A red book of market fluctuations covering various types of assets: It is a good choice to focus on volatility.

Author: Loopy Lu

As the final "judgment" day for the Bitcoin spot ETF on January 10 approaches, the sentiment in the cryptocurrency market continues to heat up. From last night to this morning, there have been major developments in the Bitcoin spot ETF, and BTC has once again experienced a substantial increase.

Currently, there is less than 24 hours until the final result of the ETF is obtained. At the time of the ETF's approval, regardless of whether it rises or falls, the market consensus is that there will be huge fluctuations. The Bitcoin spot ETF is just one step away.

In the face of huge fluctuations, how should retail investors operate? How can they profit from the potential huge fluctuations that are about to occur? Odaily Star Daily has compiled potential operating methods as follows:

Fancy leverage

Contracts and leveraged trading are the easiest to operate, the most basic, and also the highest return (or loss) choice. In the face of the upcoming market volatility, whether going long or short, there is a potential for high returns if the direction is correct.

Currently, various mainstream CEXs provide various leveraged methods such as coin-based contracts, U-based contracts, spot leverage, and leveraged tokens. In addition, leveraged operations can also be carried out through DeFi lending stablecoins on-chain.

Odaily Star Daily reminds investors that leveraging is a highly risky trading method in the crypto market.

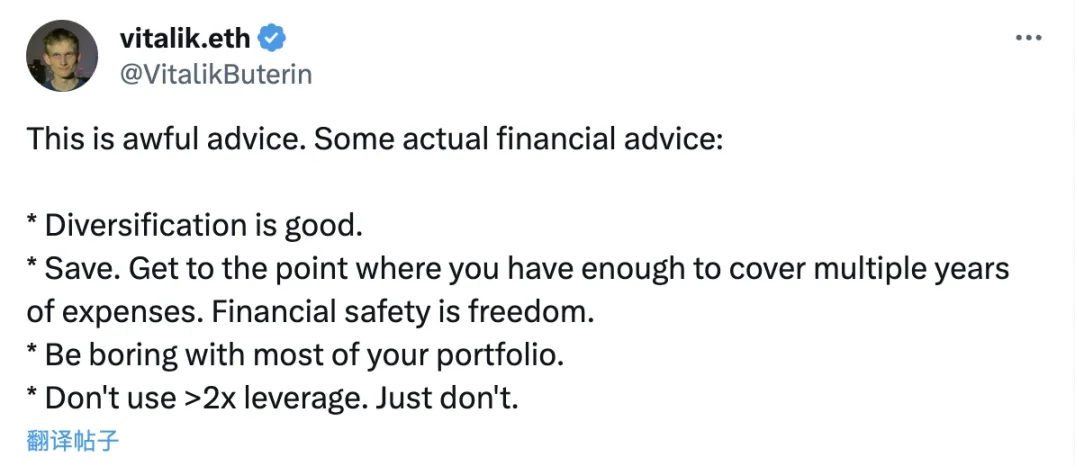

On January 7th, V God posted on X platform, providing his investment advice: Do not use leverage of more than two times. Absolutely not.

