Original | Odaily Planet Daily (@OdailyChina)

Introduction: Market Recovery, Opportunities Arise

In the past two days, the crypto market has reversed its downward trend, with BTC returning to $100,000 after three months, and ETH also rebounding strongly with a daily increase of over 20%. However, many crypto players unfortunately missed out, and some even faced liquidation from short positions.

Faced with the complex changes in the market, more and more investors are asking: Is there an investment method that has a low threshold, is easy to operate, can yield stable profits, and can adapt to complex market changes?

The answer is Binance Dual Investment. This financial tool, though low-key, has quietly become a powerful tool for smart "landlords" in the current market.

1. Binance Dual Investment: A "Smart Business" in a Complex Market Environment

In the crypto world, you may encounter such dilemmas:

Sometimes you want to wait for the price to pull back before buying, but it never reaches your ideal position; other times, you hold onto your coins waiting for a price increase, but worry that the increase won't be enough, missing the selling point. In this indecisive situation, most people miss good opportunities and also incur time costs.

The core idea of Dual Investment is to use "current price limit orders + locked interest" to monetize this idle time. Compared to limit orders for buying and selling, dual investment allows you to earn an additional interest, significantly improving the utilization of funds.

Its logic is not complicated; it is essentially a "contract for future prices" transaction: you set a target price in advance, expressing your judgment on the market, whether you plan to buy low or sell high, the system will automatically complete this transaction at maturity—regardless of whether the transaction is successful, you will receive interest as "compensation for time."

Dual Investment supports flexible strategies, catering to investors with different risk preferences. Whether you are a conservative or aggressive investor, you can achieve considerable returns through dual investment. Here are two common strategies:

Stablecoin "Buy Low": A Conservative Choice for Bearish Positions

Applicable Scenario: Expecting a price drop, want to buy mainstream coins at a low price

Example: BTC is currently priced at $85,000, and you expect a short-term pullback. You invest 2,000 USDT in a 3-day "buy low" product with a target price of $82,000 and an APR of 12%.

If BTC price ≤ $82,000: Position established successfully, you will receive approximately 0.0244 BTC + 1.97 USDT interest.

If BTC price > $82,000: You continue to hold 2,000 USDT + 1.97 USDT interest.

* Interest Calculation: Interest = Investment Amount × [Annualized Return Rate × Investment Duration (Days) / 365].

Note: Although the APR is fixed at the time of investment, actual returns may vary based on the settlement currency.

Cryptocurrency "Sell High": An Aggressive Strategy for Bullish Positions

Applicable Scenario: Holding mainstream coins, expecting a price increase, want to lock in a high selling price

Example: You hold 0.1 BTC, expecting an increase, and invest it in a 7-day "sell high" product with a target price of $100,000 and an APR of 15%.

If BTC price ≥ $100,000: You will receive 10,000 USDT + 28.77 USDT interest.

If BTC price = $100,000: You continue to hold 0.1 BTC + 0.000287 BTC interest.

Practical Suggestions

For beginners, it is recommended to start with the simple "buy low" strategy. Use USDT to invest in short-term products of 1-3 days, setting a target price slightly below the current price, which allows for quick entry and short-term gains.

After understanding the mechanism, you can try the "sell high" strategy, locking in high selling prices with BTC or ETH, and flexibly adjusting target prices based on market trends. Enable the automatic reinvestment feature to let your earnings accumulate and grow over time. Whether for short-term testing or long-term compounding, the key is to understand the mechanism, allocate positions reasonably, and avoid blindly chasing highs.

