3月5日晚上,AICoin 研究员在【AICoin PC端-群聊-直播】进行【趋势行情下的抄底机会把握(送会员)】的图文直播分享,以下是直播内容汇总。

一、研究院抄底策略分享

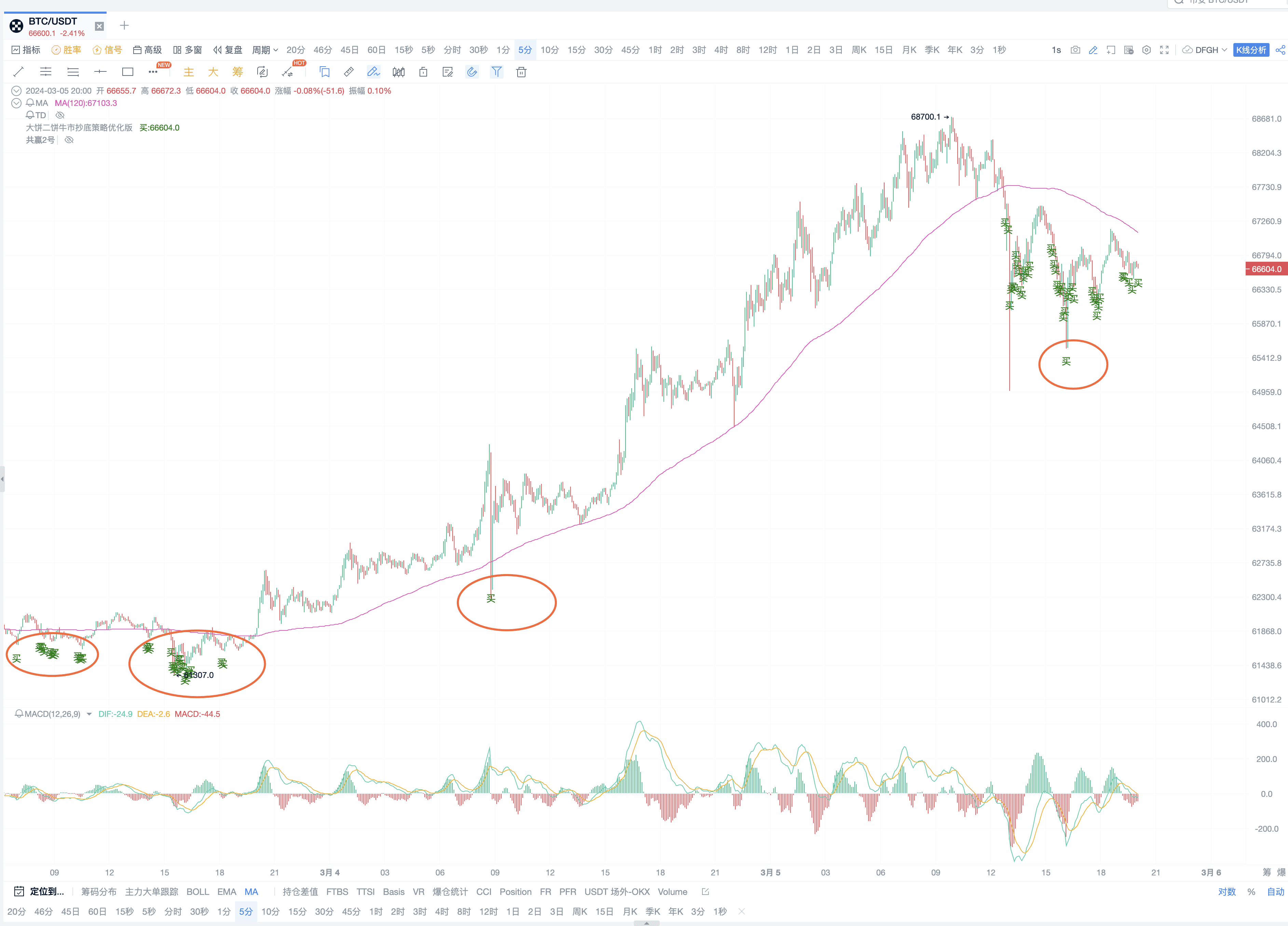

1、我们的抄底策略

2、策略的运行情况

注意:下跌行情,如果一直创新低,那么就会一直套牢;这套策略只适合牛市的抄底。

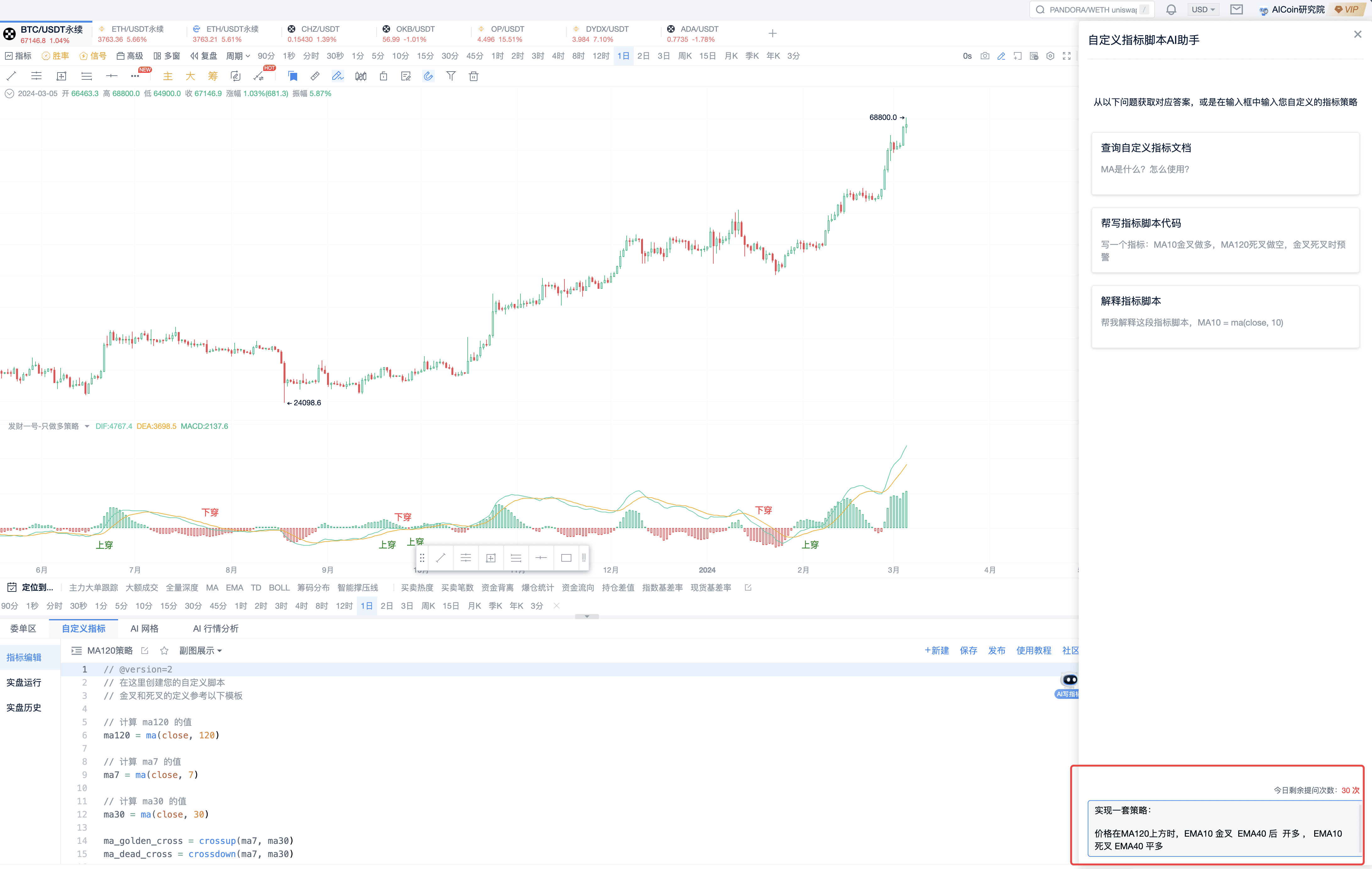

二、AI助手位置

1、如下图更新最新版本——2.9.3,可以实现 AI 助手写脚本

2、AI 助手具体位置,如图点击使用

三、AI 助手写脚本,抄底策略

1、问 AI

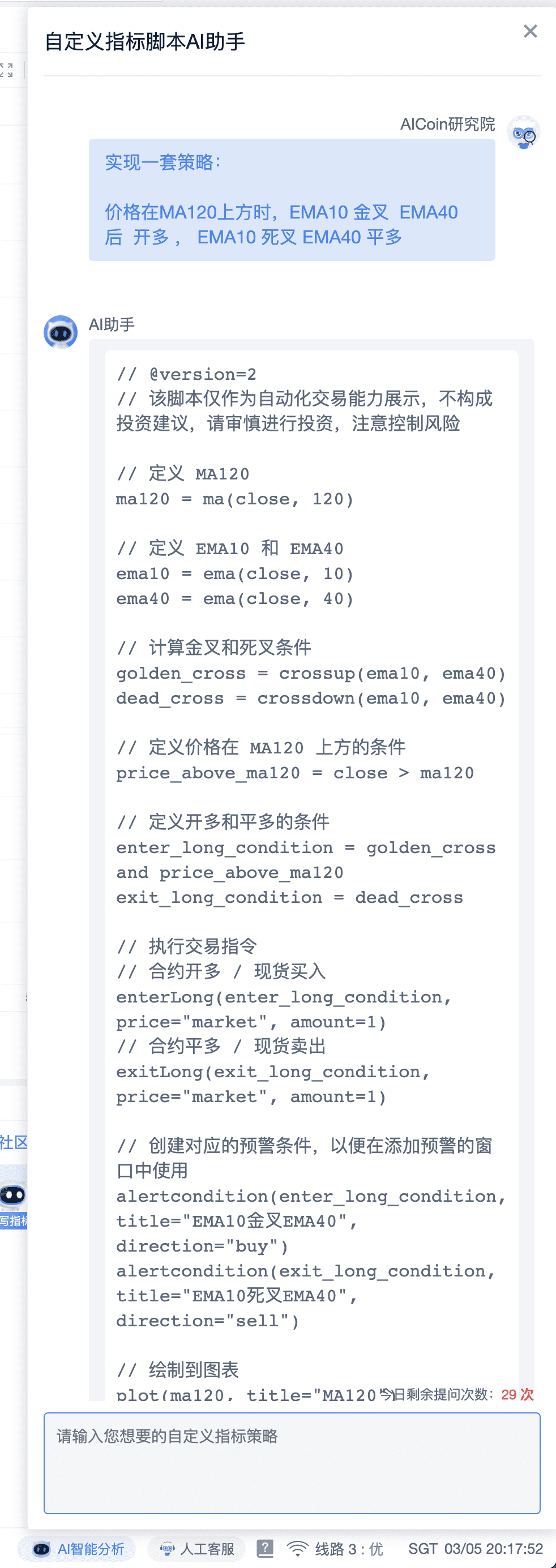

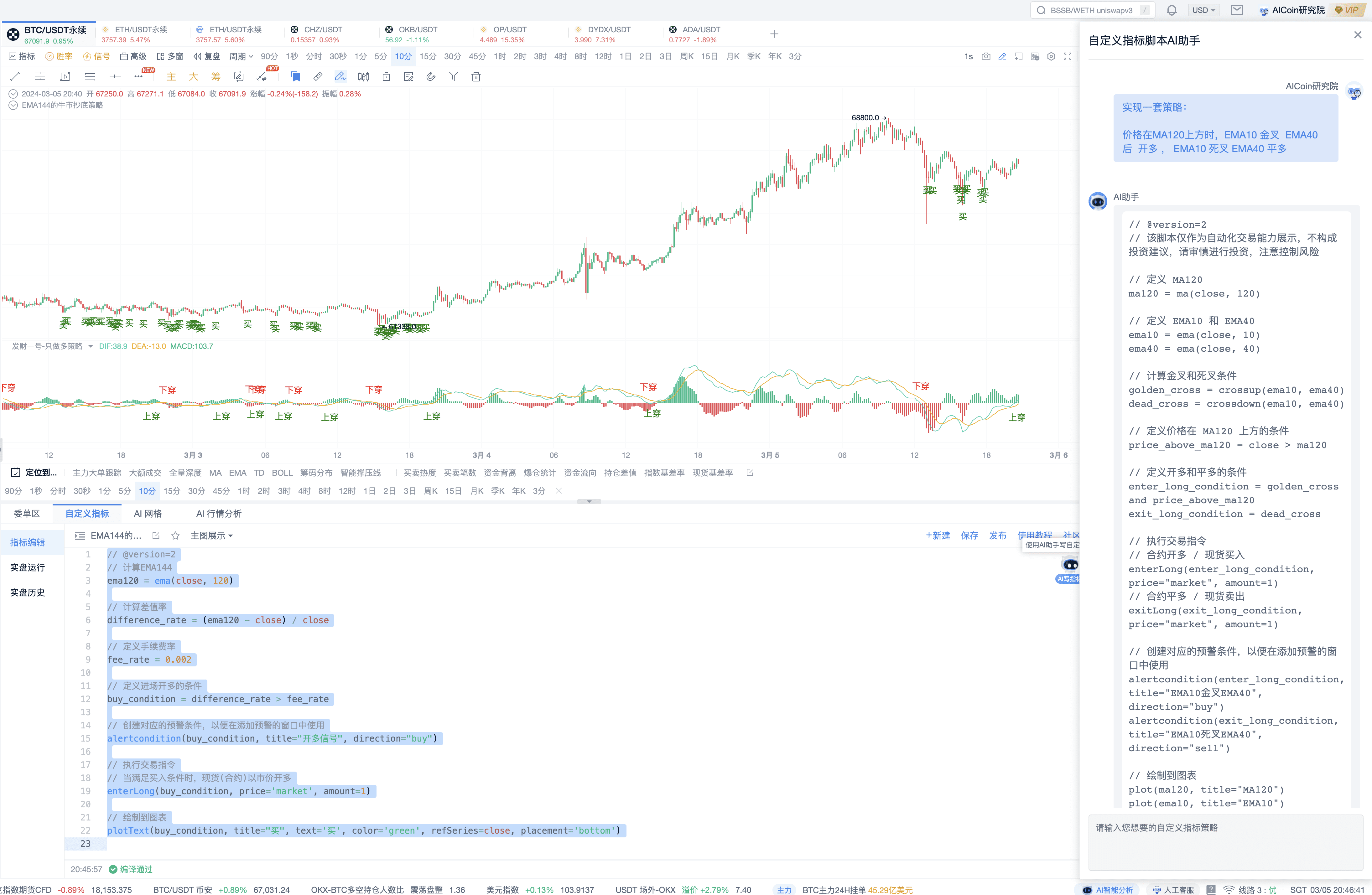

(1)提问:价格在MA120上方时,EMA10 金叉 EMA40 后 开多 , EMA10 死叉 EMA40 平多

(2)AI答复

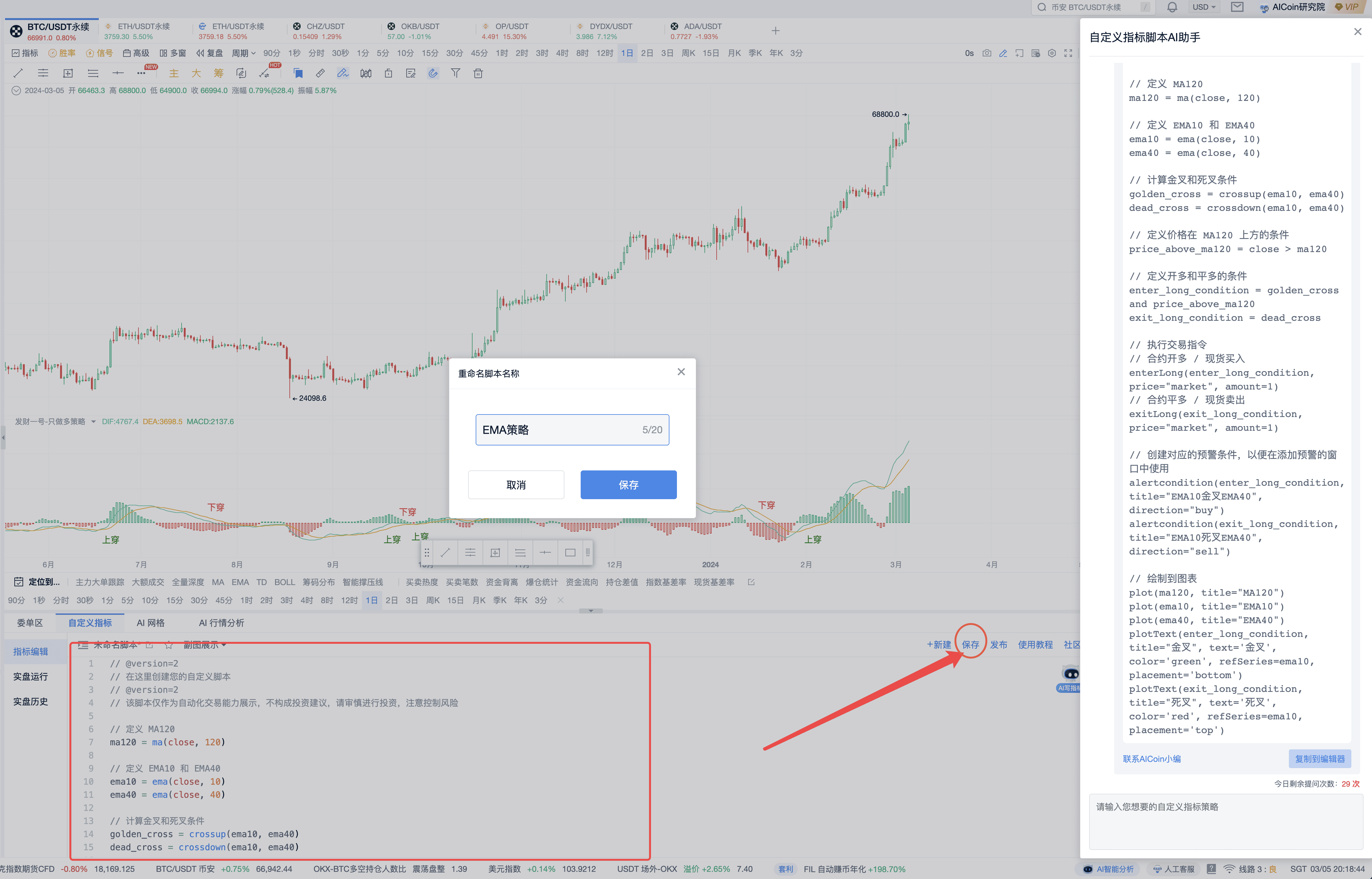

