采纳迈克尔·塞勒(Michael Saylor)以资产负债表为基础的购买策略,显然在许多上市公司中得到了广泛应用,显著提升了它们的股价和股东的财富。

但这对比特币价格的未来意味着什么?NYDIG研究团队进行了数据分析,结果令人震惊。

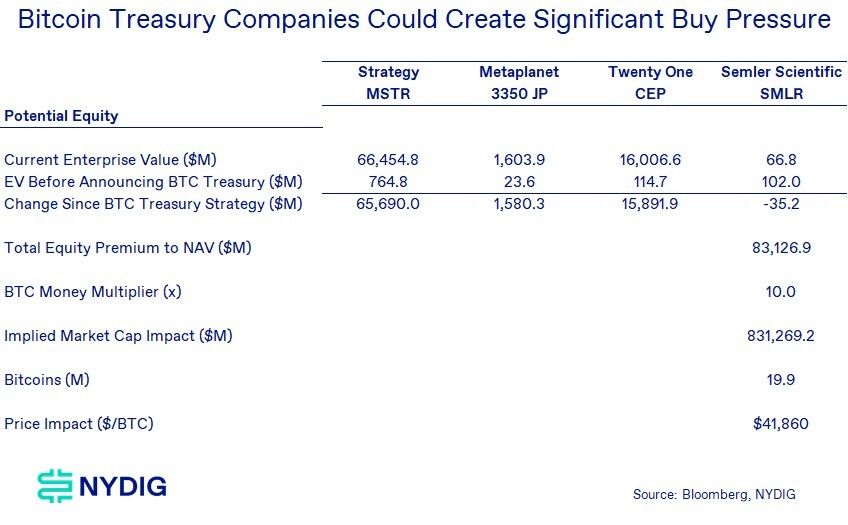

“如果我们应用一个10倍的‘货币乘数’——这是一个反映新资本对比特币市值历史影响的经验法则——并将其除以比特币的总供应量,我们可以得出潜在价格影响的粗略估计:每个比特币增加近42,000美元,”NYDIG在一份研究报告中表示。

为了得出这个结论,NYDIG的分析师回顾了Strategy (MSTR)、Metaplanet (3350)、Twenty One (CEP)和Semler Scientific (SMLR)自采用比特币购买策略以来的累计股权估值。这使分析师们大致了解了他们在当前股价下通过发行股票可以理论上筹集多少资金来购买更多比特币。

如果这一分析成真,预计价格将比当前每个比特币96,000美元的现货价格增加近44%。如果资本化,华尔街的资金经理们或许不会介意向客户展示这张盈亏图表,尤其是在当前市场波动和不确定性加大的情况下。

“含义很明确:这种以发行能力形式存在的‘干粉’可能对比特币的价格产生显著的上行影响,”NYDIG研究表示。

比特币的有限供应也为这一分析提供了良好的基础。上市公司已经持有比特币总供应量的3.63%,其中大部分由Strategy持有。根据BitcoinTreasuries的数据,加入私营公司和政府持有的比特币,总量达到了7.48%。

如果美国政府找到“预算中性策略以获取额外比特币”用于其战略比特币储备,需求在不久的将来也可能进一步增长。

阅读更多:Cantor股价因交易者对比特币SPAC热潮的FOMO而飙升130%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。