2. Product Highlights: Why is Dual Investment Worth Noting?

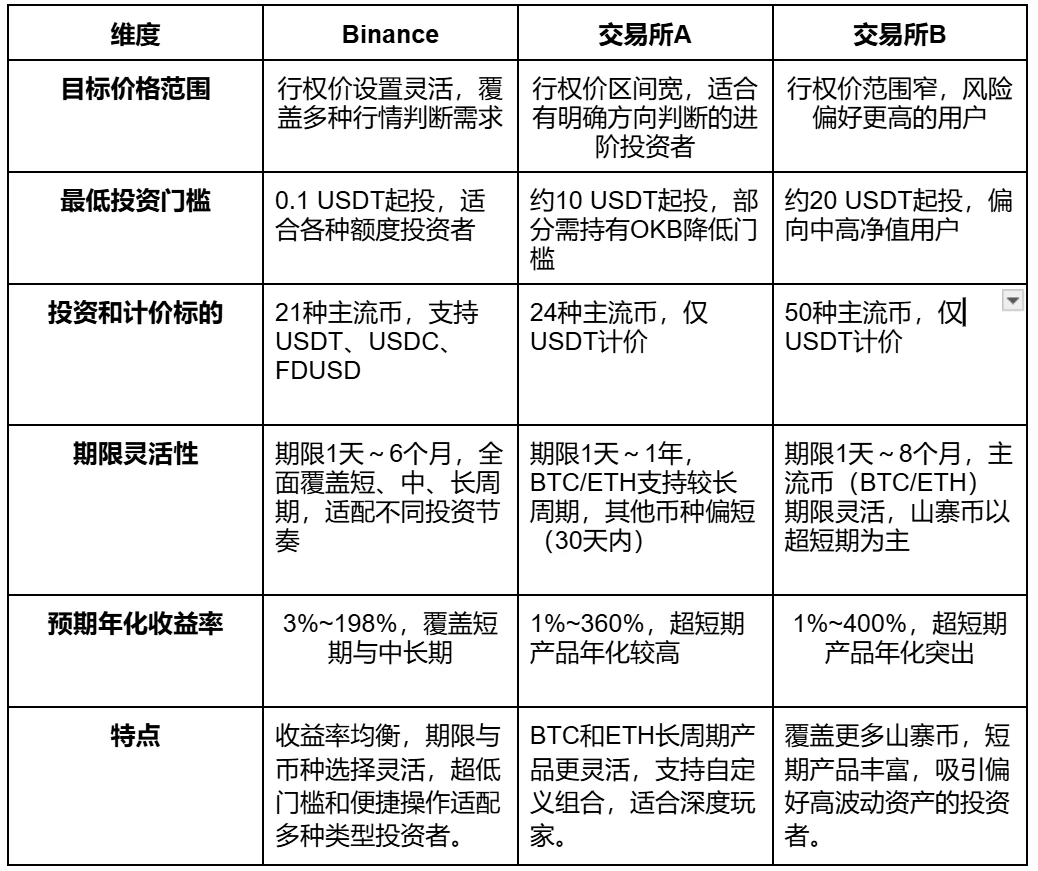

The outstanding performance of Dual Investment lies in its combination of high return potential, flexible strategy combinations, and convenient operating experience, making it the most user-friendly structured financial tool. To present the unique potential of Binance Dual Investment more clearly, we compared it with products from other exchanges:

From the list above, we can see:

Compared to traditional capital-protected financial products, Dual Investment offers more attractive annualized returns. Taking BTC as an example, the annualized return rate of ordinary capital-protected earning products is usually only about 0.27%, while the basic annualized return of dual investment can reach about 3.6%. During periods of high volatility, short-term annualized returns can even exceed 100%.

Compared to the other two platforms, Binance considers the balance between return stability and risk control in product design, with generally higher basic annualized returns. In contrast, other exchanges' high annualized return products (400%) are often concentrated in ultra-short-term products lasting 1 day or even a few hours. When converted, the daily return may only be about 1.1%, which is limited compared to the advertised figures, but the risks are significantly higher.

Investors need to be discerning when choosing, as products with annualized returns in the range of 5%-20% represent an ideal range that can provide stable returns while controlling risks, suitable for most investors.

Secondly, the strategy combinations are flexible and diverse. In terms of supported currencies, Binance Dual Investment only supports 21 currencies, while other exchanges support a wider variety of currencies. However, it is important to note that all currencies covered in Binance dual investment products support terms of 1 to 180 days, while other exchanges only offer longer terms and higher flexibility for BTC and ETH, with shorter terms for altcoins.

Additionally, Binance allows users to choose stablecoins such as USDT, USDC, or FDUSD as the investment or settlement target, further enhancing asset allocation flexibility, while other exchanges only support USDT.

Most importantly, the operating experience is simple and easy to grasp. Users can complete the investment in just a few steps, with a minimum investment starting at 0.1 USDT, no threshold restrictions, providing a channel for small and medium investors to participate in structured products. At the same time, the automatic reinvestment feature makes investing more worry-free, facilitating long-term holders to achieve compound growth.

In contrast, other exchanges have relatively high investment thresholds to cater to different user groups. When choosing, investors are advised to comprehensively consider return stability, term flexibility, and actual return expectations to ensure that investment decisions align better with long-term goals.

Whether you are looking for short-term arbitrage or want to "exchange time for returns" to pursue asset preservation, Binance Dual Investment can provide a robust and flexible solution.

3. Choosing Binance: Platform Strength Empowers Product Value

Product design is certainly key, but what truly determines whether dual investment is "usable" is the strength of the platform behind it. In the fierce competition of the global crypto market, Binance, with its outstanding market performance, rock-solid security guarantees, and unparalleled technical capabilities, provides strong value support for dual investment products, making it an ideal foundation for investors seeking stable returns.

