Bitcoin ETFs Close Week With $675 Million Inflow Led Entirely by Blackrock’s IBIT

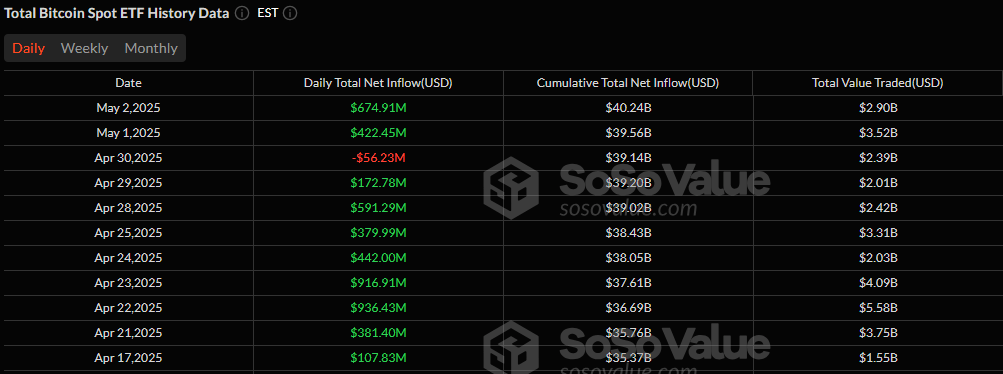

As the week came to a close on Friday, May 2, Blackrock reminded the market who’s boss. Its ishares Bitcoin Trust (IBIT) single-handedly delivered a jaw-dropping $674.91 million inflow on Friday, with no other bitcoin ETF seeing a cent of action. And yet, that was enough to push the day’s total net inflow for bitcoin ETFs to $674.91 million.

The inflow was a clean sweep, but what a move it was. With no outflows and no competing entries, IBIT’s dominance underscored just how influential a single player can be in the U.S. spot bitcoin ETF landscape. Total value traded hit $2.90 billion, and net assets climbed to a robust $113.15 billion.

Source: Sosovalue

Ether ETFs also extended their positive streak, albeit on a smaller scale. Once again, it was Blackrock’s ETHA leading the charge, pulling in $20.10 million. Just like with bitcoin ETFs, the rest of the ether ETF cohort remained silent, posting neither inflows nor outflows.

Total trading volume for ether ETFs came in at $153 million, with net assets ticking up to $6.40 billion.

The day’s data not only capped a strong week but also reinforced the gravitational pull of the Blackrock juggernaut. For now, it’s IBIT and ETHA setting the tone, while everyone else watches.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。