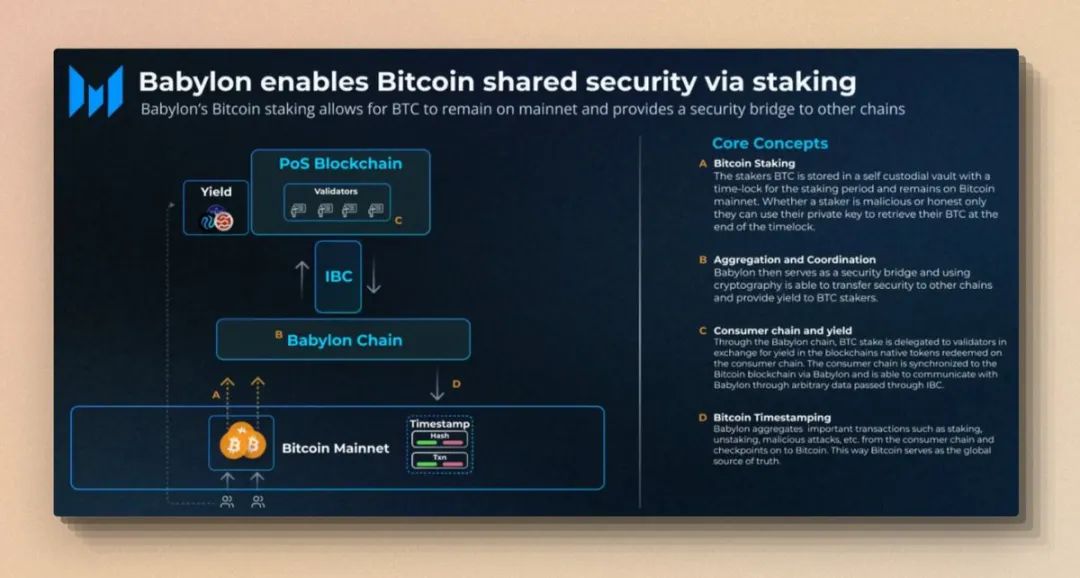

Core point: Utilizing the economic security of Bitcoin and the Cosmos IBC cross-chain communication technology, Babylon allows BTC holders to provide an additional security layer for other PoS blockchains through a unique staking mechanism, while retaining asset sovereignty and without leaving the Bitcoin network, and in return, earn rewards. It leverages some advantages of Proof of Work (PoW) to complement Proof of Stake (PoS) security.

"Remote Staking" allows staked BTC to remain on the Bitcoin mainnet.

Creating customized staking contracts on Bitcoin, Babylon uses Bitcoin scripts and restrictive clauses (covenants) to customize UTXO operations, creating a special transaction type to complete the staking lock function.

Utilizing the Cosmos IBC cross-chain communication protocol to seamlessly aggregate, transmit messages, and data between Bitcoin and other blockchains.

Additional security layer. By recording the hash values of some key data (such as transaction hashes, important decisions, or state updates) of PoS blockchains on the Bitcoin blockchain, "checkpoints" are established. Babylon is able to provide immutable timestamp proof for this data, equivalent to anchoring snapshots of the PoS chain state to the Bitcoin blockchain at regular intervals.

Research Report

1/9 · Scheme Analysis

As the second largest asset by market value, Ethereum has completed the first phase of its mission to become the largest smart contract platform. It is now aiming to become a security layer for other networks and AVS through EigenLayer's "Restaking" concept.

In the PoS consensus mechanism, one of the main sources of security for blockchains is to attract a large amount of capital through stakable assets to gradually establish economic security. The larger the network, the more ideal and stronger the consensus asset needed, and the greater the difficulty in creating assets with such high consensus. Currently, there are only two assets with strong enough consensus, BTC and ETH. To address this issue, projects like EigenLayer utilize the security of ETH to protect other blockchains or AVS, rather than guiding it through costly token issuance.

As of now, EigenLayer has achieved tremendous success, attracting over $15 billion in TVL. Therefore, Bitcoin, as the strongest consensus and most secure PoW chain, also has the potential to provide security services for other blockchains, which will also provide a good PoW security supplement to the PoS consensus mechanism, without the need to debate whether PoW is better or PoS is superior.

