Blackrock’s IBIT Powers $425 Million Bitcoin ETF Inflow As Ether ETFs Stay Flat

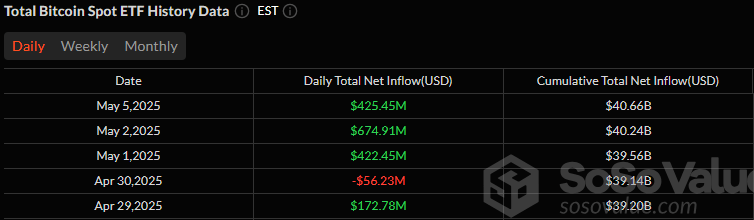

Bitcoin ETFs wasted no time setting the tone for the new week. Fueled solely by Blackrock’s IBIT, they roared into Monday with a $425.45 million net inflow, extending their momentum from last week and reaffirming investor appetite.

IBIT continues to dominate the ETF landscape, attracting a massive $531.18 million single-day inflow, more than enough to drown out the red ink elsewhere. Five other funds logged outflows, led by Fidelity’s FBTC (-$57.82 million) and Bitwise’s BITB (-$22.66 million).

Source: Sosovalue

Grayscale’s GBTC ($16.37 million), Ark 21shares’ ARKB ($6.14 million), and Franklin’s EZBC ($2.74 million) also slipped, but their combined withdrawals couldn’t dent the bullish tide from Blackrock. Total value traded across bitcoin ETFs came in at $1.83 billion, and net assets closed the day at $110.68 billion.

Meanwhile, ether ETFs hit pause. No inflows. No outflows. Just a quiet day with net assets holding steady at $6.31 billion and investors seemingly taking a wait-and-see approach. As bitcoin ETFs continue to push upward, the market’s attention remains fixed on Blackrock’s gravitational pull and whether ether will soon catch a similar wave.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。