原文作者:Kaori,BlockBeats

原文编辑:Jack,BlockBeats

9 月 21 日,Uniswap 基金会宣布与专注于区块链教育的 DoDAO 联合推出了教育平台「Uniswap University」,称这是一个为从初学者到经验丰富的 Uniswap v3 流动性提供商等所有人量身定制的综合教育平台,将为参与者提供结构化的学习途径,通过指南、Tidbits、模拟、培训四大版块,使用户更好的参与到 DeFi 世界中。

加密领域上一次掀起教育热潮是 Web3 教育协议 Open Campus 上线 Binance Launchpad,Web3 与教育的结合、Web3 入门和开发教育第一次闯入行业视野。虽然都旨在打破 Web2 普通用户或开发者踏入 Web3 世界的壁垒,想成为 Web3 大规模采用的催化剂,但 Uniswap University 与 Open Campus 不同之处在于它目前没有任何代币经济学之类的衍生内容,从其官网界面来看,只有四大学习版块的入口,没有官方 docs、没有链接到 Uniswap 的其它平台。

Uniswap University 也不提供任何激励手段,当你选择想学习的章节并完成后之后有一个很简洁的反馈模式。是的,就像普通大学里那些用来当作课后练习的学习网站一样,每一小节后面还会提供几道练习题,确实非常适合小白入门学习。

Uniswap 已是 DEX 龙头,如今推出这样新人友好的学习教育平台,还有更多可以探讨的空间。值得一提的是这次 Uniswap 选择的合作伙伴 DoDAO,它的目标是到 2025 年让 100 万人加入 DeFi、DAO 和 NFT。

