撰文:Mikhil Pandey

编译:深潮TechFlow

导读

本文是Persistence Labs的联合创始人兼首席战略官Mikhil Pandey撰写的关于“深入探究当今比特币格局的兔子洞”的成果。

通过这篇文章,Mikhil Pandey试图带领大家了解比特币在加密货币中的角色,当今的比特币格局,BTC流动质押的作用,以及他认为接下来的发展方向。

了解比特币

比特币是价值储存?最大的点对点支付网络?世界汇款系统?数字黄金?传统金融对冲的工具?史上第一个工作量证明区块链?

比特币究竟是什么?上述哪一个描述了比特币?简而言之,我认为全部都是,而且还有更多。

比特币是一种第一层区块链,最初是为货币价值的不信任和透明流动而设计的,它的想法是在2008年全球金融危机期间出现的。

驱动这一网络的原生数字资产BTC已经从我们这个时代最大胆的金融实验之一发展成为最大的加密货币。

如今,比特币,无论是网络还是资产,都已经成为金融、机制设计和希望的乐园。

-

最聪明的人们正在将比特币推向一个更加有用、资本高效和可编程的未来

-

世界上最大的机构正在提供BTC ETF,以向普通民众提供曝光度

-

新一代的建设者正在找到利用比特币区块空间的独特方式,包括Ordinals、NFT、BRC-20、Runes、质押等等

-

比特币网络活动达到了历史最高水平,并为矿工产生了比以往更多的价值(费用)

比特币适合每个人。最好的一点是,BTC的各种认知是一种特征,而不是一个缺陷。

构建在比特币上的两个支柱

对公众来说,比特币正在逐渐从一个“网络”过渡到一个“生态系统”。最近,构建在比特币之上的生态已经看到了指数级增长。

但这并不罕见,除了社区的网络改进外,多方利益相关者曾试图在比特币之上构建。事实上,这是中本聪的愿景的一部分。

中本聪曾经说过:"这个设计支持我几年前设计的各种可能的交易类型。担保交易、保证金合同、第三方仲裁、多方签名等。如果比特币大行其道,这些都是我们未来想要探索的事情,但它们都必须在开始时进行设计,以确保它们以后是可能的。”

自2012年以来,人们不断尝试将比特币扩展到支付之外更广泛的用途:

-

去中心化域名服务(Namecoin)

-

更广泛的资产代表(Colored Coins、MasterCoin、Counterparty)

-

通过侧链、Rollup和L2扩展比特币网络(Taproot、Stacks、Liquid Network、Merlin、Urbit、Lightning、bitVM等)

-

通过Ordinals和Runes扩展BTC功能(Memes、NFT、BRC-20、BRC-420)和收益(Babylon、BounceBit、 Stroom Network、Trustless Machines等)

