1. Market Observation

Keywords: LLJEFFY, ETH, BTC

With China announcing a reduction in reserve requirements and interest rates, and confirming trade talks with the United States, market risk appetite has significantly rebounded. This morning, People's Bank of China Governor Pan Gongsheng announced a 0.5 percentage point cut in the reserve requirement ratio for financial institutions, a 0.1 percentage point reduction in the policy interest rate to 1.4%, and a 0.25 percentage point decrease in the housing provident fund interest rate. This decision, along with the announcement from the Chinese Foreign Ministry that Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Janet Yellen during his visit to Switzerland from May 9 to 12, has boosted market sentiment, leading to a general rise in Asian stock markets and an increase in futures prices for iron ore, steel, and other commodities. Meanwhile, global markets are focused on the Federal Reserve's upcoming interest rate decision, which will be announced at 2 AM tomorrow. According to CME's "FedWatch" data, despite ongoing pressure from Trump to cut rates, the market expects a 96.9% probability that the Fed will maintain rates in May, with only a 3.1% chance of a rate cut. Goldman Sachs analyst Jan Hatzius's team points out that the Fed has set a higher bar for rate cuts, requiring more convincing evidence of economic slowdown, particularly in hard data showing a significant weakening in the labor market, such as rising unemployment and sluggish wage growth.

At the same time, Bitcoin has made policy breakthroughs, as New Hampshire has officially signed the HB 302 bill, becoming the first state in the U.S. to legislate a "strategic Bitcoin reserve," authorizing the state treasurer to purchase Bitcoin or digital assets with a market value exceeding $500 billion, with a holding limit of 5% of total reserve funds. In the UK, Economic Secretary to the Treasury Emma Reynolds has clearly stated that the UK will not follow the U.S. in establishing a national cryptocurrency reserve, but is inclined to incorporate crypto assets into the existing financial regulatory framework, adhering to the principle of "same risk, same regulation."

Bitcoin has been fluctuating for two weeks, with Glassnode analysis indicating that significant selling pressure may arise as Bitcoin's price approaches $99,000. FxPro analyst Alex Kuptsikevich further points out that the current key support levels for BTC are $92,500 and $89,000, with the market returning to the key resistance zone seen from December to February. A drop below $90,000 would have a significant impact both technically and psychologically, potentially breaching the 200-day moving average. Binance founder CZ recently predicted that Bitcoin's current cycle could range between $500,000 and $1 million, and he is optimistic about the integration of blockchain with AI and scientific research. Additionally, Futu Securities announced new developments, with their website showing that regular users can now recharge BTC and ETH to their Futu accounts via personal wallets, with minimum recharge amounts of 0.0002 BTC and 0.001 ETH, further promoting the integration of traditional finance and crypto assets.

The MEME market has been buzzing in recent days due to the death of Zerebro co-founder Jeffy Yu, with the related token LLJEFFY's market cap once soaring to $31 million, now having retraced to $5.7 million. Since May 4 at 1:48 PM, the LLJEFFY development wallet and several associated addresses have been frequently trading and burning tokens. Today, it was confirmed that Jeffy Yu faked his death, and with the truth revealed, this market-disturbing event may come to an end.

2. Key Data (as of May 7, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $96,523.49 (YTD +3.21%), daily spot trading volume $29.36 billion

Ethereum: $1,827.47 (YTD -45.11%), daily spot trading volume $13.78 billion

Fear and Greed Index: 67 (Greed)