Uniswap University 内容一览

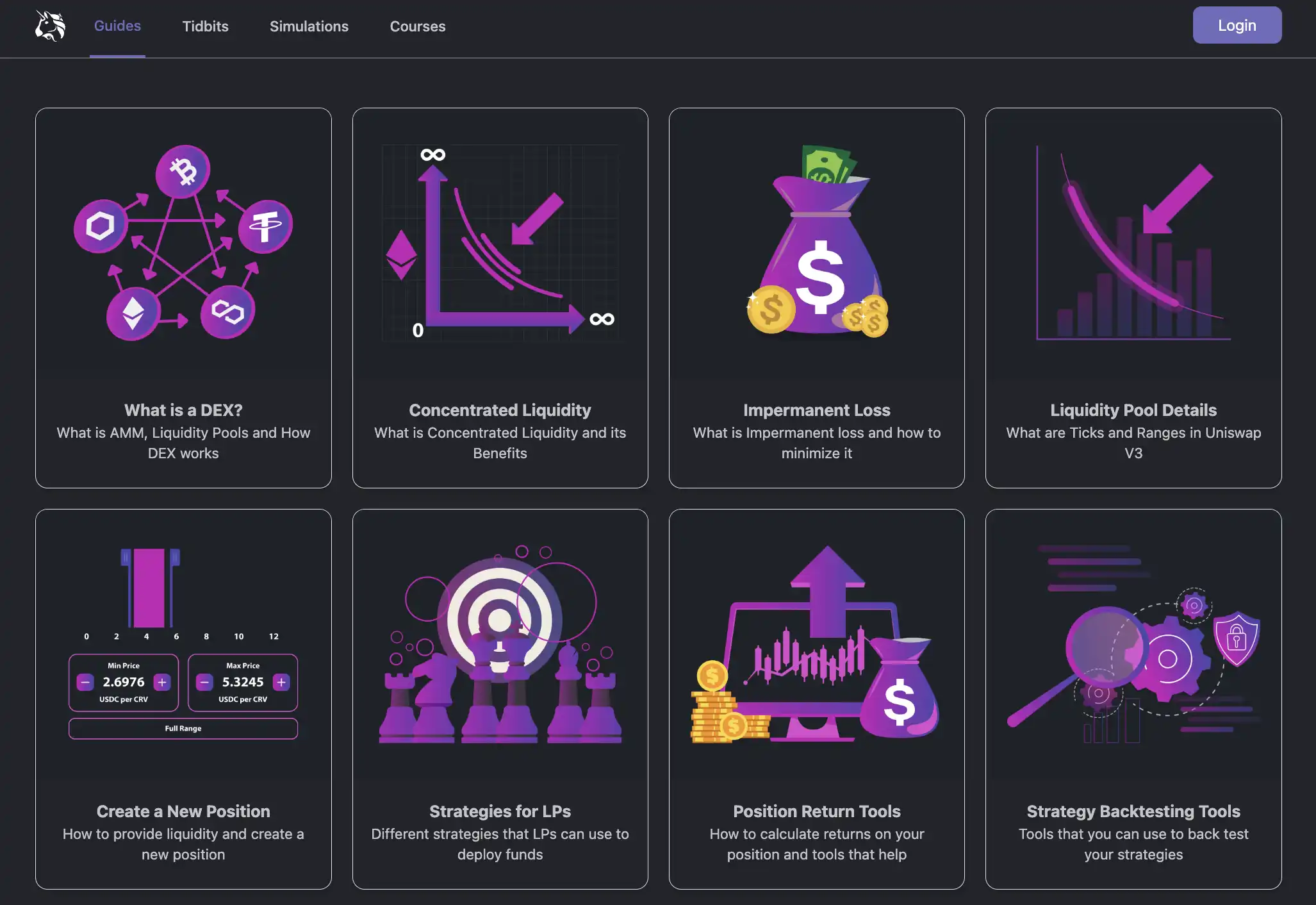

指南(Guides):这个版块提供易于理解的信息,比如从「什么是 DEX?」的基础讲解到「策略回测工具」等高级主题,并辅以解释视频和视觉效果。

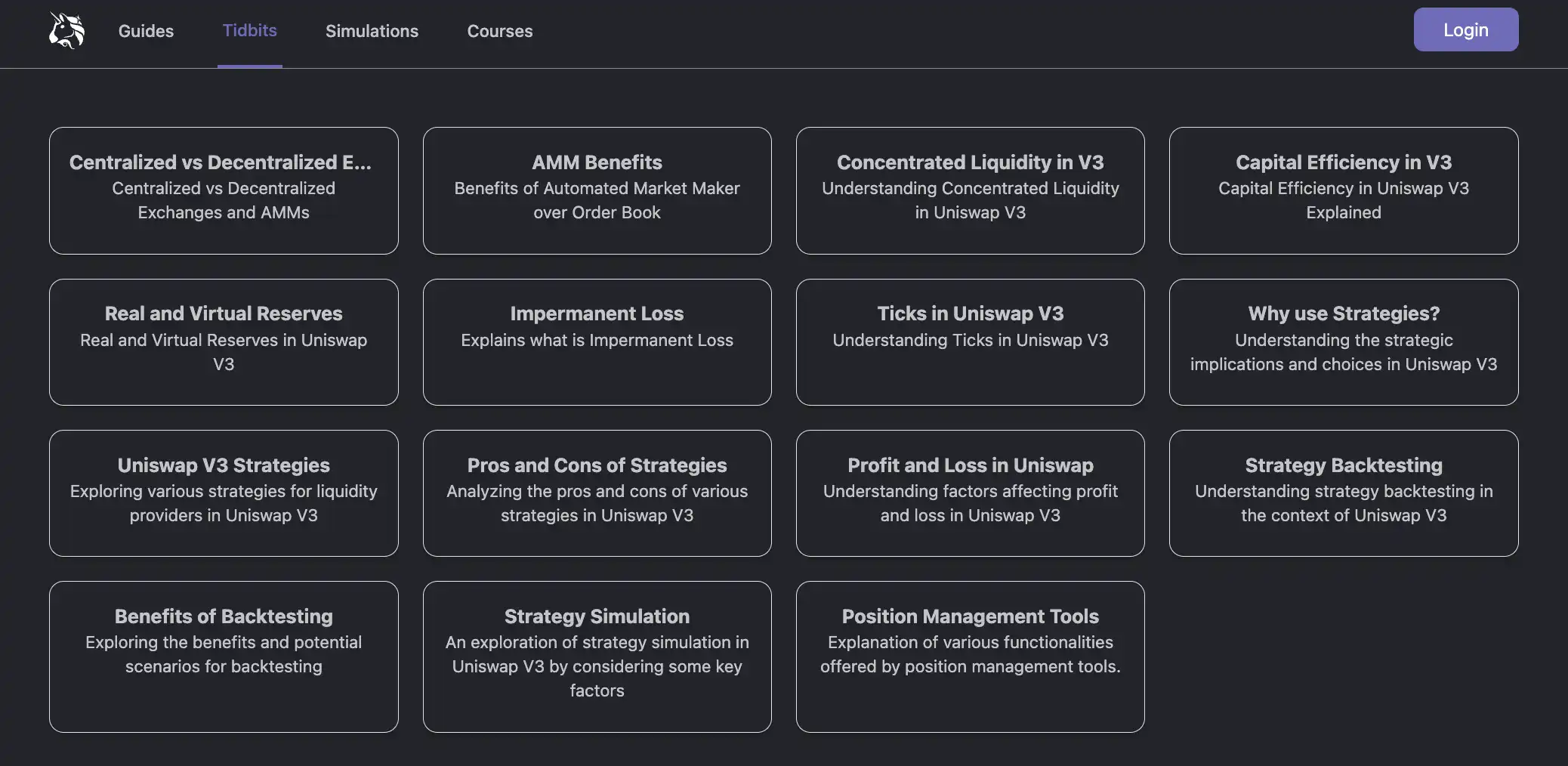

Tidbits:「时间不够?