Author: Lawrence, Mars Finance

I. A Brief History of Doodles: From "Cartoon Avatars" to the Ambition of "Web3 Disney"

As one of the most iconic blue-chip NFT projects in the Ethereum ecosystem, the growth story of Doodles is a textbook case of IP incubation in the Web3 era.

1. The Starting Point of Artistic Genes and Community Co-Creation (2021-2022)

In October 2021, 10,000 colorful cartoon avatars created by Canadian illustrator Scott Martin (Burnt Toast) landed on Ethereum. These NFTs, named Doodles, quickly broke into the mainstream with their unique "childlike doodle" style, and the floor price soared above 5 ETH, entering the "blue-chip club."

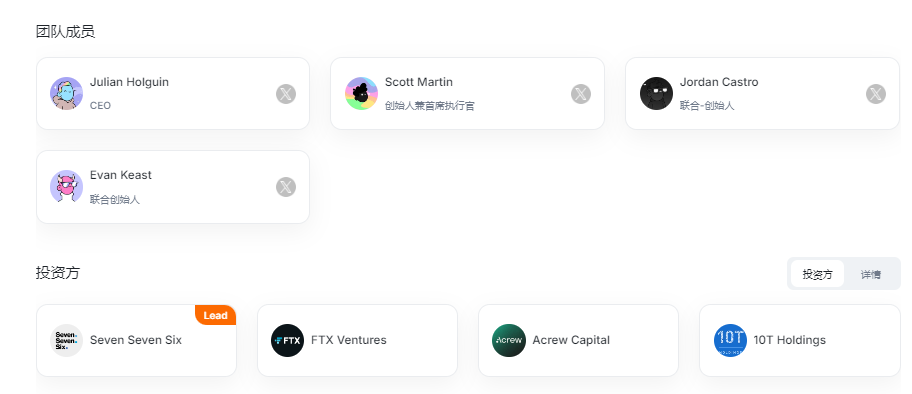

The three founders of the core team—Scott Martin, Evan Keast, and Jordan Castro—each played a key role:

- Scott Martin: The visual soul, responsible for all character designs and world-building.

- Evan & Jordan: Former core members of CryptoKitties, well-versed in NFT community operation rules.

Unlike other PFP (Profile Picture) projects, Doodles emphasized the concept of "holders as shareholders" from the beginning:

- Established the Doodlebank community treasury, where holders vote on the use of funds.

- Distributed wearable devices through mechanisms like the Genesis Box, enabling dynamic upgrades of NFTs.

2. Cross-Industry Expansion and Capital Support (2022-2024)

2022 became a strategic turning point for Doodles:

- Executive Introduction: Former Billboard president Julian Holguin became CEO, and music superstar Pharrell Williams took on the role of Chief Brand Officer.

- Capital Moves: Completed a $54 million financing round at a valuation of $704 million, led by 776 Fund (founded by Reddit co-founder Alexis Ohanian).

- Ecosystem Layout:

- Acquired the Emmy-nominated animation studio Golden Wolf.

- Launched co-branded products with Adidas and McDonald's.

- Developed the Doodles 2 dynamic NFT system, supporting cross-platform character customization.

By this point, Doodles had evolved from a simple NFT project into a "Web3 entertainment group," with its business scope covering animation, music, gaming, offline events, and more.

3. Transformation in Crisis (2025)

In January 2025, founder Scott Martin resumed the role of CEO, announcing a return to a "radical innovation" approach:

- Halted excessive commercialization collaborations (such as the McDonald's coffee partnership).

- Launched the DreamNet ecosystem, building an AI-driven decentralized content platform.

- This adjustment was driven by the ongoing slump in the NFT market: in 2024, Doodles' trading volume fell by 67% year-on-year, with the floor price lingering around the 3 ETH range.

II. Tokenization Breakthrough: The Economic Model and Strategic Logic of DOOD

Against the backdrop of a cooling NFT market, Doodles chose to break through with tokenization. On May 9, 2025, its native token DOOD will launch on Solana, with plans to cross-chain to Base L2.

(1) Token Economics: Interest Reconstruction Under Community Narrative

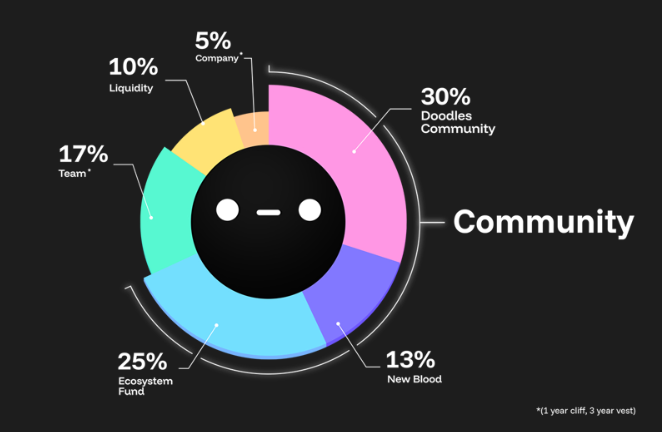

According to the white paper, the total supply of DOOD is 10 billion tokens, with the distribution framework as follows:

Design Highlights:

- Community First: 68% of tokens flow to the community, higher than similar projects (like Azuki's 37.5%).

- Multi-Chain Compatibility: Launching on Solana to leverage its high TPS (65,000+/second) and meme culture, with subsequent cross-chain integration into the Ethereum ecosystem.

