In recent days, Voyager Digital, a crypto lending company that has been out of people's sight for a long time, has regained attention.

On August 12, Voyager began the token selling process, and since then, tokens in its wallet have been continuously transferred. As of now, in less than five days, Voyager has transferred out over $40 million worth of cryptocurrencies. Similarly, its address has also received about 51 million USDC. After continuous selling, how much funds has Voyager recovered? How many tokens are still available for sale? What impact does this have on the market?

Voyager Selling Tokens to Pay Debts

According to previous reports, Voyager has been actively selling tokens to pay off debts, continuously transferring its holdings to CEX and selling them for fiat currency.

In mid-May of this year, a judge approved Voyager's liquidation plan. According to the plan, Voyager Digital will return about $1.33 billion in crypto assets to customers, although it only accounts for 35% of the total customer deposits.

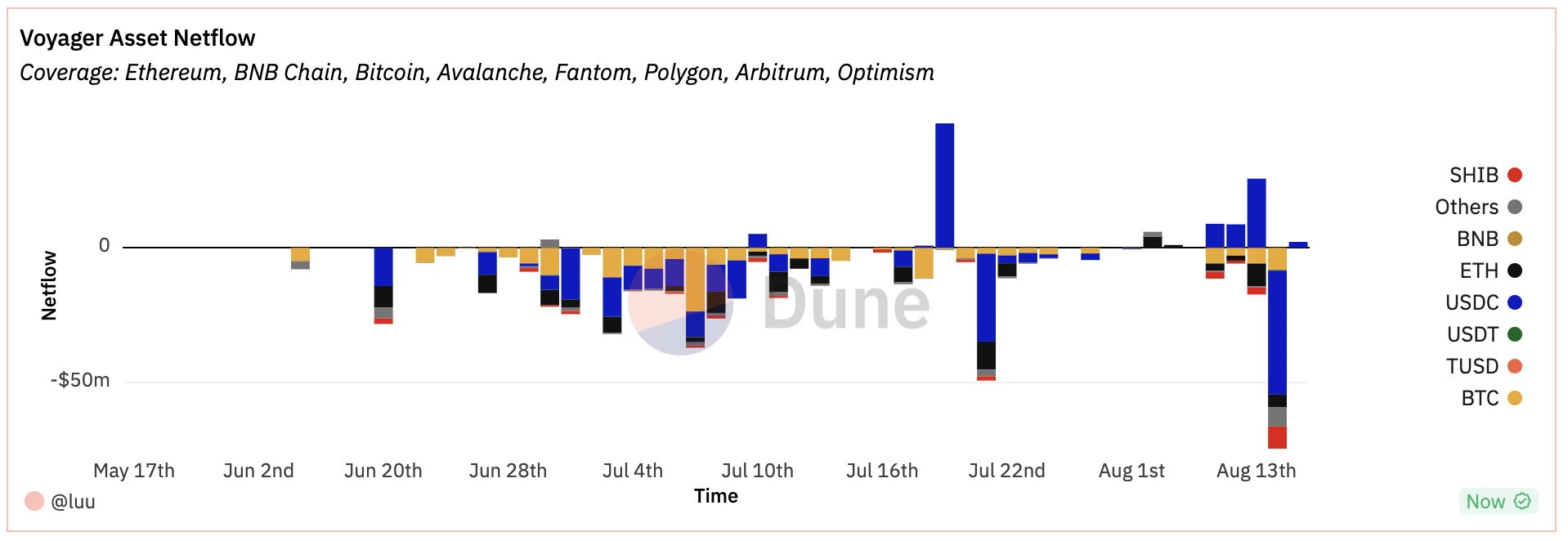

According to Voyager's repayment plan, the period from June 20 to July 5 is the cryptocurrency payout period, during which customers can choose to withdraw 35.72% of the tokens. They can also choose not to withdraw the crypto deposits and wait for Voyager to sell the cryptocurrencies and receive compensation in US dollars after the process is completed. On-chain data shows that Voyager's tokens quickly flowed out after the withdrawal began.

