一夜之间,加密领域最热门的叙事变成了「Internet Capital Markets」,以 Solana 生态新 Launchpad 平台 Believe 为首的一众加密项目和创始人纷纷发布这个短语,和「Believe in something」一起,成为拉开链上牛市的新口号。

那究竟什么是所谓的「互联网资本市场」,它会和 Base 生态此前的 Content Coin 一样成为一个昙花一现的炒作口号吗,又有哪些相关标的可供选择呢?

后 VC 币时代的融资方式

在几年前的一份融资 PPT 里,Solana 提到要做「链上纳斯达克」,或者说以纳斯达克的速度运行的区块链,以目前的加密生态来看,在速度方面,Solana 的确做到了这一点。但随着「资产发行」逐渐成为加密领域最大的元叙事,Solana 成为只提供交易功能的纳斯达克变得没有那么性感。

在经历了 Pumpfun、Timefun、Clount 等一系列产品的更新,Solana 的高吞吐量和低延迟使其适合构建全球化的去中心化资本市场,而非仅模仿纳斯达克的交易模式。市场目前更需要一个开放的、无需许可的融资和交易生态,覆盖从 meme 币到 NFT 再到初创项目的各种资产,这与 Solana 的技术优势更契合。

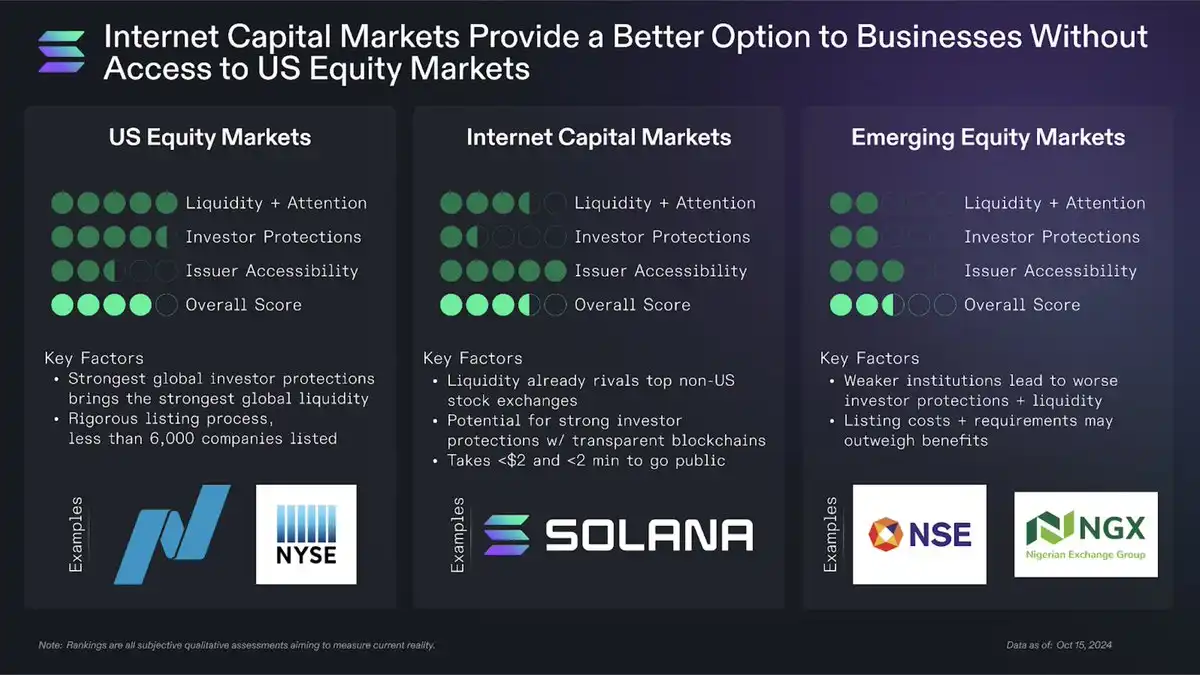

Solana 基金会主席 Lily Liu 是 Solana 致力于构建「互联网资本市场(Internet Capital Markets)」的布道者,在线上线下不同场合都曾解释到,互联网资本市场是指通过区块链技术打造全球金融基础设施,让 55 亿互联网用户都能参与资本市场的资产交易,这一愿景将 ICM 定义为一种去中心化的融资方式,打破传统金融的壁垒(如复杂文书和高门槛)。

2024 年 12 月底,Solana 生态 Superteam 负责人 Akshay BD 曾在 Solana 2025 营销备忘录中提到「互联网资本市场」和「F.A.T. 协议工程」两个概念。他认为在 2024 年,企业将直接「在互联网上」上市,并能接触到超过十亿名持有私钥的投资者——他们用手中的资金为自己期望的未来投票,不仅限于股票,而是涵盖所有值得拥有的资产类别、文化与理念。