Babylon is committed to creating BTC staking, allowing BTC holders to share over $1.3 trillion in economic security with other networks without leaving the Bitcoin network itself, in exchange for staking rewards. In its scheme, Babylon achieves the recording and verification of critical data submitted by PoS chains through remote staking, customized staking contracts, timestamps, and EOTS (Extractable One-Time Signatures). However, it should be noted that the Bitcoin architecture itself cannot verify complex computational logic and smart contracts, so there is still basic logic computation within the PoS chain. The PoW security provided by Babylon is an "additional security layer" and a supplement to PoS security, promoting the integration of PoS and PoW in terms of security. Meanwhile, due to the different underlying consensus mechanisms of Babylon and EigenLayer, the two products have differences in terms of target audience and protocol objectives. This point will be discussed after explaining the core principles of Babylon.

2/9 · Babylon Architecture

- Bitcoin Mainnet

- Babylon Aggregation Layer

- IBC Communication Protocol

- PoS Consumption Chain (Target PoS Blockchain)

Babylon is essentially an aggregation layer used to build security between any PoS blockchain and Bitcoin. If a BTC holder wants to stake their assets, they can choose the eligible network they want to stake on in Babylon, then lock their BTC on the Bitcoin mainnet, aggregate the key data of PoS on the Babylon Chain, and periodically send it to the Bitcoin network via IBC to establish "checkpoints". Finally, users can claim the rewards of the target PoS network.

This allows stakers to continue holding their BTC while earning additional rewards, and PoS networks inherit some costs while obtaining the economic security of Bitcoin.

Source: messari

Source: messari

3/9 · Remote Staking

Remote staking is a way for asset holders to provide staking verification services for other networks to earn rewards without moving their assets from their native chain. The key to remote staking is to maintain control of the assets independently and avoid using third-party intermediaries (such as custody services or bridging services).

In the Babylon project, Bitcoin holders can stake their BTC on the Bitcoin network through remote staking, rather than traditionally transferring to other chains or using centralized services. This is achieved through improved Bitcoin scripts and specific transaction types to implement "customized staking contracts".

4/9 · Customized Staking Contracts on Bitcoin

Since Bitcoin does not support complex smart contracts, Babylon must implement staking functionality within the existing range of Bitcoin script language. Unlike Ethereum, Bitcoin uses the UTXO (Unspent Transaction Output) model, where each transaction output can become the input for another transaction.

Babylon uses Bitcoin scripts and covenants to customize UTXO operations, essentially customizing the behavior of Bitcoin transactions and creating specific contract logic. This allows users to lock their Bitcoin for a period of time, and only after the lock period ends can they redeem these assets using their private keys. This "customized staking contract" replaces the staking contract implemented through smart contracts.

5/9 · Data Submission and Verification

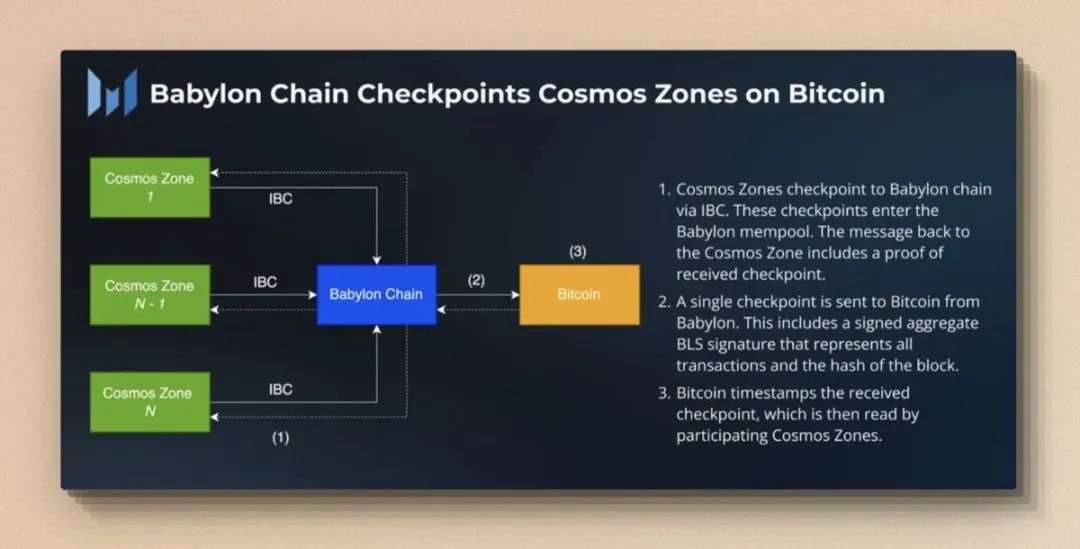

Data submission: Nodes on the PoS blockchain generate important data and convert it into hashes, such as transaction or block information.

