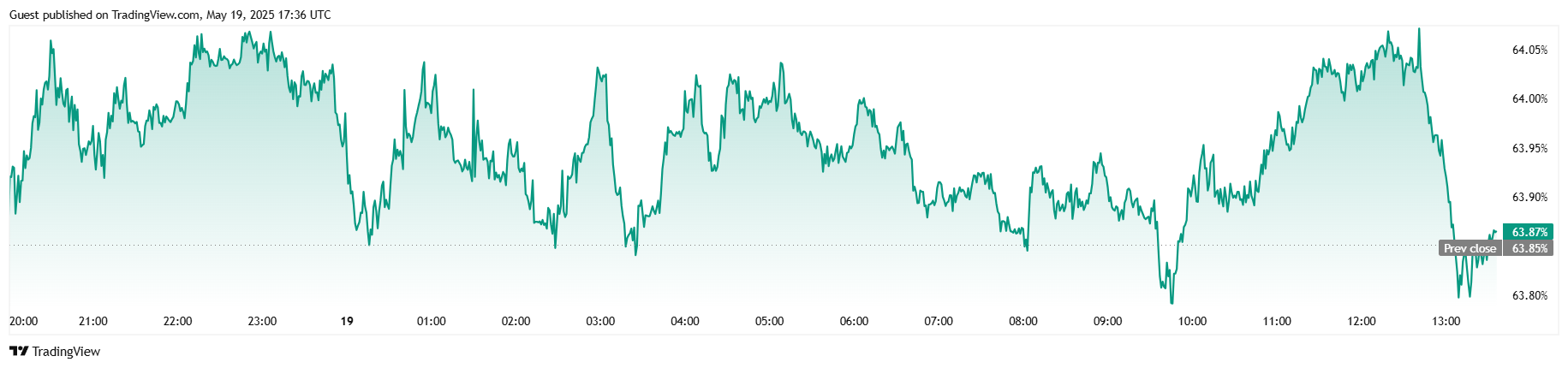

交易量激增至680.1亿美元,比前一天增加了68.72%,这主要归因于周末后市场活动的典型提升。比特币的市值略微下降0.54%,降至2.08万亿美元,反映了今天的小幅价格下跌。比特币的市场主导地位保持稳定,仅上升0.01%至63.87%,相对于更广泛的加密市场保持大致平衡。

(比特币主导地位 / Trading View)

在衍生品市场,总的比特币期货未平仓合约增加了0.96%,达到714.5亿美元,表明投资者的持续参与。Coinglass的清算数据显示,空头在最近的市场行动中承受了主要损失,空头头寸占总清算的610万美元中的570万美元,而多头损失则小得多,仅为417,220美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。