稳定币发行商Tether于去年11月推出了其现实世界资产(RWA)代币化平台Hadron,并于周二宣布已将区块链数据公司Chainalysis的合规和监控工具完全整合到Hadron的系统中。

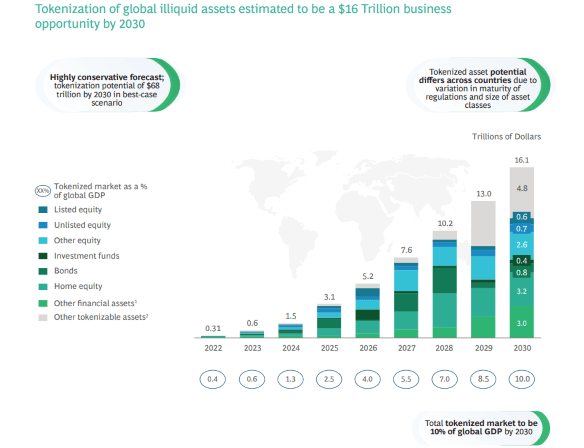

波士顿咨询集团(BCG)在2022年的一份报告中估计,到2030年,像实物艺术、房地产和私募股权等流动性差的资产的代币化可能超过16万亿美元。如果这些预测数字实现,像Chainalysis提供的合规功能将在这些代币化平台上是必需的。

(BCG预测到2030年RWA市场将达到16万亿美元 / 波士顿咨询集团)

Tether表示,Hadron可以对股票、债券、商品、基金甚至奖励积分等传统资产进行代币化。现在,随着Chainalysis的合规和监控工具的整合,Tether将能够对代币化资产进行交易监控、可疑活动标记和客户身份识别(KYC)流程。

Tether首席执行官Paolo Ardoino表示:“通过将Chainalysis直接集成到平台中,我们提供了机构级的透明度、合规性和风险缓解。” “我们正在建立合规、安全和可扩展代币化的黄金标准。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。