US Tariff Revenue Hits Record in April! BTC Mining Cost Below $37,000?

Macro Interpretation: The current global financial market is undergoing an unprecedented complex transformation, with the phased results of the US-China tariff agreement creating a counterbalancing effect against the dollar's trust crisis. This unique macroeconomic tension injects new momentum into the cryptocurrency market. Notably, the latest data from the US Treasury shows that tariff revenue surged to $16 billion in April, with a single-day record exceeding $500 million, which implicitly reflects the pressure of restructuring the global trade system. This pressure is reshaping the pricing logic of crypto assets through multiple transmission mechanisms.

From the perspective of the miner's economic model, the $36,800 single-coin mining cost line has become an important anchor point in the market. The current 182% premium space between BTC's price and the cost line effectively constitutes a "margin of safety" similar to traditional commodities. Interestingly, this profit level corresponds historically with the starting point of the bull market in November 2022, and the recovery ability of the miner community after the halving impact may determine the subsequent market resilience. The intensifying competition in computing power is noteworthy, with annual capital expenditures in the tens of billions of dollars forming a moat for computing power. This technological arms race fundamentally differs from the ASIC mining machine iteration wave of 2017, as the current growth in computing power is more driven by institutional investors' premium recognition of network security.

The trust crisis in dollar assets is catalyzing capital migration. A Bank of America survey shows that bearish sentiment towards the dollar has reached a 19-year high, resonating with UBS's downgrade of US stock ratings. This demand for capital reallocation presents structural characteristics in the crypto market: institutions like MicroStrategy continue to increase their holdings, reducing the circulating supply, while Coinbase's inclusion in the S&P 500 index marks the formal entry of crypto assets into mainstream allocation. It is worth noting that the entry of traditional institutions brings not only incremental capital but also reshapes market volatility patterns. The CME Bitcoin futures open interest has reached a historical high, indicating that the application of risk management tools is stabilizing short-term price fluctuations.

Geopolitical games inject special variables into the crypto market. The erratic tariff policies of the Trump administration have objectively strengthened Bitcoin's "digital gold" narrative. The 14% rebound in the S&P 500 index following the "buy the dip" call on April 9, along with the weakening correlation with BTC, suggests that crypto assets are beginning to show independence. This trend is particularly evident in the ETH market, where the technical breakthroughs brought by the Pectra upgrade have pushed prices to stabilize above $2,400, and the narrowing of put skew in the options market indicates that institutional investors are establishing strategic positions. It is noteworthy that BTC's dominance falling below 63% may signal the arrival of altcoin season, but the significant increase in the technical upgrade density of mainstream tokens in this cycle fundamentally differs from the mere concept speculation of 2017.

The subtle changes in monetary policy expectations are forming long-term benefits. JPMorgan's assessment of a 30 basis point rate cut space in China's monetary policy, combined with adjustments in the Federal Reserve's balance sheet reduction pace, is giving rise to new types of hedging demand amid the tightening and loosening of global liquidity. The 3% intraday volatility in gold prices contrasts sharply with the stability of BTC's range, suggesting that this ebb and flow may indicate a broader recognition of the "digital gold" value storage function. From the perspective of capital flow, the surge in demand for backend options exposes institutional investors' long-term layout thinking, and the steepening of the volatility curve suggests that the market is accumulating energy for a significant breakthrough.

The resonance effect of multiple factors at this point may be nurturing a qualitative change in the market. The hard constraints of miner costs, the technical support for computing power growth, the continuous erosion of dollar credit, and the normalization of geopolitical risks collectively form the fundamentals for Bitcoin to break through previous highs. Historical experience shows that when the mining capital expenditure curve intersects with the price curve, it often signals the arrival of a bull market's main upward wave. Currently, the annual computing power investment scale of $12 billion has far exceeded the levels of the 2017 cycle, and this "computing power premium" may be reconstructing Bitcoin's value discovery mechanism. Against the backdrop of expanding fissures in the traditional financial system, the "institutional substitution" attribute of crypto assets may usher in a critical window for value reassessment.

Data Analysis:

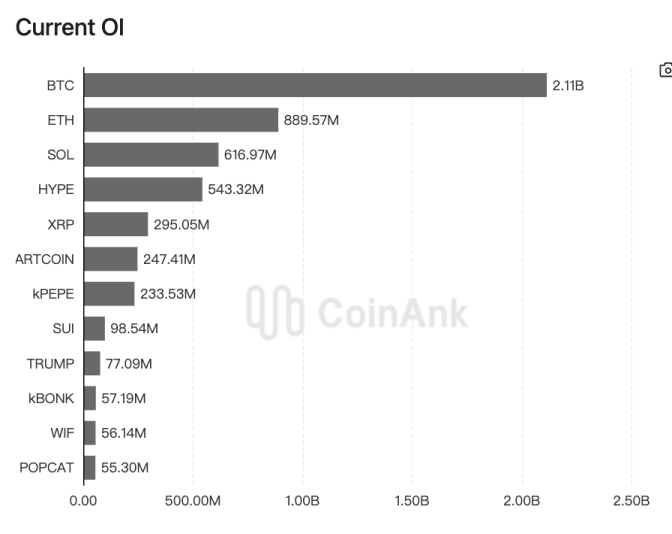

According to CoinAank data, on May 13, 2025, the open interest on the Hyperliquid platform surpassed $6.7 billion, setting a historical record in the decentralized finance (DeFi) derivatives market.

Behind this milestone, Hyperliquid continues to solidify its market dominance through the innovative combination of its high-performance Layer-1 blockchain architecture and perpetual contract DEX. On the technical side, its HyperBFT consensus mechanism achieves sub-second latency and processing capabilities of over 200,000 orders per second, attracting high-frequency traders; in terms of product design, the atomic liquidation mechanism, risk control model, and fees as low as those of centralized exchanges replicate the efficient experience of centralized trading on-chain. It is noteworthy that the platform's open interest accounted for only 10% of Binance in 2024, but through token incentives, EVM ecosystem expansion, and increased trading demand due to market volatility, its market share surged to an industry-leading level within a year.

This data breakthrough has multiple implications for the crypto market. First, Hyperliquid validates the potential of decentralized derivatives protocols to challenge centralized exchanges (CEX) in terms of liquidity and scale, with its open interest accounting for 66.2% of the total scale of the top ten DEXs, which may accelerate the migration of capital from traditional CEX to on-chain. Second, the platform distributes profits to the community through a token economic model (such as the HYPE token), promoting innovation in DeFi governance models. However, it is essential to be cautious, as excessive reliance on a single protocol may lead to concentrated systemic risks, such as the recent trust crisis caused by oracle mechanism flaws that led to a 25% drop in token prices in a single day. Overall, the rise of Hyperliquid marks a critical juncture in the transformation of derivatives market infrastructure towards a decentralized paradigm, and its technological iteration and ecosystem expansion will become an important window for observing DeFi competitiveness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。