Sending to the Bitcoin network: Babylon Chain is responsible for collecting these hashes, aggregating and packaging them, and submitting the packaged hash collection to the Bitcoin blockchain through IBC in a specific transaction.

Generating timestamps: Once these hashes are recorded on the Bitcoin blockchain, they receive a timestamp from the Bitcoin blockchain. This creates "checkpoints" that inherit the security of the Bitcoin network and are globally recognized and immutable. This means anyone can view this Bitcoin transaction and confirm when this data was submitted based on the timestamp.

Using timestamps: PoS blockchains can use these timestamps to verify the correctness and timeliness of their data. For example, when processing transactions or verifying the authenticity of blocks, they can reference these timestamps.

The use of timestamps helps prevent some security issues, such as replay attacks (where old transactions are resubmitted to deceive the network) and long-range attacks (by creating an alternative chain forked from an old state).

6/9 · Security and Penalty Mechanism

Although Babylon has implemented basic staking functionality through customized UTXO operations, it still lacks smart contract logic computation. For example, it cannot execute penalties through the logic computation of smart contracts. Therefore, Babylon has designed its own penalty and slashing mechanisms.

In Babylon's design, two types of signatures are used to ensure the smooth operation of all mechanisms.

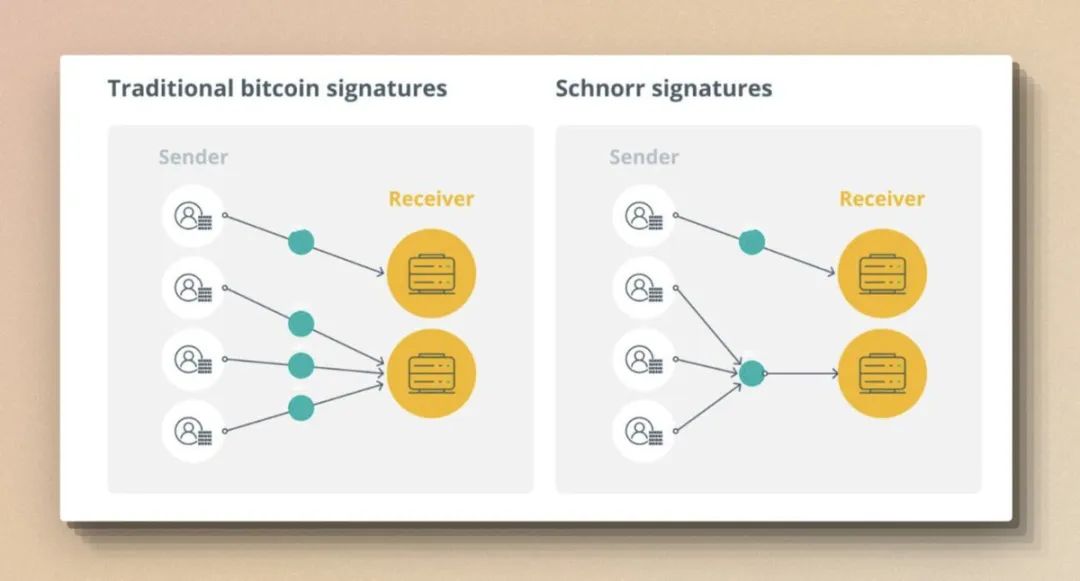

- Schnorr signatures provide an efficient (aggregated) and secure way to handle the signatures of Bitcoin stakers.

- EOTS is used to automatically extract private keys from signatures generated from malicious behavior and automate slashing when stakers attempt a double-spending attack on the network.

Schnorr signatures were introduced in the Bitcoin Taproot upgrade in 2021 to address some limitations of traditional signatures and achieve a more efficient and concise signature method. One of its main features is the ability to aggregate multiple signatures into one, which is very useful for multi-signature transactions and complex script transactions. It also significantly reduces transaction size and fees.

