Original Author: Will Awang, Diane Cheung

Original Source: Web3小律

With the arrival of the crypto winter in 2022, coupled with the thunderous collapse of regulation and CEX, the high APR of the crypto market in the past is no longer present. Investors who are still active in the market have begun to explore risk-free returns. Coinciding with the changes in the macroeconomic environment and the rise in US bond yields, the tokenization of real-world assets has become an important channel for capturing value in the current crypto market.

This article attempts to clarify the current logic of RWA narratives by sorting out the implementation paths of the main RWA projects holding underlying assets (Compound & Superstate, Franklin Templeton, MakerDAO, Ondo Finance, Matrixdock, Centrifuge).

TL;DR

It is not very meaningful to overly focus on the definition of RWA. Tokens are the carriers of value, and the value of RWA depends on bringing the rights/ values of underlying assets to the chain and its application scenarios;

In the short term, the driving force behind RWA comes more from the unilateral demand of DeFi protocols in the crypto world, such as asset management, diversified investment, and new asset categories;

DeFi protocols capture the interest value of underlying assets through RWA projects, essentially establishing a U standard, with asset categories that have real yield, similar to establishing ETH-based interest-bearing assets;

Therefore, US bond RWA is sought after, and depending on the different paths to realize US bond yields, it can be divided into (1) Off-Chain to On-Chain path represented by traditional compliant funds, and (2) On-Chain to Off-Chain path led by DeFi protocols, but regulatory compliance still poses significant obstacles;

Mapping interest-bearing assets to the chain is only the first step for RWA, and it will be very worthwhile to explore how to integrate the composability of DeFi, with the potential to further open up the ceiling of RWA+DeFi;

In the long term, RWA should not be one-way, and the future will be a two-way journey, where real-world assets can be brought to the chain, and TradFi can also leverage the various advantages of DeFi to further unleash potential;

Key areas of exploration in the future: how to enable investors to enjoy both the Beta returns brought by real-world RWA assets and the Alpha returns of the crypto market.

(Source:https://blog.isyatirim.com.tr/dijital-dunya-regulasyonlari/)

I. The Narrative of RWA in this Round

For the current $1 trillion crypto market, investors mainly derive income from on-chain activities (such as trading, borrowing, staking, derivatives, etc.), and the entire market lacks a stable source of real yield.

Since Ethereum switched to POS, liquidity staking based on ETH has been considered a native source of real yield in the crypto market, but it currently accounts for a small share of the overall crypto market. To truly break through the current market bottleneck, strong external support is still needed.

Therefore, a new source of real yield is entering reality: real-world assets (RWA) existing off-chain are brought to the chain through tokenization, serving as an important source of real yield for U-based assets in the crypto market.

The on-chain entry of RWA has an almost revolutionary potential impact on the crypto market. RWA can provide sustainable, diverse, and real yield supported by traditional assets for the crypto market. In addition, RWA can bridge the decentralized financial system and the traditional financial system for DeFi, which means that RWA can not only bring incremental funds to the crypto market but also gain access to massive liquidity, broad market opportunities, and significant value capture from the traditional financial market.

