作者:BITCOIN MAGAZINE PRO AND LANDO

翻译:白话区块链

尽管比特币在减半后遭遇了几次挫折,但这种首个加密货币的价格在有人表示当前周期触底后略有反弹。

比特币在过去一个月中经历了一些混乱。在4月19日减半前几天,这种领先的去中心化货币达到了历史最高点,打破了比特币减半行为的所有预先建立的趋势线。与比特币价格一同大幅回落的是市场整体的几个因素,加上这种不寻常的行为和信心。尽管一些相关行业仍然表现出对比特币的坚定态度和信心,但美元仍然似乎流出了ETF产品和整个比特币生态系统。这个特定的周期似乎有些奇怪。

通常,在减半之后,市场会经历一段立即且持续的低迷期,几个月后价格会创下新的历史高点。然而,这一次,极早的高点显然意味着减半前一周出现了大幅下降。比特币的价格在减半后稍有恢复,但在随后的周一进一步暴跌。然而,到了5月2日,有几个迹象表明比特币的下跌终于触底了。我们对此有多么确定?为什么整个事件会发生,比特币的复苏将会是什么样子?所有这些问题都在报告出现之际悬而未决。

这个价格周期中一个不可避免的方面是机构投资在比特币的基本动态中所起的不成比例的作用。例如,尽管摩根大通公开对目前投资比特币持谨慎态度,但他们的分析师得出了一个有趣的结论:实际上,推动比特币价格下跌的是个体零售投资者,而不是企业行为者。在大多数机构比特币卖出的同时,摩根大通的分析师声称,私人个体投资者正在从比特币和类似比特币ETF的相关衍生品中大量撤资。

比特币现货ETF的主要目标是允许从未能或不倾向于购买比特币的新投资来源,通过直接从比特币的升值中获利的新方式。看起来这个计划确实奏效了,因为黑石集团在5月2日报告称,一些非寻常的新机构投资者对他们自己的ETF产品表现出了最大的兴趣。黑石数字资产部门负责人罗伯特·米奇尼克在一次采访中表示,各种买家,如“养老金、基金会、主权财富基金、保险公司、其他资产管理公司、家族办公室等,都在进行持续的尽职调查和研究讨论,我们从教育角度发挥了作用。”尽管他没有列出具体的销售数量,其中几个肯定符合那些从未直接购买比特币的投资者的标准。这不仅仅是对他们可能对比特币不喜欢的陈述,而是一个法律现实,因为其中许多实体根本无法参与市场。

然而,通过ETF,一扇扇大门已经打开。这些大门几乎涉及全国各个层面的机构,甚至国际舞台上的参与者,如法国巴黎银行(BNP Paribas),欧洲第二大银行,也一直在投资于黑石集团的ETF。这些销售情况是通过2024年第一季度的美国证券交易委员会的文件披露发现的,尽管他们的购买规模很小,但重要的是像这样的重要机构在私人客户撤资的同时投入了资金。在一个特别有意义的事件中,富达甚至预测比特币在其15年的运营过程中终于成熟,并且已经在金融界达到了一种接受水平,使得其波动性持久下降。分析师声称,比特币目前比纳斯达克市场上的数十家高表现公司更加稳定,甚至在富达自己的ETF亏损更多的情况下提出了这一观点!

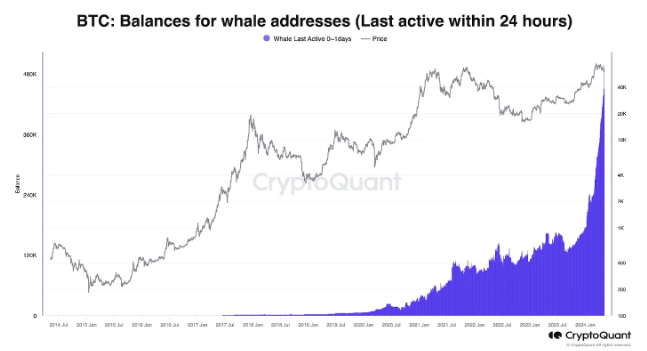

在这种背景下,一些对个体行为者令人 ger 进信心的因素导致资金开始回流,这有些合理。美联储在5月2日宣布将不会调整利率,比特币价格立即反弹。匿名的大鲸鱼“Mr. 100”以每天购买100比特币的速度恢复了失去的时间,以惊人的新收购量:4100比特币,价值超过2.4亿美元。这次大胆的购买如同发令枪,引发了一些比特币最大的鲸鱼们的行动,接下来的24小时内,大买家们抢购了十倍以上的数量。比特币还没有完全恢复到历史最高水平,但看起来复苏已经开始了。

事实上,比特币要达到用户们期望的飙升数字可能需要相当长的时间。前BitMEX首席执行官、知名社区成员Arthur Hayes警告比特币持有者,在接下来的几个月里,比特币的恢复可能会经历一个"缓慢爬升"的过程。至少从目前来看,这将与一些与比特币减半相关的趋势保持一致。然而,从长期来看,这些影响中的一些似乎令人不安,对于比特币至上主义者来说尤其如此。多年来,比特币经历了几次非常严重的挫折,往往由于一位重要领导者的失败而引发多米诺效应。这些事件被视为成长的痛苦,但我们真的准备好用全球市场主导崩盘的方式来交换这个世界吗?

有些人甚至认为,如果机构投资设法驯服了一个旨在彻底改变整个世界的去中心化经济模型,那将是比特币整体愿景的一种失败。对于那些担心比特币的新金融接受可能会破坏它的人,我邀请他们看看最近事件的规模。没错,比特币在这次减半后的表现确实是完全前所未有的,看起来是由企业资金引起的。然而,尽管这些事件对于新事物来说仍然相对规模较小。在过去的几个月里,比特币曾经有几次在大约三个月的时间里失去一半价值的情况,而2024年的价格下跌只是九牛一毛。对于比特币来说,这种混乱也是完全正常的。如果声称这个不寻常的月份预示着我们去中心化货币的完全中心化——一个具有不可逆转效应的企业控制,那是过早下结论。

除此之外,尽管ETF确实为比特币世界打开了新的大门,但这个世界本身仍然充满了一直依赖的企业家和创新者。开发者们正在为比特币的未来开辟全新的方向,小规模参与者的行动也能产生共鸣。当我们进入一个看似不确定的未来时,似乎可以肯定的是我们可以继续依赖比特币。整个社区将把比特币带到月球,而世界必须与之一起适应。

来源:https://bmpro.substack.com/p/institutional-investors-propel-optimism?utm_source=%2Finbox&utm_medium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。