比特币和以太坊ETF尽管市场信号混杂,仍录得强劲资金流入

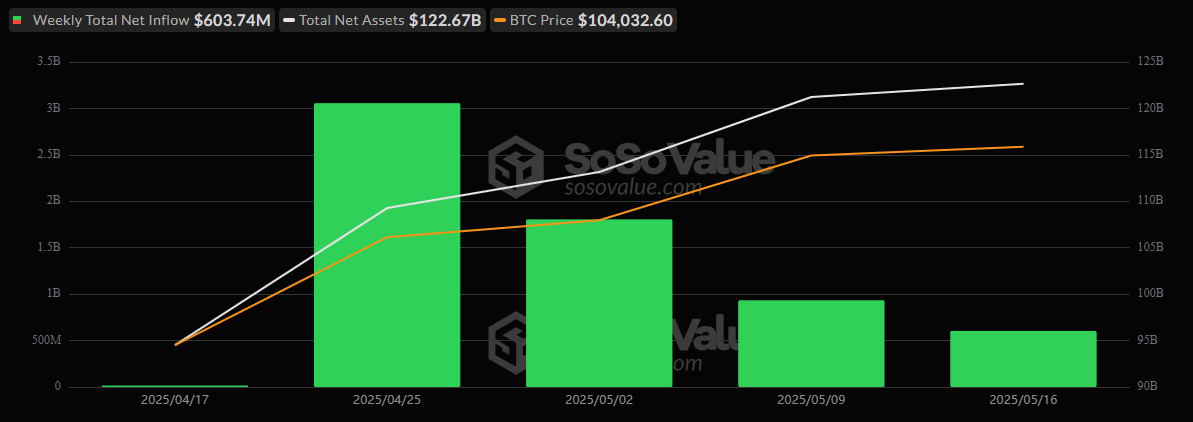

上周,加密货币交易所交易基金(ETF)的势头依然强劲,比特币ETF的净流入额达到了6.0374亿美元,标志着连续第五周的增长。亮点出现在5月14日星期三,单日流入额达到3.1956亿美元。

黑石的IBIT以8.4176亿美元的主导流入额领跑,远超其他基金。其他表现突出的包括Grayscale的比特币迷你信托(+3984万美元)和Vaneck的HODL(+732万美元)。相反,富达的FBTC(-1.2207亿美元)、Grayscale的GBTC(-7200万美元)和ARKB(-6891万美元)则出现了显著的周净流出。

来源:Sosovalue

尽管各个基金的表现参差不齐,比特币ETF的资金流入仍然显示出投资者的信心,总净资产达到了1226.7亿美元。

以太坊ETF也顺势而上,周末录得4159万美元的增幅,得益于5月14日星期三强劲的6347万美元流入。黑石的ETHA在排行榜上名列第一,流入额为6604万美元,其次是Grayscale的以太坊迷你信托(+1591万美元)、富兰克林的EZET(+306万美元)和Vaneck的ETHV(+295万美元)。

然而,富达的FETH(-2016万美元)和Grayscale的ETHE(-2622万美元)的流出略微抑制了增幅。

这两类资产都吸引着投资者的关注,随着比特币ETF流入连续五周,机构对加密货币的投资需求似乎远未减退。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。