作者:Frank,PANews

随着各个DEX开始提供个性化的优先费用选项和防夹措施之后,Solana上的三明治攻击收益明显下滑。截至5月6日,这一数据已经降为582个SOL,而在数月之前,单个三明治攻击的机器人日平均收益基本就能达到1万个SOL。但这并不是MEV的终局,一种新型的原子套利正成为Solana链上最主要的交易来源。

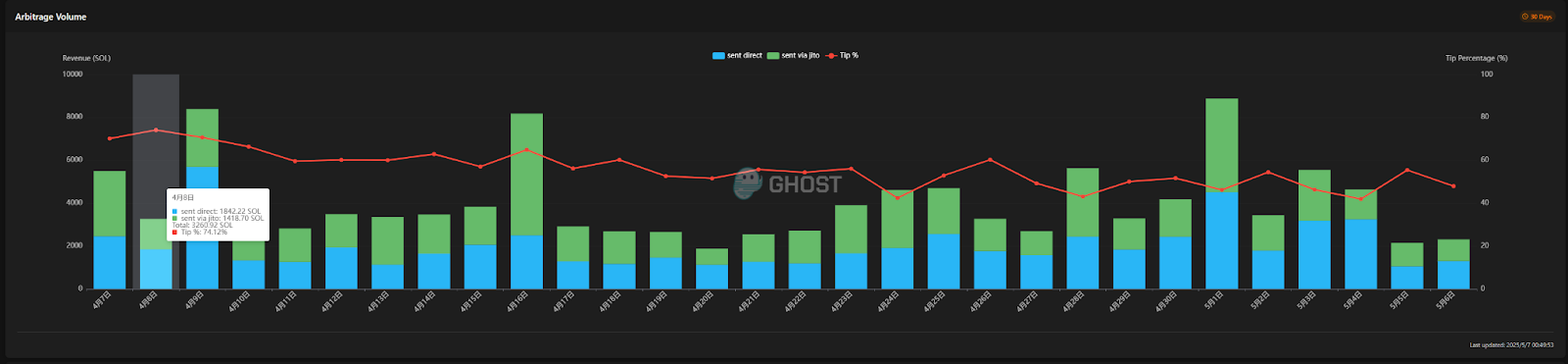

根据sandwiched.me的数据显示,这种原子套利在链上的占比已经达到了夸张的程度。4月8日,原子套利贡献的小费比例达到了74.12%,而在其他时间,也基本维持在50%以上。也就说,现在Solana链上的每两笔交易,可能就有一笔是用于原子套利。

但在社交媒体上,几乎看不到原子套利的讨论。这种新型的套利机会,到底是一个隐藏的金库?还是又一把花样的镰刀。

原子套利,MEV交易新思路

首先,我们来了解一下原子套利是什么?原子套利是指的是在一个单一的、原子的区块链交易中执行包含多个步骤的套利操作 。典型的原子套利涉及在同一笔交易中,先在一个去中心化交易所(DEX)上以较低价格买入某种资产,紧接着在另一个DEX上以较高价格卖出该资产。由于整个过程被封装在单个原子交易中,它天然地消除了传统跨交易所套利或非原子套利中存在的对手方风险和部分执行风险 。如果交易成功,利润将被锁定;如果交易失败,除了损失交易费外,套利者的资产状态将恢复原状,不会出现只完成买入而未完成卖出的情况

原子性并非为套利而设计的特性,而是区块链为保证状态一致性而固有的基本属性 。套利者巧妙地利用了这一保证,将原本需要分步执行且带有执行风险的操作(买入、卖出)捆绑在一个原子单元内,从而在技术层面消除了执行风险 。

三明治攻击或者自动交易机器人以往的重点集中在同一个交易对当中,发现有利可图的机会。然后通过打包交易的方式将对手的交易夹在中间或者干脆采用前后脚发送交易的方式碰撞出机会。而原子套利,本质上也是利用打包交易的方式,只不过更注重的是在多个交易池当中发现差价进而获取套利机会。

暴利神话与残酷现实

从目前的数据来看,这种原子套利似乎有着不错的盈利空间。近一个月来,Solana链上的原子套利获利12万枚SOL(价值约1700万美元),而获利最多的地址成本只花费了128.53SOL,收益就达到了14129个SOL,收益率达到109倍。其中最大的一个单笔收益,只花费了1.76SOL,就赚取了1354个SOL,单笔收益率达到了769倍。