(3)复制AI直接使用

(4)粘贴保存

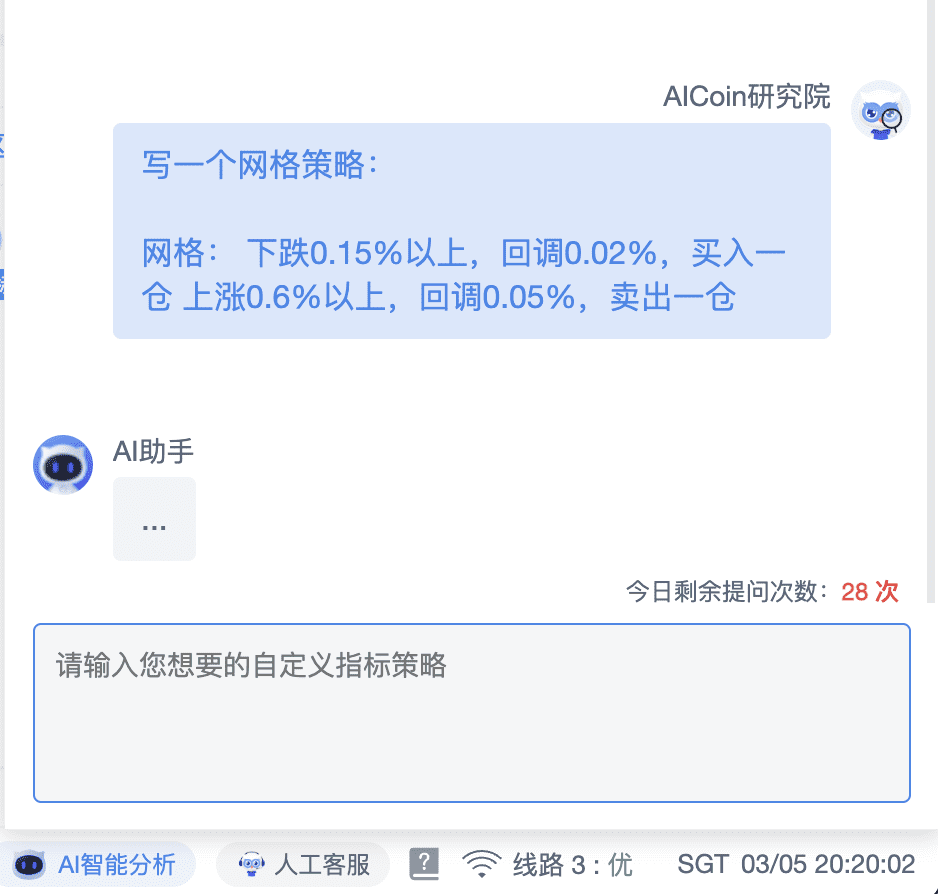

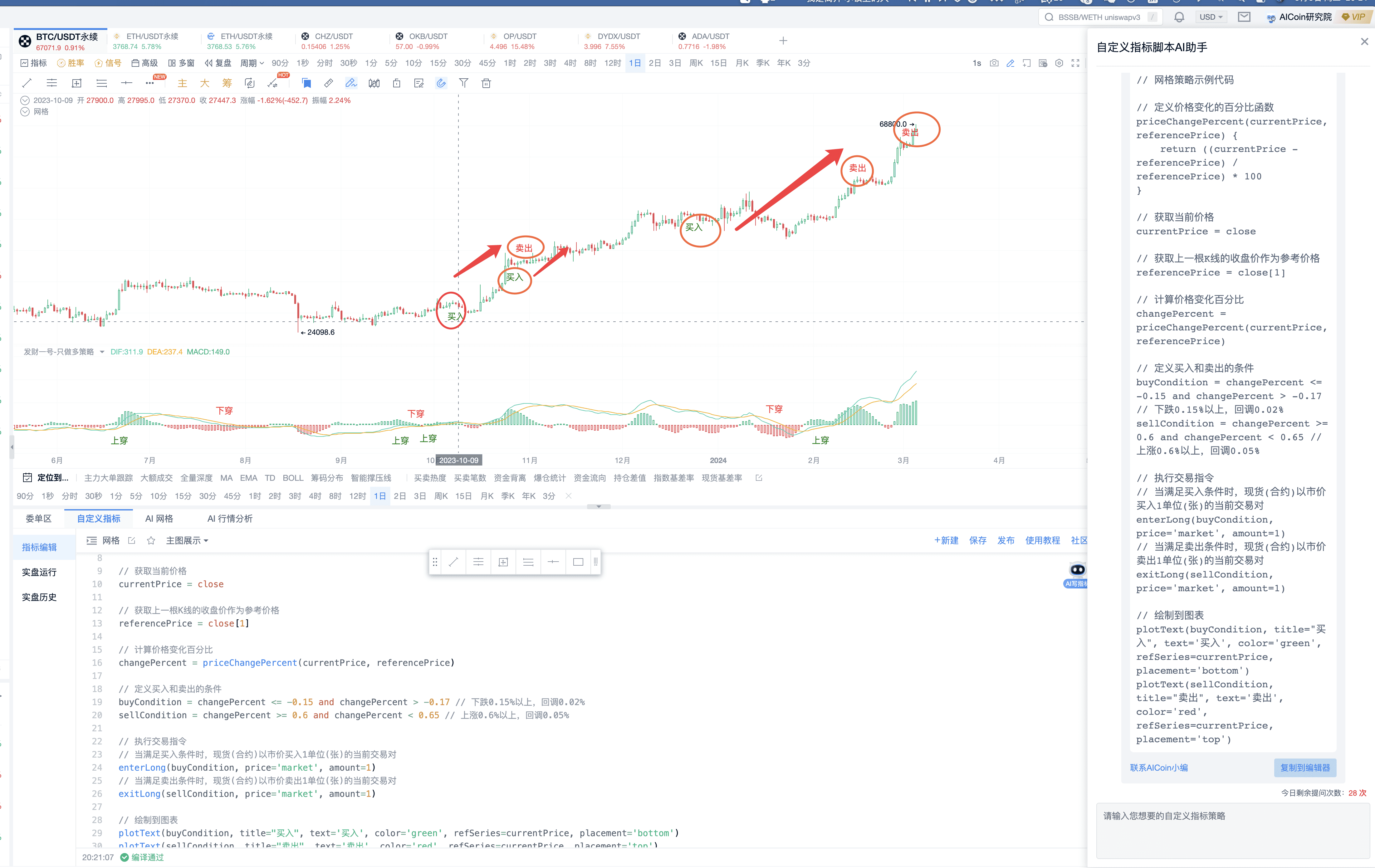

2、再问AI写网格

(1)提问:写一个网格策略,网格:下跌0.15%以上,回调0.02%,买入一仓 上涨0.6%以上,回调0.05%,卖出一仓

(2)AI答复

// @version=2

// 网格策略示例代码

// 定义价格变化的百分比函数

priceChangePercent(currentPrice, referencePrice) {

return ((currentPrice - referencePrice) / referencePrice) * 100

}

// 获取当前价格

currentPrice = close

// 获取上一根K线的收盘价作为参考价格

referencePrice = close[1]

// 计算价格变化百分比

changePercent = priceChangePercent(currentPrice, referencePrice)

