Original Author: Sam Kazemian, Founder of Frax Finance, and several contributors and community members

Translated by: Peng SUN, Foresight News

The Post-Quadratic Era of Frax

The launch of the modular L2 blockchain Fraxtal and the successful achievement of full collateralization signify the beginning of a new era for Frax. Fraxtal is the foundation of the Frax ecosystem and serves as the operating system for Frax. Fraxtal enhances the core products of Frax and is adding new sub-protocols and Frax assets, with all necessary building blocks ready. The community can now explore more opportunities and other paradigm-changing products, and issue native Frax assets in various tracks.

To achieve this goal, Frax has raised over $45 million, achieving a 100% actual collateralization rate. Many users have made sacrifices to improve the overall health of Frax. During this process, the FRAX stablecoin was overlooked by the market, and the FXS income distribution was reduced by 90% to protect the assets. It's time to completely change this situation!

Frax: The Only Full-Stack Protocol

Fraxtal is the location of the Frax Nation and the Fraxtal Network Nation. With Fraxtal, the Frax community has its own sovereign nation, culture, and digital space. Frax has issued native tokens and is fully managed and owned on-chain by FXS stakers. Now, Frax has a mature network like Fraxtal that belongs to itself.

Fraxtal's L3 will be launched soon. L3, like a fractal, is similar to a sub-community with a unique identity and culture, but is also part of the entire Frax Network Nation. They can benefit from Frax asset yields, RWA yields, Fraxtal settlements, and security guarantees, and continue to earn FXTL points based on the usage and TVL of the Fraxtal L3 contracts. All of these are managed by FXS, which represents the interests of the Frax digital nation.

Fraxtal is built on Optimism, making it the most developer-friendly L2 on Ethereum. While most L2s simply replicate Ethereum's incentive mechanism, Fraxtal has further innovated on the underlying incentive mechanism to better attract developers and users, and will continue to innovate. Throughout the entire stack, Frax can introduce account abstraction, new precompiles, privacy features, aggregated DA, and superchain interoperability, among other features. These features will greatly improve the on-chain experience, making Fraxtal the preferred destination for crypto users in the future.

- In view of this, CEX and payment service providers that integrate Fraxtal deposit and withdrawal services early can receive FXTL point allocations until the end of the program.

Launching Fraxtal

Fraxtal's Flox block space incentive mechanism has just completed the first epoch of automatically allocating FXTL points to users and smart contracts, making it the only network that automatically rewards users and developers on a per-block basis. These reward measures will continue for years and will become a core innovation of Fraxtal, as users and developers will be accustomed to earning rewards by using block space, unlike any other network.

The road to a trillion-dollar TVL for Fraxtal has now begun, with the goal of achieving it by the end of 2026. All Frax assets, including FRAX, sFRAX, frxETH (and new Frax assets), will be issued on Fraxtal first. Core Frax developers are issuing Frax assets on Fraxtal, including the native 4626 treasury, minting, and redemption. When the supply of Frax assets reaches an all-time high, the Fraxtal TVL will also reach a new high. This is the unique synergistic effect of the full-stack system of Frax.

Frax assets will interoperate with different networks, but the underlying contracts and assets will be issued on the Fraxtal mainnet.

Fraxtal's Fractal Scaling Roadmap

Fraxtal plans to launch 23 L3s in the next year to kickstart the Fraxtal Nation community. Frax has always taken a positive approach, directly supporting communities and developers integrated with us. We believe that the number 23 for L3s is very suitable, and we can actively support these networks through direct developer access, incentives, and investments. The first 2 L3s are in development, and the remaining 21 L3s are expected to be launched in the coming months. L3s can earn FXTL points through Flox, and these 23 L3 slots are reserved for official partners, who will receive additional support from the core Fraxtal developers and a large allocation of FXTL points.

If you are deploying any form of L3 or application chain and wish to join the Fraxtal Network Nation as soon as possible, please contact the core Frax developers and our strategic Rollup as a Service provider partners: Conduit.xyz, Gelato.network, and Caldera.xyz.

