行情一来,市场会用波动筛选出两种人:你是哪一种?

反者道之动还有个最恰当的解释就是:

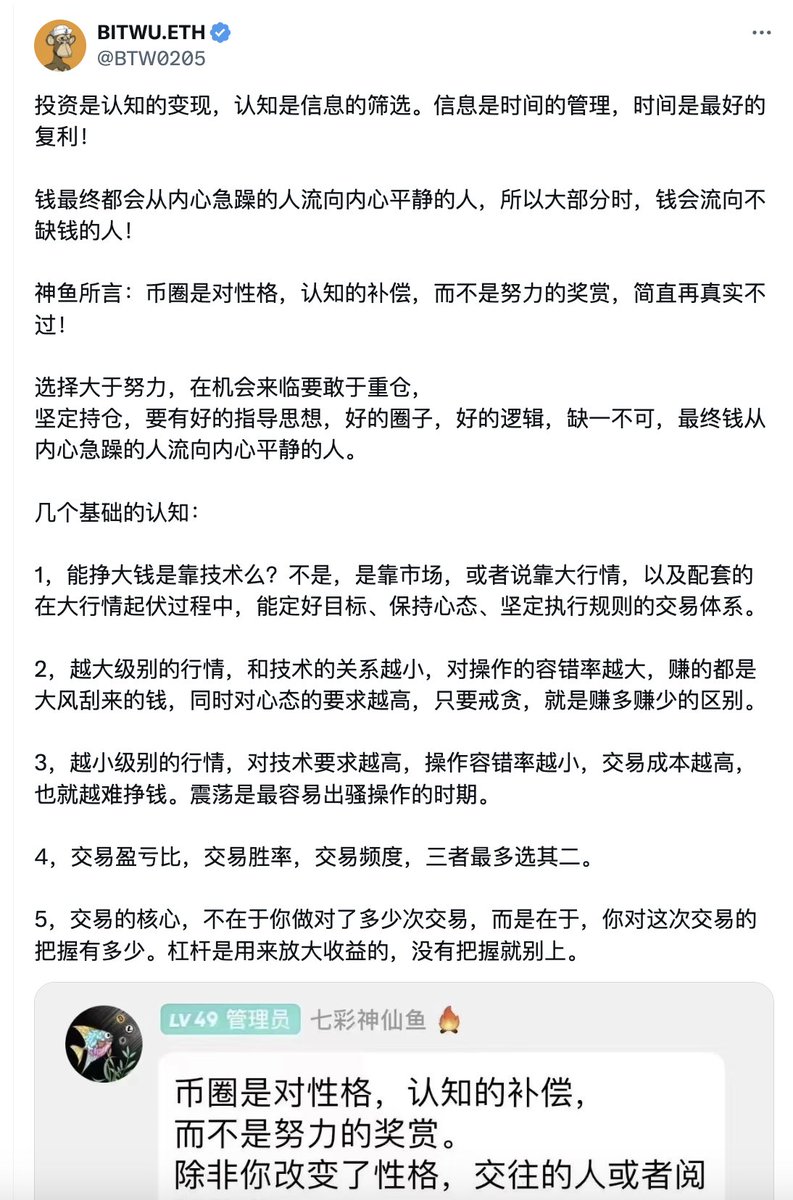

钱一直在从内心急躁的人流向内心平静的人——

所以我豁然开朗,原来投资的本质,根本不是赚快钱,甚至不是赚钱,而是让你不断逼近“那个更好的自己”。

内心沉稳,向阳而生,谦逊爱人,善良待物,成为那个更好的自己,才能拿到最好的结果;

所以所谓的提升认知,不是读懂世界,而是重塑自我。

你必须理解这个逻辑,你才能理解为什么说:赚钱的前提是自我管理,而非市场预测。

基于这个原则,我发现我之前做的很多事情都是错的;

对注意力和精力的掌控能力,可能才是核心能力,而当我们谈时间的复利的时候,其实并不是单纯的花了时间就有福利,时间复利只属于那些理解本质理解自我,有纪律地、持续执行正确策略的人才有的专属奖赏——

他们能耐住平淡,承受波动。

急躁者想征服市场,平静者先成为自己,再成为市场的一部分。

“钱最终流向内心平静的人”,这不是一句玄学鸡汤,而是交易系统对心理素质的真实考验。

每次行情一来,市场会用波动筛选出两种人:一种靠侥幸短赚快钱,最终归零;另一种知进退、懂等待、敢重仓,长期生存。

选择大于努力,是因为认知决定了努力的方向。很多人靠努力在错的方向内卷,反而跑输通胀。

投资是认知的变现,但认知不是来自读书,而是来自“痛苦之后对自己的重新理解”。

真正的高手,不是赢在市场波动里,而是赢在心态稳定之后的反应选择上。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。