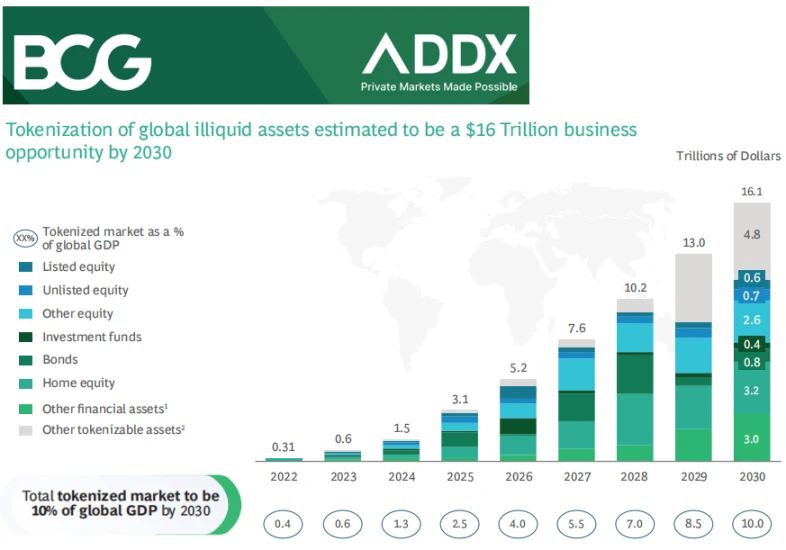

According to BCG and ADDX's research, the tokenization of global illiquid assets will create a market worth $16 trillion (which will be close to 10% of the global GDP in 2030). Citigroup's RWA report "Money, Tokens, and Games" also predicts that there will be a $10 trillion market tokenized by 2023.

(Source: New BCG report: Asset tokenization projected to grow 50x into a US$16 trillion opportunity by 2030)

1.1 What is RWA

RWA stands for Real World Assets Tokenization, which is the process of converting the value of rights in tangible or intangible assets (ownership, income rights, usage rights, etc.) into digital tokens. This allows assets to be stored and transferred without the need for a central intermediary, and the value is mapped to the blockchain for trading and circulation.

RWA can represent many different types of traditional assets (including tangible and intangible assets), such as commercial real estate, bonds, cars, and almost any value-storing assets that can be tokenized. Market participants have been seeking to bring RWA onto the chain since the early days of blockchain technology. Traditional TradFi institutions such as Goldman Sachs, Hamilton Lane, Siemens, and KKR are actively working to bring their real-world assets onto the chain. In addition, native crypto DeFi protocols such as MakerDAO and Aave are also making adjustments to embrace RWA.

Compared to the narrow scope of the 2018 ICO/STO (Security Token Offering) financing narrative, the current RWA narrative covers a broader range: not limited to the primary market in traditional finance, almost any asset that can be valued can be tokenized. In addition, the DeFi protocols and numerous infrastructures that did not exist in 2018 can also open up endless possibilities for today's RWA.

1.2 The Driving Force Behind RWA

Currently, the main driving force behind bringing real-world assets into the crypto world is that in the macro background, real-world assets (especially US bonds) can provide a stable risk-free return for the crypto market.

Therefore, the current implementation paths of most mature RWA projects are based on the unilateral demand of DeFi protocols for real-world assets, such as:

Demand for asset management: Native on-chain income mainly comes from staking, trading, and borrowing activities. However, in the context of the crypto winter, the sluggish on-chain activities directly lead to a decrease in on-chain yields. In the current context of high US bond yields, traditional DeFi protocols are gradually introducing US bond RWA. For example, MakerDAO, through recent proposals, is gradually converting stablecoin assets in its treasury (with no or low yield) into interest-bearing US bond RWA (4%-5% risk-free yield). This can ensure the safety of treasury assets while obtaining stable returns;

Portfolio diversification: In extreme market conditions, the high volatility and high correlation of native crypto assets can lead to misallocation and liquidation of assets. Introducing RWA assets with low correlation and stable returns related to on-chain crypto assets can effectively mitigate such issues. Investors can achieve diversification and build more robust and effective investment portfolios;

Introducing new asset categories: Building on RWA and integrating with DeFi can further unleash the potential of RWA assets. For example, Flux Finance provides lending for Ondo Finance's OUSG, Curve allows trading of MatrixDock's STBT, and Pendle provides AMM trading pools for interest-bearing assets.

In the short term, the realization of this demand is only based on the one-way journey of the crypto market, and traditional finance in the real world does not have much willingness to enter the crypto market, and those that do are only testing the waters. In the long term, RWA should not be one-way, such as the current one-way demand of DeFi for TradFi. The future will be a two-way journey, where real-world assets can be brought to the chain, and the real world can also leverage blockchain technology and various advantages to further unleash potential.

1.3 How to Capture the Value of RWA Underlying Assets

According to the different underlying assets of RWA, there can be various classifications.