// 定义买入和卖出的条件

buyCondition = changePercent <= -0.15 and changePercent > -0.17 // 下跌0.15%以上,回调0.02%

sellCondition = changePercent >= 0.6 and changePercent < 0.65 // 上涨0.6%以上,回调0.05%

// 执行交易指令

// 当满足买入条件时,现货(合约)以市价买入1单位(张)的当前交易对

enterLong(buyCondition, price='market', amount=1)

// 当满足卖出条件时,现货(合约)以市价卖出1单位(张)的当前交易对

exitLong(sellCondition, price='market', amount=1)

// 绘制到图表

plotText(buyCondition, title="买入", text='买入', color='green', refSeries=currentPrice, placement='bottom')

plotText(sellCondition, title="卖出", text='卖出', color='red', refSeries=currentPrice, placement='top')

(3)AI网格策略在K线上显示效果

PRO会员、信号预警会员,就是为懒人朋友专属定制的优质工具,自定义指标是可以帮任何aicoin的用户朋友,计划他们的交易,交易他们的计划。想要更多的自定义指标策略展示以及多个预警提醒,欢迎开通信号预警/PRO版K线,都能限时免费体验自定义指标会员。点击下方链接开通体验:https://www.aicoin.com/zh-CN/vip/chartpro

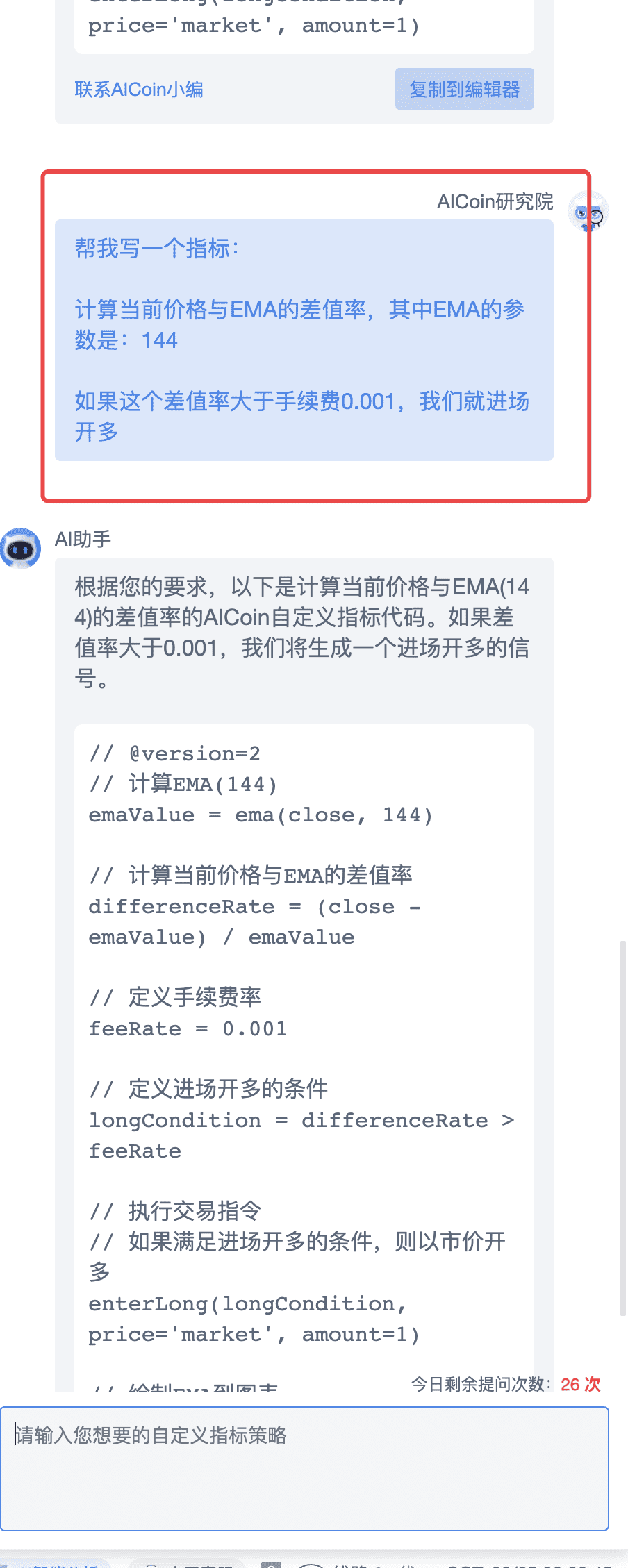

3、再问小A

(1)提问:帮我写一个指标,

计算当前价格与EMA的差值率,其中EMA的参数是:144,

如果这个差值率大于手续费0.001,我们就进场开多。

(2)核心原理,是一个均值回归法则,ema144适合抄底策略;价格与EMA144的均值回归规则,然后和手续费做比较;如果这个差值,大于手续费,那么就说明大资金可能会认为这个是一个机会,进场。(任何周期的都合适——大周期,开仓少;小周期开仓多)