最近升温迅速的 AI 发币平台 Virtuals 也在做同样的事情,其推出的积分化打新机制 Genesis,用户可通过购买 Virtuals 生态代币、质押 VIRTUAL、VADER 等渠道累积积分,并获得参与新项目发行的访问权限,这对新项目而言是一个发行代币并成功冷启动的选择。

不过,Virtuals 生态主要集中在 Crypto+AI 赛道,而当前获得最多关注的平台,则是一个叫 Believe 的发币平台,前身为社交影响力资产化平台 Clout。Believe 平台的 Slogan 类似于「Believe in Something」,用户可以在任何一条推文下面回复 @launch 代币名,就能把它变成一个代币。

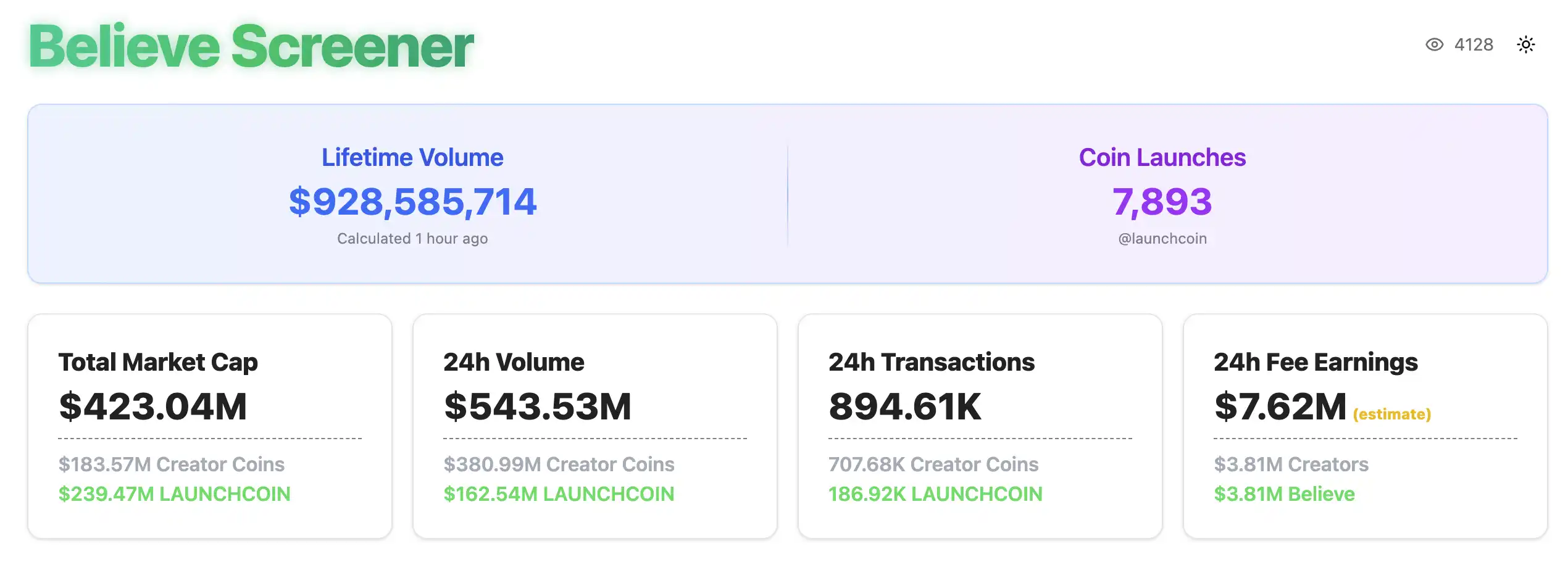

自 4 月 27 日上线以来,Believe 展现出了强大的市场爆发力。不仅得到了 Solana 生态主流项目和创始人的关注,收入方面也十分可观。据 Believescreener 数据,Believe 平台过去 24 小时收入预估达 762 万美元,其中创作者收入达 381 万美元。