In the short term, we narrowly divide RWA into "interest-bearing RWA" and "non-interest-bearing RWA." Because we believe that most RWA projects currently on the market are more focused on capturing the interest value of underlying assets, such as the yield of interest-bearing assets like US bonds, government securities, corporate bonds, REITs, etc.

The essence of interest-bearing RWA is to establish a U standard, representing a category of RWA assets with real yield from underlying assets, similar to the logic of establishing interest-bearing assets based on ETH. Although the yield of RWA assets is not high, they can be further combined in the DeFi ecosystem.

On the other hand, non-interest-bearing RWA is more suitable for capturing the commodity value of the underlying assets themselves, such as the value of gold, oil, collectibles, and the value of South American players.

II. On-Chain Path of RWA Assets

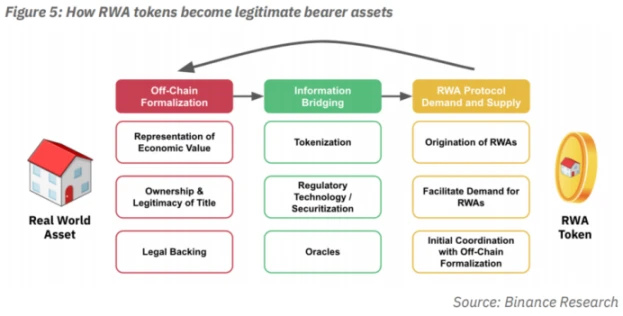

According to Binance Research's report, the implementation process of RWA is divided into three stages: (1) Off-Chain Formalization; (2) Information Bridging; (3) RWA Protocol Demand and Supply.

2.1 Off-Chain Formalization

To bring real-world assets into DeFi, the assets must first be packaged off-chain to digitize, financialize, and comply with regulations, to clarify the value of the assets, ownership, and legal protection of asset rights.

In this step, it is necessary to clarify: (1) Representation of Economic Value: The economic value of the assets can be represented by the fair market value of the assets in traditional financial markets, recent performance data, physical condition, or any other economic indicators. (2) Ownership and Legitimacy of Title: The ownership of the assets can be determined through deeds, mortgages, bills, or any other form. (3) Legal Backing: In cases involving changes in asset ownership or rights, there should be a clear process for resolution, including specific legal procedures for asset liquidation, dispute resolution, and enforcement.

2.2 Information Bridging

Next, information about the economic value, ownership, and rights of the assets is digitized and brought onto the chain, stored in the distributed ledger of the blockchain.

This step involves: (1) Tokenization: After the off-chain packaging of information is digitized, it is brought onto the chain and represented by metadata in digital tokens. This metadata can be accessed through the blockchain, making the economic value and ownership and rights of the assets fully transparent. Different asset categories can correspond to different DeFi protocol standards. (2) Regulatory Technology/Securitization: For assets that need to be regulated or considered securities, they can be brought into DeFi in a legal and compliant manner. These regulations include but are not limited to licensing for issuing security tokens, KYC/AML/CTF, and compliance requirements for listing on exchanges. (3) Oracle: For RWA, external data from the real world is needed to accurately depict the value of the assets, such as accessing performance data for stock RWA. However, since blockchain cannot directly bring external data onto the chain, services like Chainlink connect on-chain data with real-world information to provide off-chain asset value data to DeFi protocols.

2.3 RWA Protocol Demand and Supply

DeFi protocols focused on RWA drive the entire process of tokenizing real-world assets. On the supply side, DeFi protocols oversee the formation of RWA. On the demand side, DeFi protocols facilitate investor demand for RWA. In this way, most DeFi protocols specializing in RWA can serve as the starting point for the formation of RWA and provide a market for the final products of RWA.