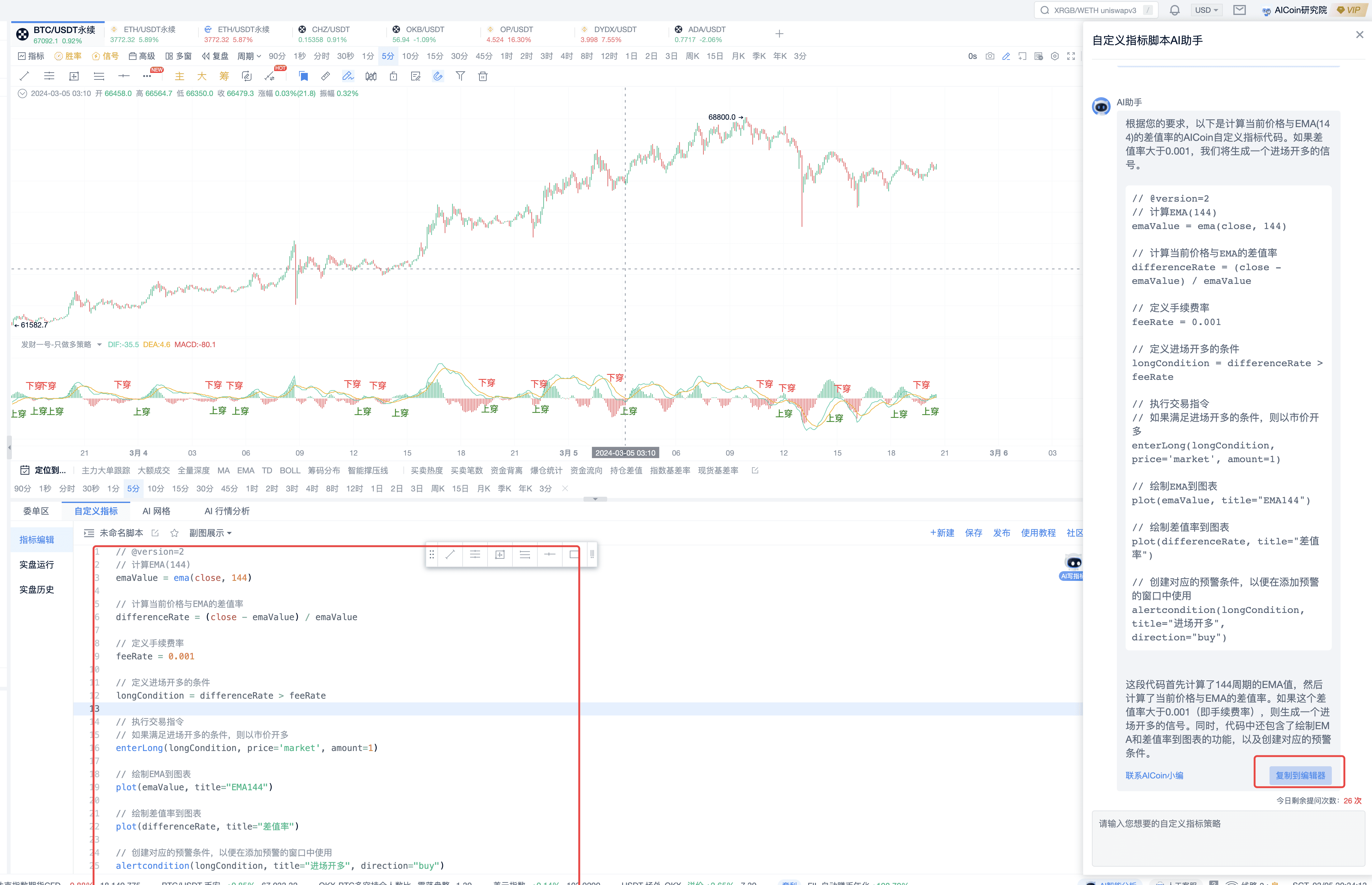

(3)复制AI脚本直接使用

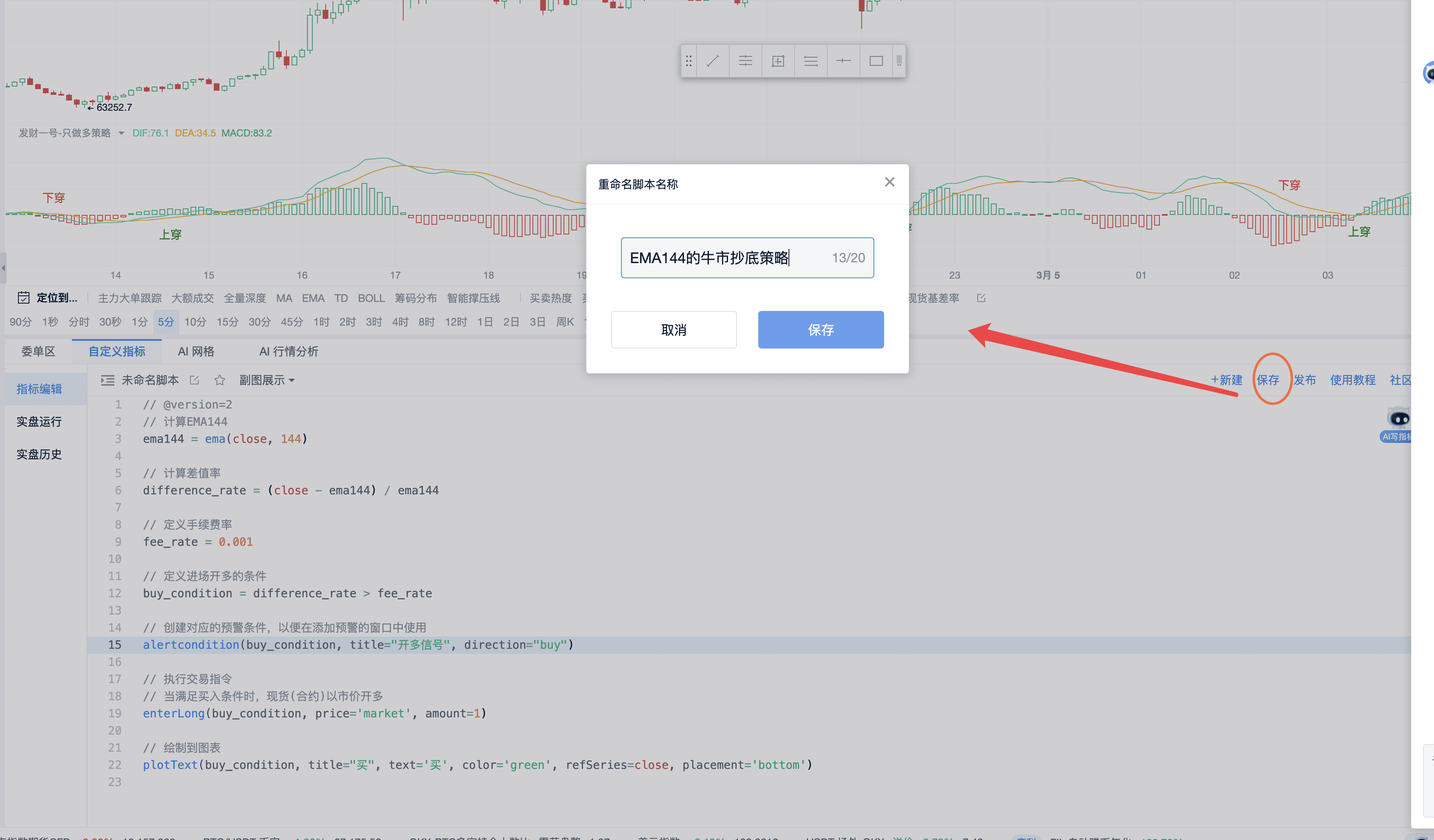

(4)粘贴保存

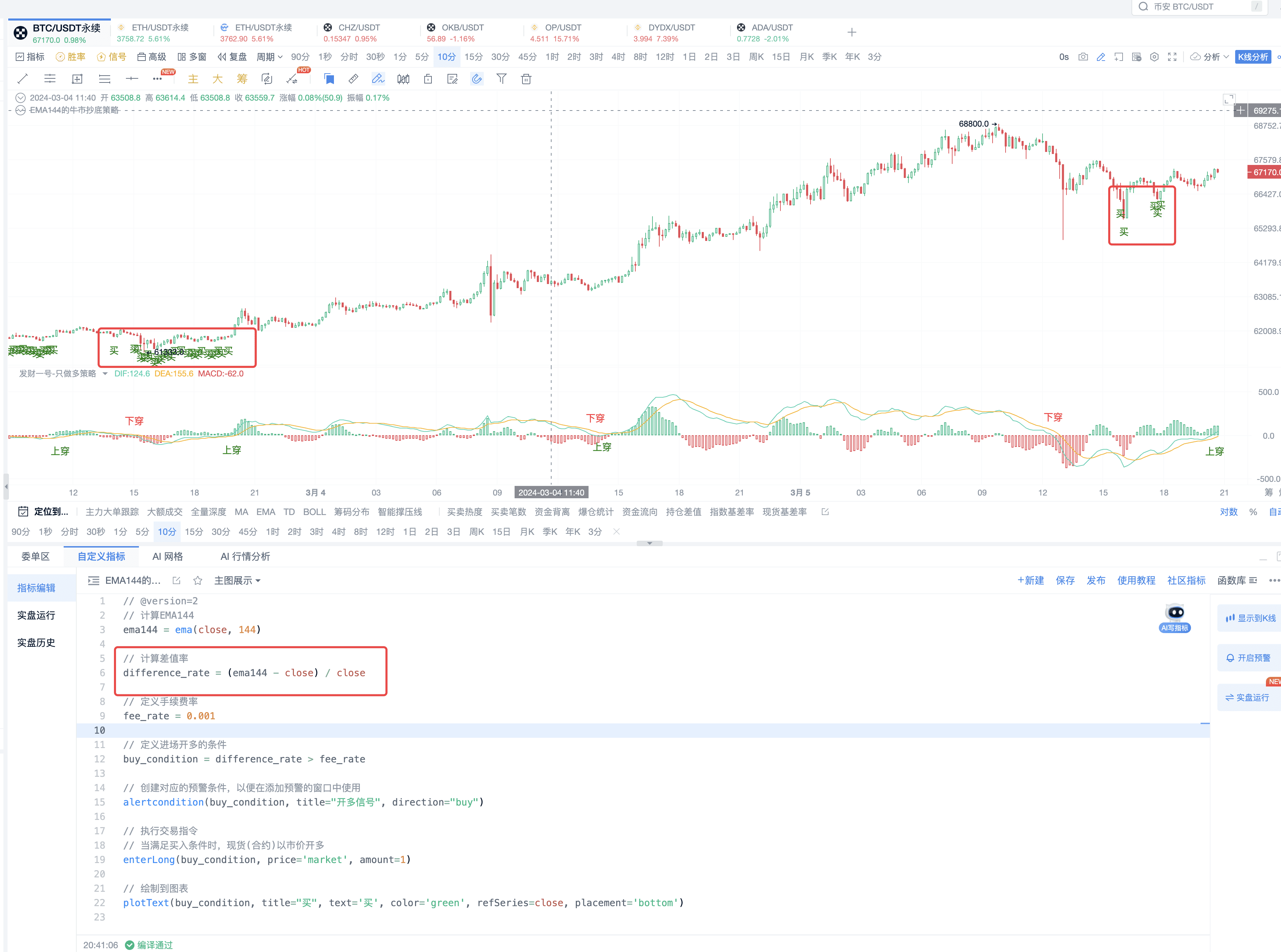

(5)AI写脚本应用到k线上

(6)无论拉多久的历史,都是能抄在底部,效果如图。

