Source: Cointelegraph Original: "{title}"

On Monday (April 14), an article titled "All trading platforms should immediately stop promoting contract experience bonuses to university students" stirred up a significant reaction in the community.

The article strongly criticized crypto platforms for promoting "contract experience bonuses" to university students. It stated that these platforms target a demographic with low risk awareness and insufficient financial management skills, comparing this practice to the "campus naked loan" incident of 2015, suggesting that a similar situation could reoccur in the future, and called for the industry, the public, and the media to collectively speak out against it.

Although the article did not explicitly name which exchanges were involved, based on the activities and promotional methods described, public opinion naturally pointed towards Bitget and Bybit.

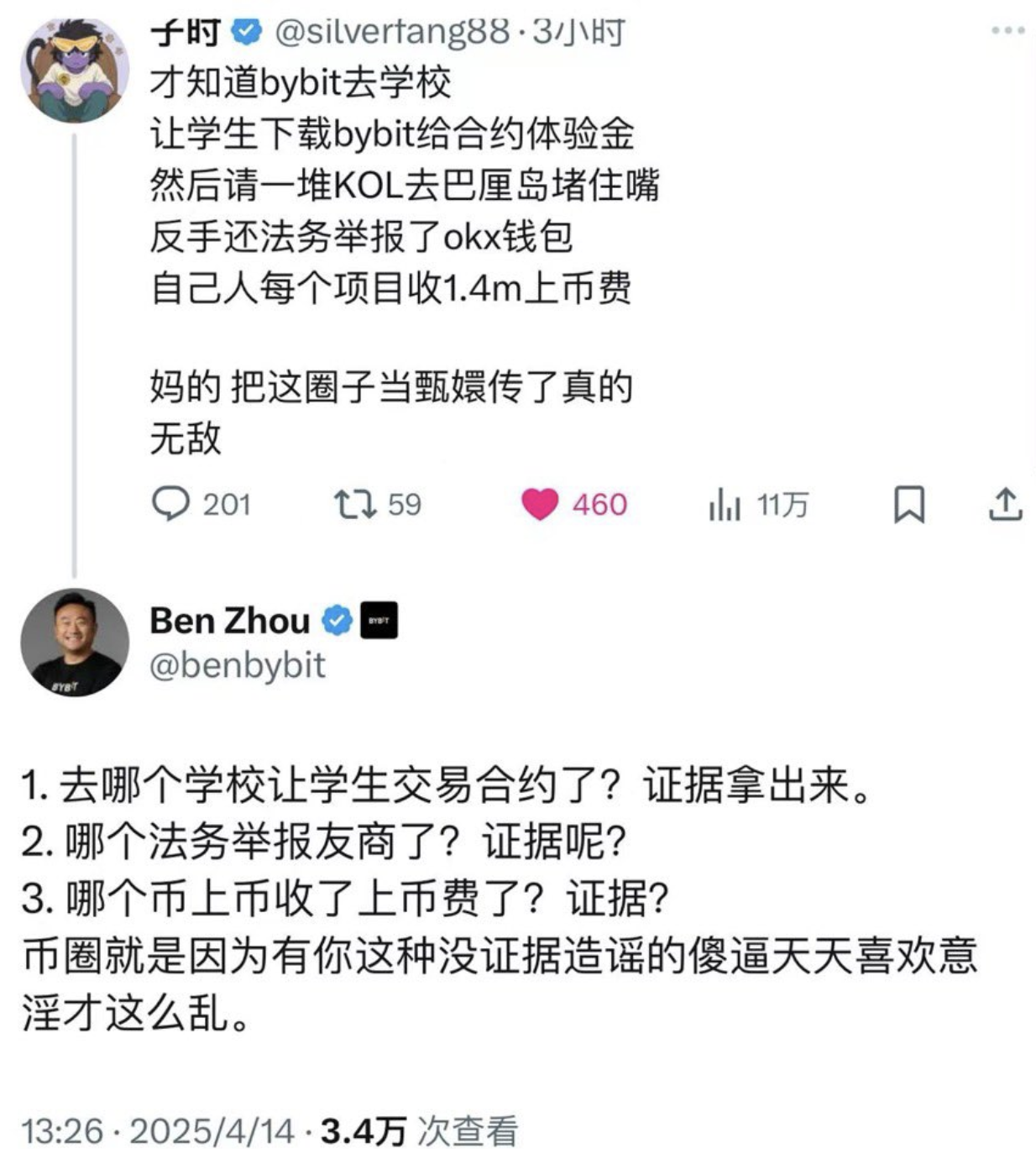

After the article was published, social media user @silverfang88 posted: "I just found out that Bybit went to schools, got students to download Bybit for contract experience bonuses, then invited a bunch of KOLs to Bali to silence them, and even reported the OKX wallet to the legal department, while charging 1.4 million for each project listing."

In response, Bybit's founder strongly refuted the accusations, questioning their validity. He wrote: "Which school allows students to engage in contract trading? Show me the evidence. Which legal department reported a competitor? Where is the evidence? Which coin charged a listing fee? Is there any evidence?"

Bitget's Chinese spokesperson, Xie Jiayin, also distanced the company from the controversy, denying that they had offered contract experience bonuses to students.

He stated: "The Bitget Campus Ambassador Program aims to promote blockchain technology, disseminate Web3 knowledge, and provide internship and practical opportunities for university students. After discovering that this activity was misunderstood as contract incentives, Bitget has also stopped promoting contract rebates to university students and has rejected all related applications."

The back-and-forth exchange of accusations has only fueled the "contract trading entering campuses" incident, making the situation more complex and attention-grabbing. Industry insiders are increasingly concerned about whether some exchanges are engaging in excessive marketing to attract young users who lack financial experience.

Negative voices argue that the platforms' practices exploit the "information gap" among students, who have limited awareness of cryptocurrency risks and are easily attracted by "referral bonuses"; furthermore, it essentially promotes a form of gambling, akin to high-leverage casinos; finally, Bybit and Bitget are seen as engaging in gray marketing, often using "campus ambassadors" or "rebate programs" to disguise their actual behavior of "recruiting people to trade coins," which is no different from casinos entering campuses.

Why are small and medium-sized exchanges frantically trying to attract new users?

The "frantic user acquisition" by small and medium-sized exchanges reflects growth anxiety and is a desperate measure taken by some brands lacking a brand moat and technological barriers to compete for survival space and capital attention.

Currently, leading exchanges like Binance and OKX have captured the vast majority of market share, and for small and medium-sized exchanges to break through and survive, they must rapidly expand their user base. Attracting new users has become the "starting line" for increasing trading volume and attracting project parties and investors' attention.

In the crypto industry, the number of users and their activity directly impact a platform's liquidity and valuation. More users represent higher trading activity, which can attract more project parties to list tokens, thus forming a positive cycle. Some exchanges even consider user growth as a key metric for attracting financing.

In recent years, some exchanges have actively crafted "big male" or "big female" personas in their marketing direction, winning the attention and resonance of many young people through inspirational narratives. However, when this narrative is continuously directed at college students who are already facing employment anxiety, problems arise. The platforms paint a beautiful picture of "ordinary people achieving a turnaround in their fate by entering the crypto industry," but in reality, many students encounter high-risk contract derivatives as their "first taste."

Beneath the sweet coating of dreams, the platforms may have quietly pushed these young individuals, who do not yet possess sufficient financial literacy, into the abyss of the derivatives market.

Related: Bybit denies the $1.4 million listing fee and school promotion allegations from X platform users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。