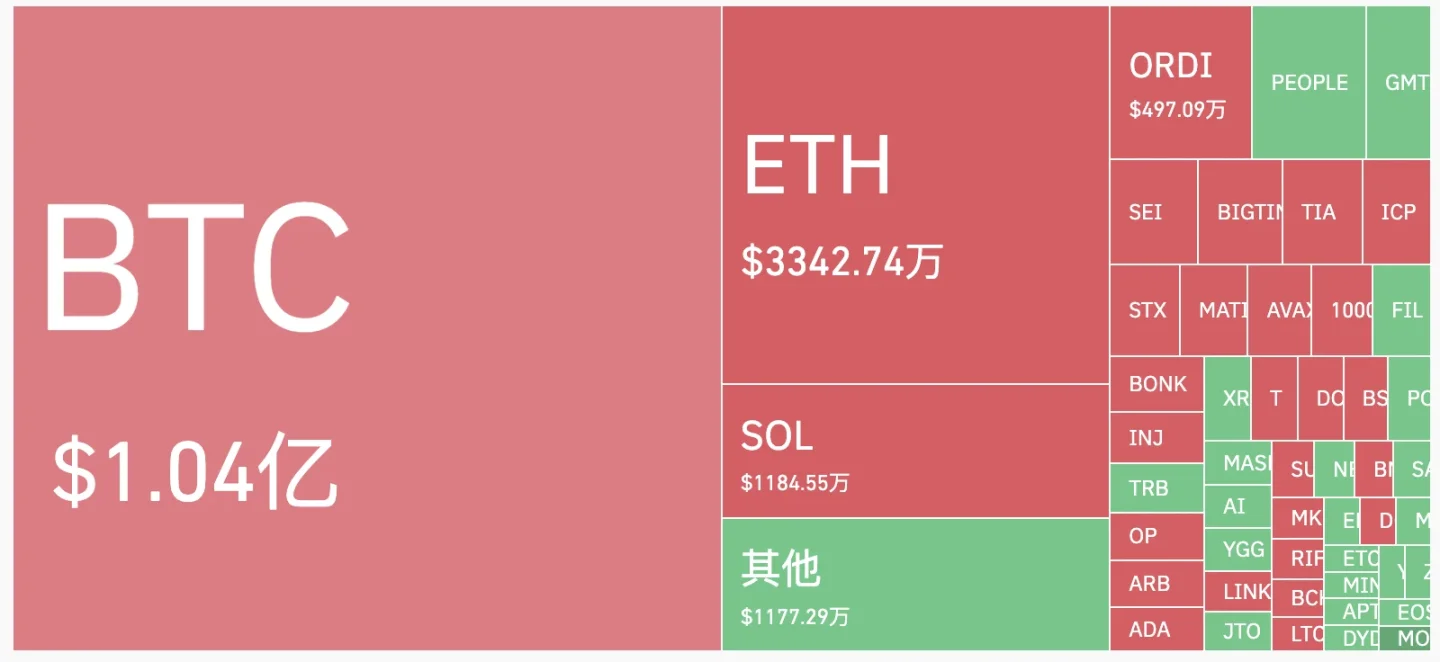

In yesterday's market intense fluctuations, Coinglass data shows that the liquidation amount in the crypto market in the past 24 hours reached as high as 208 million US dollars. BTC liquidation exceeded 100 million US dollars. In the past 24 hours, a total of 60,036 people were liquidated, with the largest single liquidation worth 9.4389 million US dollars.

Going long on volatility

Although it is currently difficult to judge the specific direction of BTC after the ETF results are announced, the market unanimously predicts that there will be intense fluctuations in the market after the announcement.

Therefore, going long on BTC volatility has become a good choice.

In the FTX era, FTX once pioneered the market by providing volatility tokens as a simple choice. Currently, FTX has collapsed, and there are no obvious competitive products on the market.

However, we still find several interesting choices from the DeFi market:

Crypto Volatility Index (CVI)

CVI (Crypto Volatility Index) is both the name of an index and the name of the DeFi project. The CVI index aims to track the volatility of the entire crypto market, with higher index values indicating greater market volatility. We can use an approximate but inappropriate analogy to understand—this index is the IV of the entire crypto market.

In simple terms, the project provides users with CVI tokens, the price of which is linked to the CVI index, and also includes funding fees, adjusted daily.

If users predict that the future volatility will increase, they can buy the token and sell it after the volatility increases. If users predict that the future volatility will decrease, they can mint the token and collect funding fees during each adjustment.

Today's hourly trend of the CVI index

Volmex

Volmex is another DeFi protocol that provides users with volatility trading. Volmex has also launched its own crypto volatility indices, namely BVIV index and EVIV index. Unlike CVI, these two are more accurate and specific to tokens, representing BTC implied volatility and ETH implied volatility, respectively.

On the Volmex platform, users can trade the index, provide liquidity for the index, and also conduct BTC volatility and ETH volatility swap trades.

Today's hourly trend of Volmex volatility

Volmex aims to provide users with a simple way to obtain cryptocurrency volatility, and based on this investment tool, users can also develop a series of complex trading strategies.

Options trading

Currently, mainstream CEXs, Deribit, and other centralized platforms, as well as some DeFi protocols, provide options markets for cryptocurrency investors.

Buying call/put options expiring on January 12 is the simplest way to go long/short on BTC through options trading.

However, it should be noted that unlike contracts on CEXs, options will be forcibly settled after the expiration date. Therefore, if the price prediction is wrong, the option will be "zeroed out" (for example, when the BTC price is $40,000, buying a call option with a strike price of $50,000, if the BTC price is only $49,999 at that time, the entire option premium will be lost, with no profit).

Users can also sell put options to profit by earning the option premium. However, it should be noted that being an option seller is a riskier role, and theoretically, the option seller will bear unlimited risk.

Option products are more complex, and it is recommended that investors who are not familiar with them should trade after a thorough understanding. Odaily Star Daily has published a series of options introductory guides.

