越来越多的机构投资者被比特币所吸引,在短短两个月内注入比特币的资金超过 10 亿美元。这可以说是加密货币复苏的风向标,预示着 2023 年及以后市场有望的发展轨迹。比特币正逐渐获得机构投资者的认可,被视为一个正统的资产类别,具有可观的长期增长潜力。此外,比特币的有限供应和即将发生的减半事件的结合增强了其吸引力,尤其是对于寻求稀缺性的投资者来说,还有潜在的比特币 ETF 的推出。

比特币的机构投资额逾 10 亿美元

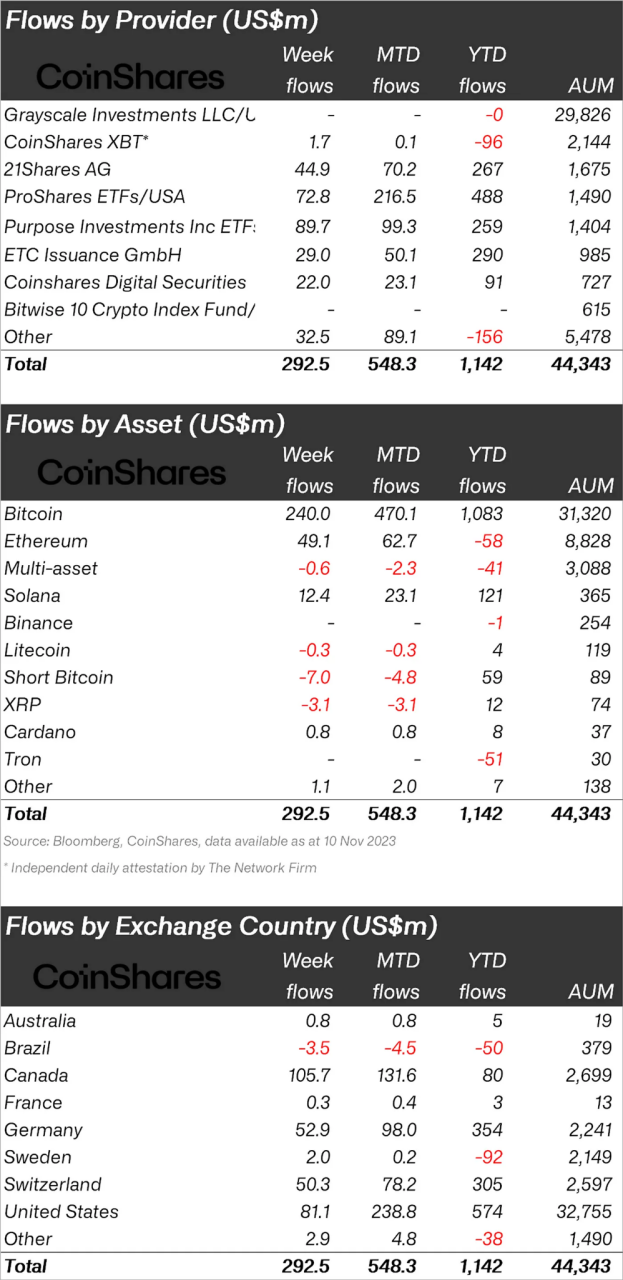

CoinShares 在 11 月 13 日发布了最新周报*,强调了资金重新流入比特币和山寨币的叙事。随着美国首个 ETF 可能获得批准的兴奋情绪升温,比特币、以太坊和部分主要山寨币正在经历价格上涨。

根据 TradingView 的数据,自 2022 年 11 月以来,整个加密货币市值已增加了6000亿美元。正如 CoinShares 报告里所详述的那样,过去两个月里,用于加密货币投资产品的资金大幅增加。该报告披露:“上周数字资产投资产品的资金流入总额为 2.93 亿美元,推动了为期七周的资金流入突破 10 亿美元大关。 今年迄今的流入总额为 11.4 亿美元,创下有纪录以来第三高的年度流入额。”

一个引人注目的统计数据凸显了加密货币在 2023 年的复兴:加密货币交易所交易产品(ETP)的资产管理规模(AUM),自年初以来几乎翻了一番,仅在上周就增加了近10%。

CoinShares 强调:“总 AUM 现在达到 443 亿美元,创下了自 2022 年 5 月重大加密货币基金倒闭以来的最高水平。”报告还透露,看涨比特币的人主导了交易量。报告指出,“比特币上周的流入总额为 2.4 亿美元,推动了年初至今流入总额达到 10.8 亿美元,而做空比特币则出现了700万美元的流出,表明市场仍然持续看涨。”

满足不断发展的需求的比特币扩容

伴随着加密市场不断的增长, Ordinals 也异常火爆。之前 veDAO 研究院的文章中提到了 Ordinals 交易激增造成的网络拥堵,随着人们对 BRC-20 代币的兴趣日益浓厚,比特币交易费用也随之攀升。在数周的积累之后,自10月底以来,平均交易费用飙升,于11月9日达到6个月来的高峰,超过16美元。值得庆幸的是,不断发展的比特币侧链和扩容协议生态系统有望简化 Ordinals交易,并将费用恢复到更易于管理的水平。