As the token payout stops, Voyager's actions have entered the next phase. Starting on August 12, the claimed cryptocurrencies of Voyager began to be transferred and sold.

On-chain data shows that Voyager has transferred over 30 types of tokens to Coinbase, totaling over $40 million. Among them, those worth over $1 million include: BTC, ETH, SHIB, LINK, and MATIC.

Specifically, about $17.5 million worth of BTC, about $12.9 million worth of ETH, and about $8 million worth of SHIB. In addition, BAT, SAND, MANA, and APE tokens total about $2 million. The substantial selling has also brought Voyager a considerable amount of cash. On-chain data shows that Voyager withdrew about $82.37 million USDC from Coinbase and transferred it to Circle for conversion into US dollars.

On August 14, the net outflow in a single day was as high as $74.4 million, including stablecoins worth $46.18 million.

How Much Does Voyager Have Left?

After continuous large outflows, how much assets does Voyager have left to sell? By checking Voyager's EVM wallet address, we can quickly overview the current holdings of this former giant.

Zerion data shows that the net value of assets in Voyager's wallet address has decreased by 70% compared to a week ago.

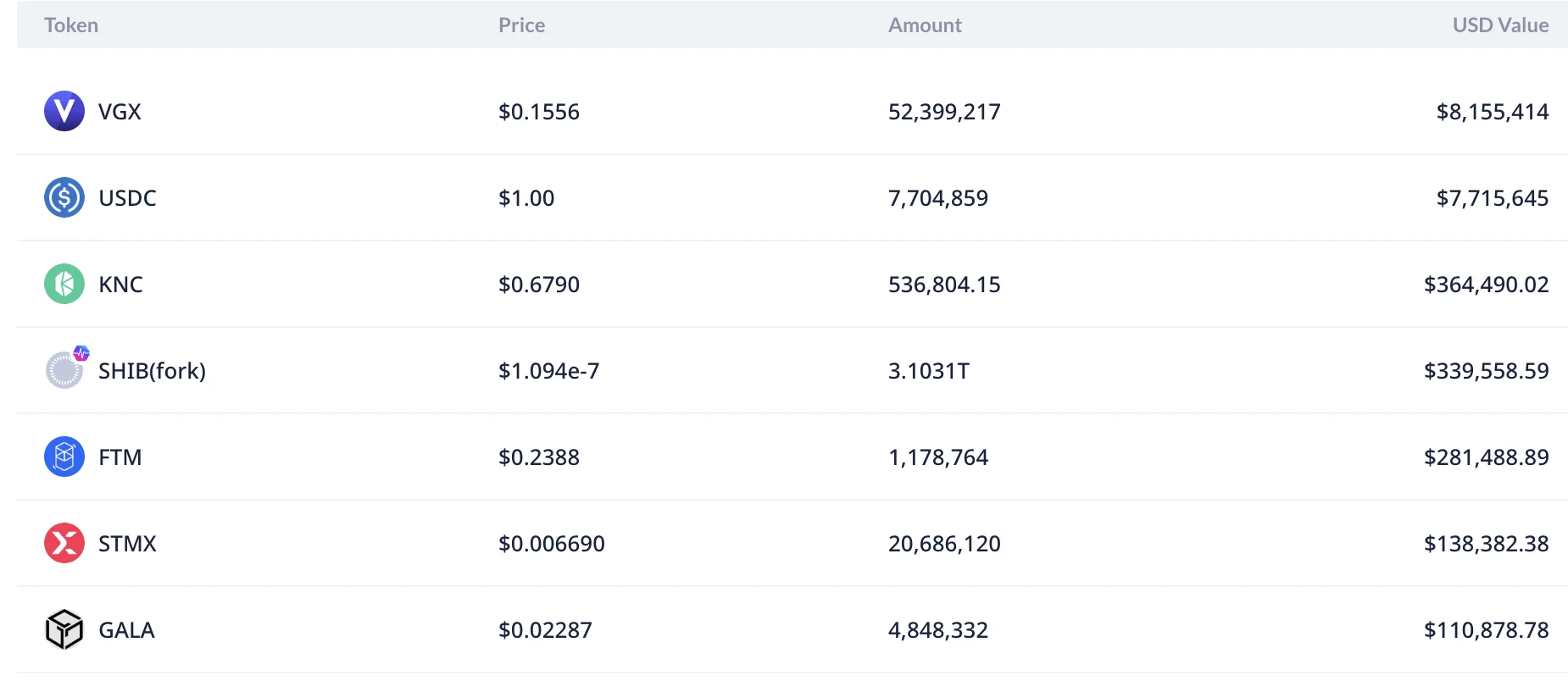

Currently, Voyager still has over $8 million worth of VGX waiting to be sold. Non-stablecoins worth over $100,000 include: VGX, KNC, SHIB, FTM, STMX, and GALA.

