本周预览(11.20-11.26),BTC与全球股指相关度降至312以来最低值;资金费率达两年高位,接近2021年末69000美元前期水平,说明…

○/文:DC研究院

老李迫击炮

本周研报目录:

一、本周宏观经济数据和加密市场的重点事件预告;

二、加密行业重点新闻回顾;

三、社区互动交流分享;

四、重要事件和数据及Deepcoin研究院解读;

五、机构观点+海外视角;

六、上周加密市场涨幅榜及社区热点币种筛选;

七、项目代币解锁利空数据关注;

八、加密市场概念板块涨幅榜;

九、全球市场宏观分析综述;

十、Deepcoin研究院后市研判。

一、本周宏观经济数据和加密市场重点事件预告:

11月20日(周一):美国10月谘商会领先指标月率。菲律宾将向机构发行代币化债券;CKB挖矿减半;Blur将开启第2季空投。

11月21日(周二):美国10月成屋销售总数年化;美联储巴尔金接受福克斯新闻的采访;英国央行行长贝利发表讲话并在议会作证词陈述;澳洲联储公布11月货币政策会议纪要。SEC对GlobalX的比特币现货 ETF 推迟至12月22日,设置意见征询期。

11月22日(周三):美国10月耐用品订单月率;美国11月密歇根大学消费者信心指数终值;美联储公布11月货币政策会议纪要。

11月23日(周四):欧元区11月制造业PMI初值;欧央行10月货币政策会议纪要。ACDE讨论ETHDevnet#12的启动。

11月24日(周五):日本10月核心CPI年率;德国第三季度未季调GDP年率终值;美国11月Markit制造业与服务业PMI初值;欧央行行长拉加德发表讲话;因感恩节,美股休市。 AVAX将解锁 950 万枚代币,价值 1.069 亿美元,占流通量的 2.7%。

11月26日(周日):第36届欧佩克部长级会议举行。

二、加密行业重点新闻回顾(独家梳理):

数据方面:

灰度GBTC负溢价率收窄至10.11%,创2021年8月12日以来最低水平。

本月至今比特币平均交易费用上涨超过1000%;

长期投资者持有的比特币数量创历史新高;

比特币、以太坊活跃供应量均创历史新低;

至少持有0.1枚BTC的地址数量达450万个,创历史新高;

数据:81,954个地址至少持有100万美元的比特币;

报告:2018年以来,Web3游戏项目投资已达190亿美元。

项目和平台方面:

ARK方舟基金上周至今增持超3000万美元的Coinbase股票;

过去30天NFT总销售额增幅超65%;

Tether计划未来6个月投资5亿美元用于比特币挖矿;

Polygon生态系统增长地址向70个地址分发2.17亿枚MATIC;

Tether:法官驳回针对Tether和Bitfinex的集体诉讼,原告放弃上诉;

Solana市值超越USDC,目前市值排名第六,仅次于比特币、以太坊、Tether、BNB和XRP;

Starknet超越Arbitrum成为日活地址第二高的Layer 2;

CBOE Digital将于2024年1月11日推出比特币和以太坊保证金期货交易和清算。

宏观政策和监管方面:

欧洲央行行长:欧洲应建立一个与美国SEC相对应的欧洲机构;

美联储12月维持利率不变的概率为100%。

SEC将Global X现货比特币ETF的决议推迟至明年二月;

SEC推迟对富兰克林邓普顿的现货比特币ETF作出决议;

美财长耶伦:在亚太经合组织会议上讨论加密货币监管问题;

美两党议员致函敦促监管机构不要执行SEC的加密会计公告;

SEC一年内已对加密货币等行业开出近50亿美元罚单。

机构研报和观点方面:

调查:45%机构投资者预计在未来三年内配置加密货币;

彭博分析师:SEC向交易所建议现货比特币ETF采用现金创建,要求在未来几周内提交修订。

Bitfinex分析:明年比特币可能会出现“大量资本流入”;

Kevin OLeary:现货比特币ETF可能还要18个月才能获得批准;

摩根大通:比特币减半的影响是不可预测的,并且已经被定价。

三、社区互动交流分享:

关于什么是左侧和右侧交易。左侧是主观逆势交易,比如逃顶 猜底,高抛低吸。右侧是客观顺势交易,比如跟随趋势 突破跟进。

关于多空比,这个我们以前介绍过很多,简单说就是多头持仓和空头持仓的比值,大于1时说明多头多,小于1时说明空头多。多头过多的话,如果多头平仓就会引发回调行情。反之亦然。

关于USDT价格,历史usdt价格到7.5都是极端行情下的瞬时价格,停留时间比较短,这是一种情况;另一种就是未来美元兑人民币真实汇率到了7.5,那么usdt价格有望到此位置,这样停留时间才会长些。目前usdt还是存在小幅的溢价,真实在岸和离岸汇率目前在7.16附近,汇率回落的原因是因为美联储未来加息预期减弱和降息预期增强。

