Bitcoin and Ether ETFs Keep Momentum With $191 Million Combined Inflows

The crypto exchange-traded funds (ETF) rally rolled on Tuesday, April 29, with another wave of fresh capital flowing into both bitcoin and ether ETFs, extending a multi-day trend of renewed institutional interest.

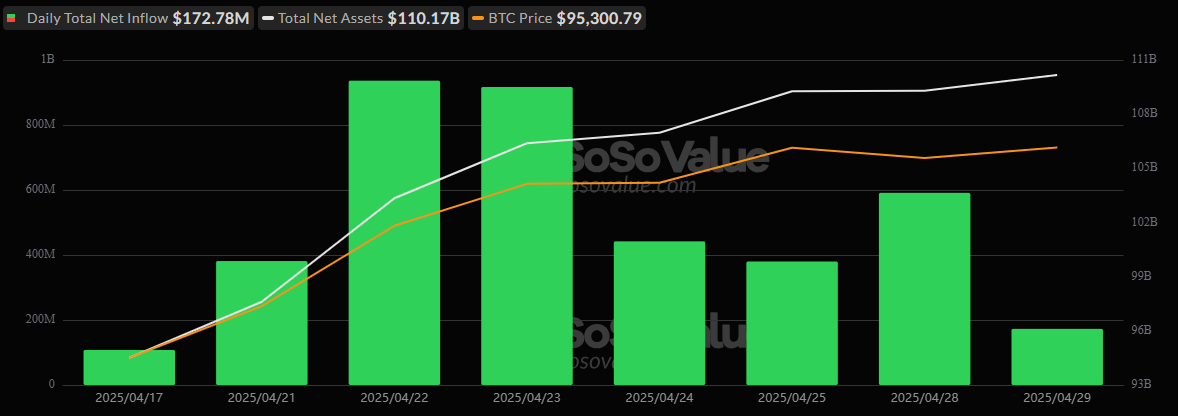

Bitcoin ETFs brought in $173 million in net inflows, marking the 8th straight day of gains. For the second day in a row, Blackrock’s IBIT was the engine behind the surge, attracting a sizable $216.73 million in fresh funds. Offsetting some of the momentum were outflows from Bitwise’s BITB ($24.39 million), Ark 21Shares’ ARKB ($13.32 million), and Fidelity’s FBTC ($6.24 million).

Source: Sosovalue

The remaining ETFs sat quietly with no recorded movement. Still, it was enough to push total net assets past a new milestone, closing the day at $110.17 billion with a total trading volume of $2.01 billion.

Over in the ether camp, the mood stayed upbeat. Ether ETFs posted a fourth consecutive day of net inflows, totaling $18.40 million. Fidelity’s FETH captured the entirety of the inflow action with a $25.52 million haul, while Grayscale’s ETHE reported a $7.12 million outflow. All other funds remained neutral.

Total value traded across ether ETFs stood at $184.32 million, and total assets climbed modestly to $6.30 billion.

Momentum remains strong on both sides, with bitcoin pushing deeper into inflow territory and ether ETFs gradually reversing weeks of red.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。