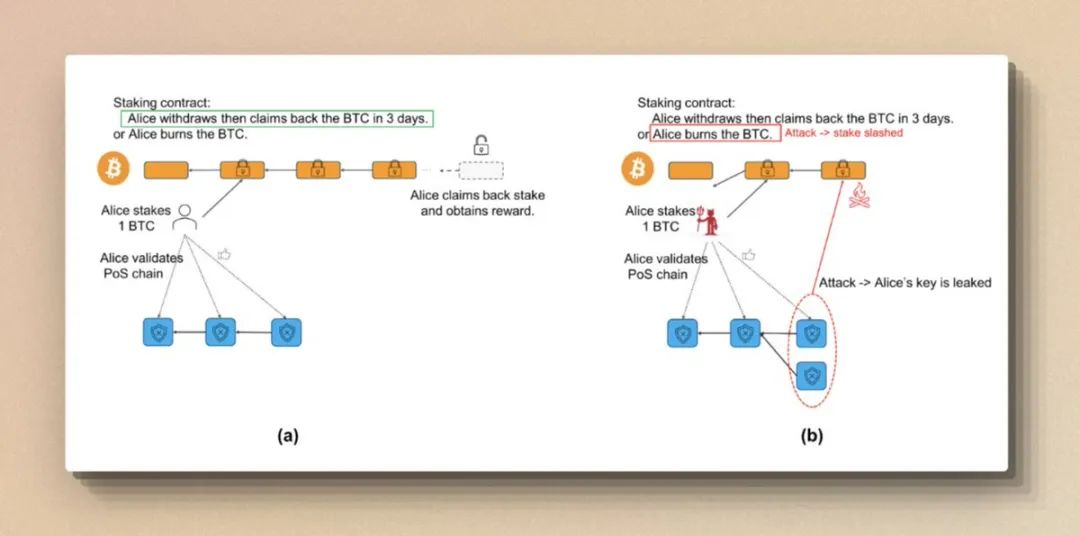

In terms of security, due to the limited expressive power of Bitcoin scripts, it cannot directly implement complex penalty mechanisms (such as slashing) similar to those in PoS blockchains. Therefore, Babylon has cleverly implemented a slashing mechanism.

If a Bitcoin staker's private key is used to sign two different blocks at the same time, this behavior is considered an attempt at a double-spending attack, and their private key will be exposed. In this case, anyone can pretend to be the staker and submit a slashing transaction to the Bitcoin chain, burning the staker's staked BTC.

This is achieved through Extractable One-Time Signatures (EOTS), which are compatible with Schnorr signatures. It is a special form of encryption that ensures the integrity of block signatures and punishes improper behavior. The process involves an additional consensus layer called the "termination round," which comes into play after the basic consensus protocol functions of the consumption chain. The block only reaches a final confirmed state after collecting EOTS signatures involving BTC staking from more than two-thirds of the validators. If any validator attempts to attack the protocol by signing two different blocks at the same block height, the EOTS system ensures that their private key is exposed.

This system also addresses the challenge of enforcing penalties on blockchains like Bitcoin that lack native support for smart contracts and complex transaction types.

Alice's Journey as a BTC Staker:

(a) The Happy Path: Alice stakes, validates the PoS chain, requests unstaking, and unstakes within 3 days.

(b) The Unfortunate Path: Alice stakes, commits a security offense on the PoS chain, and then her BTC is burned.