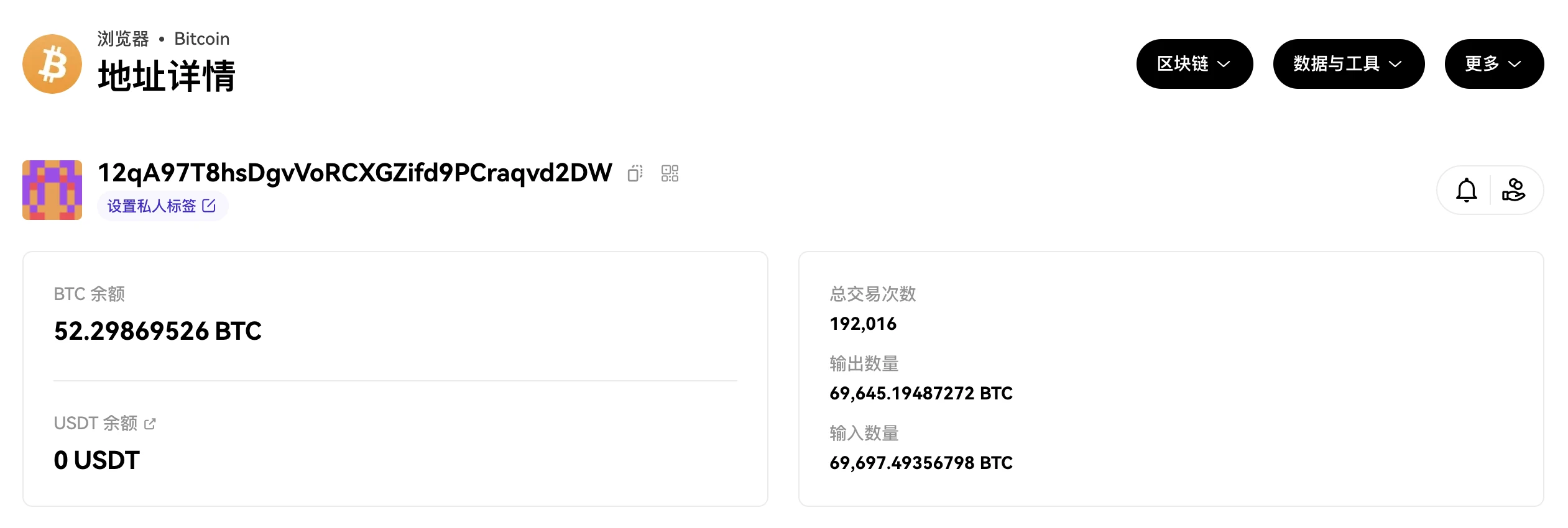

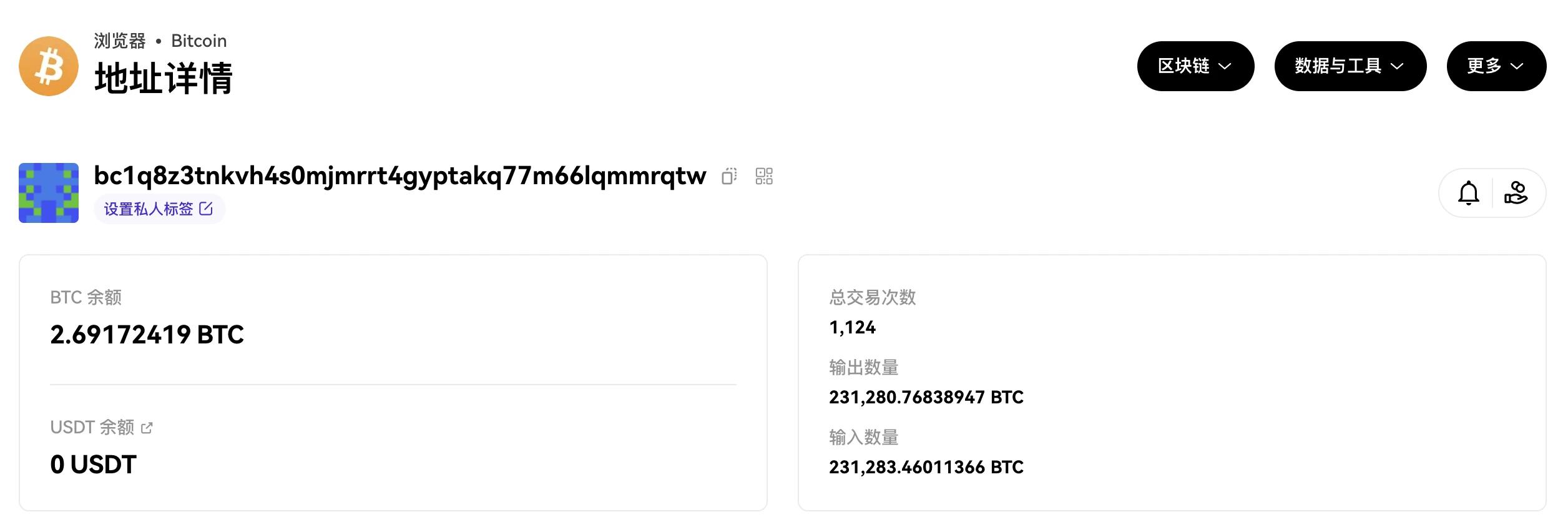

And Voyager's two Bitcoin addresses still hold some assets, totaling about 55 bitcoins, worth about $1.62 million at the current price.

How Will It Affect the Market?

In July 2022, Voyager Digital filed for bankruptcy protection in the United States, becoming another giant to fall in the bear market. Previously, Three Arrows Capital had borrowed a large amount of assets from Voyager. With the bankruptcy of Three Arrows Capital and the decline of the crypto market, Voyager Digital was also impacted by a chain reaction and eventually faced bankruptcy.

Less than a week before Voyager's collapse, the company suspended trading and halted customer fund withdrawals. After the bankruptcy, Voyager attempted to sell its assets to FTX for $1.42 billion, but the deal failed due to FTX's collapse.

Voyager's ultimate goal is to complete compensation for all customers (although only partially compensating for losses). Currently, as the compensation process progresses, it is gradually coming to an end.

What we are most concerned about is Voyager's selling, whether it will affect the market? Mainstream tokens can absorb the selling pressure, for example, Voyager has sold millions of dollars worth of SHIB in the past few days. And SHIB's 24-hour trading volume recently reached $280 million.

However, other smaller tokens are not optimistic, especially VGX issued by Voyager itself. According to Coingecko data, the current market value of VGX is only $45.81 million, with a 24-hour trading volume of only $4.86 million. And there is still $8.15 million worth of VGX waiting to be sold in Voyager's wallet.

Currently, Voyager's asset selling is still ongoing, and the subsequent handling methods are still to be observed. For the vast investors (or speculators), there are still certain market opportunities in this selling process.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。