2.4 Specific Implementation Paths for RWA

(Source:https://forum.makerdao.com/t/poll-rwa-working-group-covenant-structure/4836)

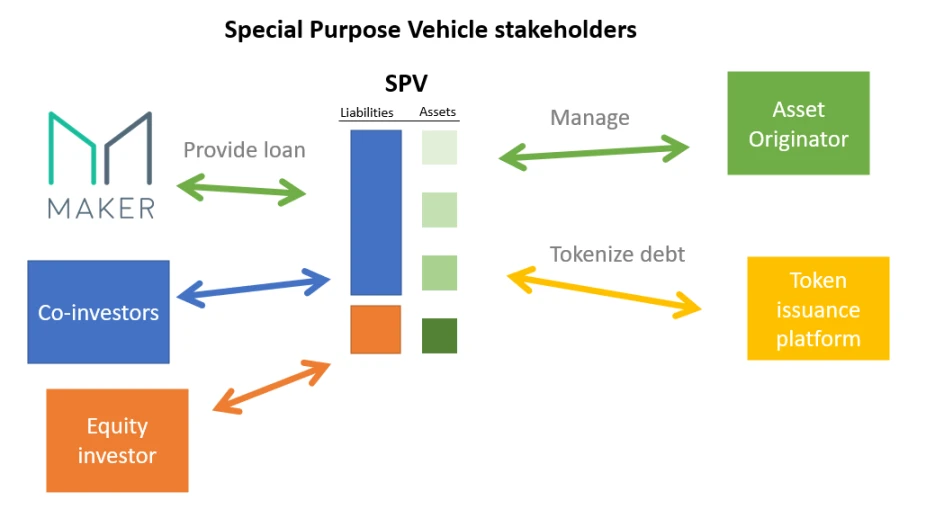

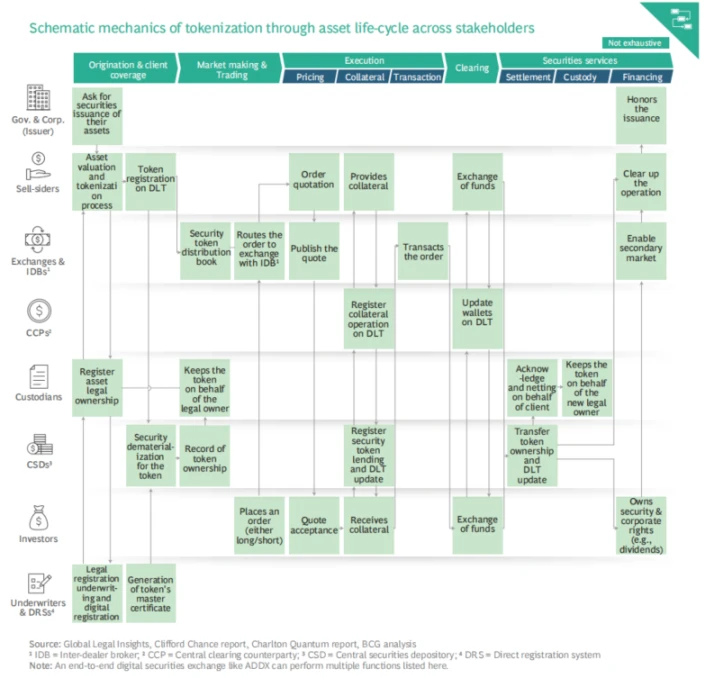

In the specific implementation path of bringing RWA assets onto the chain, a similar approach to asset securitization can be taken, by establishing Special Purpose Vehicles (SPVs) to support underlying assets, playing a role in control, management, and risk isolation. Additionally, the BCG and ADDX report provides a roadmap for various ecosystem participants (asset initiators, issuance platforms, asset custody, fund settlement, etc.) from the perspective of the initiator of RWA assets.

III. Current Implementation Paths for US Bond RWA

We have clarified that RWA represents the tokenization of real-world assets off-chain, so it is crucial to understand how the rights and values of assets in the real world and the crypto world are converted, or how RWA is explained as a legal representation of real-world assets, and how real-world assets are mapped onto the chain.

By examining the most mature RWA project—US bonds, we find two paths: (1) Off-Chain to On-Chain represented by traditional compliant funds, and (2) On-Chain to Off-Chain led by DeFi protocols. Since the main driving force behind RWA currently comes from the crypto world, DeFi protocols are more mature in exploring RWA projects.