目前在统计内的原子套利机器人有5656个,平均每个地址的收益达到了24.48SOL(3071美元),平均成本约为870美元。这个数值似乎虽然不如此前的三明治攻击者更高,但似乎也算一个不错的生意经,毕竟月收益率可以达到352%。

不过,值得注意的是,这里显示的成本仅为链上交易的成本。原子套利背后还需要更多的投入。

根据某位MEV开发者制作的网页信息显示,执行原子套利的硬件条件有几点要求,一个私有RPC、一个8核8G的服务器。从成本的角度来计算,服务器的成本每月大概在100美元到300美元之间,而搭建私有服务器最低需要每月50美元左右。整体下来的月成本在150美元到500左右,且这只是最低门槛。除此之外,由于要更快地进行套利,通常还要同时配置多个IP地址的服务器。

从实例来看,在某个原子套利部署网站上可以看到,近一周只有15个地址的收益超过了1SOL,最大的为15 SOL,其他的一周内的收益均在1 SOL以下且还有不少处于亏损状态。而如果结合上服务器和节点成本的话,基本这个平台的所有机器人可能都处于亏损状态。且能明显看到,不少地址已经选择停止套利。

谁在盈利?揭开“稳赚不赔”的套利迷雾

当然,现实看起来与大数据似乎有所冲突,从总体数据来看,在Solana上进行原子套利的机器人还是处于盈利状态。这其中也难逃“二八法则”的制约,少数的高水平套利机器人获取了大量的收益。而其他的则依旧沦为新的韭菜。

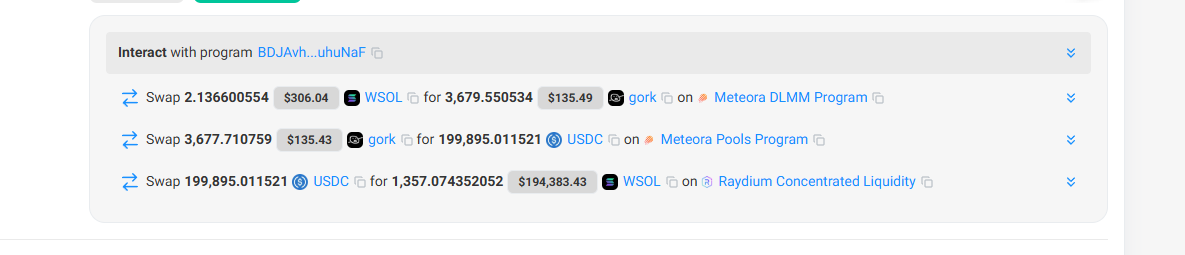

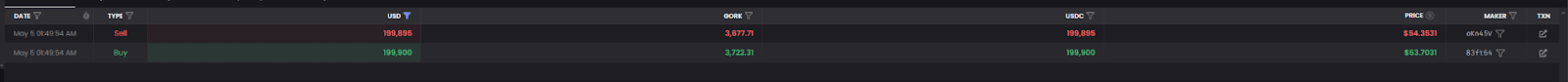

回顾原子套利的整体逻辑不难发现,要实现盈利最重要的点在于发现套利机会。以获利最高的一笔套利为例,这笔交易最初用2.13 SOL购入了3679枚grok代币(单价约为0.08美元),然后以19.9万美元的价格出售(单价约为54.36美元)。很明显,这次套利成功也是抓住了某个交易池流动性稀少的漏洞,由某个未注意池子深度的大户买单。

但本质上这种机会很少,且由于链上的机器人几乎都在盯着类似的机会。因此这种偶尔的大套利机会更像是中彩票一样。

而原子套利近期的兴起,可能因为一些开发者将这个套利机会包装成稳赚不赔的生意开发出免费版供小白用户免费使用,并提供教程。只是在套利获益的时候收益10%的收益分成。除此之外,这些团队还通过协助搭建节点和服务器,以及提供更多IP的服务收取订阅费。