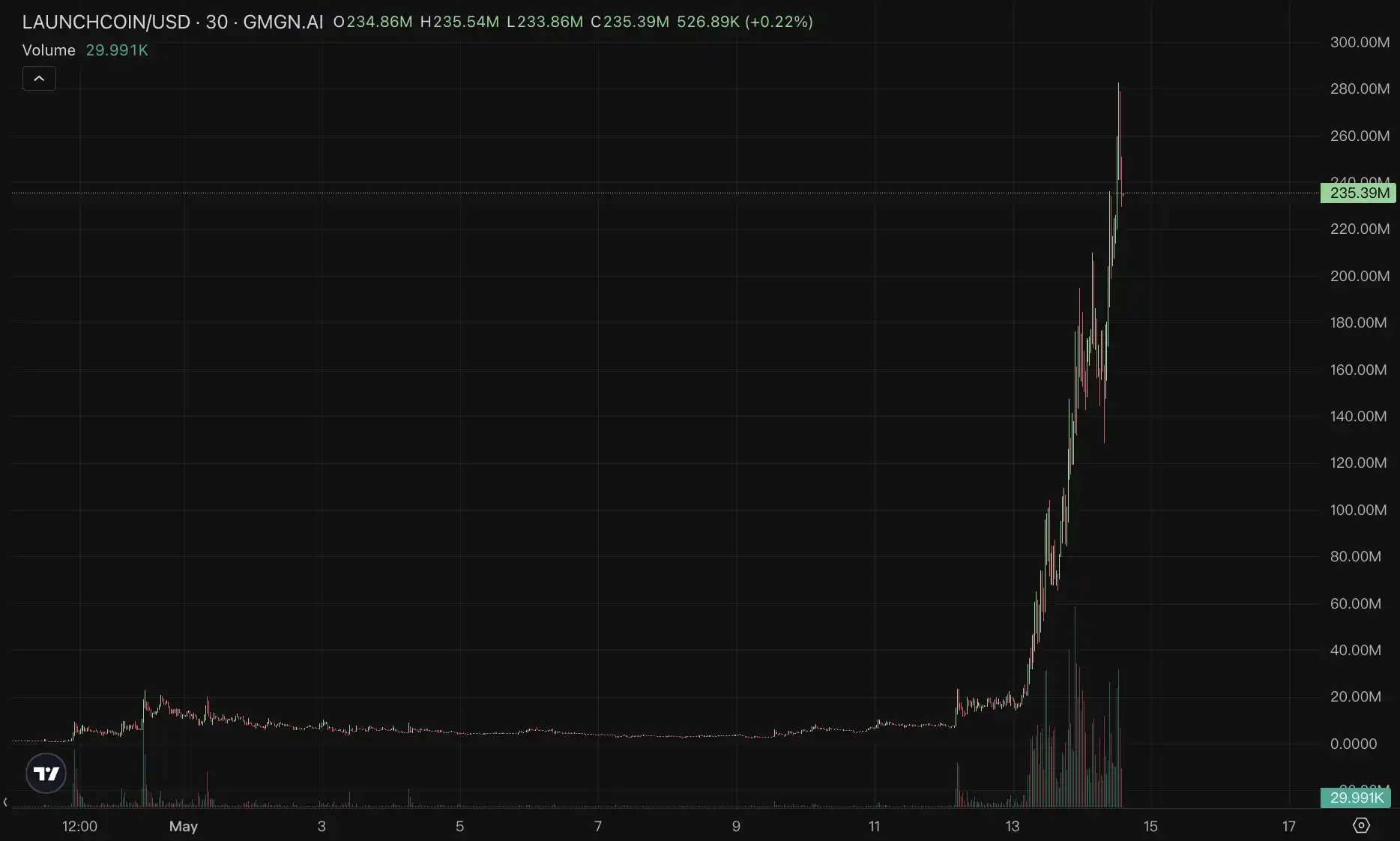

随着 Believe 的平台币 LaunchCoin 暴涨,Believe 平台发射的其它代币也获得了市场关注,而这些代币又被划归到前文所提到的「Internet Capital Markets」概念中,因为它们相较于 Pump.Fun 上的代币只有一张图片而言,还创建了实际的产品。

ICM 相关概念币

目前的 ICM 龙头概念当属 Believe 平台币 LAUNCHCOIN。其实 Believe 和以往的代币发射平台并无任何技术上的区别,如果你有一个想法,只需在 X 上 @launchcoin 并写上代币名,就能创建一个代币。别人相信你的想法,就会购买你的代币。你作为创建者可以提取费用,用于将想法付诸实践。

LAUNCHCOIN 当前市值达 2.35 亿美元,24 小时涨幅达 220%。

相关阅读:《LaunchCoin 一天 200 倍,Believe 如何在归零后造出 2 亿美元金狗?|100x 复盘》

BSCREENER

BSCREENER 是 BelieveScreener 的平台币,BelieveScreener 是 Believe 的一个看板平台,发起人为 @nanowisp,其表示代币交易费用将用于支付网站和托管成本。没有代币效用,没有奖励机制,也没有路线图——只是一个简单的代币来帮助保持项目运行。

目前 BSCREENER 市值达 1360 万美元,24 小时涨幅达 2500%,由于代币上线时间不久,仍有待观察后续表现。

DUPE

DUPE(Deal Unlocking Price Engine)是一个「寻找平替」的工具,由 @nikitabier 和 @ghoshal 提出。只需在任意商品页面链接前加上「dupe dot com」,系统就会自动帮你找到更便宜的相似商品。