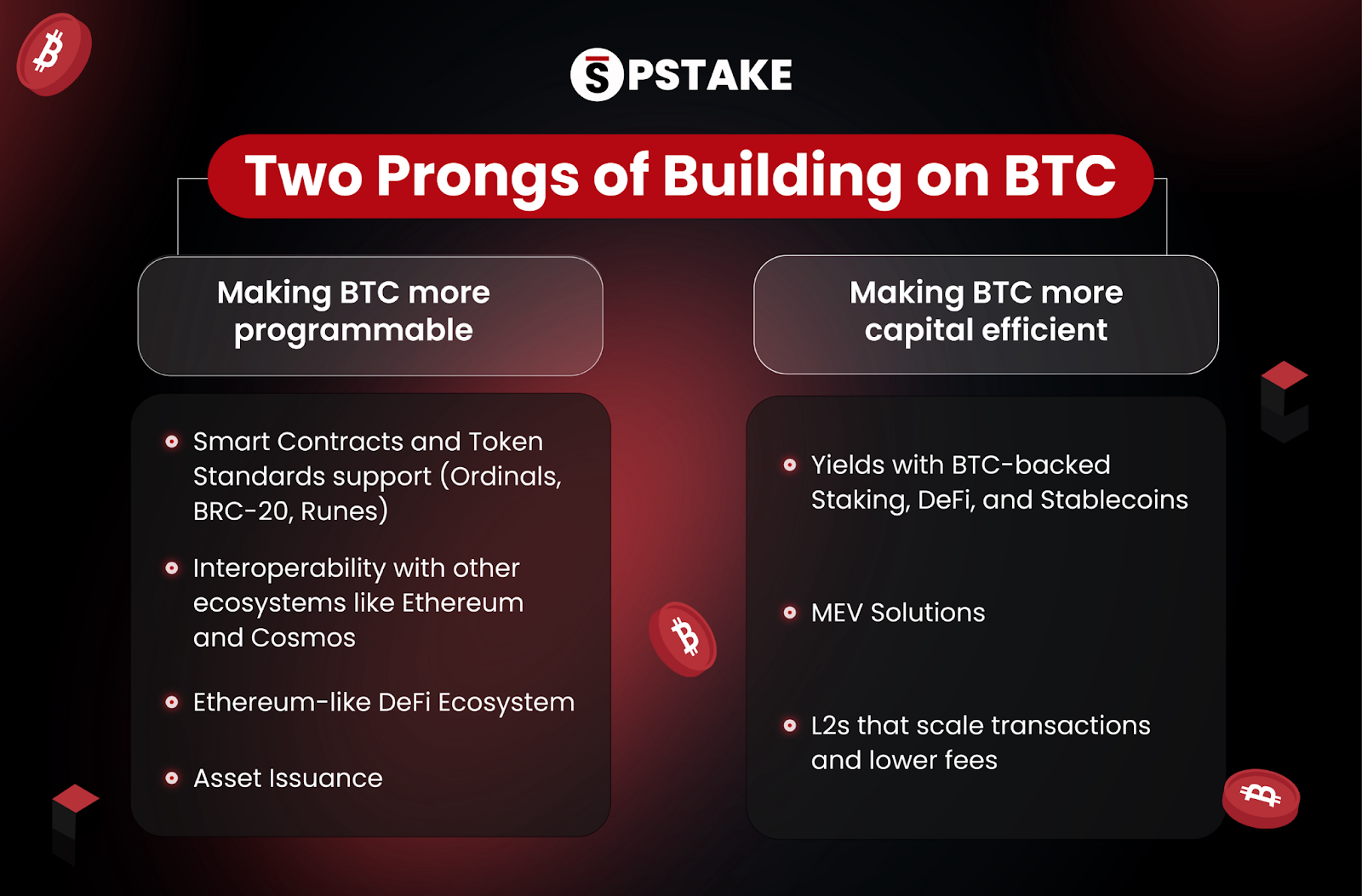

但这些发展将比特币引向何方?Portal Ventures的关于比特币观点的文章最能概括:

-

使比特币更具可编程性,解决智能合约和扩展限制,以部署在比特币网络上

-

使BTC更具资本效率,用BTC构建的超级金融化

BTC流动质押适用于何处?

比特币是一个工作量证明网络,矿工通过贡献计算能力来解决区块生产的数学难题,并获得新的比特币作为奖励。

那么,质押又如何出现在市场上,更别提流动质押了?让我们了解一些区块链的基础。

共识涉及对网络状态(数据、交易、余额等)的持续一致意见。虽然PoW依赖于计算能力(挖矿)来实现和维持网络共识,PoS包括安全保证的概念。质押涉及锁定代币参与共识,为整体网络安全做出贡献,并获得质押奖励。

当我们需要信任其他人/交易对手能够行为良好时,通常会设立保证金来保证良好的行为。一个典型的例子是房东向租户收取保证金。

简而言之,PoS是由对资产经济安全的信任驱动的。还有什么比拥有数十亿美元的经济信任的资产更好?比特币又有什么更好的?

通过“锁定”BTC,它的经济安全可以导出到几乎任何加密应用。想象一下一个世界,在这个世界中,金融应用包括各种形状和大小的区块链都可以利用BTC,为每一个应用增添活力和安全性。

无需信任的BTC质押(因此是流动质押)为以BTC为主导的DeFi带来了蓬勃发展的可能性,使BTC更加资本高效。货币市场、稳定币、经济安全、保险等等。应用无限。

比特币的未来是什么?

有人可能会争论,BTC已经在市值上涨、采用和在加密货币中的首要价值存储地位方面是否已经具有了资本效率?

这就涉及到一个问题:资本效率究竟是什么?华尔街将其定义为“公司如何有效地使用资金来运营和成长”。在这个背景下,BTC基本上是在与零售持有者、矿工和机构的大部分时间里闲置着。

这可以归因于多个因素:

-

缺乏可持续的收益机会

-

风险厌恶持有者“移动”BTC的摩擦

-

缺少机构友好的收益产品

-

将BTC从比特币网络中移出的未知安全风险

-

一些OG比特币持有者的反对

最近,整个行业都在努力解决 BTC 所面临的上述各种障碍,以便在加密世界中释放其流动性和资本效率。

虽然比特币社区似乎有些分裂(这总是最好的),但要密切关注像比特币L2、最小信任BTC质押、Ordinals和Runes、VM等比特币生态系统的重要发展。

BTC流动质押不仅仅是一个说法。它来了并可能决定加密货币的收益。随着简单的以BTC为首的金融产品预期将为当今的DeFi格局带来急需的流动性和效用,比特币的未来从未如此令人兴奋。

我们已经看到了以太坊流动质押的指数级增长以及随后在链上金融领域蓬勃发展的进展。当相同的事情发生在首次创造“加密”资产类别的资产时,只能想象可能性和打开的大门。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。