四、重要事件和数据及Deepcoin研究院解读:

关于上周比特币永续合约7日平均资金费率约0.02%,达近两年高位,接近2021年最后一个季度的水平,而当时比特币正向顶点上涨。Deribit数据也显示,到12月底比特币的看涨期权大量押注筹码将达到40000美元甚至45000美元。

Deepcoin研究院认为,上周市场乐观情绪导致永续合约资金费率高企,连续七天综合资金费率已经逼近2021年涨至69000美元前的水平,这个现象值得我们谨慎一些,特别是市场盲目看涨以及多家etf申请再次被延期消息传出之后,谨防出现21年11月那种较大幅度的下跌,时隔两年,周期效应。而最新数据显示,在最近的市场乐观情绪导致加密货币期货交易者支付异常高资金费率以维持多头仓位之后,目前主流币期货的资金费率已开始恢复到正常水平。但我们需要注意后期如果资金费率水平再次持续在高位的话,我们应该在相对高位时可适当获利减持,并选择高位寻求理想位置左侧做空对冲潜在的回调风险。

关于自美国CPI数据周二公布以来,比特币下跌了2%,而全球股票指数则上涨了2%,原因是市场押注美联储已经停止加息,并将在明年转向减息。数据显示,比特币与摩根士丹利资本国际公司MSCI的全球股票指数的30天相关系数目前为-0.23,这是自2020年初以来的最低值。

Deepcoin研究院认为,BTC与全球股指月度相关系数降至2020年312前后以来最低值,说明近期加密市场的影响因素更多受市场本身的消息面影响,因为前期热点维系在比特币现货ETF审批,近期围绕几家ETF被再次延期而左右行情在前期按预期上涨之后,目前在上下宽幅震荡。而全球股市更多受宏观消息影响,在APEC召开前后,多边关系缓和给股市带来提振预期而上涨。当然,两者相关系数在回溯历史数据上,大多时候比较吻合,所以未来两者还将大概率走出同涨同跌的走势,所以在关注加密市场本身消息的同时,我们也应该关注宏观市场消息和数据,比如每周我们整理的本周预告和宏观分析内容。

五、机构观点+海外视角:

Bitfinex分析表示,随着市场指标表明美联储可能在2024年转向更加鸽派的立场,比特币可能会出现“大量资本流入”。FedWatch的最新数据显示,美联储在12月13日的会议上维持目标利率不变的可能性几乎是100%。数据还显示,期货交易商目前预计美联储在2024年12月政策会议结束时至少会降息四次。Bitfinex分析表示,从美联储当前的货币紧缩立场转向更加宽松的政策可能会对风险资产产生积极影响,包括贝塔系数较高的加密货币,这可能会导致资本更多地流入加密货币等风险较高的资产类别。此外,如果美联储发出 2024 年利率逆转的信号,这将表明央行预计经济指标将恢复平衡,这可能进一步促进投资者更加乐观的情绪。

Bernstein最新的研究报告表示,比特币有望成为全球宏观政治资产,比特币市值有望在2025年中期前增至3万亿美元以上,加密货币的基本面从未如此良好。截至目前,比特币市值为7265亿美元。

区块链分析公司Glassnode的比特币交易净头寸变化指标(衡量特定日期与四个星期前同一日期相比交易钱包持有的代币数量)周日升至31,382.43枚BTC(11.6亿美元),为5月11日以来的最高水平,2023年。这使得交易所持有的总余额达到235万枚BTC。流入交易所钱包被广泛认为代表投资者打算清算其持有的资产、潜在的抛售压力,或在期货和期权市场上部署代币作为保证金。 数据显示,按市值计算的BTC本月上涨了7.5%,延续了10月份28%的涨幅。

六、上周加密市场涨幅榜及社区热点币种筛选:

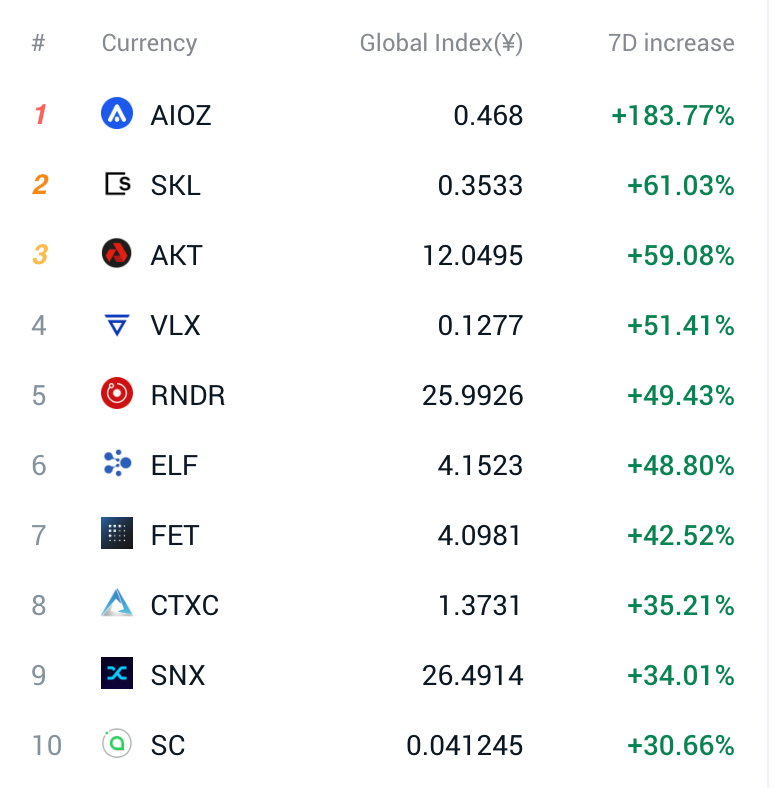

过去一周山寨币种涨幅排行如上,AIOZ涨幅183.77%,约1.8倍上涨空间;SKL\AKT\VLX\RNDR涨幅约为50%-60%左右,本周可继续关注榜单上前十币种潜在交易机会,如果市场整体回调则需注意转变方向。

跌幅方面,在11月17日24小时交易额排名前三的BRC20代币价格普遍出现回调,其中:rats 24小时跌幅26.9%,sats 24小时跌幅11.58%,csas 24小时跌幅26.08%。

以下为dc社区讨论热点币种,筛选如下,观点仅供参考,不构成买卖依据:

wld名声大于实力,前期有过多次分析。监管层面对于其并不是太友好。据监测,WLD巨鲸0xA61...5cD02在11.17-11.18WLD下跌时,从Huobi转出21万枚代币至钱包,平均价格2.02美元,又在昨天暴涨前向交易所转入共5.9万枚,平均价格2.41美元,若全部卖出回报率高达20%,目前还持有15.8万枚代币。

mav目前没有特别之处,上方阻力参考0.335美元和0.39美元附近,下方支撑参考0.21美元和0.2美元附近。

sol作为前期强势币种,等冲高时左侧做空,或者等顶部形态出现时再考虑右侧¨做空,目前来看,并没有出现这两种信号。而在美国证券交易委员会将SOL与Cardano、Polygon等公司一起列为证券后的五个月里,SOL的价格上涨了386%。SOL的表现优于其他代币,其市值在11月份跃升65%后接近Ripple。激增可能归因于Solana网络将自己构建为L1,并因卓越的速度、低成本和可扩展性与以太坊展开竞争。

doge日线级别有个潜在的双底形态,上方阻力参考下降趋势线0.095美元附近,如果突破并站上,有望测试0.11192美元乃至0.1589美元附近;支撑参考0.076美元附近,强支撑0.0688美元附近。

tia还是上涨趋势,目前上方没有可参考阻力,支撑参考上升趋势线,回调就是比较好的买入机会,目前支撑参考6.3美元和5.75美元附近。

APT目前支撑参考近期高点8.27-8.5美元附近,支撑参考6.3美元和5.77美元。

TRB受主力操纵较多,即便反弹,空间也相对有限些,上方阻力参考107.34美元附近。

AMB日线图走势来看,相对弱势,在近期普涨行情中,amb却震荡了一个多月,说明不受主力资金青睐,一般不建议关注这种币种。

LDO算是比较强势的币种,在上周的整体回调中,ldo独善其身依然表现强势,目前短期阻力参考2.564美元附近,中期阻力参考2.82和3.33美元附近。

目前doge走势跟币市整体一致,没有走出独立行情,看了下相关消息面,DOGE-1 登月计划延期两年后,原是准备在今年 11 月 15 日至 20 日实行,但盘面暂时没有反应。最新消息是12月23日发射。

看了下APE历史走势,比加密市场整体表现要弱势,上个月还创下了历史新低,一般而言这种币种不会受主力资金青睐的。目前反弹也只是跟随市场的走势,不太具有持续性。未来除非有重大利好,才有机会拉涨,暂时看不到什么潜力。上方阻力重重,参考2.15-2.6美元附近区域。

YFII短期支撑参考920美元附近,只要没有跌破,未来有机会继续上涨,上方比较关键的阻力还是参考我昨天提到的1265美元附近,中期阻力参考1550-1600美元附近。

七、项目代币解锁利空数据关注:

据Token Unlocks数据显示,本周将有AVAX、ID、LOOKS等代币进行解锁。其中:

Avalanche(AVAX)将于11月24日上午8点解锁约954万枚代币,价值约2.18亿美元;

SPACE ID(ID)将于11月22日上午8点解锁约1849万枚代币,价值约483万美元;

LooksRare(LOOKS)将于11月27日上午7:01解锁约3750万枚代币,价值约294万美元;

Euler(EUL)将于11月23日中午12点解锁约13.5万枚代币,价值约36.8万美元;

Acala(ACA)将于11月25日上午8点解锁约466万枚代币,价值约26万美元。

本周关注这些代币因解锁带来的利空效应,避开现货,合约寻求做空机会。其中,AVAX解锁幅度较大,多加留意。

今年Sol从底部报复性上涨激活了曾经的新公链板块,作为21年用户和生态最耀眼的三大新公链之一的Avax,也有机会反弹。Avax的Tvl和链上交易量在所有公链中排名第七,和Sol不相上下。相比其他基本没有用处的老的代币,公链有用户有生态有经济模型有消耗,有一定的底层价值支撑,确定性更高,未来两年被淘汰的可能性很小。但本周大概率因解锁而大幅回调,等待时机。

八、上周加密市场概念板块涨幅榜:

过去一周,概念版块具体表现如上,按涨跌幅度来划分,最近七日涨幅,火币生态链Heco、BRC20、Cardano生态和AI人工智能以及Solana 生态等版块上涨领先,关注上述较大涨幅币种所属版块的轮动炒作行情。

九、全球市场宏观分析综述:

上周五,美股三大股指窄幅波动,KWEB涨0.4%。截至收盘,道指涨 0.01%,纳指涨 0.08%,标普涨 0.13%。美国十年国债收益率涨 0.023%,收报4.437%,相较两年期国债收益率差-45个基点。恐慌指数VIX跌 3.63%,布伦特原油收涨 4.01%。现货黄金从22年11月持续走高,23年5月以来持续走低,23年10月2日-10月23日有所反弹,昨日跌 0.03%,报1980.78美元/盎司。美元指数从22年10月的高位持续回落,期间有所反弹,收跌 0.54%,报103.82。

上周整体来看,美股三大指数集体上扬。道指周涨1.94%,纳指周涨2.37%,标普500周涨2.24%。大型科技股走高,谷歌A周涨2.05%,Meta周涨1.91%,亚马逊周涨1.13%,苹果周涨1.77%,微软周涨0.25%,特斯拉周涨9.15%,英伟达周涨1.99%。

A股方面,上周三大指数涨跌不一。上证指数周涨0.51%,深证成指周涨0.01%,创业板指周跌0.93%。盘面上,华为昇腾、鲲鹏、鸿蒙相关概念股涨幅靠前,快手概念、汽车零部件、算力、无人驾驶、数据确权等板块上涨;自由贸易港、猪肉、中字头股票、证券等板块下跌。

港股方面,三大指数全线上涨。恒生指数周涨1.46%,国企指数周涨1.25%,恒生科技指数周涨2.25%。板块方面,电子零件、苹果概念、半导体、应用软件等涨幅靠前,彩票、体育用品、影视、医药外包等跌幅靠前。

本周国外热点事件颇多,周二英国央行行长贝利发表讲话,澳洲联储公布11月货币政策会议纪要;周三美联储公布11月货币政策会议纪要;周四纽交所因感恩节休市一日,欧洲央行公布10月货币政策会议纪要;周五欧洲央行行长拉加德发表讲话。

十、后市研判:

BTC日线图,近期美元走势较弱,是有利于btc走强的,但近期一直维持在区间震荡,说明目前市场情绪可能有一定的迟疑。上周行情回落的原因主要是市场上有了预期,关于现货比特币ETF可能再次会被驳回而延期。而前期上涨的主要原因也是各种炒作etf利好消息而推升的上涨,所以预期未兑现而回落。

技术面来看,未来大级别只要能守住31800-32400美元,还有望维持高位震荡行情。短期则参考我上边分析内容,btc测试了上升趋势线之后目前有所反弹,后市如果继续收线在35860美元上方有机会反弹;但如果持续收线在35500美元下方,则后市可能会测试33200美元乃至32400-31800美元附近。上方压力目前短期参考近期高点38000美元,中期参考我11月初分析的位置,即上方阻力参考40000美元上方和42976美元附近。前期高点38000美元附近,可以考虑左侧做空,比较容易控制盈亏比。

目前eth下方支撑参考近期回调低点1905.7美元附近,短期平台支撑参考1944美元附近。目前eth下降趋势线阻力参考2082美元附近,这里是理想做空位置。

关注我们:老李迫击炮

DC研究院

2023年11月20日

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。