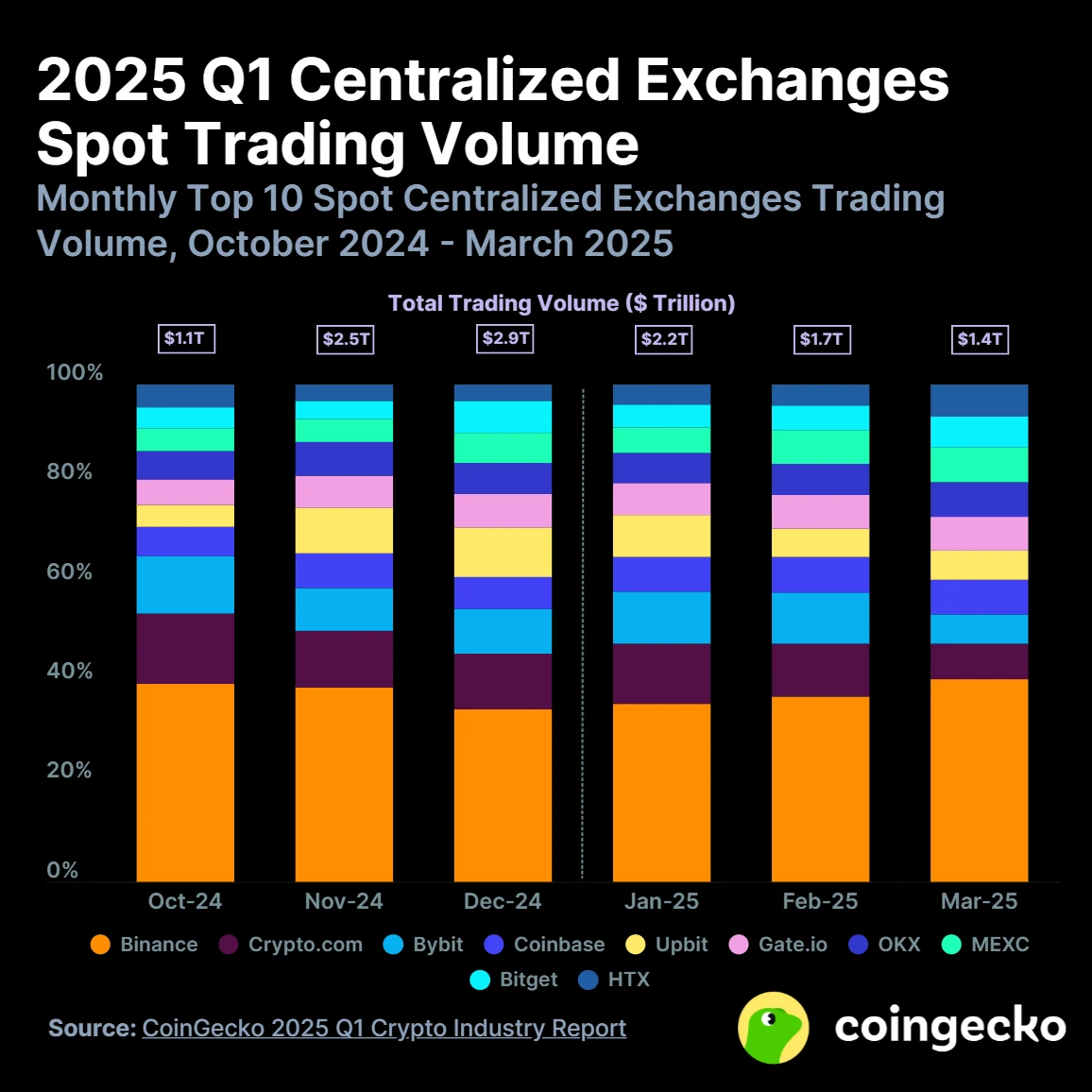

Binance's market dominance is one of its most dazzling labels. According to Coingecko's Q1 2025 crypto industry report, the spot trading volume of the top ten centralized exchanges worldwide reached $5.4 trillion. Despite a 16.3% quarter-on-quarter decline, Binance maintained its leading position with a 40.7% market share, an increase of about 5% from the previous quarter. This achievement not only reflects the high trust of the market but also highlights its absolute advantages in trading matching systems and liquidity management.

Whether during critical moments of market volatility or the precise conversion of dual investment products at maturity, Binance's deep liquidity pool ensures that transactions are efficient, smooth, and prices are fair and stable. This strong market support provides a solid foundation for the flexibility and return stability of Dual Investment.

In the crypto market, security is the lifeline of the platform. Binance provides additional protection for funds through the establishment of the "User Security Asset Fund" (SAFU) to address potential risks. Since the launch of Dual Investment products, its payment record has remained stable, with no public reports of defaults. The rules for calculating and settling returns are transparent, effectively reducing the risk of information asymmetry.

Technological innovation is also an important pillar empowering Dual Investment products at Binance. As a leading global crypto platform, Binance not only has an efficient trading engine but also provides users with a smooth and convenient operating experience through continuously iterated product features. In the wave of the crypto market, choosing a platform that balances "technical strength, security, and liquidity" is undoubtedly the first step to successful investment.

Conclusion: In a Complex Market Environment, Be a Smart "Landlord"

Dual Investment is not a "novelty" in the crypto market; its underlying logic comes from traditional finance's structured investment products, which are popular in the traditional financial industry for generating excess returns in volatile or low-interest-rate environments. According to S&P's "2024 Global Structured Finance Outlook," this market has exceeded $1 trillion. Now, it has been introduced into the crypto industry, providing investors with a more strategic means of yield management.

In a complex market environment, either holding cash on the sidelines or frequent trading can lead to missed opportunities. Binance Dual Investment offers an alternative path: exchanging certainty for yield, replacing high-risk speculation with strategic investment.

As long as you deeply understand the mechanism, scientifically allocate positions, and reasonably control risks, dual investment is the best "rental" tool in a volatile market. Choose Binance for investment and be the smart person who collects "rent" with ease.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。