编译:深潮TechFlow

要点总结

1. 应用链的发展受到多种因素的影响,包括基础设施的成熟、区块空间竞争的加剧以及对定制化代币经济模型的需求日益增长。

2. 尽管去中心化应用程序 (dApps) 和应用链在商业模式上有相似之处,但各自的优势和局限性也很明显。如果更加重视与生态系统的合作,dApps 可能更为合适;而在优先考虑自主性和独立性时,应用链则更具优势。

3. Cosmos 和 Polkadot 的发展受到技术挑战、经济机制设计以及应用链高门槛的共同制约。

4. 应用链发展的核心在于建立应用壁垒,利用低成本交易促进高频链上活动,并积累流量和用户。虽然技术支持和增强非常重要,但它们更像是辅助因素而非核心要素。

5. 未来,应用链可能通过聚合层、超级链或链抽象技术来解决现有的流动性碎片化和互操作性问题。

6. 尽管应用链的市场资本化或完全稀释估值可能会增加,但真正的关键在于应用本身的质量和用户体验。

应用链的必然趋势

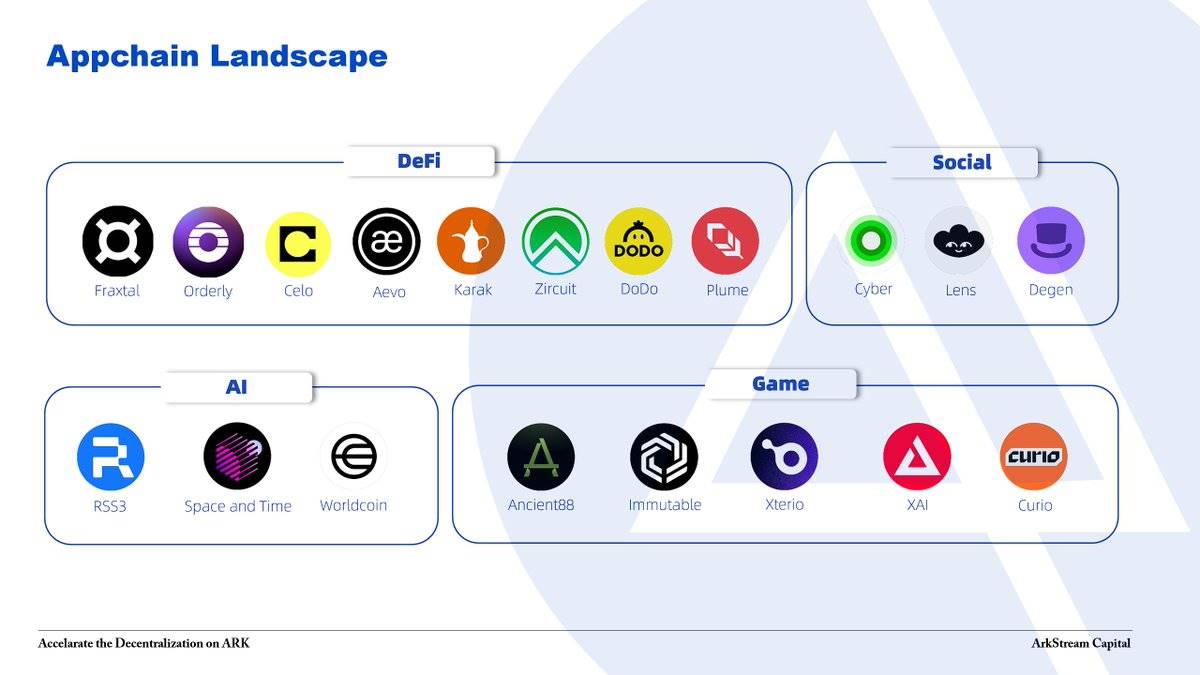

在 2023 年和 2024 年,越来越多的 dApps 宣布转型为应用链。经过对应用链领域的分析,我们发现这些链主要集中在 DeFi、游戏、社交和人工智能等领域。我们认为,应用链的发展已成为一种必然趋势,受到模块化技术的成熟、通用 Rollup Layer 2 网络的广泛采用、RaaS 平台数量的增加及其服务的改善、以及 dApps 在区块空间上的竞争压力和对定制化代币经济的需求所驱动。