7/9 · Market Space

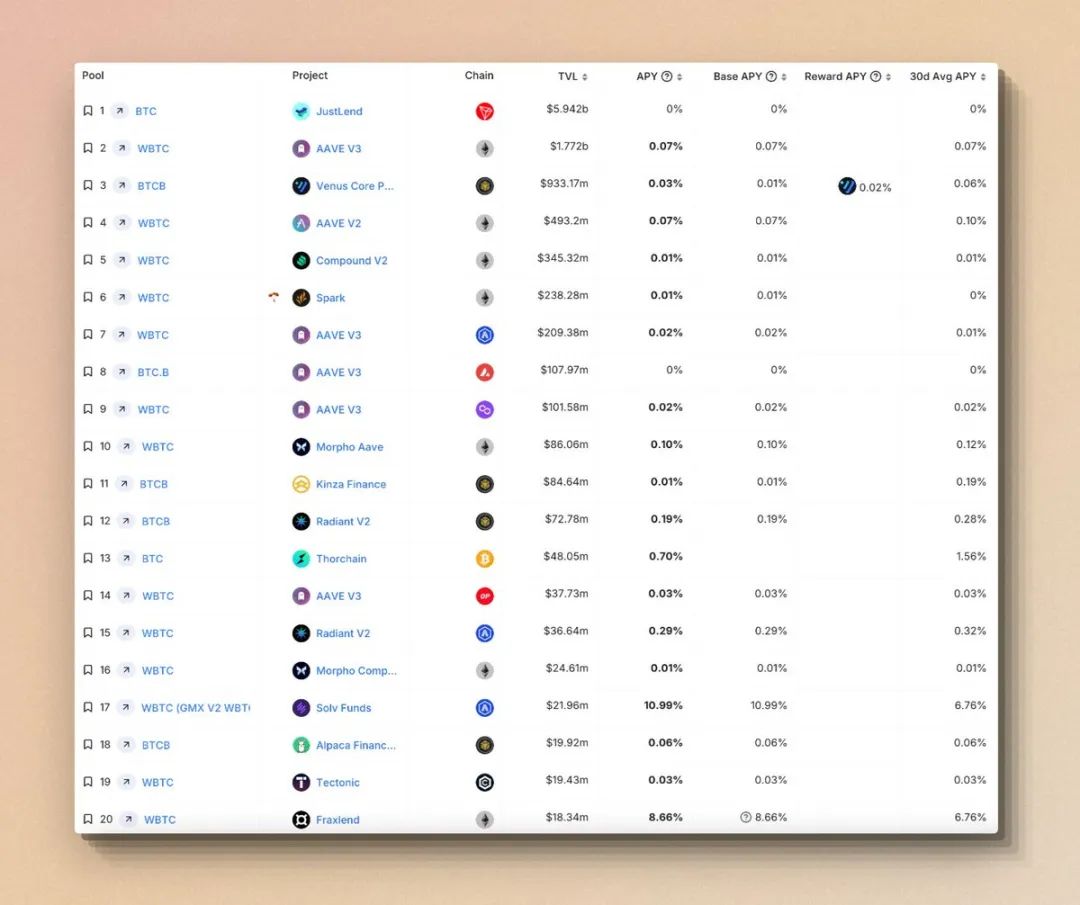

According to DefiLlama's data, the majority of single-coin yield rates in the current Bitcoin yield market range from 0.01% to 1.5%, with very limited opportunities to achieve yields between 5% and 10%.

The market value of BTC currently stands at $1.26 trillion (1 BTC = $64,000), while the market value of WBTC is $10 billion. However, the amount of BTC actively earning yields in DeFi is less than $5 billion. This is related to several factors:

- Most BTC holders are unwilling to move their BTC away from the Bitcoin network.

- Concerns about the security of wrapped assets like WBTC and tBTC.

- Low yields.

- A portion of BTC is in a dormant state (according to Coinshares' data, 25% of the BTC supply has been idle for over 5 years, and 67% has been idle for over 1 year).

As a reference, in 2021, Celsius attracted 43,000 BTC worth nearly $3 billion by offering a competitive yield of 8% to BTC holders. It can be inferred that there is demand among idle BTC holders to earn yields on their assets. However, the main friction points currently are low yields, centralized trust assumptions, and risks.

Therefore, assuming that staking through Babylon can capture close to an 8% yield, it could potentially reach a scale of $30 billion. Combined with Babylon's decentralized nature and the ability to stake native BTC without leaving the Bitcoin network, it has the potential to make a significant impact on a market worth tens of billions.

8/9 · Problems Solved

Based on the current project information, Babylon addresses four issues:

- Native staking of BTC on the Bitcoin network and providing higher yield opportunities.

- Reducing the security budget for PoS chains and decreasing token emissions to attract stakers.

- Providing a PoW security supplement for PoS chains - mitigating "long-range attacks."

- Providing a PoW security supplement for PoS chains - increasing the threshold for liveness attacks.