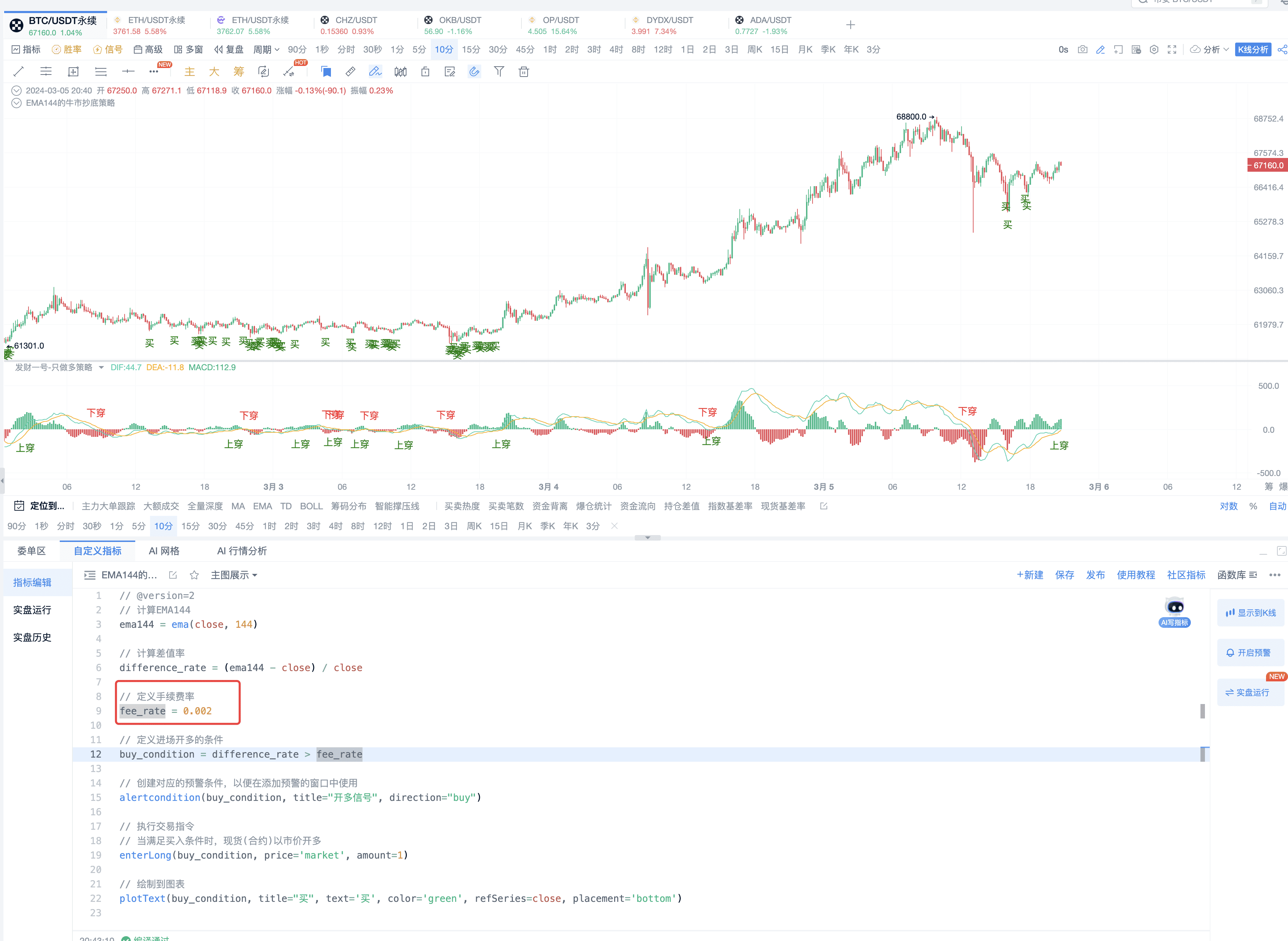

4、再问AI

(1)提问:帮我写一个指标,

计算当前价格与EMA的差值率,其中EMA的参数是:120,

如果这个差值率大于手续费0.002,我们就进场开多。

(2)应用原因:EMA120也是可以的,因为有一些大资金,用的也是120

(3)AI答复,AI写策略代码

// @version=2

// 计算EMA120

ema120 = ema(close, 120)