然而,我们认为 dApps 升级为应用链并不会立即转化为基础设施层面的高估值,因为 dApps 和应用链更多的是技术选择,而非成功的决定性因素。应用链的优势在于通过低成本交易促进更高频率的链上交易,利用数据积累提升用户体验,增强用户粘性,从而实现网络效应。因此,应用链发展的核心仍在于其独特的应用壁垒和流量。

探索应用链的起源

在讨论应用链的起源时,不能不提到开创性的 Cosmos 项目。Cosmos 以其模块化和可插拔的设计而闻名,它将虚拟机与共识引擎分离,允许开发者选择虚拟机框架并自定义关键的共识引擎参数,如验证者数量和 TPS。这种设计使得各种应用能够作为独立链存在,展现出灵活性和主权的独特优势。这些创新概念使 Cosmos 成为应用链探索和实践的重要贡献者,为该领域奠定了坚实基础。

通过在 Mintscan 上回顾 Cosmos 的应用链生态系统,我们发现许多知名且成熟的应用链,如 dYdX、Osmosis、Fetch AI、Band 和 Stride,都是基于 Cosmos 框架构建的。然而,基于 Cosmos 的应用链的整体增长并未持续,新的链数量也没有显著增加。我们认为,这主要是因为 Cosmos 赋予应用链过多的主权,而在 Atom 2.0 的 ICS 解决方案推出之前,高启动和维护成本阻碍了它们的安全性。

通常,构建基于 Cosmos 的应用链需要一个熟悉 Cosmos SDK 和 Tendermint 共识引擎的团队,这给主要专注于应用开发的团队增加了额外的技术负担。此外,即使一个项目团队能够组建足够的技术人员,大多数基于 Cosmos 的链的启动逻辑都涉及空投代币以吸引初始验证者并确保网络安全,而高通胀率则激励验证者维护安全性。然而,这种方法加速了代币贬值,削弱了网络的价值,使得应用链更难在市场上立足。

随着 Atom 2.0 的 ICS 解决方案的推出,应用链的概念将演变为无许可消费者链模型,从而降低保护消费者链的成本。然而,这种由 DAO 管理的投票模型可能面临与 Polkadot 的平行链拍卖机制类似的低效。此外,Cosmos 在链的活跃性、开发者文档资源和社区文化方面的不足削弱了其对新应用链的吸引力。例如,Cosmos Hub 在今年早些时候停止了区块生产,而在 2023 年的铭文热潮期间,有限的开发者文档也影响了其吸引力,加上跨链基金会的“小圈子”政策,使得新项目的加入变得更加困难。

新应用链的催化剂

早期的 Cosmos 应用链可以被视为以链为中心的应用,强调链的主权,而新的应用链则更加以应用为中心,专注于应用开发。这些新链的兴起受到多个因素的推动,包括模块化区块链概念的普及、通用 Rollup Layer 2 的成熟与广泛应用、互操作性和流动性聚合层的发展,以及 RaaS 平台的崛起。