- 8.1 Long-Range Attacks

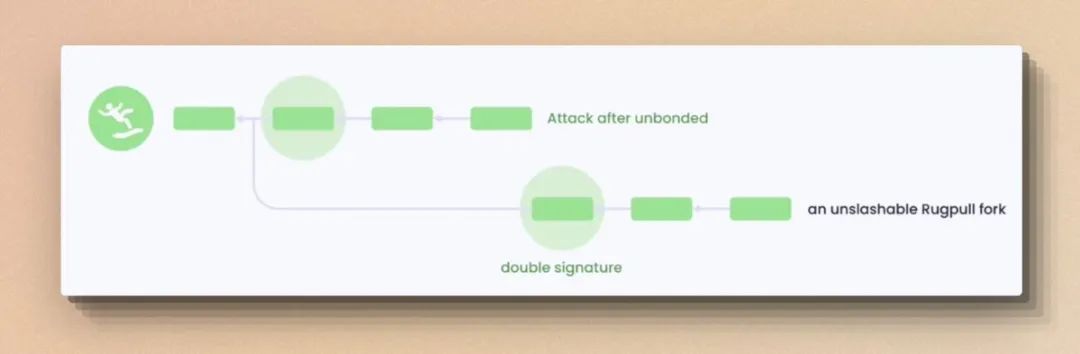

First, let's understand what a "long-range attack" is, also known as a long-range attack, which is a specific security risk faced by Proof of Stake (PoS) blockchains. This type of attack involves stakers using their staked tokens at an early point in the blockchain's history after they have unstaked (i.e., retrieved their staked funds) to create a fork. This attack attempts to rewrite the blockchain's history using past staking states.

Attack Process

Attack Starting Point: The attacker selects an early point in the blockchain's history, usually when their staking is still valid. They then begin to secretly construct a private fork chain at this point.

Constructing the Fork Chain: The attacker builds blocks on their private fork chain, which may include invalid or fraudulent transactions. Because they have sufficient staking power at this historical point, they can influence which blocks are added to this fork chain.

Releasing the Fork: Once the fork chain is long enough and covers blocks on the main chain at the same time, the attacker can release it. Since PoS protocols typically accept the heaviest (i.e., the chain with the most staking power or the longest chain) as the valid chain, the attacker's fork may be accepted by the network as the legitimate history.

In PoS systems, reorganizing old blocks (i.e., blockchain reorganization) is relatively easy because it does not require the extensive computation needed in PoW. Attackers only need to present a chain on their private chain that is longer or in some systems has more "weight" than the main chain to convince the network to accept their chain as the valid chain.

This type of attack typically involves emerging or smaller PoS chains with fewer network nodes, weaker monitoring, and security measures, as such networks are more susceptible to the influence of a few large stakers.

To mitigate long-range attacks, typical PoS chains set a minimum unstaking period, usually ranging from 7 days to 21 days. This is why when you unstake assets (e.g., ATOM) from a node, you have to wait for a fixed period to receive the staked assets. Setting an unstaking period means that once validators decide to unstake their funds, these funds are not immediately available. During this period, their staking is still considered part of the network's security, but they cannot use these staked tokens to validate new blocks or participate in consensus decisions, significantly increasing the cost and complexity of launching an attack.

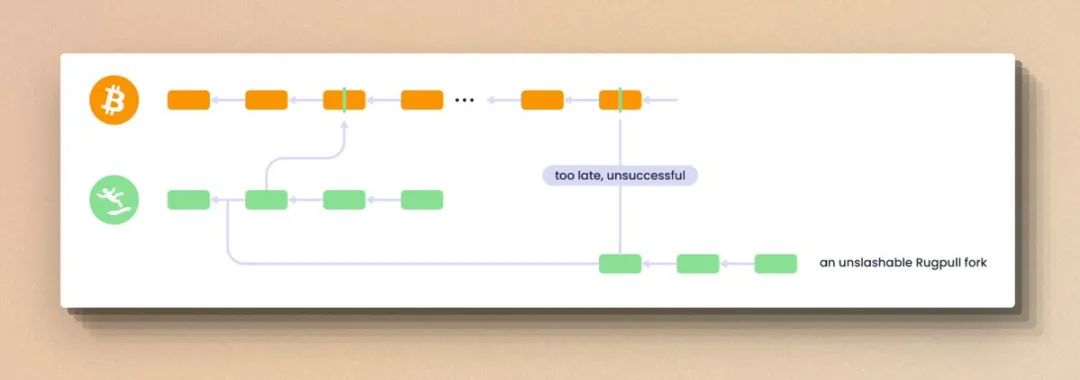

How does Babylon mitigate "long-range attacks"?