Currently, except for T protocol, which is a permissionless protocol, all other projects have strict KYC/AML verification processes for compliance, and the majority of US bond RWA projects do not support transfer and trading functions, with very limited use cases, requiring further exploration and development.

3.1 Off-Chain to On-Chain in Traditional Finance

3.1.1 Superstate, a New Company by Compound Founder

(Source: https://www.axios.com/2023/06/28/defi-robert-leshne-rmutual-fund)

Compound founder Robert Leshner has targeted the current hot RWA narrative and announced the establishment of a new company, Superstate, on June 28, 2023, dedicated to bringing regulated financial products from the traditional financial market onto the chain.

According to the documents submitted by Superstate to the U.S. Securities and Exchange Commission (SEC), Superstate will use Ethereum as an auxiliary accounting tool and create a fund investing in short-term government bonds, including U.S. Treasury bonds and government agency securities. However, the documents are very clear that the fund will not directly or indirectly invest in any assets that rely on blockchain technology, such as cryptocurrencies.

In summary, Superstate will establish an off-chain SEC-compliant fund to invest in short-term U.S. government bonds and process the fund's transactions and records on-chain (Ethereum), tracking the ownership shares of the fund. Superstate states that investors must be whitelisted and that smart contracts such as Uniswap or Compound will not be whitelisted, so these DeFi applications cannot use it.

In a statement to Blockworks, Superstate stated: "We are creating an SEC-registered investment product that will allow investors to have a record of ownership of this mutual fund, just like holding stablecoins and other crypto assets."

3.1.2 Franklin OnChain U.S. Government Money Fund

(Source: rwa.xyz & Stellar expert)

Prior to Superstate, we have seen that Franklin Templeton launched the Franklin OnChain U.S. Government Money Fund (FOBXX) in 2021, which is the first SEC-approved fund that uses blockchain (Stellar) technology to process transactions and record ownership. As of now, its assets under management (AUM) have exceeded $29 billion, and investors can enjoy an annualized return of 4.88%.

Although one share of the fund is represented by one BENJI token, there is currently no interaction between the BENJI token and DeFi protocols on-chain. Investors need to undergo compliance verification through Franklin Templeton's app or website to enter its whitelist.

3.1.3 Tokenization of Private Equity Funds by Hamilton Lane

Hamilton Lane is a globally leading investment firm with assets under management of up to $823.9 billion. The company has tokenized partial shares of three of its funds on the Polygon network and made them available to investors on the Securitize trading platform. Through the collaboration with Securitize, partial shares of the funds will form a feeder fund on the platform and will be managed by Securitize Capital.

The CEO of Securitize stated, "Hamilton Lane offers some of the best-performing private market products, but historically, they have been limited to institutional investors. Tokenization will allow individual investors to participate in private equity investments for the first time in a digital way and create value together."

From the perspective of individual investors, although tokenized funds provide an "affordable" way to participate in top-tier private equity funds, with the minimum investment threshold significantly reduced from an average of $5 million to just $20,000, individual investors still need to undergo qualified investor verification through the Securitize platform, which presents a certain barrier.

From the perspective of private equity funds, tokenized funds offer the obvious advantage of real-time liquidity (compared to the traditional private equity funds' lock-up period of 7-10 years) and the flexibility to diversify LPs and allocate funds.

3.1.4 Summary

The Off-Chain to On-Chain path is more of an innovative exploration by traditional finance on its compliance foundation. Considering the strong regulation of traditional finance, the current exploration only applies blockchain technology to traditional financial products and uses blockchain as its accounting method, rather than directly integrating with DeFi for interaction, and has not expanded externally. However, the ownership certificate of the fund shares is essentially no different from a token, so imagine the difference between holding a certificate and holding a stablecoin.

We look forward to Compound founder Robert Leshner providing more value exploration for the Off-Chain to On-Chain path of RWA from a more Crypto-native/DeFi perspective.