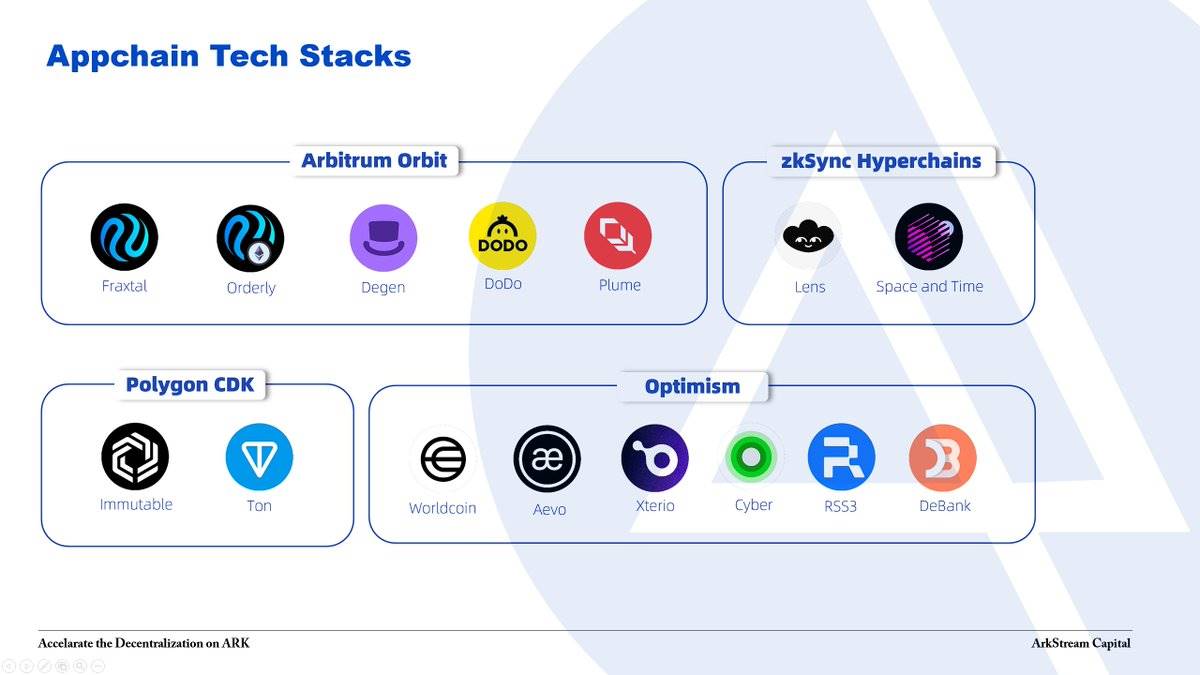

Optimism 在 2022 年成功推出,标志着模块化区块链理论的实现,展示了 Rollup 如何高效扩展以太坊,并鼓励对 Layer 2 解决方案的探索。在此基础上,Optimism 借鉴了 Cosmos 的理念,引入了 OP Stack 概念,该概念在 Worldcoin 和 Base 等项目中得到了广泛应用,进一步吸引了行业的关注。其他 Rollup 解决方案也推出了类似的概念,例如 Arbitrum Orbits、Polygon CDK、StarkWare Appchains 和 zkSync Hyperchains。因此,应用链成为 dApps 实现业务逻辑的新方式,面临的主要挑战转向技术选择、业务设计和运营维护。

实施 Rollup 解决方案通常需要选择合适的执行框架,例如 OP Stack 或 Arbitrum Orbits。OP Stack 是一个不断发展的 Rollup 框架,需要不断升级以支持以太坊的新特性,如 Cancun 的 Blob 特性,同时还要支持诸如替代数据可用性等新兴功能。为了简化应用链的开发过程,通常遵循以下步骤:

-

技术选择:评估不同框架的特性和优势,选择最合适的框架。

-

需求设计:根据框架的定制能力设计应用链。

-

运营和维护:完成部署、测试、上线和持续维护。

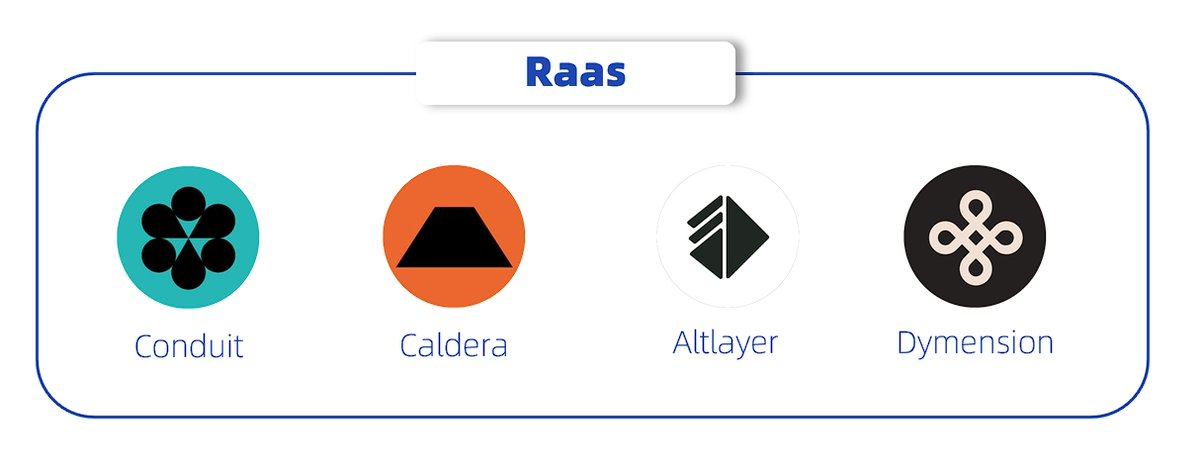

选择和实施合适的 Rollup 框架并不容易,尤其是在上线后进行更改可能会更加复杂。这就是 Altlayer、Caldera 和 Conduit 等 RaaS 平台出现的重要原因。这些平台类似于 SaaS,专注于 Rollup 解决方案,帮助 dApps 快速选择不同框架,简化应用链开发的复杂步骤,提供定制的核心功能,并支持上线后的维护和优化。

与此同时,应用链的基础设施和相关功能也在快速进步,推出了诸如 Celestia、EigenDA 和 NearDA 的替代数据可用性等新协议和特性,以降低成本并提高吞吐量。RaaS 平台还推出了对自定义燃气代币和原生账户抽象等功能的集成支持。随着基于 Rollup 的应用链越来越受到欢迎,流动性碎片化和互操作性问题变得愈发明显,推动了 Optimism 的超级链、Polygon 的 AggLayer、Caldera 的 Metalayer 和 zkSync 的弹性链等解决方案的出现,旨在改善应用链之间的互操作性和流动性聚合。

虽然这些催化剂降低了应用链的进入门槛,但初级和次级市场的挑战正在加剧 dApps 对突破路径的探索。根据 CMC 和 Rootdata 的数据显示,在次级市场前 100 个项目中,除了由社区和文化驱动的 meme 代币外,仅有少数纯应用项目,如 Uniswap、LDO、Aave、Ondo、Jupiter 和 Ethena 存在,大多数项目仍属于基础设施。这一现象隐含地表明,基础设施在加密行业中的地位高于应用。

在初级市场中,应用融资的金额也远低于基础设施。我们认为,这部分是由于 Web3 应用的 UI/UX 设计复杂性远不及 Web2 的成熟和易用性,同时应用缺乏真正的范式创新。尽管如此,我们相信应用链的潜力尚未被完全挖掘,未来可能成为 Web3 发展的重要突破。目前,知名的应用链项目如 IMX、Cyberconnect、Project Galaxy 和 Worldcoin 正在展示应用链的巨大潜力。

新应用链的利与弊

在科技和创新领域,常常将“银弹”描述为解决所有问题的完美方案。然而,实际上没有任何技术能够一次性解决所有问题。同样,新应用链也并非一种普遍或完美的解决方案。以下是我们对其优缺点的分析:

优点

-

模块化设计:应用链通常采用模块化设计,允许开发者根据具体需求定制结算机制、数据可用性和其他基础设施组件。

-

性能优化:许多新的应用链引入了替代数据可用性解决方案,以降低成本并提高吞吐量。

-

增强价值捕获:自定义燃气代币和账户抽象等功能使得应用开发更加灵活,并支持更复杂的商业和代币模型。

缺点

-

流动性碎片化:新应用链可能面临流动性碎片化的问题,导致资源配置不均。

-

互操作性和组合性问题:应用链缺乏以前在公链上享有的组合性和互操作性便利,限制了其发展潜力。

-

复杂性增加:与传统的 dApps 相比,新应用链引入了更高的复杂性,特别是在设计和实施方面,可能需要更多的技术资源和支持。

决定应用链的核心考虑因素

从项目团队的角度来看,在决定是否升级或迭代到应用链时,建议遵循以下原则:

1. 对现有公链特性的依赖:如果您的应用严重依赖于公链上的其他 dApps,例如流动性或产品功能,建议继续使用现有的 dApp 解决方案。

2. 对自定义功能的需求:如果当前应用无法在协议层面支持关键的业务需求,例如账户抽象或特定的入驻机制(如收益分享),而这些功能对业务运营至关重要,则建议考虑转向应用链。

3. 成本敏感性:如果最终用户对区块空间资源非常敏感,或者希望减少如 MEV 等损失,那么应用链可能是更好的选择。此外,如果应用涉及高频交易,应用链可以提供更高的资源效率和更低的交易成本。

为应用链构建护城河和发展路径

我们认为,应用链的护城河始终在于其应用业务。成功的关键在于深刻识别市场痛点并建立产品市场契合度 (PMF)。单纯依赖链基础设施的叙述类似于“拿着锤子到处找钉子”,这并不是构建护城河的有效策略。

在当前的新应用链浪潮中,重点应放在构建透明且低成本的应用,识别市场需求,解决产品痛点,完善并保障产品,同时积累大量用户数据,发展具有现金流的商业模型。这将形成强大的用户粘性和网络效应。

采取过于高调的方式未必适合应用链。至少在核心产品得到完善且用户增长数据完全建立之前,重点应放在产品开发上,而市场营销则应作为次要优先事项。用户数据的积累、用户习惯的培养以及产品功能的迭代并非一蹴而就,因此,稳健和审慎的方法更为适宜。应用链应首先建立核心功能,甚至是不可替代的功能。在此基础上,可以开发新功能和产品线。即使新功能反响平平,也可以采取防御策略放弃它们。在升级和迭代应用链时,可以与原有应用功能进行多次深度整合。

