作者:NingNing

从市场层级上来说,LBP 平台是介于一级风险投资市场与二级交易市场之间的 1.5 级市场。

它的机制是利用智能合约实现荷兰拍销售一级市场项目 Token。荷兰拍与我们常见的拍卖方式不同。它的 IDO 价格会从高开始,自动下降,有成交则停止下降。成交之后如果过段时间没有新的成交,会继续下降。

LBP 允许将二级交易市场机制引入到一级市场代币发行过程中,从而能更有效的发现新项目的市场价格。

LBP 通过智能合约和市场博弈实现了新币销售的相对公平,能防止出现鲸鱼包场某新币然后在二级市场倾销的现象。

但是 LBP 并不能保证绝对的公平(任何技术和机制也实现不了)。在 LBP 的游戏规则之下,鲸鱼仍然具有资金优势、信息优势等非对称优势。

当市场进入牛市周期后,一级市场逐渐热闹起来,大家对新资产需求旺盛,LBP 平台成为一门好生意。

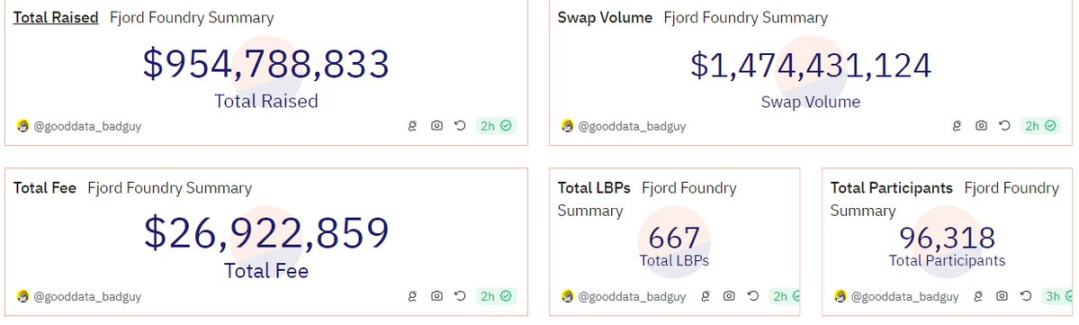

以当前的 LBP 平台龙头 Fjord Foundry 为例,总融资 $954,788,833,LBP 期间交易量 $1,474,431,124,协议总费用收入(不包括策展费用等)$26,922,859。

但对散户来说,参与 LBP 是一种好的投资方式吗?

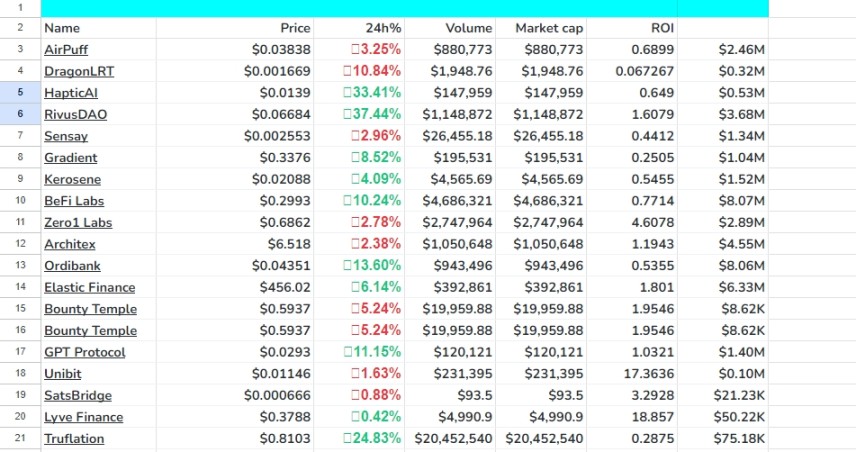

还是以 Fjord Foundry 为例子,根据 coincarp 的统计,最近 36 个 IDO,平均当前 ROI(回报率,100% 相当于保本)304.78%,平均最高 ROI(回报率)为 1872.69%。

貌似还不错,但这是一个常见的数据统计 Trick,只统计平均值,而不统计方差。

coincarp 的统计中,ROI 的有效数据 20 个,方差值为 29.50,收率率分布极度不均衡。

在去掉两个最高值,Lyve Finance 的 18.86 倍和 Unibit 的 17.36 倍后,平均当前 ROI 为 127.55%,方差值为 1.425。

也就是说,正常情况下,这段时间参与 Fjord Foundry LBP 比较稳定的能赚 27.55%。这个收益率并没有跑赢同时期比特币涨幅。

LBP 本质上是一个粉单市场。在计算交易成本、Gas 费、机会成本的情况下,可能已经属于负 EV 博弈。参与 LBP 的话,建议抱着一个打土狗心态。操作原则是少量多次。万一碰上金狗呢,对吧?

PS.我有参与 Solana 生态的新 LBP 平台 1intro 的 LBP。虽然参与 LBP 不是一笔好投资,但 LBP 平台是门好生意嘛?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。