3.2 On-Chain to Off-Chain in Crypto Finance

3.2.1 Monetalis Trust Legal Framework by MakerDAO

MakerDAO is a decentralized autonomous organization (DAO) aimed at managing the Maker protocol running on Ethereum. The protocol provides the first decentralized stablecoin DAI (which can be understood as the dollar on Ethereum) and a range of derivative financial systems. Since its launch in 2017, DAI has always been pegged to the dollar.

Due to the high volatility of the cryptocurrency market, relying on a single collateral asset may lead to a large amount of liquidation. Therefore, MakerDAO has been actively exploring ways to diversify collateral, with RWA being an important part of it. After years of experimentation, MakerDAO has implemented two mature RWA paths: (1) directly purchasing and holding assets through DAO + trust (MIP65 proposal); (2) directly purchasing tokenized RWA assets (through the decentralized lending platform Centrifuge), including New Silver (real estate loans) and BlockTower (structured credit) held in the Vault.

According to MakerBurn.com's data, there are currently 11 RWA-related projects used as collateral for MakerDAO, with a total TVL of $2.7 billion.

(Source: https://makerburn.com/#/rundown)

Let's take a look at MIP65: Monetalis Clydesdale: Liquid Bond Strategy & Execution proposal. The proposal was put forward by Monetalis founder Allan Pedersen in January 2022, aiming to invest a portion of the stablecoin assets in the MakerDAO treasury through a trust managed by Monetalis into real-world high-liquidity, low-risk bond assets. The proposal was later approved by the MakerDAO community and implemented in October 2022, with an initial debt ceiling of $500 million. In May 2023, a subsequent proposal increased the ceiling to $1.25 billion.

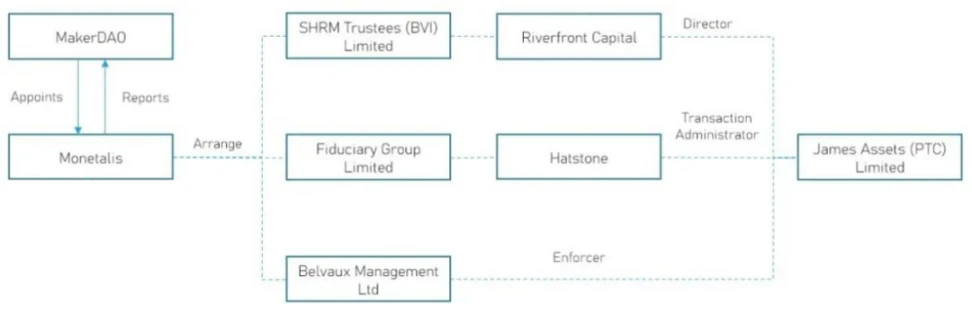

According to the MIP65 proposal, MakerDAO entrusts Monetalis as the project executor through voting, responsible for designing the overall legal framework and reporting periodically to MakerDAO. Monetalis has designed a trust legal framework based in the British Virgin Islands (BVI) to unify on-chain governance (MakerDAO), off-chain governance (trust company's authorized resolutions), and off-chain execution (off-chain transactions).

First, MakerDAO and Monetalis authorize a Transaction Administrator to review all transactions and ensure that the execution of transactions aligns with MakerDAO's proposals. Second, MakerDAO's on-chain proposals serve as a precondition for off-chain entities to make resolutions, excluding any matters unrelated to MakerDAO resolutions from the off-chain entity's authorization scope. Finally, based on the flexibility of BVI law, it ensures a unified approach to on-chain governance and off-chain governance and execution to a certain extent. Through complex legal arrangements and trust authorization, the arrangement between MakerDAO and Monetalis is as follows:

(Source: DigiFT Research, MakerDAO MIP65)