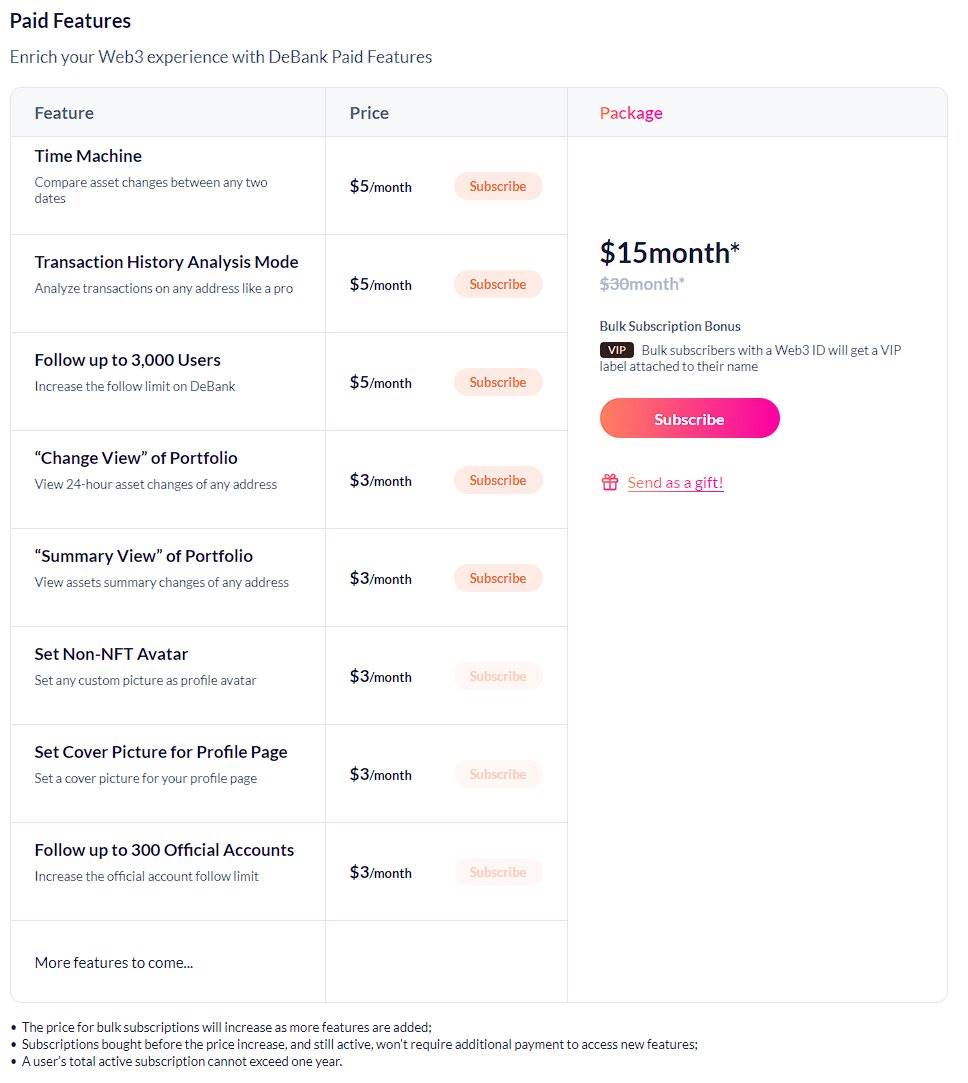

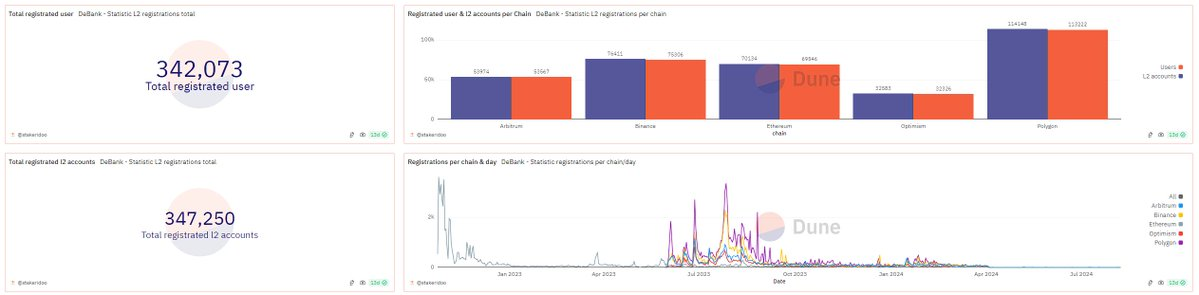

例如,知名的投资组合可视化和资产管理平台 Debank 长期以来一直在 ETH 和 EVM 基于的钱包地址中建立资产、交易历史和 dApp 位置的跟踪和观察,并基于此迭代了许多功能。尽管 Debank 的一些不太知名的功能,如通知、书签和问候,并未削弱其核心资产管理能力,但它们仍然存在。Debank 的付费功能也体现了其对细节的关注,提供多样化和细化的付费选项以及集成的套餐优化,为用户提供了周到的选择。这些功能的整体表现强劲,与 Debank 的其他产品线 Rabby Wallet 形成良好的协同。尽管 Debank 基于 OP Stack 推动 Debank Chain 的发展,用户并未感受到明显的差异,这表明 Debank 的应用链有效地建立了其核心护城河,并为其他应用链的发展路径提供了宝贵的见解。

为应用链设计代币模型

在构建应用链的代币经济模型时,我们提倡采用一种“有机”的方法。这种策略的核心在于尽量减少人为干预,避免依赖短期激励。我们的目标是让代币的流通和价值增长与应用本身的扩展以及用户基础的增长相契合。通过这种方式,代币经济能够与应用的长期发展和用户的实际需求相同步,从而实现可持续增长。