只需 30 秒即可掌握基本概念」,相比于第一部分的丰富和多样性,这个版块的内容非常适合快速复习或简要了解内容,小卡片式的 UI 设计,像背单词一样的感觉。

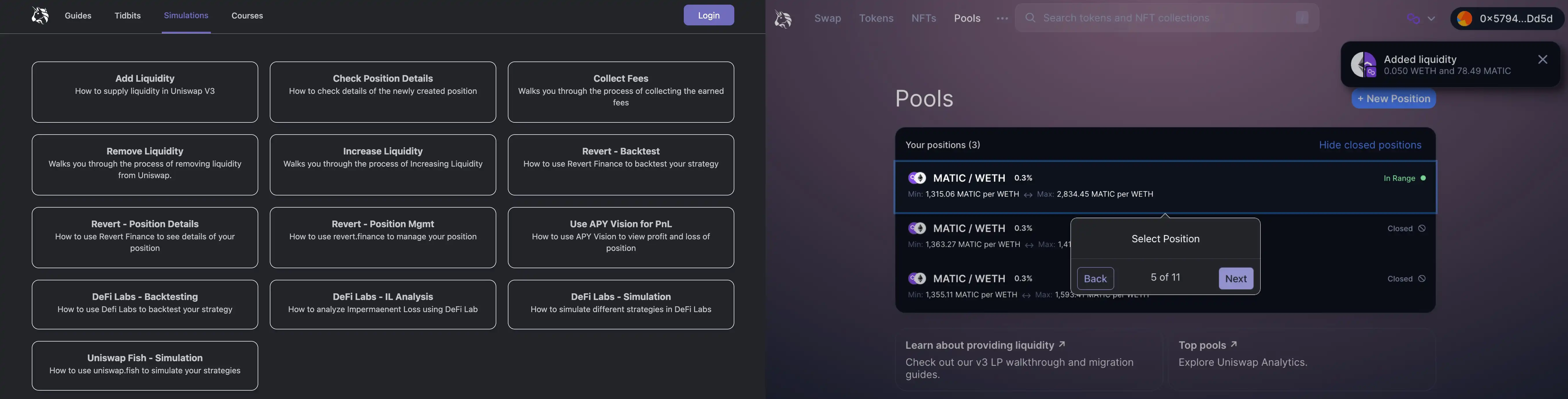

模拟(Simulations):这部分就到了要深入实践学习的阶段。在这个版块里,你可以练习添加、删除流动性等场景,还可以探索高级头寸管理工具,这里相当于一个视频教程,每一步操作都有演示,相比于看文字教程,视频形式对加密小白更友好。

