Bitcoin is facing challenges on Thursday, with its price declining 1.9% over the past 24 hours. However, despite this downturn, BTC has seen a 4.8% increase over the past week. Over the past month, though, statistics reveal a 12.4% decrease during the 30-day period. Concurrently, on May 9, BTC’s dominance stands at about 53% of the $2.27 trillion crypto economy.

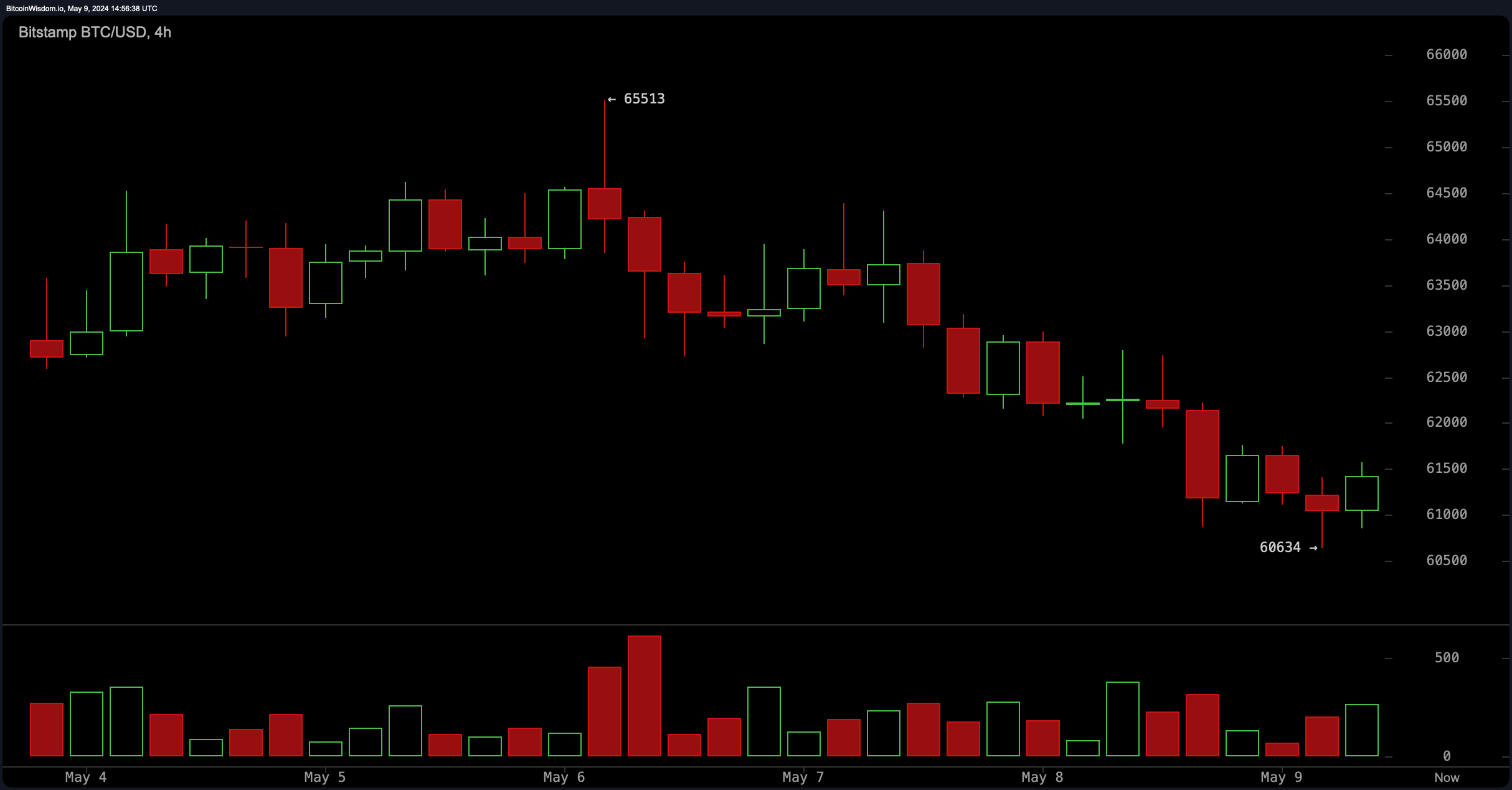

BTC tapped an intraday low of $60,634 at approximately 7 a.m. EDT.

At press time, bitcoin’s market valuation is hovering around $1.2 trillion with around $24 billion in 24-hour trade volume. BTC’s top pair on Thursday is FDUSD as it captures 44% of BTC trades while USDT commands 33%. USD, USDC, and KRW follow those two stablecoins in terms of BTC’s most traded pairs over the last day.

Coinglass.com metrics indicate that the downturn in bitcoin’s value has caused a significant amount of long liquidations across derivatives crypto exchanges. $34.79 million in BTC longs were liquidated in 24 hours. On the other hand, during the past four hours, $7.85 million in BTC shorts were wiped out. Across the entire crypto economy, $134.34 million in both short and longs were liquidated during the day.

The day’s liquidation figures underscore the volatile nature of leveraged bitcoin trading, emphasizing the risks and rewards inherent in crypto derivatives markets. Moving forward, stakeholders will be closely monitoring bitcoin’s performance as it attempts to stabilize and regain its footing in a dynamic financial landscape. Meanwhile, the recent downturn has resulted in the liquidation of 61,321 crypto derivatives traders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。