Author: Mary Liu, BitpushNews

The speculation on spot Bitcoin ETF has been given another boost.

Bloomberg analysts James Seyffart and Eric Balchunas stated today that starting tomorrow (November 9th, US Eastern Time), the US Securities and Exchange Commission (SEC) will have a brief window during which it can approve 12 pending spot Bitcoin ETF applications.

This approval includes BlackRock's iShares Spot Bitcoin ETF and the conversion of Grayscale Bitcoin Trust (GBTC).

Eight-day Window

The analysts' reasoning is that when the SEC extended the deadline for pending ETF applications, it chose November 8th as the last day for rebuttal comments. The SEC may also approve several applications from now until November 17th, but for fairness, all funds must start trading on the same day.

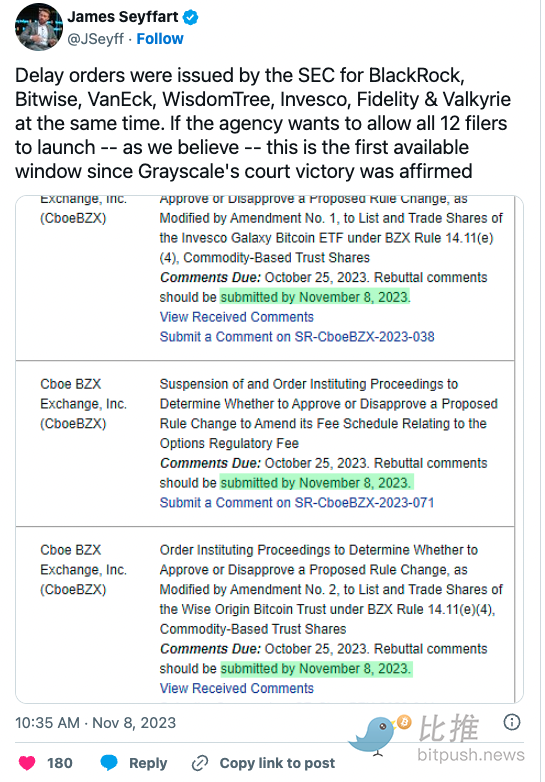

Seyffart wrote on X platform, "The US Securities and Exchange Commission simultaneously issued delay orders to BlackRock, Bitwise, VanEck, WisdomTree, Invesco, Fidelity, and Valkyrie. If the agency wants to allow all 12 applied products to launch simultaneously - as we believe - this is the first available window since Grayscale's court victory was confirmed."

Spot Bitcoin exchange-traded funds (ETFs) will allow investors to gain exposure to BTC by purchasing shares backed by Bitcoin acquired by the issuer, without needing to hold and manage the asset themselves.

Balchunas also pointed out that the SEC's educational short videos released on X platform may further enhance hopes for early approval. The commission released similar materials shortly before approving ProShares' Bitcoin futures ETF in October 2021.

Seyffart and Balchunas added, "Even if approval is not obtained this month, we still believe there is a 90% chance of approval by January 10th."

However, spot Bitcoin ETFs may take several months to start trading. Analyst Seyffart pointed out, "Even if the SEC approves the rule change allowing ETF trading (194-b filing), this is completely separate from approving the fund's registration statement (S1 filing). Both documents need approval before the Bitcoin ETF can start trading."

American lawyer Scott Johnsson explained on X platform that assuming approval is obtained this week, it may still take at least a month (or possibly several months) before any ETF is actually launched. Many applicants' S-1 filings are still under review, and this process has no real hard deadline. It may take several weeks or even months between approval and launch.

But the rise of BTC has already proven investors' optimism. BTC saw an increase of over 20% in October, and it surged to $36,000 shortly after this news was released.

Grayscale in Negotiations with SEC

CoinDesk reported on Wednesday, citing sources, that after the court ruled that the SEC must re-examine the GBTC conversion application, Grayscale has been in contact with the SEC's trading and markets division as well as the company's finance department.

SEC Chairman Gary Gensler has stated that the company's finance department provides feedback, while the trading and markets division reviews documents, both playing important roles in the ETF approval process.

Grayscale CEO Michael Sonnenshein stated that his company has not received any news of SEC approval for spot Bitcoin ETF.

Grayscale Chief Legal Officer Craig Salm, in an interview with Coindesk, stated, "Currently, we are focused on constructive engagement with the trading and markets division, and there are still some things to be resolved." He also noted that other applicants for Bitcoin ETFs (including financial giants BlackRock and Fidelity) seem to have made progress in their negotiations with the SEC. "Overall, this is a very positive engagement, it's just a matter of time, not if."

Just a Matter of Time

Analysts state that spot Bitcoin ETFs may attract between $50 billion and $100 billion in inflows over the next five years, potentially causing significant shifts in the asset's market dynamics. According to cryptocurrency asset management company CoinShares, crypto funds attracted deposits worth $767 million in just the past six weeks.

Among all the applicant companies, investors are most excited about the prospect of BlackRock's approval. BlackRock is a global leading financial firm managing around $8.5 trillion in assets. Steven Schoenfeld, former Managing Director of BlackRock and current CEO of MarketVector Indexes, predicts that BlackRock's approval could bring in $200 billion in revenue for Bitcoin and push the price of BTC to $330,000.

Several industry insiders have stated that regardless of the twists and turns in the process, the landing of a Bitcoin ETF on Wall Street is only a matter of time. Analysts at JPMorgan stated earlier this week in a report that a spot Bitcoin ETF now seems almost inevitable, as "any rejection could lead to lawsuits against the SEC, causing more legal trouble for the agency."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。