在比特币诞生的14年中,交易数据的量激增,而Ordinals的出现只是最新的趋势,对区块链有限吞吐量施加了压力。随着研究人员从2010年代中期开始关注比特币的可扩展性挑战,最初的重点是实现更快、更便宜地交易。例如,于2019年推出的闪电网络,作为专用的 Layer2 网络,旨在支持点对点比特币小额支付。

在 Ordinals 的背景下,将 BRC-20 代币连接到更高效的侧链可以大幅降低费用,并创建一个更流畅的交易环境。例如,Bioniq 使用互联网计算机协议(ICP)来封装Ordinals,然后用户可以在不产生交易费用的情况下进行交易。同样的还有 Bitmos,一个建立在 Cosmos 上的专用区块链网络,旨在提高 Ordinals 项目的可扩展性。该平台计划于明年推出,跨链桥将使用户创建可以自由在 Cosmos 链之间移动的 BRC-20 代币。

随着 Ordinals 的发展,桥接和扩容解决方案可能为基于比特币的资产的新、更复杂的用例提供支持。而这也将反应到比特币的供应动态上。

比特币供应动态的重新评估

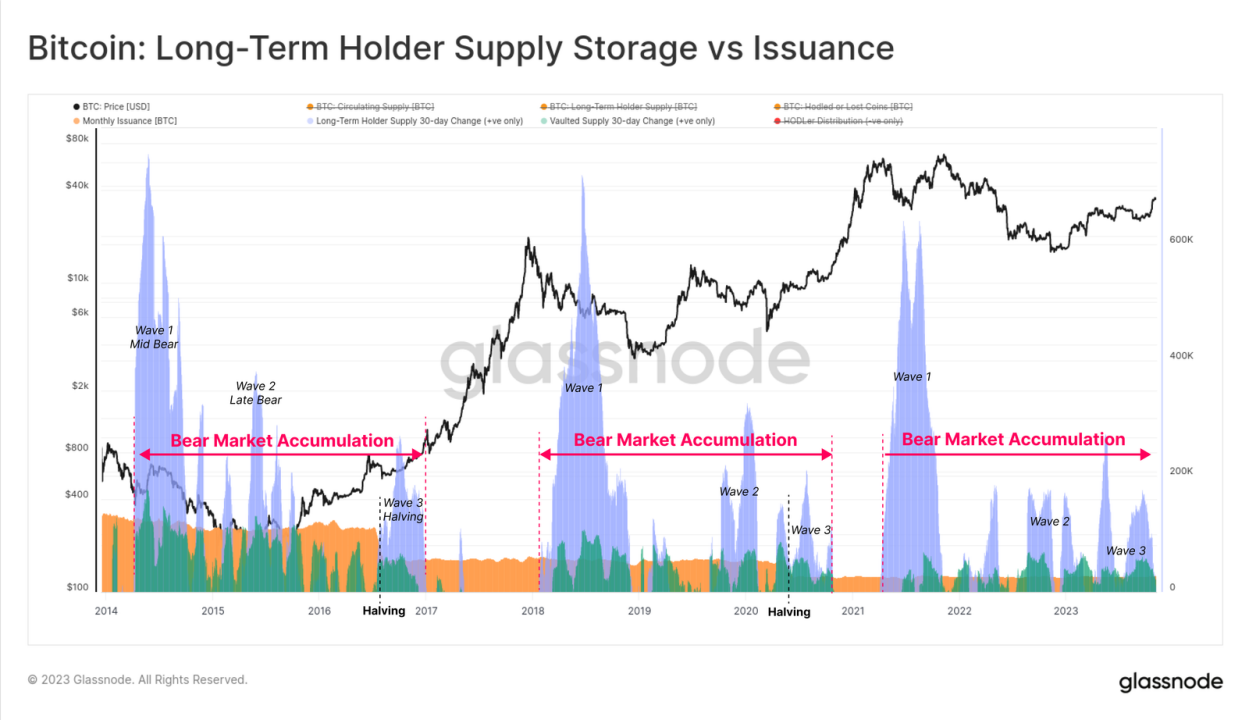

为了应对不断增长的兴趣,链上分析公司 Glassnode 已深入研究重新评估比特币供应动态。 根据 Glassnode 最新的周报“The Week On-Chain**”,距离下一次区块减半的到来仅剩五个月,用于存储的比特币数量现已超过开采量的 2.4 倍。即将到来的第四次减半事件对比特币具有重要的基本面和技术面上的意义。 Glassnode 注意到,考虑到先前周期中显著的回报情况,这对投资者来说是一个极具吸引力的事件。

