比特币价格突破历史高点,主要原因是美国市场上市的比特币 ETF 吸引了资金流入。

原文标题:《Market Byte:bitcoins price reaches new all time high》

撰文:Grayscale 研究团队

编译:Yvonne,火星财经

- 3 月 5 日 ( 周二 ),比特币的价格一度突破了 69000 美元的历史高点。尽管上涨的直接原因是资金流入美国上市的现货比特币ETF,但边际需求最终反映出投资者对比特币资产的兴趣,认为它是一种替代性的「价值储存」和去中心化计算网络。

- 比特币的活跃交易者持仓现在似乎相当多。ETH 和大多数其他代币的估值仍低于上一个加密周期的高点。

- 如果宏观市场背景仍然有利,我们可能会看到代币估值进一步上升,但宏观因素也可能成为不利因素。

周二,比特币的价格达到 69,325,000 美元的盘中高点,超过了 2021 年 11 月 10 日以美元计算的 69,000 美元的高点。此前几周,比特币以其他主要货币(例如欧元、日元和人民币)计算的价格已经达到历史新高。从 2022 年 11 月 21 日的周期低点 15600 美元至今,比特币以美元计算的价格已经上涨约 330%。此外,由于流通代币的数量随着时间的推移逐渐增加,比特币的市值在同一时期 (2022 年 11 月 21 日至今 ) 增加 340%。

为何比特币价格反弹如此之快?在 GrayscaleResearch 看来,最近比特币价格上涨的直接原因是对在美国市场上市的现货比特币 ETF 的需求。自 1 月 11 日推出以来,这些产品已经吸引了将近 80 亿美元的净流入资金,该数额远远超过了新发行的速度,甚至在我们于 4 月份迎来比特币减半之前(更多详情请参阅我们的报告 2024 减半:这一次确实不同)。在我们看来,ETF 不断增长的需求和有限的新比特币供应之间的不平衡可能导致了比特币价格的上涨。

虽然现货比特币 ETF 为美国的加密货币投资提供了一种新的产品结构,但对比特币的边际需求最终反映了投资者对比特币作为一种替代货币媒介和去中心化计算网络的特性的兴趣。

我们认为,比特币是一种宏观资产,可以与美元和实物黄金(两种传统的「价值储存」资产)竞争。美联储已发出信号,可能在今年降息,而美国两党似乎都没有把重点放在控制和平时期的巨额预算赤字上。较低的实际利率和不断上升的公共部门债务都可能对美元的价值造成压力,并支持包括比特币在内的竞争资产。此外,对于某些投资者来说,比特币可能比实物黄金更有优势,例如,它易于携带:只要持有者能够上网并持有私钥,比特币就可以在世界任何地方使用。在我们看来,对比特币的需求上升主要来自于投资者对美元中期前景的担忧,并寻求一种替代的「价值储存」资产。值得注意的是,以美元计算,实物黄金价格周二也创下新高。