Of course, if only simple "long/short" predictions are made, options tools may seem overkill. It is only when hedging and combining with other positions (such as spot, contracts, options, etc.) to execute some strategies that options truly come into play.

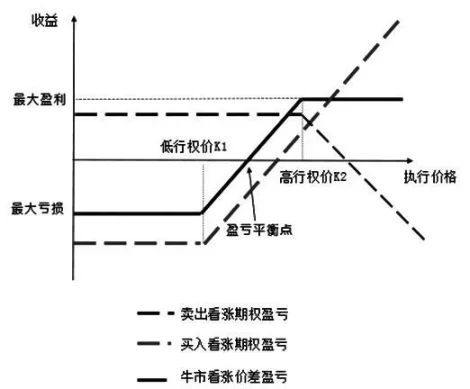

How to go long on volatility with options?

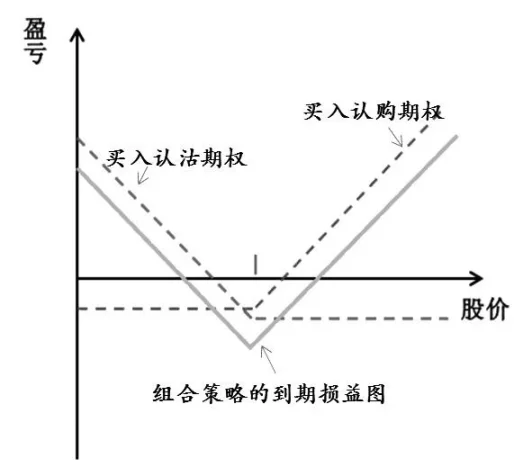

Constructing a straddle is the simplest way to go long on volatility,

For example, when Bitcoin is at $40,000, simultaneously buying call and put options at $40,000. For investors, this only requires paying two option premiums, and once there is a substantial increase/decrease, and the increase/decrease is enough to cover the option premium cost, they can start making a profit. The straddle combination is a simple way to go long on volatility. In theory, this is a combination strategy with limited loss (option premium zeroed out) and unlimited gain (price fluctuation has no upper limit).

Straddle option profit and loss diagram

Of course, if the same operation is carried out in reverse—acting as an option seller—it is going short on volatility, and can earn option premium income due to the stagnation of market volatility.

Practical example

Taking the current market as an example, constructing the most basic straddle option combination, although there is still a possibility of profit, it seems to be not cost-effective.

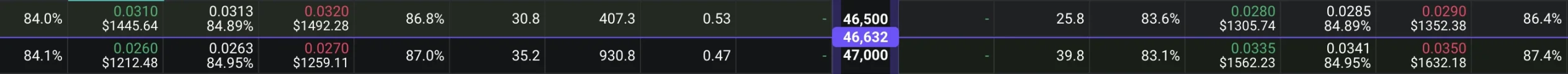

Taking the BTC expiring on January 12 as an example (current price $46,632), constructing a combination with BTC-46500-CALL and BTC-47000-PUT requires paying a premium cost of about $3,000, and BTC needs to fluctuate to $49,932 or $43,362 to start making a profit.

One-way call/put: Spread strategy

If users have a one-way directional prediction, they can execute a bull market/bear market spread strategy.

Taking the bull market spread strategy as an example, it involves buying a call option at a lower price and selling a call option at the same strike date but at a higher price. For example, when the BTC price is $40,000, if the future market is predicted to be bullish, one can buy a $45,000 call option and sell a $50,000 call option.

The profit potential of this strategy is within a limited range and cannot achieve theoretically unlimited profits. It is approximately when the BTC price stays between $45,000 and $50,000 that profit can be made. (This is an approximate value because the cost and income of the option premium need to be calculated)

Practical example

Compared to just buying a single call option, the advantage of this strategy is that it reduces the holding cost by acting as a seller. With a little flexibility, capital efficiency can be further improved.

Using the current market and the BTC expiring on January 12 as an example.

If one buys BTC-48000-CALL and sells BTC-52000-CALL, it would cost about $900 and receive about $200 in option premium, resulting in a net cost of about $700 for the strategy.

When the expiration date of January 12 arrives, profit can be made when the BTC price stays above approximately $48,700 and below $52,000. However, when the price reaches above $52,000, because we act as the option seller, the seller's option starts to lose, and further increase will offset the profit and loss of the two options, making it impossible to achieve unlimited profit from the upward movement.