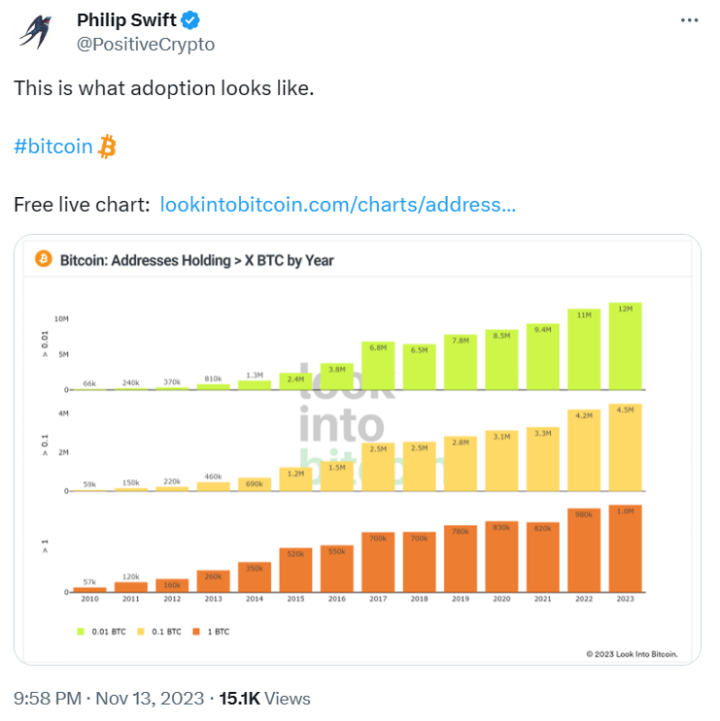

该周报包括了多个图表,上图显示了长期持有者(LTH)的比特币供应存储,即持有代币 155 天或更长时间的实体 。统计平台 Look Into Bitcoin 的创始人 Philip Swift 强调,无论大小,钱包实体的存在都在不断增加,并在13日发推表示,“这就是采用的样子”。

减半将如何影响2024年的投资?

下一次比特币减半事件将于 2024 年 4月发生,在减半事件期间,奖励给矿工的比特币数量将减半。 预计这一事件将进一步减少比特币的供应,这可能会使该资产对投资者更具吸引力。

在过去的几次比特币减半中,我们可以观察到一些有意义的趋势。首先,每次减半后,比特币的价格都会经历一段时间的上涨。这种趋势是否会持续到下一次减半,尚不得而知。从历史上看,比特币的减半事件加剧了加密货币的市场稀缺,导致价格上涨压力,这解释了每次减半事件后出现的牛市。

在经历了2022年的加密寒冬和2023年的经济低迷之后,比特币2024年的减半时间表至关重要。通过减慢比特币的创造速度,它会随着时间的推移限制比特币的供应,黄金般的稀缺性也适用于此。比特币的减半促进了其原生加密货币的创新和弹性,使其与法定货币区分开来。2024 年的比特币减半将影响新比特币进入市场的速度。该事件将导致奖励从 6.25 BTC 减少至 3.125 BTC,为了保持盈利能力,随着奖励的减少,矿工必须找到优化运营的方法。这可能会促使矿工提高效率。

此外,我们还可以从更长的时间线来看待这个问题。在比特币的早期阶段,其价格相对较低,且波动性较大。然而,随着时间的推移和比特币的逐渐普及,其价格开始逐渐上升。这意味着,虽然减半事件可能对比特币的价格产生一定的影响,但长期趋势可能更多地取决于市场供需、宏观经济环境以及比特币生态系统的发展等其他因素。

结语

总体而言,机构对比特币的增加是加密行业的一个积极信号,这表明机构投资者对比特币的接受程度越来越高,并将其视为一个合法的资产类别。下一次减半事件还可能对比特币价格产生积极影响,吸引更多的投资者投资该资产。

参考文献:

https://insights.glassnode.com/the-week-onchain-week-46-2023/

关注我们

veDAO是一家由AI驱动的web3趋势追踪&智能交易一站式平台,将大数据分析所呈现出的市场趋势与交易深度结合,致力于打造更适合Web2和Web3用户买卖投资的web3 AI交易所。

veDAO拥有行业领先的由链上分析&情绪指标构成的AI大语言模型,为用户提供主动型数据支持,结合智能、快捷、安全、实时监控的AI交易功能,截止目前,平台重度使用用户已超过40000人,关联22000+Web3垂直行业 Twitter KOL,与180+专业机构组成veDAO专家委员会,平台项目库超10000+个,且有240+星探与veDAO一起不断增加Web3项目。

veDAO以两周一次版本更新的速度不断升级,决心搭建起Web2通往Web3的桥梁,成为未来Web2和Web3用户查项目、找热点、看趋势、一级投资、二级交易的首选平台。

Website: http://www.vedao.com/

Twitter: https://twitter.com/vedao_official

Facebook:bit.ly/3jmSJwN

Telegram:t.me/veDAO_zh

Discord:https://discord.gg/NEmEyrWfjV

投资有风险,项目仅供参考,风险请自担哦

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。