在应用的早期阶段,代币可以作为吸引用户并实现“冷启动”的有效工具。然而,要确保这些初始用户不仅被吸引,还能转化为长期用户,关键在于设计一个高效且具有吸引力的机制。这一机制应基于对应用产品的清晰定位、对用户需求和偏好的深刻洞察,以及对商业背景的全面理解。此外,必须明确代币的核心价值,以确保用户能够识别其长期潜力和收益。通过这样的策略,代币不仅能吸引用户,还能鼓励他们持续参与并深入使用该产品。

代币持有者数量的增长应与用户基础的扩展保持一致,以确保代币经济的健康发展。我们应避免采取过于激进的代币分配策略,而应专注于实现持续增长的模型。这要求我们充分考虑当前市场的流动性和潜在变化,同时确保代币经济模型与应用的愿景紧密相连。此外,NFT 作为一种新型的储备资产,可以创新性地结合,为用户提供多样化的使用场景,从而增强代币的吸引力和市场竞争力。

从失败案例中学习是设计应用链代币时避免犯错的关键。

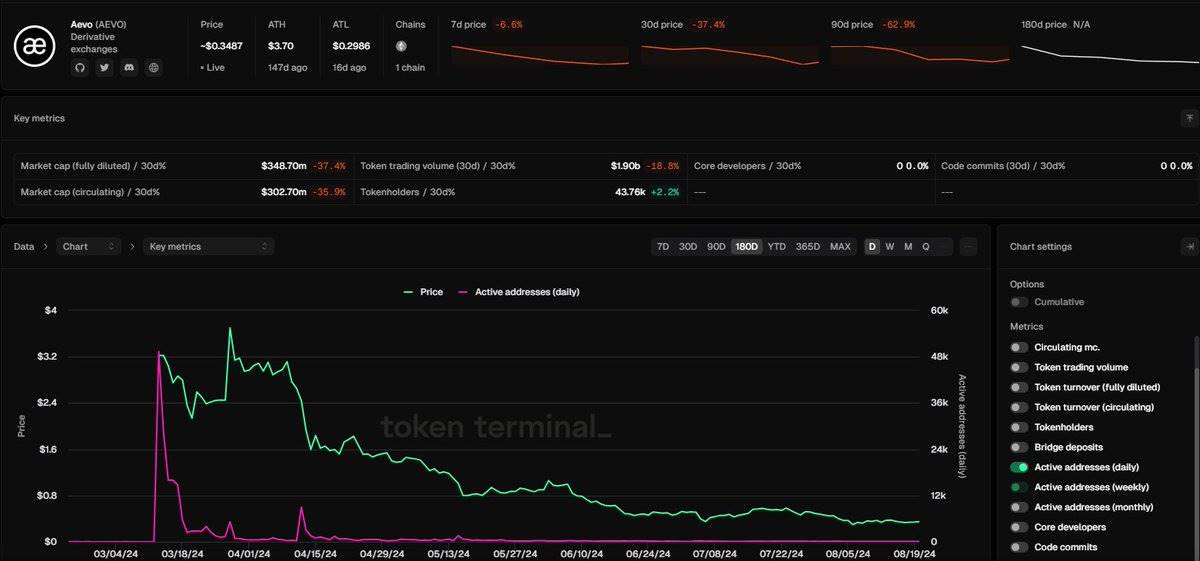

例如,Aevo 是在过去六个月内在 Binance 上市的新代币。它并未受到流动性不足的影响。在通过空投吸引大量早期用户后,Aevo 在预发行交易领域取得了一定的立足点。不幸的是,Aevo 过于激进和不受限制的代币设计最终损害了产品的核心增长指标。目前,Aevo 在代币持有者增长、每日交易活动和预发行交易的基本市场深度等关键指标上显示出停滞。因此,为了构建一个既能吸引用户又具有长期可持续性的代币经济模型,我们提倡一种有机增长策略,以内在价值和用户需求为基础,推动代币的自然增长和应用的扩展。