Babylon aggregates the "unstaking" operations of PoS chains by setting checkpoints with timestamps on the Bitcoin blockchain. The benefit of doing this is to use Bitcoin's strong consensus to provide an external security validation point for PoS chains, potentially reducing the unstaking time from several weeks to a few hours, significantly improving the liquidity and efficiency of funds.

- 8.2 Liveness Attacks

Next, let's understand what a liveness attack is. It refers to a situation where a small number of validators (e.g., one-third) may attempt to censor or block certain transactions or operations, thereby affecting the normal operation of the chain. For example, validators intentionally exclude certain transactions, possibly for their own benefit or external incentives.

How does Babylon increase the threshold for liveness attacks?

Babylon leverages the security of the Bitcoin blockchain to create checkpoints. These checkpoints are snapshots of the state of the PoS chain, regularly anchored to the Bitcoin blockchain. This approach enhances the security of the PoS chain by using the immutability of the Bitcoin blockchain to provide a trusted, externally validated record of important decisions or states on the PoS chain.

Additionally, Babylon creates an additional security layer on the Bitcoin blockchain, increasing the economic and technical costs for attackers to carry out liveness attacks on the PoS. (This may include disrupting Bitcoin's strong consensus.)

9/9 · Comprehensive Analysis Compared with Eigenlayer

Limitation: Inability to Implement Advanced Security Support Without Smart Contracts

Babylon is typically compared with Eigenlayer, which coordinates the needs between AVS and Restaker stakers by writing smart contracts. In theory, as long as smart contracts can be written, Eigenlayer can handle the task, such as supporting dual staking requirements for ETH Restaking and protocol token staking, and setting adjustable ratio parameters to provide an additional Ethereum-level security protection for existing middleware, or directly building a consensus layer for new middleware. Although smart contract risks are also introduced, they can support a wider range of business.

Currently, Babylon mainly achieves regular snapshots of the state of the PoS chain on the Bitcoin chain, establishing "checkpoints" to provide a protected PoS chain with a trusted, externally validated record based on strong consensus. While it achieves native staking of BTC through customized UTXO, it still lacks the functionality of smart contracts and cannot handle and coordinate complex requirements and logic.

Limitation: Constrained by IBC

Babylon uses IBC to aggregate data and communicate between Bitcoin and any PoS blockchain. This is a necessary prerequisite for BTC staking and establishing checkpoints through timestamps. The reason for using IBC is its ability to seamlessly pass arbitrary data and validator messages between different chains. Currently, Babylon addresses a market of 91 Cosmos chains that natively support IBC. However, extension protocols based on IBC are gradually being built, such as Composable, which is establishing IBC support for other networks such as Ethereum, Polkadot, Solana, NEAR, and TRON.

Advantage: Large Market Space for Idle BTC

Compared to Eigenlayer, Babylon targets BTC as the underlying asset. As discussed in the [Market Space] section, there is currently a huge amount of idle BTC. Additionally, the basic requirement of not leaving the Bitcoin main chain has been achieved. Therefore, theoretically, once more partners integrate with Babylon to provide significant yields for BTC staking, market growth will be rapid.

Similarity: Economic Security Support

Similar to Eigenlayer, Babylon also provides economic security support for some early small-scale PoS chains, increasing the economic and technical costs for attackers to carry out attacks on small-scale PoS chains.

Difference: Target Audience and Objectives

Babylon may be more effective in mitigating long-range attacks and reducing the lock-up period for PoS asset staking, for example, if Osmosis collaborates with Babylon, the unstaking of OSMO may only require 1 day or even less (currently 14 days), which represents a relatively clear demand. Of course, Babylon brings the PoW strong consensus of BTC to PoS, and as the protocol matures, it may unlock more possibilities.

Eigenlayer, on the other hand, relies on the vast Ethereum ecosystem to radiate the security of Ethereum to various corners and middleware through smart contracts + restaking. Therefore, Eigenlayer fully benefits from the inherent advantages of smart contracts in terms of scalability and offers a more diverse range of target audiences and functional implementations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。