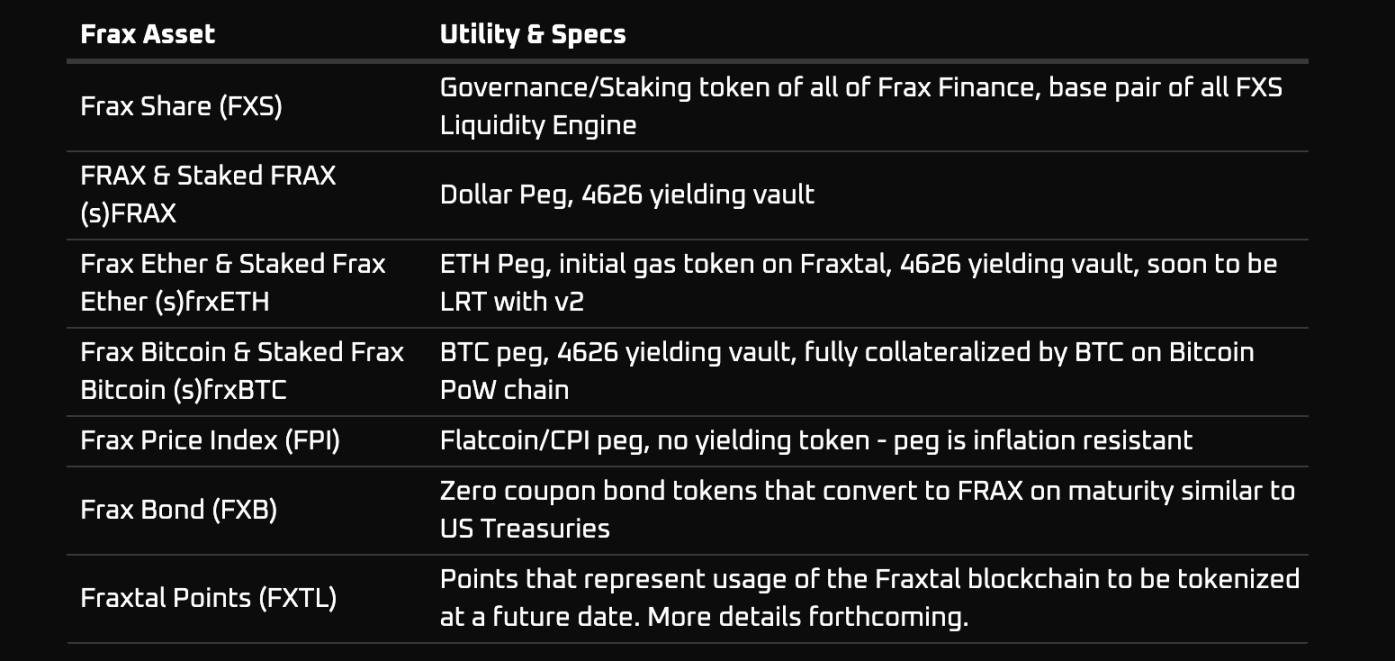

Overview of Frax Assets

Frax is the only protocol in the top 200 by market cap to have 4 independent tokens/assets. The number of these protocols will increase as the ranking of Frax assets rises. Therefore, it is important to understand the latest status of all Frax assets and their utility, pegs, and design specifications.

As the Fraxtal chain matures, all Frax assets can be used as gas tokens on Fraxtal.

New Frax assets that may be launched this year include: frxNEAR, frxTIA, frxMetis, and more.

FXS Singularity Tokenomics

All roads lead to Rome, and FXS is the ultimate beneficiary of the Frax ecosystem. With full collateralization now achieved, FXS can gain all the utility and income of the entire Frax stack. We propose to re-collect protocol fees, with 50% of the revenue flowing to veFXS, and the other 50% used to purchase FXS and other Frax assets to match in the FXS Liquidity Engine (FLE). FLE will allow Frax to continue to create a balance sheet while significantly increasing the liquidity of FXS and matched Frax assets. According to DefiLlama, as of the time of writing, Frax's annual revenue has exceeded $40 million, even without considering various sources of income such as Fraxtal fees and Fraxlend AMO.

veFXS Income Distribution + Fees

After this proposal is passed, veFXS stakers will receive the total protocol fees, which will be transferred to the veFXS income distributor on the Ethereum mainnet and shortly after to the veFXS income distributor contract on Fraxtal.

The FXS Liquidity Engine will create more and more FXS POL (Protocol-Owned Liquidity) for the first batch of Frax assets, but can also be expanded to other trading pairs decided by community vote.

FXS Liquidity Engine (FLE)

FXS Liquidity Engine (FLE) is the protocol-owned liquidity sink for each Frax asset against FXS. The income allocated to FLE is used to buy back half FXS and half Frax assets to increase the liquidity depth of the trading pairs. The income allocated to FLE is based on the tracking price of FXS. If the 30-day tracking price of FXS is lower than the previous month, 25% of the protocol income will be allocated to the FXS Liquidity Engine instead of veFXS. If the 30-day tracking price of FXS is higher than the previous month, an additional 25% of the protocol income will be allocated to veFXS.

The long-term goal of FLE is to increase the utility, liquidity, and lending credit of FXS to unprecedented levels as the income increases per block.