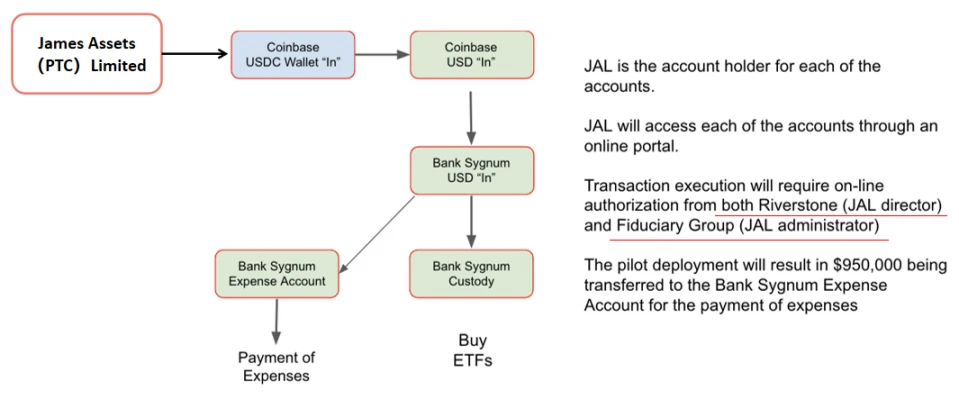

After unifying the on-chain governance and off-chain governance and execution of MakerDAO and Monetalis, the subsequent trust company James Assets (PTC) Limited, established in the BVI, will execute the purchase of US bond ETFs externally, including BlackRock's iShares US$ Treasury Bond 0-1 yr UCITS ETF and iShares US$ Treasury Bond 1-3 yr UCITS ETF. The specific process is as follows:

(Source: MakerDAO MIP65)

In the overall process, James Assets (PTC) Limited, as the external entity of MakerDAO and Monetalis, will handle each transaction under the premise of on-chain and off-chain authorization, with Coinbase serving as the fiat currency exchange institution and Sygnum Bank providing trading and custody of trust assets, as well as setting up an account for trust operation expenses (initial expenses amounting to $950,000).

3.2.2 Tokenization Path of SPV by Centrifuge

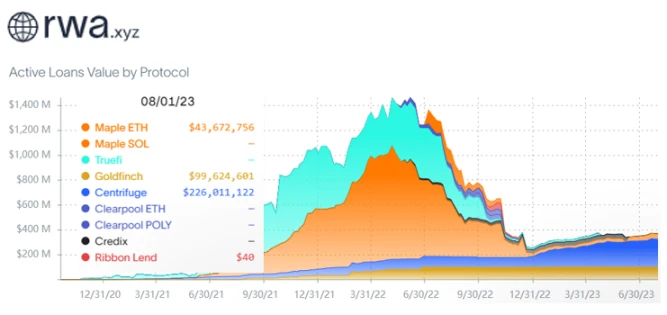

Centrifuge is a decentralized lending platform dedicated to bringing real-world assets into the crypto world, providing more investment opportunities and liquidity through tokenization, fractionalization, and structuring. Centrifuge is one of the earliest DeFi protocols involved in the RWA field and is also the technology provider behind leading DeFi protocols such as MakerDAO and Aave. According to rwa.xyz's data, Centrifuge is currently one of the most comprehensive projects in the RWA field and has its own Centrifuge Chain and main product, the Tinlake protocol.