Average GAS: BTC 1 sat/vB, ETH 0.44 Gwei

Market Share: BTC 64.2%, ETH 7.4%

Upbit 24-hour Trading Volume Ranking: LAYER, XRP, BTC, MOVE, LOOM

24-hour BTC Long/Short Ratio: 1.0517

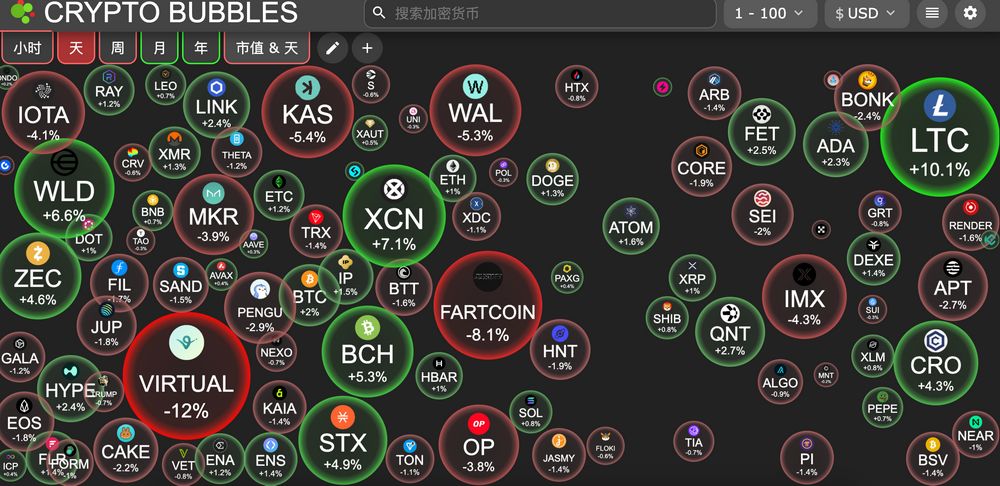

Sector Performance: NFT sector down 2.96%, GameFi sector down 2.83%

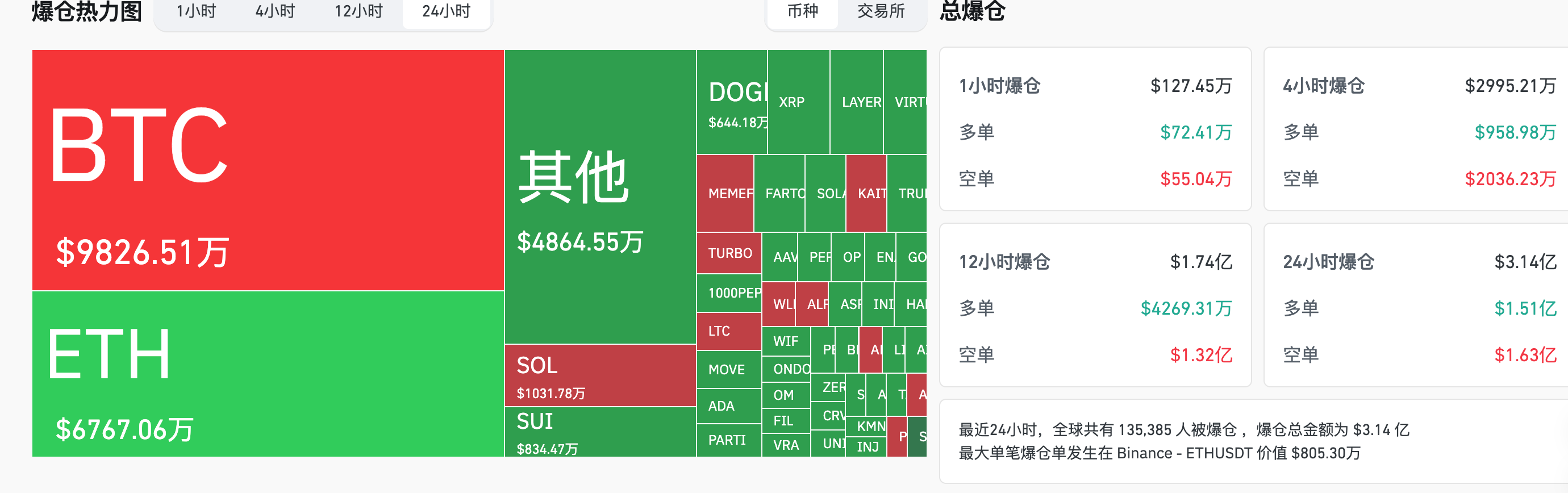

24-hour Liquidation Data: A total of 1,135,385 people were liquidated globally, with a total liquidation amount of $314 million, including $98.26 million in BTC, $67.67 million in ETH, and $10.31 million in SOL.

BTC Medium to Long-term Trend Channel: Upper line ($95,261.41), lower line ($93,375.05)

ETH Medium to Long-term Trend Channel: Upper line ($1,811.27), lower line ($1,775.40)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of May 6)

Bitcoin ETF: -$85.63 million

Ethereum ETF: -$17.87 million

4. Today's Outlook

Binance Alpha will open trading for Obol Collective (OBOL) on May 7

Jito (JTO) will unlock 11.3 million tokens on May 7, valued at approximately $20.4 million

Ethereum Name Service (ENS) will unlock 1.45 million tokens on May 8, valued at approximately $26.2 million

U.S. Federal Reserve Rate Decision (Upper Limit) as of May 7 (May 8, 2:00 AM)

- Actual: To be announced / Previous: 4.5% / Expected: 4.5%

UK Central Bank Rate Decision as of May 8 (May 8, 7:00 PM)

- Actual: To be announced / Previous: 4.5% / Expected: 4.25%

U.S. Initial Jobless Claims for the week ending May 3 (in thousands) (May 8, 8:30 PM)

- Actual: To be announced / Previous: 241.0 / Expected: 231.0

Top Gainers in Today's Market Cap Top 500: KAITO up 31.81%, BAN up 21.75%, SYRUP up 15.93%, REX up 13.63%, SHFL up 12.34%.

5. Hot News

Futu Crypto supports BTC and ETH deposits, USDT limited to professional investors

U.S. Senator Proposes MEME Act to Ban Presidents and Congress Members from Issuing Meme Coins

Trump Family Project WLFI Transfers Over $4.5 Million in Assets to Unknown Wallet

New Hampshire Becomes the First State in the U.S. to Pass "Strategic Bitcoin Reserve" Legislation

Doodles Announces $DOOD Will Launch on Solana and Initiate 13% Airdrop Plan

People's Bank of China Announces Interest Rate and Reserve Requirement Cuts

sns.sol Releases SNS Token Economics: Airdrop Accounts for 40%

Listed Company KULR Technology Increases Holdings by 42 Bitcoins, Total Holdings Rise to 716.2

Listed Company DeFi Development Increases Holdings by 82,404 SOL, Total Holdings Exceed 400,000

Standard Chartered Bank: BNB Price May Reach $2,775 by the End of 2028

Listed Company SOL Strategies Announces Purchase of 122,524 SOL

Haedal Launches Buyback Plan Aimed at Directing Protocol Revenue to Reward veHAEDAL Stakers

Binance Will List Maple Finance (SYRUP) and Kamino Finance (KMNO) and Add Seed Tags for Them

Two New Wallets Withdraw 83,000 SOL from Kraken for Staking, Valued at $11.97 Million

Financial Times: Traders Made $100 Million Profit Buying Before Melania Trump Token MELANIA Launch

Creator of Meme Coin TRUMP Has Earned Over $320 Million in Fees So Far

Florida's Strategic Bitcoin Reserve Bill Withdrawn, Exiting State-Level Crypto Legislative Race

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。