目前 DUPE 市值超过 5000 万美元,24 小时涨幅达 30%。

AURA

AURA 是 Aurascope 的平台币,Aurascope 是一款相机优先的移动应用程序,用户可以扫描现实世界的物体、地点和人物,以了解它们如何影响您的能量,跟踪您的每日得分,增加您的收藏,并与朋友竞争以与周围环境保持同步,并且会奖励在平台上发帖的贡献者。其创始人是前 VC 及 Rising Star 的合伙人 @sabakarimm。

AURA 当前市值为 900 万美元,24 小时涨幅 800%。

BUDDY

BUDDY 是由 @AlexFinnX 推出的 CreatorBuddy 平台币,CreatorBuddy 是一个拥有你 X 平台发文权限的 AI 助理。你可以问它任何和你过往内容相关的问题。功能包含 8 个 AI 工具:内容教练、算法分析、内容创作、回复助手、账号研究、历史回顾、大脑转储与灵感激发。

BUDDY 当前市值为 1200 万美元,24 小时跌幅为 4%。

FITCOIN

@fittedcloset 一个由 AI 驱动的虚拟衣橱应用,用户可以上传自己的衣服,搭配造型,转售闲置,还能和朋友分享。目前已超 30 万下载、3 亿+社媒浏览量,平台已上传超 100 万件服饰。

FITCOIN 目前市值接近 700 万美元,24 小时涨幅 96%。

此外,Believe 平台上还有短视频 App Giggles,用户互动可获得加密奖励;帮助开发者「可视化理解并对话代码库」的工具 SuperFriend;无需流动性支持的预测市场平台 PNP;专注于 AI 格斗训练、提供个性化训练计划的应用 Kayyo;可生成超写实 AI 网红的工具 CreatorGen;整合多个顶级 AI 工具于一体的 NinjaChat 等不同应用,其都在 Believe 上发行了自己的代币,读者可前往 Believe看板进行查看。

ICM 的真正命题,谁来为好资产代币化?

尽管 Believe 的炒作让 Launchcoin 的市值不断上涨,但社区中仍有不少人发出质疑,认为「Internet Capital Markets」不过又是另一场虚无的代币生成泡沫,如同去年底的 AI Agent 狂潮,并未产生多少 AI 应用的实际价值,只是资金与流量的狂欢。

然而,如果把眼光放远,会发现这些现象背后其实隐含着一种结构性的转变——加密世界正在从「虚构叙事」走向「现实套利」。如 Akshay BD 在其最新的推文中阐释的那样,从资本市场的角度看,Crypto 已经很好地解决了降低资产获取门槛的问题。无论身处何地,只要你有一个手机 App 和一点稳定币,就能自由地投资任何链上的资产,不再需要绕过复杂的银行、券商系统,也无需等待数周来开设离岸账户。这种「自由」的可及性,在传统金融体系中是不可想象的。

问题在于,Crypto 还没有解决「优质资产的发行机制」。当前代币市场充斥着大量毫无内在价值的 Meme、空壳项目和炒作概念,这并不是技术的错,而是监管缺位和激励扭曲的自然结果。在传统市场里,证券发行有明确的门槛、流程和信息披露机制,而在链上,任何人随便就能发币,流动性瞬间就能跟上,投机者迅速涌入。这种「高度自由」的发行机制,反而让真正具备价值的资产更难脱颖而出。

Akshay 认为,构建一个让「优质资产」也能以同样便捷方式发行的系统是 Solana 下一步要考虑的事情,换句话说,「Internet Capital Markets」的最终落点,不应是「谁都能发一个币」,而是「让那些原本难以发行、难以接触的好资产,变得触手可及」。

背后的判断标准一是资产是否能从当下特殊的经济/地缘环境中受益,二是是否难以通过传统券商和银行买到。如果这两个条件都满足,那它就有理由被「代币化」。

比如过去十年,美元之所以成为链上主权资产的霸主,不是因为它技术上容易代币化,而是因为全球用户对抗本国法币贬值时,别无选择。比特币在 2010 年代的崛起,同样也是一种「环境套利」——以货币超发背景下的去中心化对冲资产自居。而今天,若能识别出类似的「结构性需求资产」,并通过链上发行真正实现「自由获取」,这才是真正意义上的 ICM,不是虚无的叙事,而是制度红利的兑现。

从这个角度看,Believe 和 LaunchCoin 也许只是一个开端,一种原型,一场带有明显娱乐性和泡沫色彩的「实验性破口」——它未必能留下价值沉淀,但它试图打通的机制路径,确实是未来一部分资产要走的必经之路。最终,「Internet Capital Markets」不会是所有人随便发个币,而是所有人都能方便地买到好资产。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。