So why adopt this strategy? It should be noted that, as mentioned earlier, our cost is only about $700, not the approximately $900 for the call option. Compared to a single operation, this "two-operation" combination improves capital efficiency by an astonishing 22%.

Can the maximum profit limit be broken while improving capital efficiency?

The answer is yes, as long as a little flexibility is applied. In the spread strategy we just constructed, because of the "buy 1, sell 1" operation, the portfolio's Delta value is approximately 0 (not equal to 0), so as long as Delta produces a greater deviation towards the positive direction, the maximum profit limit can be broken.

The same strategy can be used, but "buy 3, sell 2" or "buy 2, sell 1", which can break the maximum profit limit and achieve a one-way call option strategy position.

The above strategies are just some simple and convenient strategies, but options trading carries huge risks. Odaily Star Daily reminds users to carefully assess the risks and operate cautiously.

Options trading is quite mature in traditional markets, and investors can learn more about options through stock options trading.

Stock Trading

In the upcoming high volatility, trading in cryptocurrency concept stocks is another channel for betting on the cryptocurrency market.

Cryptocurrency concept stocks represented by COIN have always been correlated with the cryptocurrency market. The stock market, as a more mature and easily accessible investment tool, provides more possibilities for betting on the cryptocurrency market, whether it's going long, short, or trading volatility, finding some cryptocurrency sector stocks as trading targets is a good choice.

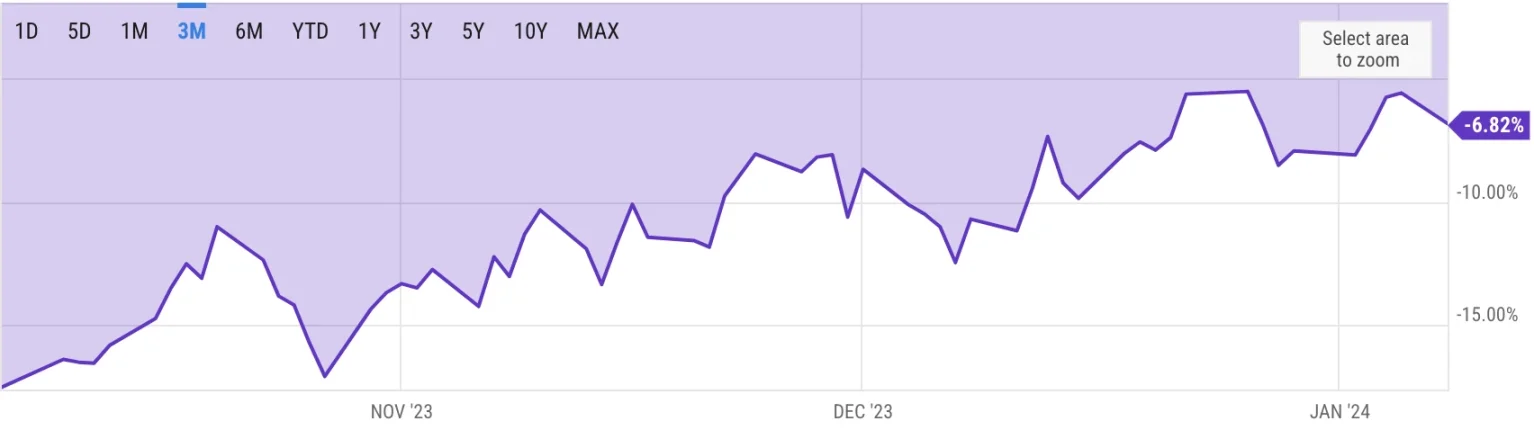

COIN compared to BTC trend

In addition to COIN, there are various other ways to operate, including a series of cryptocurrency mining companies, "alternative BTC leveraged tokens" like MicroStrategy, and Grayscale GBTC shares.

Furthermore, if GBTC is approved, the price difference between GBTC and BTC is a potential arbitrage opportunity. Currently, GBTC is at a 6.82% discount.

Recent 3-month GBTC premium rate changes

CEX Products

Apart from trading cryptocurrencies, what other services can CEX provide? Robot products and wealth management products are both good choices.

In the market's repeated fluctuations, the grid trading strategy is an extremely effective strategy.

The grid strategy is a method of profiting from market oscillations. In a market where the price of the underlying asset keeps oscillating, the grid strategy automatically buys/sells at the preset grid line price to make a profit.

Taking OKX as an example, the grid strategy officially launched by OKX, which is ranked high and sorted by default, has achieved good profits in the previous oscillating market.