Supported by Fraxswap+BAMM, the initial FLE POL pairs will be:

- FXS-frxBTC

- FXS-sfrxETH

- FXS-sFRAX

- FXS-FPI

The FLE dashboard will be released soon to support different FLE trading pairs (including custom FLE trading pairs). The FLE trading pairs launched with this vote are FXS-frxETH and FXS-FRAX.

The Frax Liquidity Engine operates entirely on the Fraxtal mainnet, so the profits of Frax can directly increase the TVL, liquidity, and lending capacity of Fraxtal.

The income brought to FXS and the FXS Liquidity Engine by Frax Finance is non-cyclical and generates stable income in all market cycles, continuously increasing POL under all macro conditions. When the value of volatile assets decreases, the income from FXB and (s)FRAX should increase. Therefore, FLE can bring long-term, direct value appreciation to FXS holders and stakers.

Note: Some strategic assets will be retained in the balance sheet/treasury, including CVX (pledged as vlCVX), cvxCRV, cvxPRISMA, and cvxFXN, as well as other assets that will be added as "strategic assets" in future governance votes. These strategic assets will not be sold or distributed to veFXS holders, nor will they be sold to FLE.

FPIS Solution

Having a separate token and alternative governance process can be a heavy burden. Before the release of FPIS in 2022, Frax has always used FXS as the token. To unlock the growth potential of FPI, simplify the structure of Frax, and reduce the expenses of developers and the community, Frax proposes to merge FPIS into Frax. Additionally, this will bring an additional $4.5 million in income to the Frax balance sheet to strengthen the financial position. It is important that the entire Frax community supports FXS and Fraxtal. Therefore, for simplicity, Frax proposes to reduce the exchange rate of FPIS to veFXS by 67%, i.e., 1 FPIS can be exchanged for 1.33 veFXS, with a lock-up period of 4 years. This significantly reduces the governance and utility capabilities of FPIS while still consolidating it into a single FXS token allocation. veFPIS also qualifies for the April 3rd FXTL point snapshot at a rate of 1.33.

sFRAX and sfrxETH Updated Yield Rates and sfrxETH LRT Function

Meanwhile, sFRAX will be set with a 50% upper limit rate and a 5.4% lower limit IORB rate. This means that compared to the current model of using the IORB rate as the maximum upper limit rate, the maximum APR for sFRAX at the time of this proposal's approval will be 50%, with a minimum rate of the IORB rate. This new mechanism will make sFRAX the benchmark DeFi rate for all sFRAX integrators. Users currently holding sFRAX or minting/exchanging sFRAX will immediately update to the new upper limit rate after the proposal is approved. To maintain a 50% upper limit rate for sFRAX, Frax will increase the sUSDeFRAX POL through the Curve AMO. Therefore, this proposal also sets a limit of 250 million for the sUSDeFRAX Curve AMO.

With the launch of Frax Ether v2, the annual rate for sfrxETH will be higher. In v2, the annual rate for sfrxETH can be as high as the rate that validators are willing to pay, meaning that the annual rate for sfrxETH is likely to be close to or even exceed that of the LRT token. Additionally, Frax Ether v2 will support direct re-staking, officially turning sfrxETH into LRT. This governance proposal provides convenience for EigenLayer re-staking pods and direct deposits into sfrxETH. This allows sfrxETH stakers to enjoy above-average LSD yields, FXTL points (if held/used on Fraxtal), and EigenLayer points. Frax has also collaborated with EigenLayer to design a Fraxtal AVS, which allows for re-staking with both FXS and sfrxETH, making Frax one of the few full-stack integrations in EigenLayer and providing blockchain-level re-staking functionality for FXS. In the Singularity era, sfrxETH will become a major LRT in DeFi.

Accumulate Strength for Future Success: Full Stack

The launch of Fraxtal and the successful completion of the full collateralization process for FRAX were challenging, but finally successful. Frax's strategy is to build core infrastructure internally, which requires a significant amount of time and effort in the short term. If the community is overly concerned, it may feel like there is no progress, and the various parts may become disjointed. Indeed, some say that Frax has done too much, but in reality, if the community now looks ahead, they will begin to see the enormous flywheel that has just been completed. We have just launched an innovative L2 and filled the $45 million asset gap, providing security for the FRAX balance sheet. Frax Ether v2 is about to be released, bringing competitive and attractive LSD+LRT and FRAX yields. Protocol fees can once again flow to veFXS to prevent a liquidity black hole on our own chain. Frax assets will also integrate with every top protocol, winning over user mindshare and driving token appreciation.

Now, Frax and other companies can rapidly develop on this foundation. Fraxtal will be at the center of this growth, and FXS will be the ultimate beneficiary.

Additionally, the second part of this roadmap will be released on a date to be determined after community governance voting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。