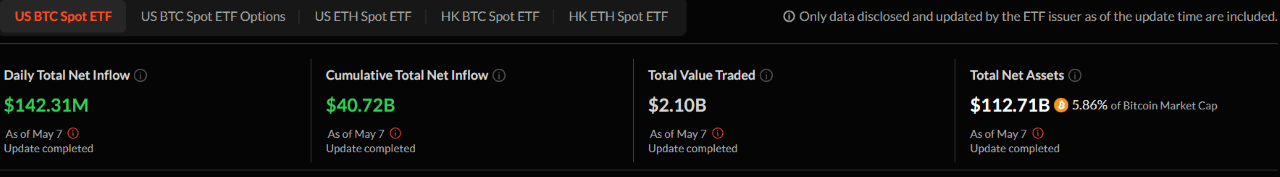

Bitcoin ( BTC) broke through the $100K barrier on Thursday morning, as net cumulative inflows for spot BTC exchange-traded funds (ETFs) peaked at $40.72 billion according to data from sosovalue.com. The last time BTC broke through the six-figure threshold in early February, net inflows had also peaked just above $40 billion.

(Total cumulative inflows for BTC ETFs have topped $40B again / sosovalue.com)

Bitcoin ETF providers aren’t the only institutions rushing to hoard the digital asset. On Wednesday, Japanese bitcoin treasury firm Metaplanet announced a 555 bitcoin purchase bringing its overall holdings to 5,555 BTC. The company plans to reach a total of 21,000 BTC by the end of next year. Michael Saylor’s bitcoin firm Strategy, announced its most recent public purchase at the end of April and now holds 555,450 BTC currently worth more than $56 billion.

On Tuesday, New Hampshire became the first U.S. state to establish a strategic bitcoin reserve, and the day after, Arizona followed suit. Strive Asset Management, a company co-founded by former presidential candidate Vivek Ramaswamy, announced on Tuesday that it’s in the process of establishing the first publicly traded bitcoin treasury asset management company. It appears the institutional floodgates have finally opened, and bitcoin only stands to benefit.

“The dominant story for bitcoin has changed again,” said Geoffrey Kendrick, head of digital assets research at London-based Standard Chartered Bank, in a note to clients. “It is now all about flows, and flows are coming in many forms.”