Potential Controversies:

- Ambiguous Definition of "New Blood": The 13% allocation for New Blood lacks transparent rules, posing risks of internal manipulation.

- Pressure from Institutional Exits: Early investors like 776 Fund have not disclosed exit plans, which may lead to cashing out through the ecosystem fund.

(2) Value Capture: From JPG to the Imagination of "Digital Skins"

DOOD is positioned as the "economic blood" of the Doodles ecosystem, with its value capture mechanism revolving around three layers:

1. Governance Rights

- Proposal Voting: Holders can participate in decision-making regarding the direction of DreamNet content creation.

- Staking Rewards: Locking tokens earns animation IP dividends, discounts on co-branded products, and other benefits.

2. Consumption Scenarios

- DoodlesTV: Pay with DOOD to watch exclusive animated shorts.

- Virtual Fashion: Purchase wearable devices on the Stoodio platform.

- In-Game Purchases: Future in-game item trading in the metaverse.

3. Speculative Targets

- The MEME culture on the Solana chain boosts trading activity.

- Cross-chain bridging with Base may create arbitrage opportunities.

However, compared to competitors, the practicality of DOOD remains weak:

- Compared to PENGU: Pudgy Penguins have generated stable cash flow through physical toys.

- Compared to ANIME: Azuki is tied to an anime crowdfunding platform, providing clear consumption scenarios.

III. Deconstructing the Motivation for Token Issuance: Lifesaving Medicine or Harvesting Scythe?

In the current environment of halved NFT trading volumes and sluggish growth of blue-chip projects, Doodles' decision to issue tokens has sparked polarized evaluations.

Strategic Rationality

1. Breaking the Liquidity Dilemma

The non-standard nature of NFTs leads to a lack of liquidity. By binding tokens, holders can obtain liquid assets through staking, airdrops, and other means, avoiding the pressure of selling NFTs at a loss.

2. Community Activation Experiment

The operation of the DreamNet system relies on token incentives:

- Creators uploading content can earn DOOD rewards.

- Users participating in interactions (likes, shares) earn points.

- This "creation is mining" model attempts to replicate the successful path of StepN.

3. Capital Exit Demand

Early-stage investment institutions need to achieve exits through token listings. Based on a $54 million financing estimate, DOOD's FDV (Fully Diluted Valuation) needs to reach $700 million for VCs to break even, while the current NFT market cap of Doodles is only $6.48 million.

Suspicions of Harvesting

1. Token Distribution Risks

Despite a community distribution ratio of 68%, the detailed rules are questionable:

- 30% community airdrop lacks a clear snapshot time, posing "mouse warehouse" risks.

- The ecosystem fund is controlled by the team, which may be used to manipulate market prices.

2. The MEME Trap

Choosing to launch on Solana essentially caters to MEME speculation culture. Referring to the average lifecycle of tokens on that chain:

- 80% of projects lose 90% of their market value within one month of listing.

- Trading volume is concentrated on CEX, with a lack of on-chain liquidity.

3. NFT Reflexivity Risks

A decline in token prices may trigger a wave of NFT sell-offs, creating a "death spiral." After Azuki's token issuance in 2024, its NFT floor price dropped by 58%.

IV. Listing Outlook: Short-Selling Signals and Risk Warnings

According to models from Marsbit Research Institute, DOOD may exhibit the following trends:

Short-Term Speculative Window

- First Day of Listing: Driven by MEME sentiment, FDV may surge to $1.5-2 billion.

- Airdrop Selling Pressure: Based on a 30% community allocation, potential sell-off volume in the first week could reach 3 billion tokens (approximately $450 million).

Medium to Long-Term Risks

- Ecosystem Realization Pressure: If the DreamNet MVP product is not launched within six months, the token will lose narrative support.

- Multi-Chain Operational Costs: The cross-chain bridge between Solana and Base may become a target for hacker attacks.

Short-Selling Strategy Recommendations

Suitable Short-Selling Signals:

- FDV exceeds $2.5 billion (corresponding to a DOOD price of $0.25).

- Large transfers appear from team addresses.

- DreamNet release is delayed.

Risk Warnings:

- The degree of control by whales on the Solana chain is high, necessitating caution against short-squeeze risks.

- Exchanges like Binance may implement short-selling restrictions.

V. Conclusion: The Paradigm Revolution and Speculative Bubble of Web3 IP

Doodles' tokenization experiment is essentially an adventure in "digital asset securitization." Its idealistic side is reflected in:

- Attempting to achieve value sharing between creators and consumers through token economics.

- Exploring the transformation of NFTs from collectibles to "digital identity passports."

However, the harshness of reality is equally clear:

- In the interest chain formed by VCs, exchanges, and market makers, the community remains in a disadvantaged position.

- The maturity of the Web3 entertainment ecosystem is far from supporting a valuation in the tens of billions.

For ordinary investors, the recommendations are:

- Short-Term Participation: Utilize liquidity premiums during the initial trading period on exchanges, with a stop-loss set at -20%.

- Long-Term Avoidance: Unless DreamNet achieves a user retention rate exceeding 50% after launch, it is advisable not to hold positions for more than three months.

- Ecosystem Observation: Focus on the progress of music collaborations with Pharrell Williams and animation output from Golden Wolf.

In the crypto world, "innovation" and "harvesting" are often two sides of the same coin. Whether Doodles can break the curse of "token issuance equals peak" will be a key test in the autumn and winter of 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。