课程(Courses):目前网站的第四部分是两集课程教学,可以让你深入了解 Uniswap 的结构化课程,包括从《Uniswap 入门》中的基础概念到《流动性提供商课程》中的掌握策略。

加密 CEX 必备的「用户教育经」

目前尚没有搜寻到搭建 Uniswap University 的背后人员主要是谁,但作为去中心化 DAO 组织和 DEX,推出一个需要集中资源和精力才能完成的教学平台,是一件值得肯定的事情。相比之下,CEX 在这方面有更大的优势。

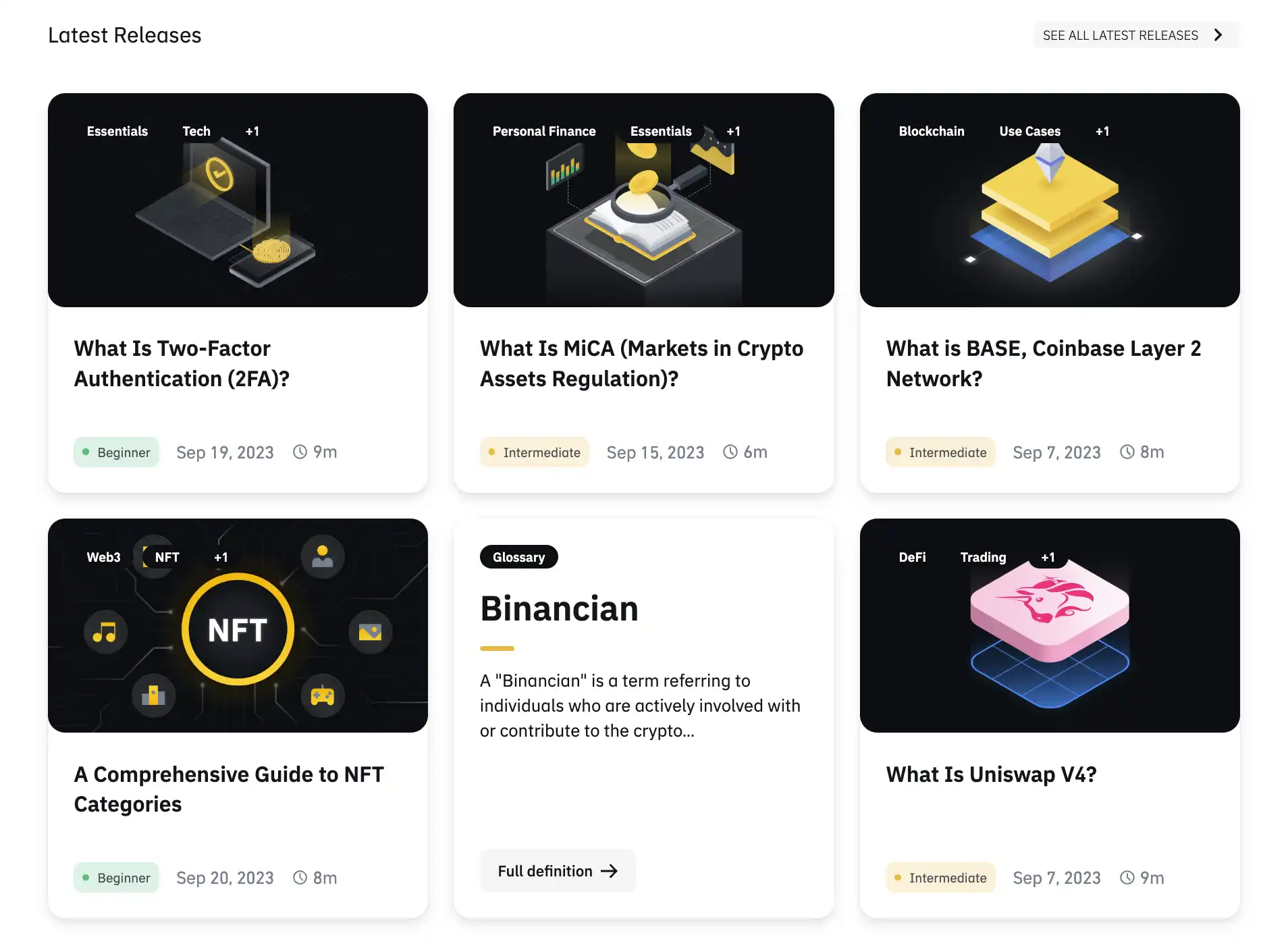

作为加密世界 CEX 的龙头,Binance 也有自己的教育平台——Binance Academy。这里也有课程和教学内容的推出,但从网站导航栏的「Learn & Earn」、Partnership 就可以看出,Binance Academy 相比于 Uniswap University 最大的不同在于生态更加复杂,想要的也更多。

今年 4 月,Binance 推出了基于 AI 的加密货币知识助手 Binance Sensei,Binance Sensei 覆盖了 Binance Academy 上超 1000 篇文章与课程,可帮助用户学习加密货币、区块链和 Web3 的相关知识。

图片来源:Binance Academy 官网

Binance 注重新人教育及用户交易教学已经有很长的时间,2022 年,CZ 等加密企业高管与在线教育平台 Masterclass 合作推出加密课程,主题包括加密货币的历史、去中心化、Web3、DAO、NFT、细分市场的波动性等。

除 Binance,另一大 CEX 同样在加密教育方面不甘落后,5 月 17 日,Coinbase 面向 Web3 开发者推出了教育平台 Base Camp。之前它是 Coinbase 为了加快开发人员的入职速度,内部开发的一个教育平台,运行在以太坊 Layer2 网络 Base 基础设施上。

与 Coursera 和 edX 等多功能学习平台不同,Base Camp 包含链上练习,为开发者提供实践经验。在每个学习里程碑,开发者将获得 NFT 徽章。并且还设有社群组织,可以链接到每一个使用 Base Camp 进行开发的人。