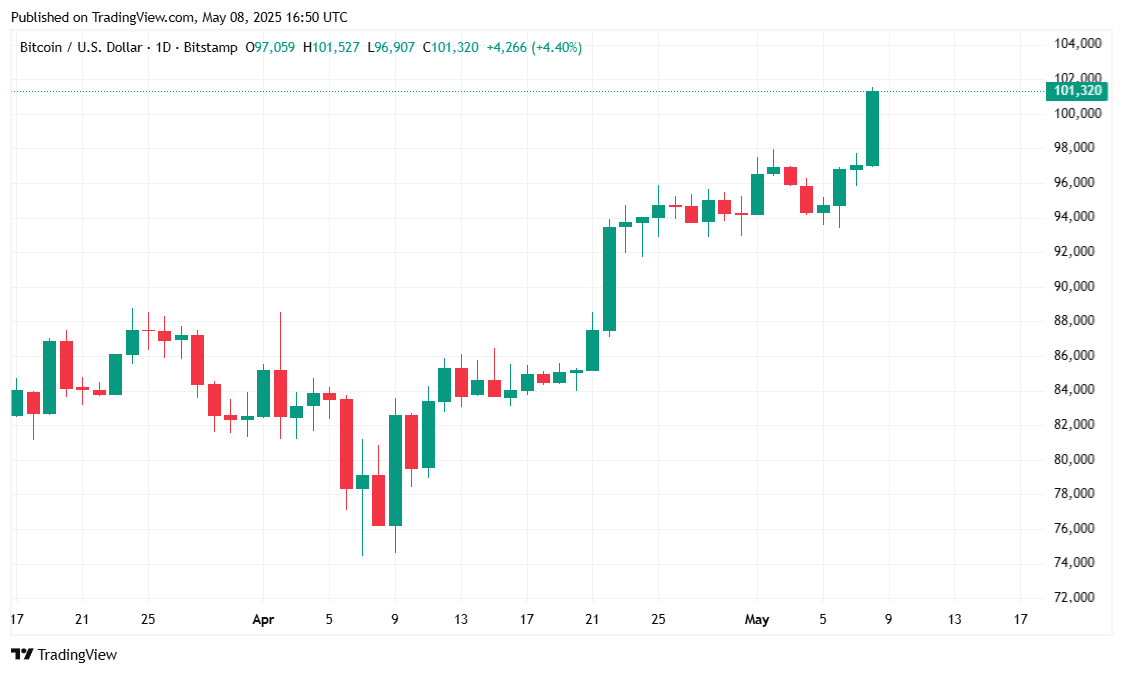

Bitcoin has been trading between $95,829.33 and $101,517.39 and is priced at $101,167.65 at the time of this writing, which is a 4.66% gain over 24 hours and a weekly appreciation of 3.91%, according to Coinmarketcap. The price surge highlights renewed institutional confidence across markets, even as volatility intensifies.

( BTC price / Trading View)

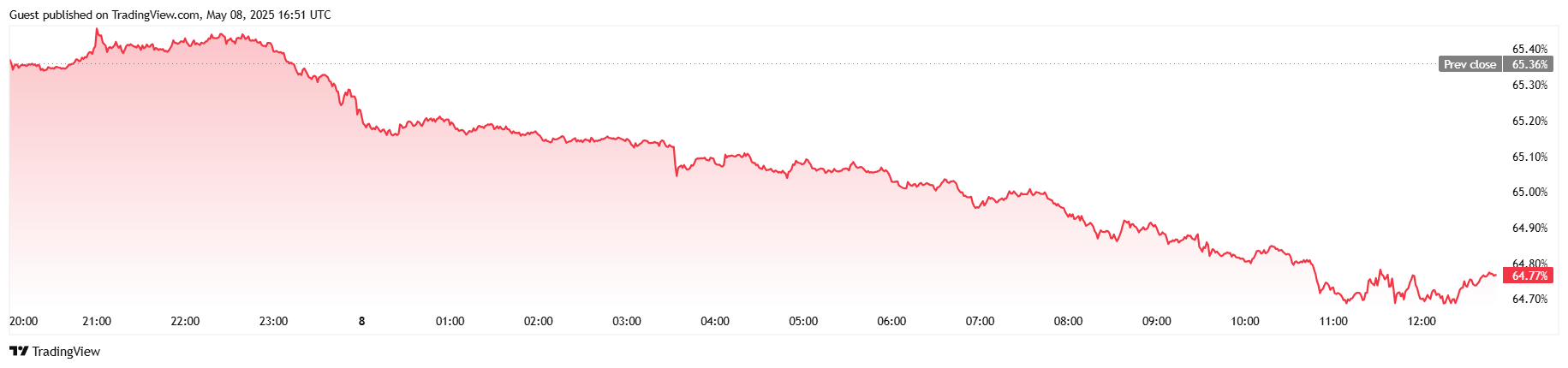

Accompanying the price spike was a 41.12% increase in trading volume, which reached $62.38 billion. Bitcoin’s market capitalization also saw a noteworthy jump, climbing 4.56% to hit $2 trillion, a key psychological and structural milestone. However, BTC dominance fell by 0.91 percentage points to 64.77%, indicating some capital rotation into altcoins even as bitcoin leads the broader charge.

( BTC dominance / Trading View)

Futures markets responded with heightened activity, as open interest rose 6.39% to $68.88 billion, showing increased leverage and speculation. Despite bitcoin’s bullish momentum, traders on the long side absorbed the bulk of the damage in the liquidation charts. Coinglass reported $2.47 million in total liquidations over 24 hours, with long positions accounting for $1.55 million compared to $915,160 in shorts. The data suggests that some overly aggressive bulls were caught offside by intraday volatility, despite the broader upward breakout.

“I think a fresh all-time high for bitcoin is coming soon,” Kendrick reiterated. “I apologise that my USD120k Q2 target may be too low.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。