知名应用链项目概述

让我们深入探讨市场上一些突出的应用链项目,并对其进行分析。

Cyber 是一个重质押的以太坊 Layer 2 网络,旨在在社交领域实现大规模采用。其核心特性包括原生账户抽象、去中心化存储 (CyberDB) 和由 CyberGraph 及 CyberAccount 的 Enshrined Social Graph Protocol 支持的去中心化排序。其核心应用产品 Link3 允许经过验证的 Web3 公司和专业人士在链上创建可重用的数据,这些数据可以被其他应用整合和利用。

XAI 是一个兼容 EVM 的 Layer 3 网络,专为游戏开发,由 Offchain Labs 开发,利用 Arbitrum 技术。XAI 允许玩家在不使用加密货币钱包的情况下拥有和交易游戏内物品,同时网络的节点运营商参与治理并获得相应的奖励,从而为传统玩家创造开放和真实的经济体验。

MyShell AI 是一个创新的平台,面向 AI 智能体创作者,同时也是连接用户、创作者与开源 AI 研究者的消费者 AI 层。用户可以利用 MyShell 的专有文本转语音技术和 AutoPrompt 工具,快速定制具有个性化语音风格和功能的智能体。对于智能体创作者,该平台提供高效的智能体创建、变现选项,以及从其智能体中获利的能力。

GM Network 旨在成为消费者 AIoT 领域的领导者。它结合先进的 AltLayer 技术、EigenDA 和 OP Stack 创建去中心化的 DePIN。GM Network 的目标是建立一个大型激励和沟通平台,通过整合 AI 和 DePIN/IoT 技术,弥合虚拟与现实世界之间的差距,从而推动 AI 在消费者端的广泛应用。

投资分析框架

在进行投资分析时,我们使用以下框架,以确保对应用进行全面和深入的评估:

1. 行业理解与市场定位:深入了解加密领域的机制和实践,识别市场痛点,并提出创新的应用解决方案。

2. 目标客户群体:应用应针对庞大且潜在的用户基础,因为这直接影响其市场资本上限。

3. 产品交付与迭代速度:与基础设施相比,应用需要强大的产品交付能力和快速的迭代速度,以确保功能的持续优化和创新。

4. 用户留存与商业模式:应用必须建立强大的用户留存能力,并通过 GMV 增长和匹配的商业模式实现可持续增长。

通过遵循这一框架,我们可以系统地评估项目的整体实力和市场潜力,为投资决策提供坚实的基础。

展望

我们对应用链的发展持乐观态度。这种乐观源于应用链作为用户活动核心平台的潜力,在社交网络和游戏等多元化领域发挥着重要作用。未来,这些应用链不仅将提供丰富的交互体验,还将通过其独特的技术优势推动相关行业的创新和发展。

附注

-

B 端和 C 端应用商业模型各具特点,但它们与应用链的整合方式相似。本文并未严格区分这两者,而是重点关注它们如何利用应用链技术实现商业目标和增长。

-

Layer 3 和 Layer 2 应用链之间的主要区别在于,Layer 3 采用特定的 Layer 2 作为结算和数据可用性层,因此在结构上与 Layer 2 并没有太大区别。

-

Solana 尚未正式支持 Layer 2 的开发,其重点仍然是构建高性能的 Solana 公链。对于 Solana 上的 Layer 2 或应用链,其整合方式与以太坊类似,主要区别在于执行框架和数据可用性层。

-

尽管当前 Layer 2 的状态看起来比较沉寂,但真正的问题在于一些 Layer 2 过于依赖通过空投预期带来的链上繁荣,而没有充分运营和维护生态系统。根据 Defillama 的数据,像 Arbitrum 和 Base 这样的 Layer 2 链仍然保持高度活跃。

-

应用链与 RaaS 平台之间的收入分成模型各不相同,例如固定费用或排序器收入的分配。不同规模的应用链可以根据其商业情况选择合适的收入分成模型。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。