撰文:Tonstakers

编译:白话区块链

TON 的发展路线图有许多有趣的计划,如稳定币工具包、分片工具和 BTC、ETH 和 BNB 的本地桥接。虽然没有发布日期,但我们希望它们将在 2024 年上线。在本文中,我们将解释即将推出的功能,它们将如何影响网络,并且它们是否会改变 TON 的质押奖励。

我们将最有趣的点分为三个类别,以更好地理解其综合影响。让我们深入了解!

1、无手续费交易

这是 TON 2024 年路线图中最引人注目的里程碑。没有其他主要链提供无手续费交易,因此 TON 有可能革新区块链领域,并吸引更多来自其他生态系统的用户。

在每个区块链中,用户必须为其交易支付 gas 费用。区块链协议无法取消 gas 费用,因为它们防止垃圾邮件发送者每秒发送数千个交易而导致网络堵塞。

可能 TON 将对某些情况下的 gas 费用进行补贴,例如 Telegram 钱包或 USDT 转账,以吸引更多用户在日常需求中使用 TON。想象一下,你可以在 Telegram 中向你的朋友发送 5 美元,而无需询问他的信用卡号或钱包地址,更重要的是,这是免费的。

2、质押奖励的变化

1)验证人和共识人分离

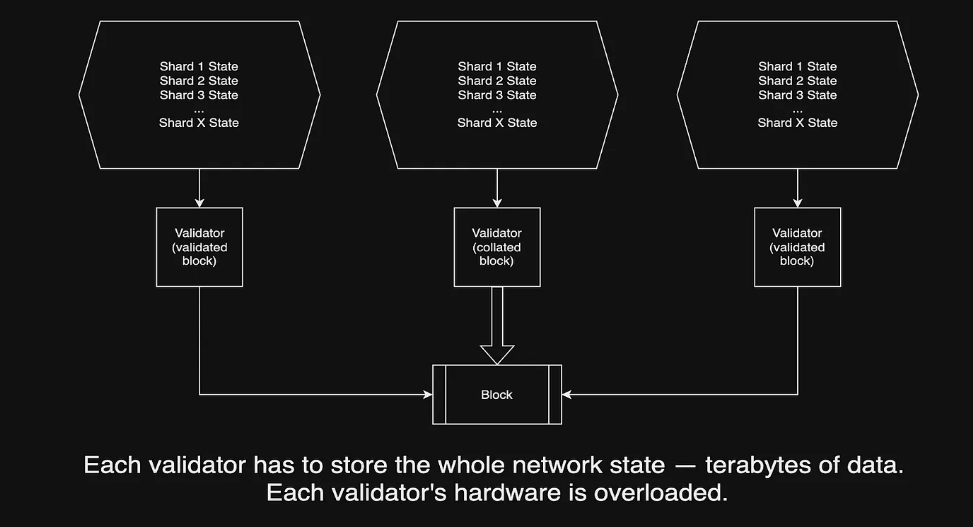

这是 TON 可扩展性的一项重大升级。共识人是指收集交易、验证交易并将其组合成一个区块的过程。为此,节点存储并不断监视 TON 区块链中所有地址的所有余额。

TON 计划到 2028 年将 5 亿 Telegram 用户引入,并利用分片技术提供足够的交易执行时间和低交易费用。通过分片,区块链被分割成几个分片链。2 个分片链提供 2 倍的吞吐量,4 个分片链提供 4 倍的吞吐量,以此类推。

每个分片链将有自己的验证人子集来收集和验证区块。为了确保安全性,这些验证人必须经常在子集之间进行随机轮换。这里出现了问题:随机轮换的情况下,验证人将不得不存储每个分片的状态,而不仅仅是自己所在分片的状态。存储 100 万个账户的状态需要强大的服务器,而将 500 万个账户的状态存储在一个地方是不可能的。

