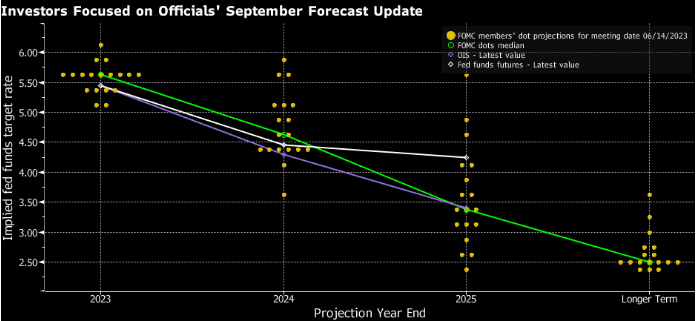

Federal Reserve policy makers will make their latest forecasts for their benchmark interest rate in the early hours of Thursday Beijing time, a key potential determinant for the U.S. Treasury market, which faces the risk of a third consecutive year of losses.

Although Fed Chairman Powell sometimes downplays the importance of the so-called dot plot forecasts, the importance of these forecasts is self-evident given that he and his colleagues are unwilling to provide too much specific verbal guidance on policy prospects. This was especially true for the September 19-20 policy meeting, as it was widely expected that the Fed would stand pat this time.

The two key questions about the dot plot are: whether policy makers will maintain the expectation of another 25 basis point rate hike before the end of the year, and how much accommodation they are preparing for 2024. They had previously projected a 1 percentage point cut in June.

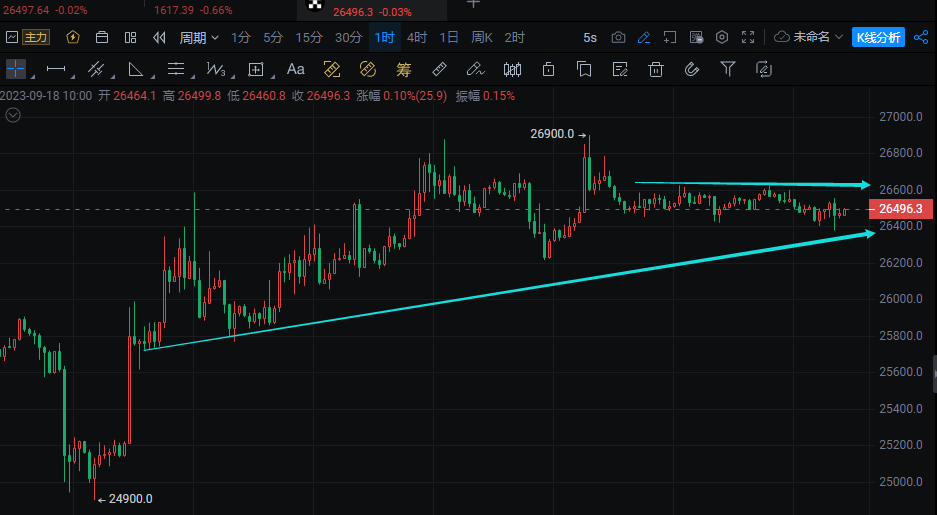

Bitcoin, over the weekend, surged and then fell back, maintaining narrow range operation overall. It quickly fell back after probing 26900 and did not break below 26400, mostly oscillating within the 2-300 range. The daily chart closed with two small doji candles, and the integer resistance at 27000 is very strong. Caution should be exercised against the risk of a pullback in the future!

The four-hour chart shows weak continuity in both bullish and bearish trends. Currently, the price is hovering around 26492, and the direction for today is not yet clear. In terms of operation, it is still advisable to enter and exit based on resistance levels. Resistance above is at 26650-700; support below is at 26200.

Bitcoin trading strategy for September 18:

Short at 26650-700, with a stop loss of 300 points, and a target of 26400-300;

Long at 26200-250, with a stop loss of 25900, and a target of 26666;

After reaching a high around 1654 on Saturday morning, Ethereum has been in a pattern of oscillation and decline, with the decline being slow and progressing step by step. This morning, it quickly probed the position of 1600, and the daily chart also closed with two small bearish candles, indicating an obvious trend. For the short term, it is advisable to go short on rebounds. It is possible to take a small long position in the support area of 1600-1605.

Ethereum trading strategy for September 18:

Continue to short at 1620-30, with a stop loss of 15 points, and a target of 1605;

Take a short position near 1605-1600, with a stop loss of 1588, and a target of 1620-25;

As a financial investment analyst, the happiest thing is not how much money you make, but how many investors' trust you win. From being strangers to becoming familiar, from being familiar to being trusted, and eventually becoming friends who continue to trust and support you. This is a charm that cannot be bought with money. Duan Chenbei would like to express his gratitude to all new and old clients for their continuous support and trust. I will continue to work hard and persist as always, striving to be an even better financial analyst.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。