Investors dumped U.S.-based spot bitcoin (BTC) exchange-traded funds (ETFs) at the fastest pace on Wednesday, even as Federal Reserve (Fed) chairman Powell dismissed the prospect of a rate hike.

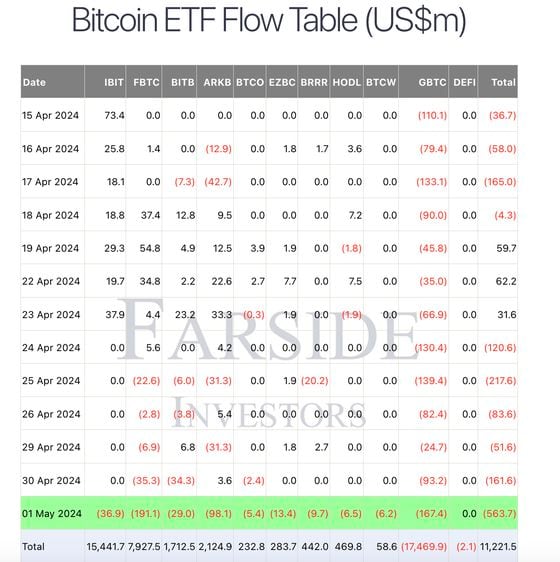

The 11 ETFs saw a cumulative net outflow of $563.7 million, the largest since the funds began trading on Jan. 11, extending a five-day losing streak, according to data source Farside Investors and CoinGlass. Investors have pulled out nearly $1.2 billion from the ETFs since April 24.

Fidelity’s FBTC spearheaded outflows on Wednesday, losing $191.1 in withdrawals. This might be alarming to bulls as FBTC and BlackRock’s IBIT consistently attracted funds in the first quarter, more than compensating for the regular large outflows from the relatively costly Grayscale ETF (GBTC).

On Wednesday, GBTC witnessed the second-largest outflow of $167.4 million, followed by ARKB’s $98.1 million and IBIT's $36.9 million. Other funds also bled money even though Powell's net-dovish approach put a floor under risk assets, including bitcoin. A dovish stance is one where the central bank prefers employment and economic overgrowth over excessive liquidity tightening.

The Fed on Wednesday kept the benchmark interest rate unchanged between 5.25% and 5.5% as expected. During the press conference, Powell said the economy is too strong to cut rates while pushing back against fears of renewed rate hikes or liquidity tightening stoked by recent disappointing inflation figures.

The Fed also said it will significantly curtail its alternate liquidity tightening program, called quantitative tightening (QT), starting June. Meanwhile, the U.S. Treasury announced a program to buy back billions of dollars in government debts for the first time in over two decades to improve liquidity in the bond market.

Like other risk assets, bitcoin is sensitive to expected changes in liquidity conditions and witnessed a brief rally from $56,620 to $59,430 following Powell’s comments. The yield on the 10- and two-year Treasury notes fell along with the dollar index.

BTC’s bounce, however, was short-lived, with bitcoin falling back to $57,300 at press time. Early this week, Asia's first spot bitcoin and ether (ETH) ETFs debuted in Hong Kong with disappointing volumes, worsening the mood in the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。