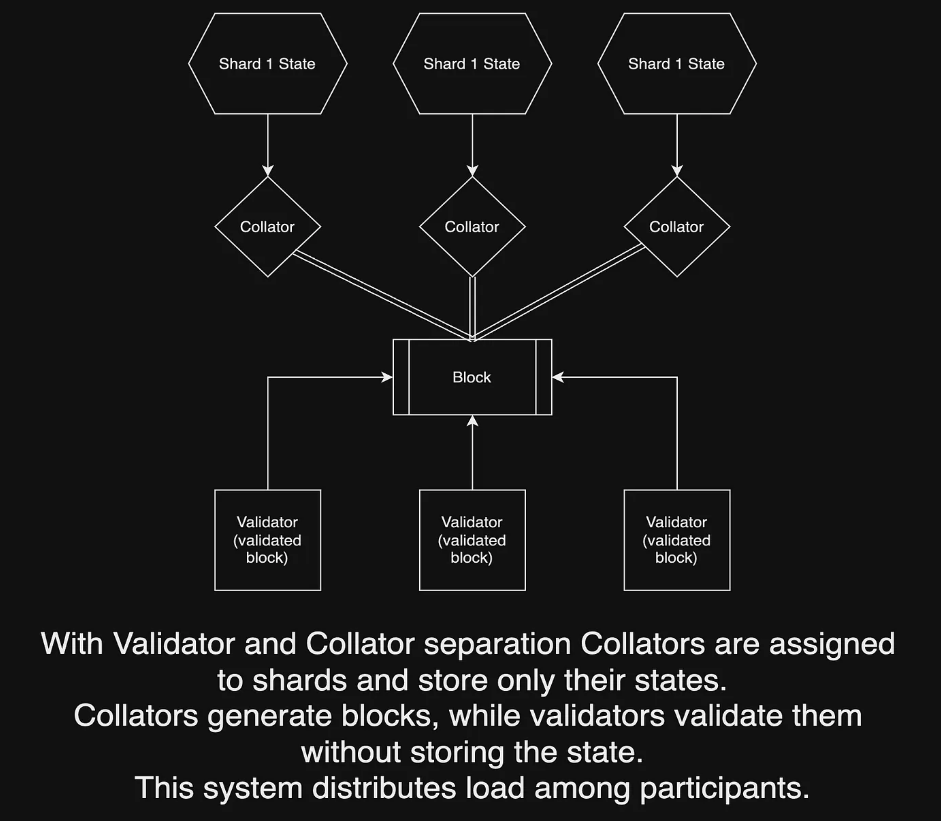

为了解决这个问题,TON 团队提议将验证和收集分为两个角色:Collators 可能只存储其分片链的状态并收集区块,而 Validators 仅在一段时间内分配给该分片链来验证和签署区块。负载和风险将被平均分摊,TON 将能够扩展以满足数十亿用户的需求。

在官方文档中,并没有提到质押奖励的问题。虽然只有验证人在区块验证中承担风险,但收集人也应该因为存储状态和生成区块而获得奖励。

尽管验证过程变得更加复杂,但 TON 的质押年化收益率不会改变,Tonstakers 的流动质押仍将像现在一样有利可图。

2)分片指南和工具

得益于负责的杰出开发人员,TON 将成为首批有效利用分片的区块链之一。中心化交易平台、支付系统,甚至 TON 的服务和应用程序都需要特殊的工具集和文档来实现分片支持,因为这是他们不熟悉的技术。这就是为什么 TON 开发人员希望在不久的将来发布这样的工具的原因。

3)惩罚优化

惩罚是对表现不佳的验证人的一种惩罚方式:缺失区块、经常离线,甚至试图将欺诈性交易放入区块中。

目前,TON 使用投诉机制来惩罚行为不端的验证人。任何网络参与者都可以提供证据并追究不良验证人的责任。

惩罚优化应该带来一个更好的系统,用于检测和惩罚行为不端的验证人,增强 TON 的稳健性。这将分为几个步骤实施:首先,流动质押协议不受验证人惩罚的影响,用户的奖励将得到保证。然后,惩罚将分布在由流动质押协议提供的 TON 上,略微降低平均年化收益率。

4)选民和配置合约更新

TON 的质押、流动质押和链上治理都是通过智能合约实现的。Tonstakers 还使用这些合约来汇集 TON,向验证人提供 TON,并在我们的用户之间分配奖励。

选民和配置合约的更新将允许我们的用户对网络提案进行投票,使网络更加开放,并增加每个用户的价值。

3、去中心化金融

我们将这些变化放在一起,因为如果结合起来,它们将对 DeFi 生态系统产生积极影响。

1)TON 稳定币工具包

除了名称之外,文档中没有对其具体内容进行解释。我们可以猜测,稳定币工具包将允许任何人发行与当地法定货币挂钩的算法稳定币,如英镑、欧元、新西兰元等。

考虑到 TON 与 Telegram 的整合、内置钱包以及最近决定与频道所有者分享 TON 的广告收益,我们可以假设 Telegram 可能会添加使用当地稳定币进行内置服务支付的功能。

2)Jetton 桥

TON 已经与以太坊和 BNB 链建立了桥梁,用于桥接 $TON 和诸如 ETH、BNB 和 USDC 等热门币种。

Jetton 桥将允许用户将类似 tsTON 的 TONToken 发送到其他链上。为什么不在 Uniswap 上添加 tsTON 呢?

3)以太坊、BNB 和比特币桥

尽管我们有第三方桥梁,但在发行额外货币方面,推出官方桥梁将是合乎逻辑的。

4)额外货币

$TON 是原生 Token:用于质押和支付燃气费用。例如,用于交易 $TON 的功能代码已内置在 TON 协议中,并且余额保存在账户中。

Jettons(例如 USDT 和 tsTON 等常规 Token)通过第三方智能合约操作,并且不能替代燃气费用和质押的 $TON。用户的余额存储在这些合约中。

额外货币将允许 TON 用户创建类似原生 Token 的 Token,这些 Token 也将存储在账户中。额外货币和 Jettons 之间最显著的区别是,额外货币的交易应该比 Jettons 便宜 2-3 倍,因为它们将在没有合约调用的情况下发生。

发行类似桥接的比特币和以太坊或原生 USDT 等主要 Token 作为额外货币,将使得与 TON 合作更具优势,并将吸引更多新用户使用 TON。想购买比特币、以太坊和 BNB?TON 将在一个平台上提供它们。

4、结论

TON 的路线图看起来很有前途,并带来了许多新工具,使 TON 在大众中更加受欢迎。

我们认为最有影响力的更新是原生货币、桥梁和稳定币工具包,它们将共同扩展 TON 在日常支付方面的应用场景,并允许更多人开始建立自己的加密资产组合。

与此同时,我们 Tonstakers 对验证人和收集人的分离、惩罚优化和质押合约更新很感兴趣。分离和分片不会影响质押年化收益率,而合约更新将为流动质押用户带来更多价值,因为他们将获得对 TON 更新提案的投票权。

迫不及待地期待 2024 年 TON 将给我们带来的未来!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。