// 计算差值率

difference_rate = (ema120 - close) / close

// 定义手续费率

fee_rate = 0.002

// 定义进场开多的条件

buy_condition = difference_rate > fee_rate

// 创建对应的预警条件,以便在添加预警的窗口中使用

alertcondition(buy_condition, title="开多信号", direction="buy")

// 执行交易指令

// 当满足买入条件时,现货(合约)以市价开多

enterLong(buy_condition, price='market', amount=1)

// 绘制到图表

plotText(buy_condition, title="买", text='买', color='green', refSeries=close, placement='bottom')

(4)AI应用到K线效果

5.再问AI

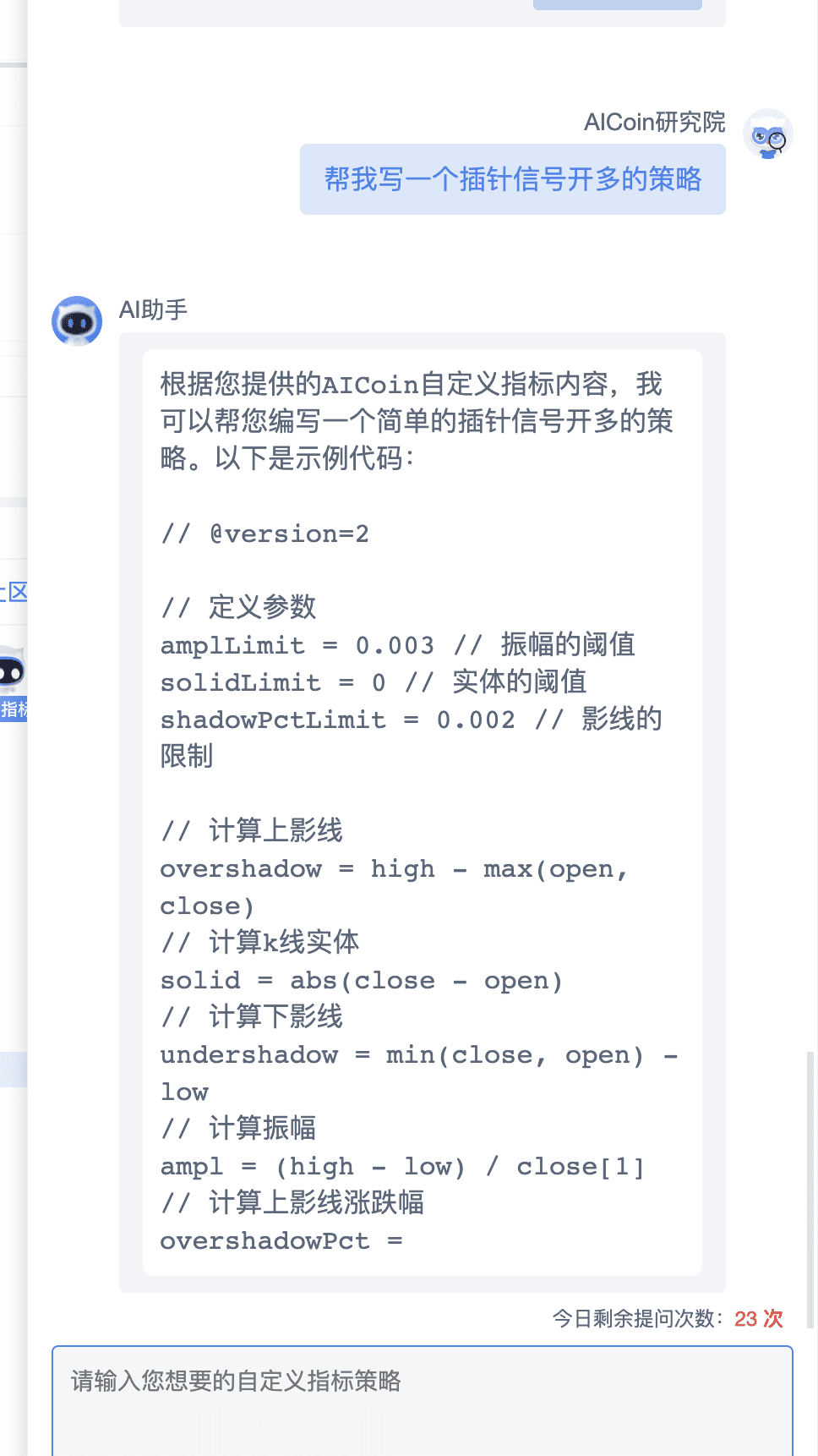

(1)提问:帮我写一个插针信号开多的策略

(2)AI 答复

// @version=2

// 定义参数

amplLimit = 0.003 // 振幅的阈值

solidLimit = 0 // 实体的阈值

shadowPctLimit = 0.002 // 影线的限制

// 计算上影线

overshadow = high - max(open, close)

// 计算k线实体

solid = abs(close - open)

// 计算下影线

undershadow = min(close, open) - low

// 计算振幅

ampl = (high - low) / close[1]

// 计算上影线涨跌幅

overshadowPct = overshadow / max(open, close)

// 计算下影线涨跌幅

undershadowPct = undershadow / min(close, open)

// 插针判断算法

pinbar = 0

if (ampl > amplLimit) {

if (solid >= solidLimit && overshadowPct > shadowPctLimit) {

pinbar := 1

}

}

// 1 是上插针

up = pinbar == 1

// 创建对应的预警条件,以便在添加预警的窗口中使用

alertcondition(up, title='上插针', direction="buy")

// 绘制到图表

plot(close, title="收盘")

plotShape(up, title="上插针", shape='arrowUp', color='green', refSeries=close, display='bottom', fill=true)

// 现货买入或合约开多

enterLong(up, price='market', amount=1)

6、再问AI

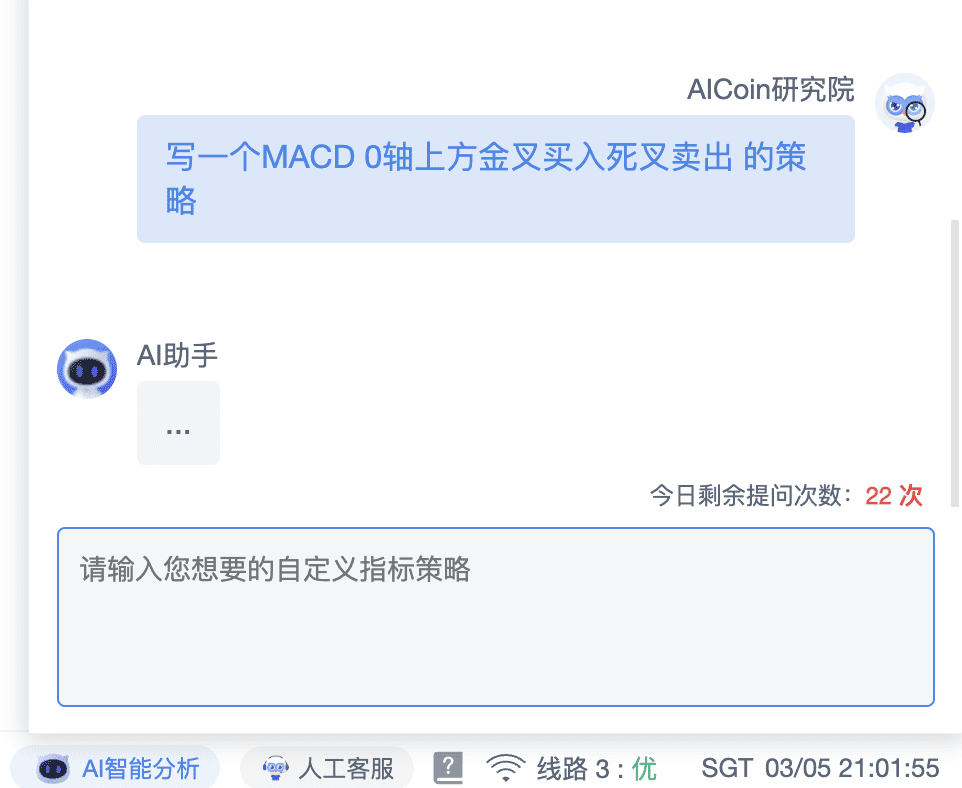

(1)提问:写一个MACD 0轴上方金叉买入死叉卖出 的策略

(2)AI答复

// @version=2

// 该脚本仅作为自动化交易能力展示,不构成投资建议,请审慎进行投资,注意控制风险

// 定义MACD指标相关参数

N1 = 12

N2 = 26

M = 9

zero = 0

// 计算MACD指标的值

dif = ema(close, N1) - ema(close, N2)

