据官方公告,Binance 宣布将其全部俄罗斯业务出售给 CommEX,已达成协议。为了确保现有俄罗斯用户的顺利过渡,下架过程将需要长达一年的时间。现有俄罗斯用户的所有资产都受到安全可靠的保护。展望未来,Binance 认识到在俄罗斯开展业务与 Binance 的合规战略不兼容。Binance 对全球 Web3 行业的长期增长仍然充满信心,并将把精力集中在 Binance 开展业务的 100 多个其他国家。

CommEx 接手更像「换马甲」

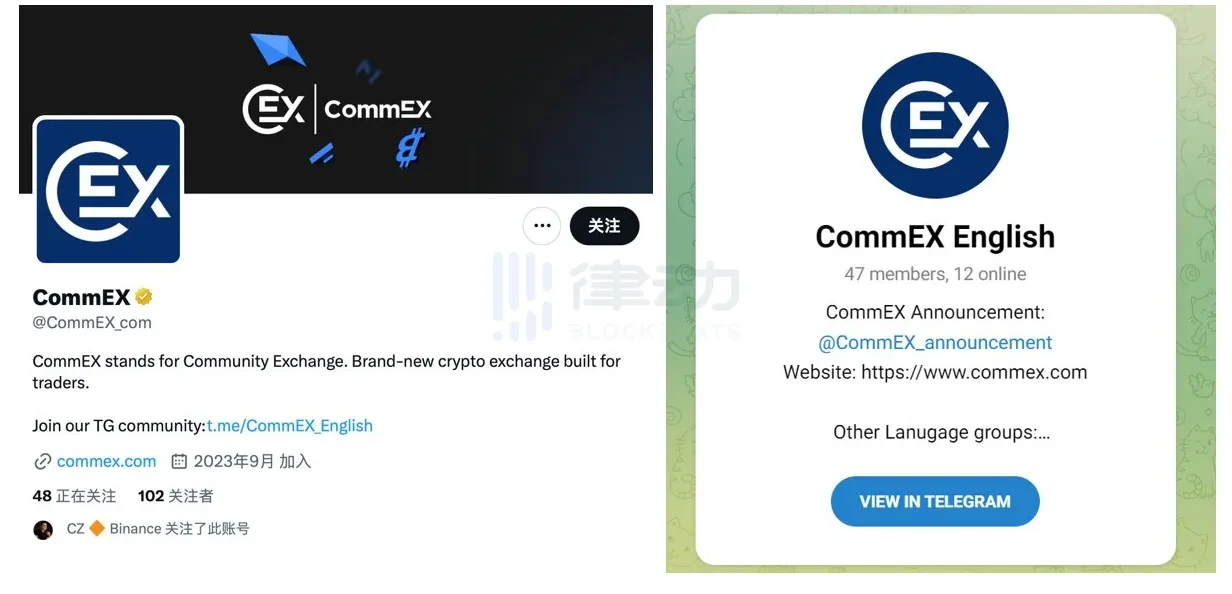

BlockBeats 发现,接手 Binance 俄罗斯业务的交易所 CommEX,于昨日晚正式上线。其官方推特账号注册于今年 9 月,截至撰稿时,关注人数仅 102 人,其中行业关注者仅 CZ 一人,唯一一条推文发表于 20 小时前。其次,CommEX 英文官方 Telegram 频道成员不足 50 人。

Binance 今年已退出多国市场

自今年以来,Binance 迫于监管压力,连续退出多国市场。

BlockBeats 曾于 5 月 13 日报道,Binance 官方账号在社交媒体上发文表示将主动退出加拿大市场,尽管该地区的市场很小,但作为 Binacne 创始人的祖国,它对 Binance 来说具有情感价值。当加拿大用户再次可以自由访问更广泛的数字资产套件时,Binance 将会重返加拿大市场。

6 月,据官方消息,Binance 已于16 日起不再接受居住在荷兰的新用户,自北京时间 2023 年 7 月 17 日 08:00 起,荷兰居民用户将只能从 Binance 平台提取资产,无法进一步购买、交易或存款。Binance 鼓励用户采取适当的行动,从他们的 Binance 账户中提取资产。

今日下午,Binance 联创何一于社交平台发布最新文章,对 Binance 退出市场做出公开回应。

「需要注意的是,我们在 Binance 的运营中需要更加严格地考虑 KYC、合规性、EDD(尽职调查)、WCK(风险客户检查)、POA(授权代表)等事项,而我们的许多竞争对手则没有如此严格的要求。此外,正如我们之前讨论过的,由于我们的规模较大,效率方面存在一定挑战。我注意到一些员工在面对问题时会情绪化,而不是理性思考。然而,在过去的六年里,我们经历了无数的挑战,这一次也不例外。我们正在面对新一轮的挑战,因此重振团队的精神至关重要。」

大牌交易所相继退出地域性市场

除了 Binance,多家加密货币交易所今年以来也都相继宣布退出多个地域性市场。

9 月 14 日,加密货币交易所 Bybit 首席执行官 Ben Zhou 表示,英国 10 月 8 日生效的新营销规则或将迫使 Bybit 退出英国市场。英国新营销法规规定,从 10 月 8 日起,加密货币服务将被归类为英国营销材料的高风险投资类别,全球所有平台都需要向英国客户显示明确的风险警告,并由授权公司批准任何公开促销活动。

9 月 11 日,Coinbase 通过电子邮件通知客户,计划将在 9 月 25 日后停止为印度用户提供交易服务,并建议提取账户中资金。与此同时,Coinbase 已经禁止印度用户注册其交易平台。

对此,Coinbase 回应在回应 Cointelegrah 询问中指出,其电子邮件通知「仅针对违反平台标准的客户,并非所有印度客户」。

从 Binance 到 coinbase、Bybit 等,曾经在世界各地均有布局的交易所们,如今纷纷因监管问题或选择退出当地市场,或选择「换个马甲」继续寻找出路。各国监管与加密货币交易所的博弈,或许还将持续下去。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。