Wealth management products are also a good choice.

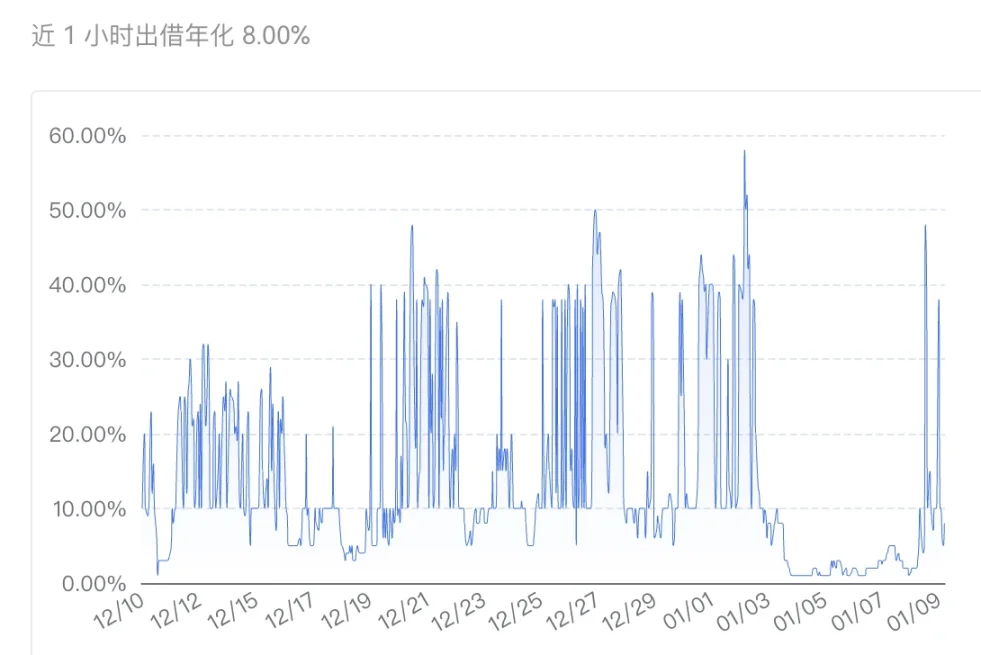

Recently, the market sentiment has been strong and positive. In this situation, investors' leveraged sentiment has led to a large demand for loans in various lending products. As a result, loan interest rates remain high.

Correspondingly, the lenders can earn high returns.

Using OKX as an example again, the annualized return rate for stablecoin wealth management on OKX is 8%. In the past 30 days, this number has soared to 58% and has remained above 20% for a long time. In a strong market sentiment, stablecoin wealth management on various CEXs is a relatively low-risk and good choice.

OKX USDT wealth management yield trend

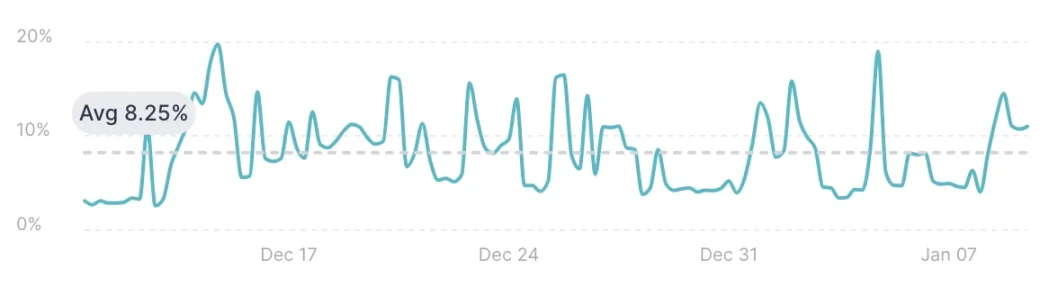

Of course, there is also a strong demand for on-chain lending in the market. For example, the average APR of USDC on Aave in the past month has exceeded 8% in the Polygon market and the Optimism market.

Aave Optimism USDC interest

Aave Polygon USDC interest

ETF is coming, what should I do?

The only factor currently affecting whether the Bitcoin spot ETF is approved is the attitude of the SEC commissioners with voting rights (including Gary Gensler and 4 others), and the actual voting results. No one can know the final result of the ETF, and this event is almost impossible to predict.

For the majority of investors, being mindful of risks and paying attention to positions is still the best choice.

There are still differing opinions in the current market about the "success or failure" of the ETF. What will be the final result? It will be revealed within 24 hours.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。