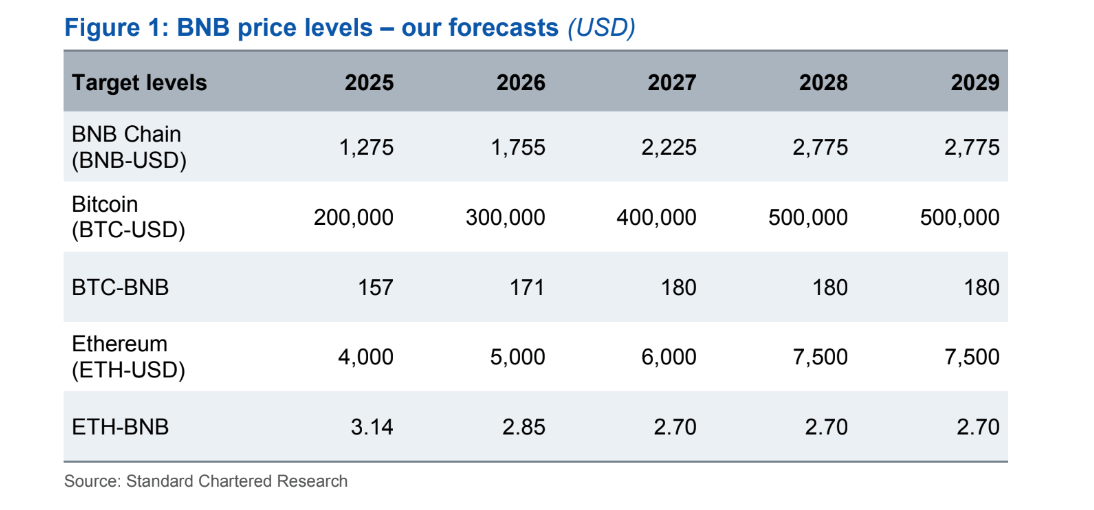

渣打银行,这家总部位于英国伦敦的8000亿美元金融机构,周二发布了一份研究报告,预测支持BNB链生态系统的加密货币BNB将在未来三年内逐渐升值,到2028年底将达到约2775美元。

尽管相对不为人知,BNB目前是市值第四大的加密货币(不包括稳定币)。它于2017年通过首次代币发行(ICO)首次亮相,作为币安的推出的一部分。币安现在是全球最大的加密货币交易所,BNB的市值根据Coinmarketcap已膨胀至845亿美元。尽管存在显著的中心化、高费用、有限的使用案例以及开发者基础稀少(目前不到50人),但由于与币安的关系,该代币仍然保持相关性。

渣打银行的研究部门将BNB链描述为“由币安支持的以太坊的中心化版本”,并称其为“老派”平台,主要被去中心化交易所、借贷协议和流动质押者使用,停滞在2021年。但自2021年以来,该银行表示,BNB的交易表现得像比特币和以太坊的无权重指数,并有望提供“稳定的回报”,最终在2028年底达到2775美元的价格。

(BNB预测 / 渣打银行研究)

“BNB是不同寻常的。尽管是第四大非稳定币数字资产(仅次于BTC、ETH和XRP),但它并不会出现在大多数人的雷达上,”渣打银行数字资产研究负责人Geoffrey Kendrick解释道。“然而,这种老派特性以及BNB几乎完全像无权重的BTC和ETH篮子(无论是回报还是波动性)进行交易,使其在我看来作为更广泛数字资产的基准非常有趣。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。