最近投研团队一直在挖掘 #SOL 链上的创新项目,摒弃掉老掉牙的套娃概念,贴近最近的热点,比如 #Payfi ,#RWA,稳定币等。还真发现了一个比较有意思的项目,算法稳定币项目,蛮有趣的。项目目前还没币,传言的ca,也没官方证实,注意风险和安全,仅作为研究观察。

Convergent Protocol( @convergent_so) 想在 Solana 上搞一个真正去中心化的算法稳定币,叫做USV。咱们都知道现在稳定币市场 USDC、USDT 这些中心化的家伙当道,虽然方便,但总有点“命脉掌握在别人手里”的感觉。#Convergent 就是想改变这个局面,让 Solana 生态有一个更独立、更抗审查、由社区驱动的稳定币。同时,它还想让你手里的 SOL 能更高效地“生钱”。

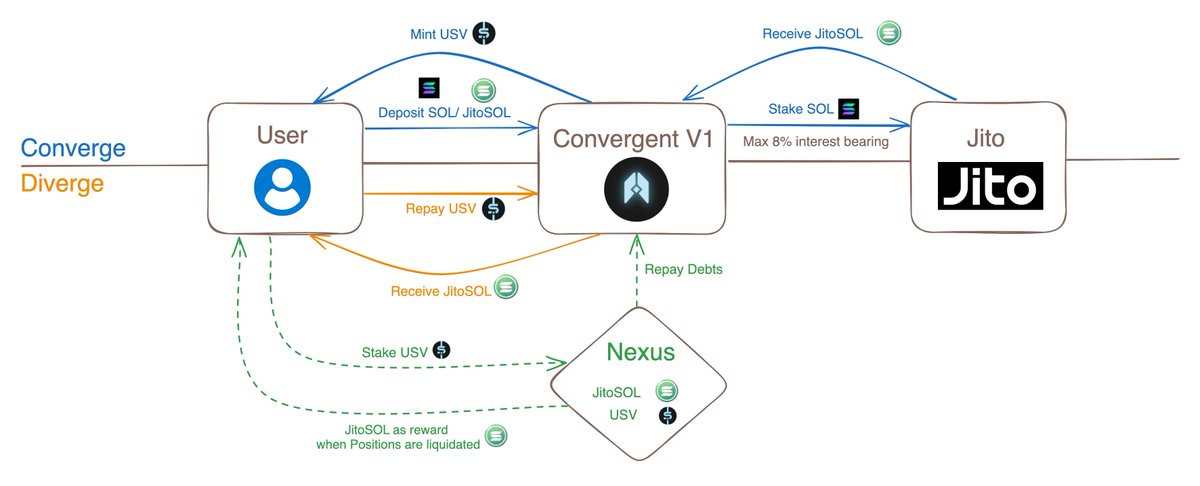

咱们通俗易懂,掰开揉碎了讲解一下,毕竟算法稳定币还挺复杂:

首先那个叫 #USV 的稳定币是咋回事?

目标价就是1美元: USV 这玩意儿,跟美元是 1:1 锚定的。

怎么保持1美元?靠算法机制,不靠中心化大哥: 如果 USV 跌破1美元了(比如0.9美元): 系统会鼓励大家去市场上买便宜的 USV,然后拿回来销毁。你销毁 USV,就能以折扣价赎回你之前抵押的资产。这样一来,USV 的供应量减少,价格就往1美元回升。

如果 USV 涨过1美元了(比如1.1美元): 系统会提高你铸造新 USV 的成本(比如要抵押更多东西),这样大家就不太想去铸造新的 USV,需求降下来,价格也就慢慢回到1美元。

核心呢,不依赖 USDC,这还蛮有趣的! 这哥们强调了,它不像 #FRAX 或者 #DAI(早期也依赖 USDC)那样需要中心化资产来维持稳定。它是用一套激励和惩罚机制来动态调节的,更纯粹。

USV 的好处: 0利息贷款、超额抵押、你的流动性质押收益(LSD yield)它不抽成、完全去中心化、抗审查、还能跟其他 DeFi 乐高积木一样随便组合。

用户怎么玩?怎么赚钱?

存 SOL,借 USV (0利息): 因为跟 #Jito 合作,你可以把你的 SOL (主要是 JitoSOL 这种带收益的 SOL) 抵押到 Convergent Protocol 里,然后就能借出来稳定币 USV,而且是0利息的(不知道怎么做到的,是早期补贴,还是啥)!

反正这有点香。 你的 SOL 还在帮你赚钱: 你抵押的 SOL (JitoSOL) 会自动帮你获取 Solana 的质押收益和 MEV 收益。等于说,你的本金还在工作。

#USV 的用途: 借出来的 USV 可以在 Solana 生态的其他 DeFi 项目里浪,比如去搞杠杆、组 LP (流动性提供)、借贷等等。

Nexus 系统: 你可以把 USV 存到这个叫 Nexus 的地方,能赚清算产生的收益,还能挖到他们未来的治理代币 $CVGT。 未来 V2 版本更强大: 看 V2 的图,用户、SOL、USV 之间的互动更多了。还引入了一个叫 AMO (算法市场操作控制器) 的东西,当 USV 高于1美金时,它会自动去 USV/USDC 池子里平衡价格。用户还可以质押 CVGT 代币来赚取协议手续费。

AGENTS NFT 和 FRAGMENTS 是什么鬼?

AGENTS J (NFT): 这是他们的创世 NFT 系列。说白了,就是项目方在项目正式上线前,通过 NFT 来吸引早期核心用户、建立社群、对接一些有价值的投资者/DAO 组织。持有这个 NFT 的人,未来可能有空投、白名单或者其他福利。你看他们也列举了很多合作的 NFT 项目方。

FRAGMENTS (积分系统): 在他们的代币 $CVGT 正式发行 (TGE) 之前,搞了一个积分系统。

你怎么获得积分呢?比如质押你的 AGENTS NFT、使用他们的 dApp (应用)、或者满足一些(目前还没完全公开的)追溯空投条件。这些积分,未来会按一定比例换成他们的 $CVGT 代币。这是一种很常见的早期用户激励和社区引导方式,让大家在项目初期就参与进来,贡献力量。

总的来说吧,还是蛮有意思的项目,去中心化算法稳定币是 #DeFi 的圣杯之一,尤其是在一个公链生态里,有原生的、强大的去中心化稳定币非常重要。#Solana 生态确实需要这样一个角色,看看能不能泡出来吧。据说是直接pumpfun公平发射,目前官方还没有ca,注意安全,蹲一波官推更新吧。任何新项目都有不确定性,团队执行能力、技术实现、市场接受度都需要时间检验,各位老板还是要 DYOR,别盲目冲。可以先关注着,看看项目后续的发展情况,尤其是 NFT 和积分系统的进展,以及最终产品上线后的实际表现。🧐纯研究,非广。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。