Coinbase CEO Brian Armstrong 曾在一份他的不那么秘密的「秘密总体规划」里将公司的使命分为四个阶段,每个阶段的目标是让员工人数是之前的十倍。如今从第三阶段到第四阶段需要吸引 10 亿用户,Coinbase 认为这需要 100 万开发人员来构建这些用户会喜欢的有用的 dapps。Coinbase 协议团队负责人 Jesse Pollak 在一份采访中表示,这意味着要将全球约 3000 万 Web2 开发人员中的一小部分引入 Web3,而 Base Camp 的用意即在于此。

再回到 Uniswap University 来说,它的使命也是将更多人带入到 Web3 世界之中。

教育会是 DeFi 流动性的突破口吗?

Uniswap University 的使命是「让所有人都能理解和如何获得流动性。」这个使命告诉了我们 Uniswap University 的「What」和「How」,弦外之音是推出这个平台的「Why」。

Uniswap 受到 2020 年的 DeFi Summer 利好,一路成长为如今最大的 DEX,已经成功地饱和了其目前的可触达市场,Uniswap V3 占所有去中心化交易所交易量的 46.5%,此外,还在 2022 年 5 月创下了累计交易量达 1 万亿美元的纪录。

但随着越来越多成长起来的 DEX 争夺市场份额,一家独大注定无法持续,这意味着继续优化 DEX 并挤压现有市场的增长将不足以继续其目前的轨迹。最直接的表现是,Uniswap 的流动性持续不足。

图片来源:DeFiLlama

据 Coingecko 数据,2023 年上半年的 DEX 市场份额中,Uniswap 占据 64%,但在 2022 年上半年,这个数据是 89%。

Uniswap V3 上有超过 13,000 个流动性池,举个例子,Uniswap 流动性池中大约 1,500 个池使用 wETH 作为基础或报价资产,占总池数的大约 11%。令人惊讶的是,对于像 CRV 这样的小型代币,与提供 CRV-(w)ETH 市场的前 5 个最具流动性的 CEX 相比,Uniswap 的流动性较低。

相对中心化交易平台来说,Uniswap 的交易操作难度和门槛对于新人来说有些偏高,也许这就是 Uniswap University 最大的意义。相比于将 Web2 的人引入加密世界,吸引更多人踏入 DEX 的世界对 Uniswap 更为迫切。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。