dea = ema(dif, M)

macd = (dif - dea) * 2

// 计算预警条件的值

golden_cross = crossup(dif, dea) and dif > zero

dead_cross = crossdown(dif, dea) and dif > zero

// 创建对应的预警条件,以便在添加预警的窗口中使用

alertcondition(golden_cross, title='MACD金叉', direction="buy")

alertcondition(dead_cross, title='MACD死叉', direction="sell")

// 执行交易指令

// 合约平多 / 现货卖出

exitLong(dead_cross, price="market", amount=1)

// 合约开多 / 现货买入

enterLong(golden_cross, price="market", amount=1)

// 绘制MACD到图表

plot(dif, title='DIF')

plot(dea, title='DEA')

plotColumn(macd, title='MACD')

// 绘制信号到图表

plotText(golden_cross, title="金叉", text='金叉', color='green', refSeries=dif, placement='bottom')

plotText(dead_cross, title="死叉", text='死叉', color='red', refSeries=dif, placement='top')

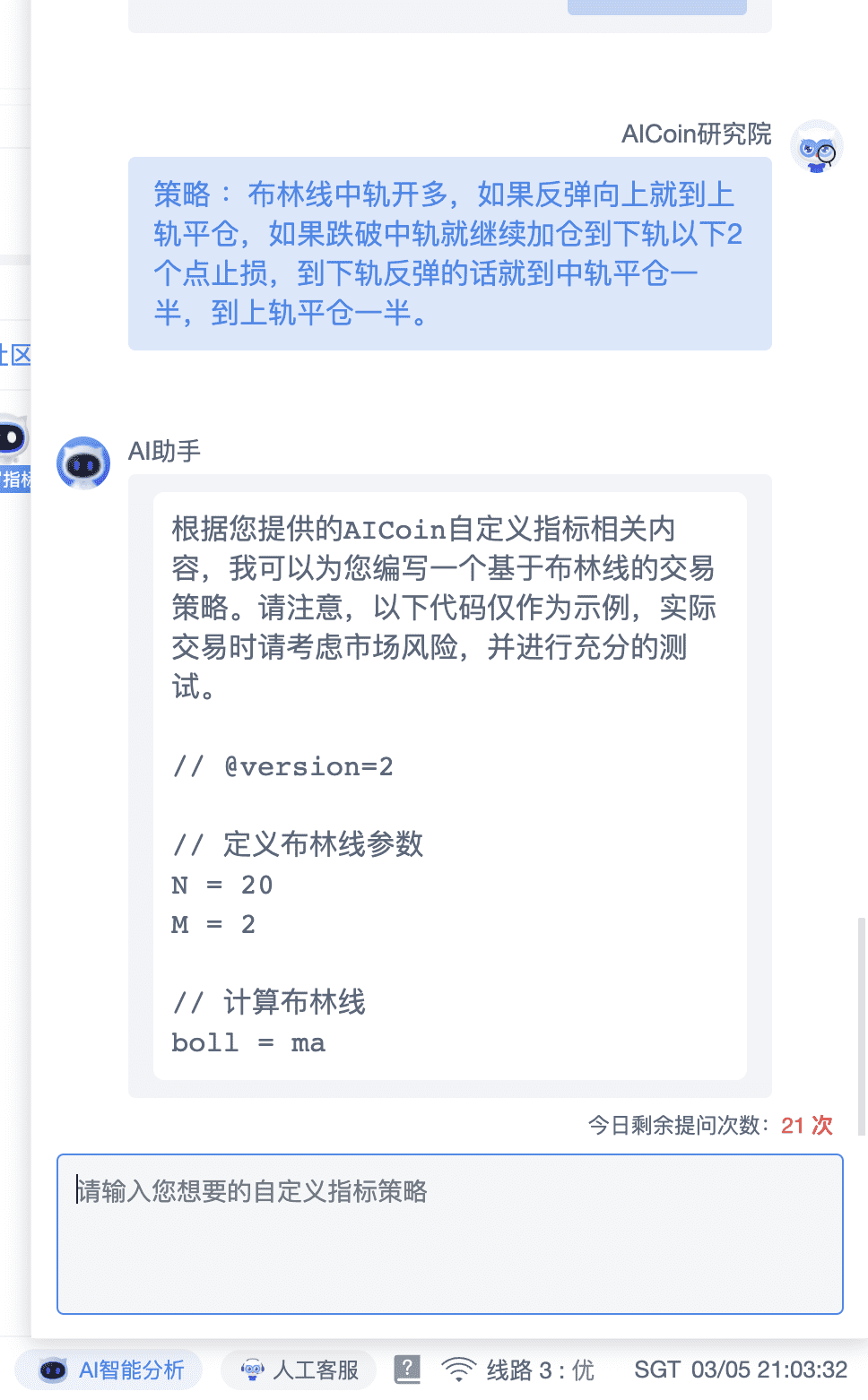

7、再问AI

AI助手写BOLL策略如下

boll策略:

// @version=2

// 定义布林线参数

N = 20

M = 2

// 计算布林线

boll = ma(close, N)

ub = boll + sd(close, N) * M

lb = boll - sd(close, N) * M

// 定义交易信号

longEntry = close > boll

longExit = close > ub

addMore = close < boll

stopLoss = close < lb - 2

takeHalfProfit1 = close > boll

takeHalfProfit2 = close > ub

// 执行交易指令

// 开多条件:收盘价大于布林线中轨

enterLong(longEntry, price='market', amount=1)

// 平多条件:收盘价大于布林线上轨

exitLong(longExit, price='market', amount=1)

// 加仓条件:收盘价跌破布林线中轨

enterLong(addMore, price='market', amount=1)

// 止损条件:收盘价低于布林线下轨以下2个点

exitLong(stopLoss, price='market', amount=1)

// 到中轨平仓一半:收盘价大于布林线中轨

exitLong(takeHalfProfit1, price='market', amount=0.5)

// 到上轨平仓一半:收盘价大于布林线上轨

exitLong(takeHalfProfit2, price='market', amount=0.5)

// 绘制布林线到图表

plot(boll, title="BOLL")

plot(ub, title="UB")

plot(lb, title="LB")

四、加入我们 AICoin 会员俱乐部

AI助手可以满足很多条件,只要你把你的想法提给AI;我们的AI工具以及自定义指标工具,会对会员有更多支持;如果对AI写指标感兴趣,想构建自己的交易策略,欢迎开通信号预警/PRO版K线/指标胜率,三个会员任意一个都能限时免费体验自定义指标会员。点击下方链接开通体验:https://www.aicoin.com/zh-CN/vip/chartpro

推荐阅读

更多直播干货,请关注AICoin“新闻/资讯-直播回顾”栏目,欢迎下载AICoin PC端

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。