Wealth management firms controlling more than $50 trillion in assets continue to limit access to bitcoin exchange-traded funds (ETFs), according to a chart published by Tephra Digital on April 30. Strategy’s executive chairman, Michael Saylor, shared the chart and commented on the delayed adoption curve among financial advisors. He stated on social media platform X:

By the time your financial adviser says it’s OK to buy bitcoin, it’ll cost $1 million. When they say it’s a good idea, it’ll be $10 million.

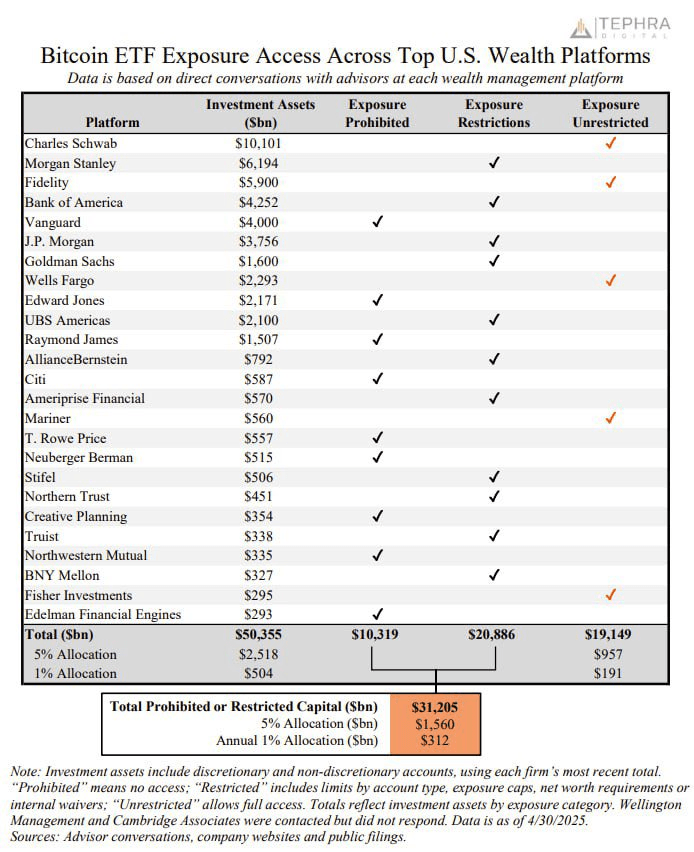

The analysis, based on direct conversations with advisors, sorted ETF access into three categories: prohibited, restricted, and unrestricted. Despite surging demand after regulatory approval, only about 38% of the assets are housed in firms offering unrestricted access to bitcoin ETFs.

Firms such as Charles Schwab, Fidelity, and Wells Fargo have opened the door fully, offering exposure without limits and accounting for $19.1 trillion in assets. However, approximately $20.9 trillion is tied to platforms with restricted access, which includes conditions based on account type, exposure limits, or investor eligibility. Another $10.3 trillion is completely cut off from ETF access, with platforms like Vanguard, Edward Jones, and Citi continuing to bar any exposure to bitcoin ETFs.

Tephra Digital underscored the magnitude of these restrictions by estimating potential capital flows. If just a 5% allocation to bitcoin ETFs were allowed on platforms currently prohibiting or limiting access, as much as $1.56 trillion could be invested. Even a 1% allocation would account for $312 billion. While critics emphasize market volatility and regulatory concerns, bitcoin supporters argue that dismantling these access barriers could accelerate mainstream institutional adoption. The chart illustrates not only current accessibility but also the scale of unrealized capital that could shift markets if policy positions at these wealth platforms evolve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。