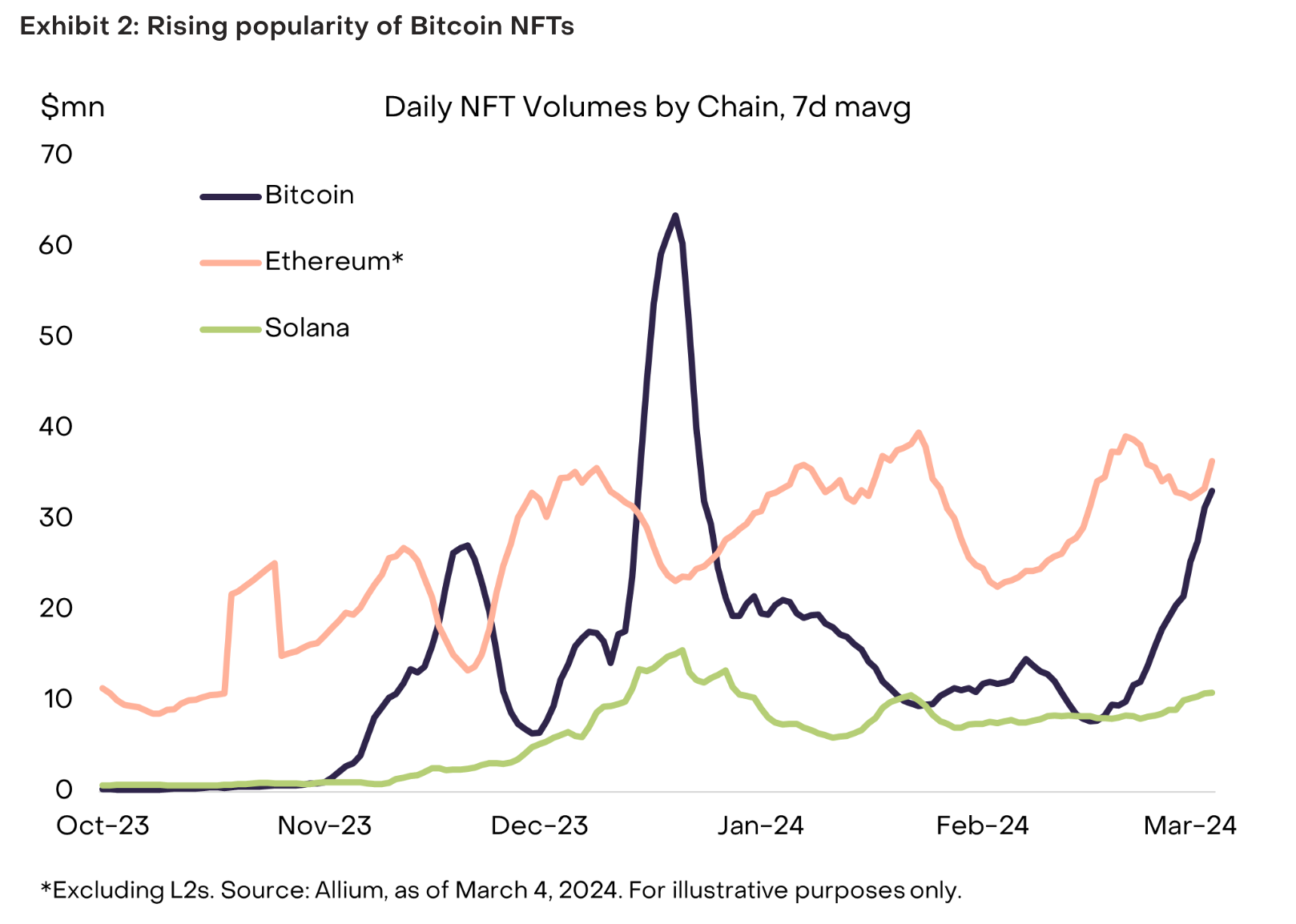

此外,随着时间的推移,技术进步扩大了比特币网络的潜在用例。Ordinal铭文始于 2022 年 12 月,作为将不可替代代币 (NFT) 铭文到比特币网络的一种方式,已经迅速发展成为规模最大的 NFT 网络之一 ( 图 2)。Ordinals 的出现不仅鼓励了新用户尝试比特币,而且还刺激了那些看到其他类型用例潜力的人的创新,如无信任的比特币担保稳定币贷款和比特币在去中心化应用中的更多使用。鉴于主链上的交易费用正在上涨,有多个 L2 项目已经开始在比特币上开发,以提高可扩展性和用例。有证据表明,越来越多的人开始采用加密货币:自 2023 年第三季度以来,加密货币的总价值从 1.6 亿美元增加到 27 亿美元,在短短几个月内增长了 15 倍。