实际上,由于大多数用户对技术的理解不深,所用的套利机会监测工具又雷同。最终导致获利并不多,且无法覆盖基础费用。

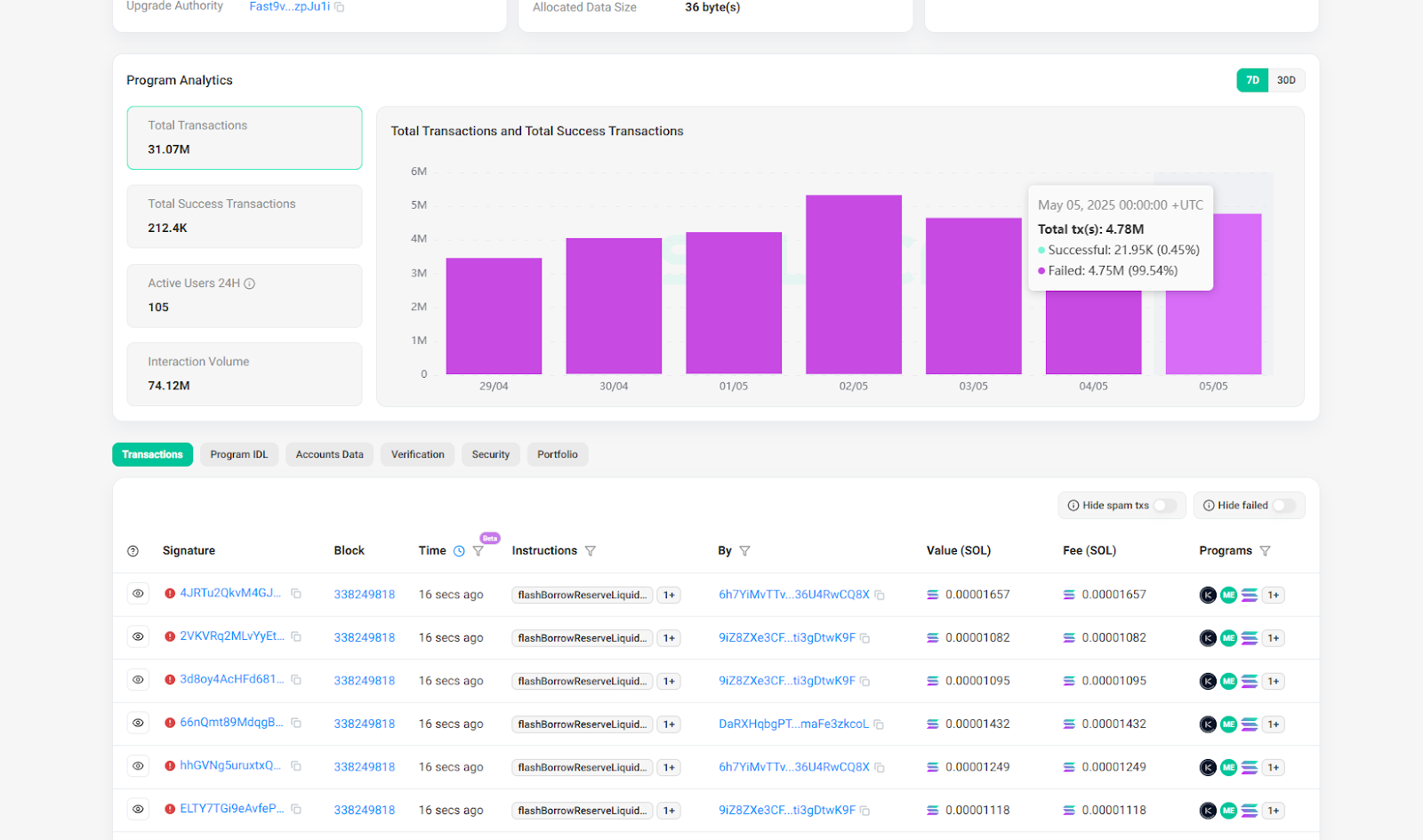

以PANews的观察来看,除非具备一定的技术基础,有独特的套利机会监控工具且配置了性能较高的服务器和节点。大多数希望参与原子套利的玩家只不过是从炒币被割变为买服务器和订阅费被坑。且随着参与的人越来越多,这种套利失败的概率也在提升,以sandwiched.me上收益最高的程序为例,该程序目前的交易失败率达到99%以上,也就是基本上所有的交易都失败了,而参与的机器人仍要缴纳链上费用。

在投身这场看似诱人的“原子套利”浪潮之前,每一位潜在的参与者都应保持清醒的头脑,充分评估自身的资源和能力,警惕那些被过度包装的“稳赚不赔”的承诺,避免成为这场新型“淘金热”下的又一波韭菜。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。