原创:举大名耳

来源:AI新智能

相比于国内的AI企业,海外的这些同行们,大部分都已经在AI的应用层,尤其是C端应用上实现了盈利。国内绝大部分应用,却仍集中在B端。

a16z是一家美国硅谷的风险投资公司,成立于2009年,在科技界有着深厚的背景。

由于其优秀的投资业绩和行业影响力,a16z 已成为全球最有声望的风险投资公司之一。

最近,a16z发布了一份月流量TOP 50的AI产品榜单,经过分析对比之后,一个有趣的现象浮出了水面。

相比于国内的AI企业,海外的这些同行们,大部分都已经在AI的应用层,尤其是C端应用上实现了盈利。国内绝大部分应用,却仍集中在B端。

分野

从榜单来看,目前实现盈利的海外AI应用,大致有如下特点:

1、大部分国外的AI应用都是以C端为主,商业模式是以订阅制为主。

2、应用的类型中有相当多是情感陪伴、AI绘画这类偏向于泛娱乐的应用。

3、即使是在这些产品缺乏核心技术壁垒的情况下,仍然有大量用户愿意付费。

举例来说,榜单上提到的Character.Ai就是一款面向C端的情感陪伴类AI,迄今为止,用户已经创建了超过1000万个自定义AI角色。使用者既可以与虚构人物或名人聊天,也可以自创一个自定义角色。

而榜单上提到的Leonardo.ai,也是一个订阅制为商业模式的AI绘画应用,从功能上来说,几乎与之前大火的Midjourney别无二致。

然而,即使在同类竞品颇多,且无核心技术壁垒的情况下,这类以绘画为主的C端应用却仍然实现了盈利。

而相较之下,目前国内市场上较为亮眼的C端AI应用,只涌现出了妙鸭相机一个爆款案例。

除此之外,国内的AI应用主要阵地仍在B端,无论是智能客服、办公助理还是文字生成,大多都是面向企业提供的服务。

例如,百度智能云推出的“Comate”代码助手,借助文心一言大模型的能力,旨在帮助企业实现代码的快速补齐,自动查找代码错误等功能。

而金山办公通过接入文心一言,快速推出了智能办公助手WPS AI,同样是一款基于办公领域的,面向B端的应用。

同样的,钉钉的斜杠,360接入了自身全家桶的360智脑,都纷纷将焦点聚集在了B端。

从产业的角度来说,这种应用方向上的“偏科”,这未必是一种乐观的局面。

为什么在有着如此庞大用户基数,以及广阔市场的前提下,中国AI应用仍然难以在C端涌现出繁茂的生态呢?

三大枷锁

就目前来看,制约国内AI企业在C端发展的因素,主要有“三大枷锁”。

1、缺乏活跃的应用生态。

相较于国内而言,有着先发优势的美国,AI应用市场更加成熟和开放,有更多的平台和社区供AI应用开发者和用户交流和互动。

举例来说,国外的AI应用开发者可以利用各种在线平台和工具来快速构建和部署AI应用。

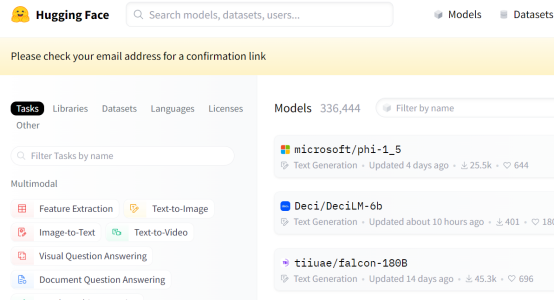

以Hugging Face为例,该社区拥有超过30万个预训练的模型,覆盖了100多种语言,目前,有超过50万个组织和个人在使用Hugging Face,他们可以通过各种渠道和方式来分享和评价模型、数据集和应用。

这些平台和工具可以为AI应用提供丰富的数据资源、技术支持、用户反馈、社区交流等,降低了AI应用的开发成本和难度,也让开发者能直接了解到用户的声音,知道他们想要什么。

“合规性”制约

这是套在目前中国大模型C端应用上的又一大枷锁。

其实在数个月的大模型竞争中,国内也曾涌现过一些较有灵气的C端应用,但在整体大环境下,这些没活跃多久的社区或网站,就很快因法律或合规性原因而下架、关闭。

就在9月月初,国内多家采用AIGC技术建立的中小型AI绘画网站如四必三(4B3.com),某某.com),某art.com)等纷纷在无预警情况下被关停,或转移到境外域名,同时在国内无法访问。

而这现象的原因主要是“在未经评估的情况下调用境外的ChatGPT产品接口,提供智能对话问答等功能,存在较大的安全风险隐患”。

虽然一些AI绘画社区的用户和开发者喜欢分享自己用AI生成的作品,比如使用Stable Diffusion模型或LoRA等。但是,由于“合规性”的制约,如果想要继续分享自己的作品,开发者就可能需要使用一些技术手段来绕过监管,这无疑会增加他们的成本和难度,从而降低他们的分享意愿。

“跟随策略”的思路

早在互联网兴起的时代,国内的各大企业,就产生了一种“拿来主义”的策略,众人今天所熟知的各种互联网产品,当初无一不是“照抄”、“照搬”的产物。

例如qq模仿Icq、淘宝模仿ebay、百度模仿谷歌。

这样的思路,对于在产业上处于明显后发地位的国家、企业来说无可厚非,毕竟在一个未知的新领域,后发者想做一个全新的产品,但市场上没有任何案例,在这种情况下,降低风险、节约成本的最优解,就是跟随。

否则的话,如果要求在算力、数据方面不占优的国产AI应用去打头阵,去为整个AI产业蹚路,这显然是不合理,也不符合商业逻辑的。

从这点上来说,“拿来主义”需要做的是微创新,说白了,就是低风险的创新,既保持了原来的商业模式内核,又适应了国内的用户。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。