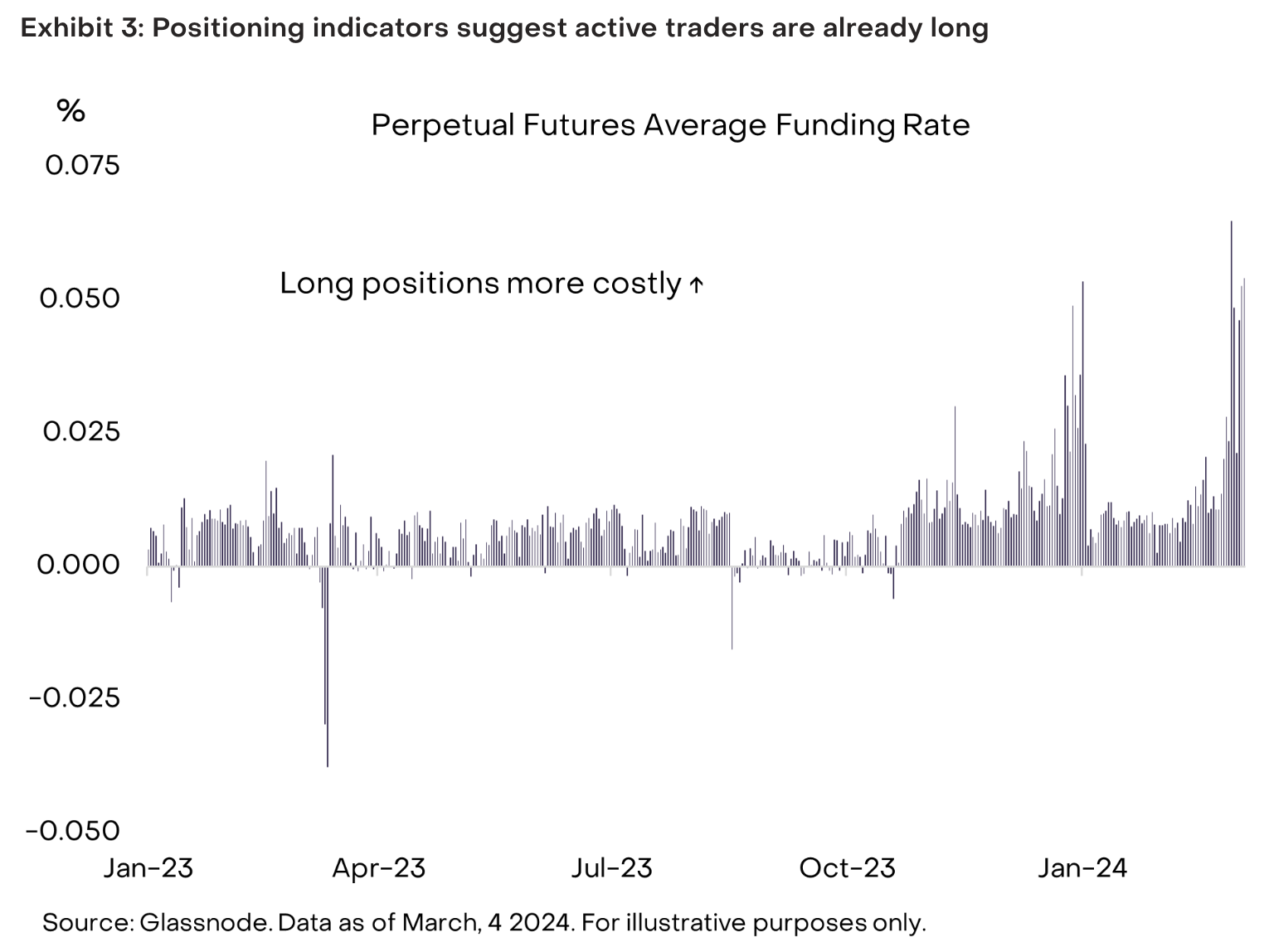

各种市场指标都表明,活跃的加密货币交易者目前持有的头寸相当多。资金利率(衡量交易杠杆成本)已升至近期区间的高端(见图3),但仍低于上一轮周期的高点。期货未平仓合约也同样升至2021年第四季度以来的最高水平。最后,受欢迎的合规交易平台Coinbase的谷歌搜索量的增加也可能表明散户的回归。加密货币期权市场正在对下行风险的增加进行定价:隐含波动率和负偏度(即看跌期权的价格高于看涨期权的价格)均有所上升。

尽管比特币已经突破了之前的历史高点,但大多数其他加密货币还没有突破。例如,ETH 仍然比 2021 年 11 月的历史高点 ( 以收盘价为基础 ) 下跌 21%。对于我们的加密货币行业框架内的其余资产(不包括 BTC 和 ETH),代币价格仍比历史高点低约70%。

2020-2022 年的加密周期提醒我们,加密市场的下跌可能是显著的:比特币的价格从峰值到低谷下跌了 77%。尽管投资比特币在中期带来了稳定的回报,但该资产也经历了大幅下跌和波动。比特币是一种高风险、高回报潜力的资产,与股票的相关性较低。因此,它可以成为某些投资者多元化投资组合的有用成分。正如我们在最新的月度更新中所讨论的那样,如果宏观市场背景仍然有利,我们可能会在未来几个月看到代币估值进一步上升。相反,不太有利的宏观前景——例如:美联储加息 / 经济衰退可能会抑制加密货币的估值。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。