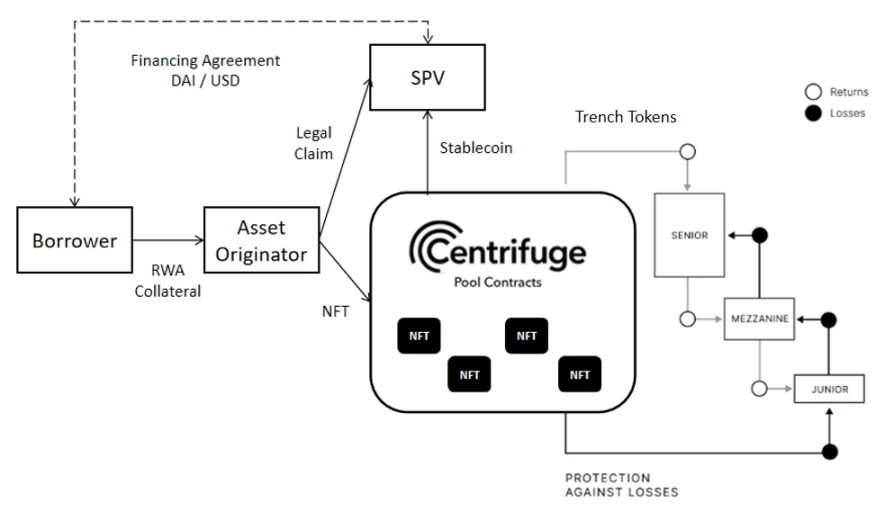

The implementation path of RWA by Centrifuge can be roughly summarized as follows: (1) Borrowers tokenize off-chain assets into NFTs through asset initiators (underwriting) and lock them in Centrifuge's smart contract asset pool; (2) Multiple NFT assets of the same type from different borrowers are pooled together to form an asset pool, with liquidity providers providing funds for the pool as a whole, rather than individually; (3) Through structuring, the asset pool is divided into junior and senior tranches (corresponding to different ERC20 tokens), with junior tranche investors earning more returns and bearing more risk, while senior tranche investors earn lower returns and bear lower risk, catering to different risk preferences.

Centrifuge has done a considerable amount of work in compliance based on the legal structure of asset securitization in the United States (Regulation D under 506 (b)(c) of the U.S. Securities Act), and continues to improve. For example, Centrifuge collaborates with Securitize to assist investors in completing KYC/AML and other compliance verifications. Every asset originator on Centrifuge needs to establish an independent legal entity corresponding to the asset pool, known as a Special Purpose Vehicle (SPV), which serves the purpose of bankruptcy isolation. Legally, these assets have been sold to the SPV, so even if the asset originator goes bankrupt, it will not affect the assets held by the SPV, thus protecting the interests of investors. Investors sign investment agreements with the SPV corresponding to the asset pool, which include investment structure, risks, terms, etc., and then use DAI to purchase DROP or TIN tokens corresponding to different tranches.

(Source: https://docs.centrifuge.io/learn/legal-offering/)

In February 2021, MakerDAO issued the first RWA002 Vault with New Silver on Centrifuge. Subsequently, the larger-scale BlockTower S4 (RWA013-A) and BlockTower S3 (RWA012-A) were based on the aforementioned RWA implementation path, with BlockTower S4's underlying assets mainly consisting of consumer loan ABS products.

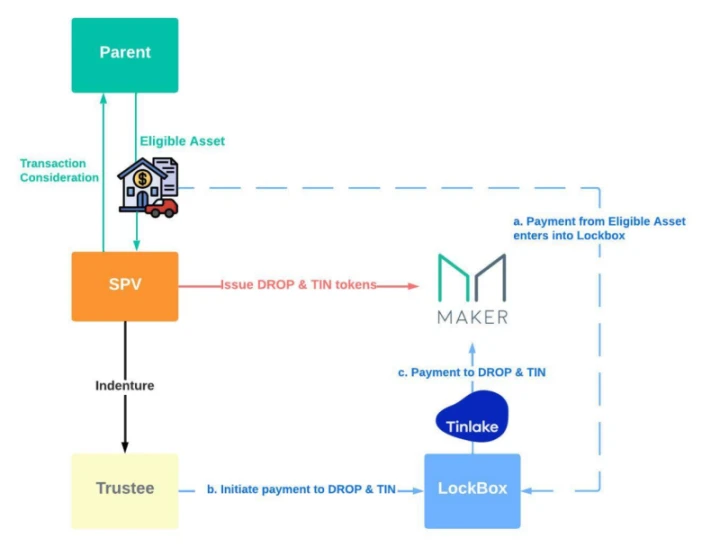

Following these improvements, the MIP6 proposal introduced the concepts of a Trustee and LockBox to Centrifuge's RWA implementation path. MakerDAO believes that this transaction structure standardizes asset pool transactions and better protects the interests of investors and the DAO. The two most significant changes are:

The asset issuer appoints a third party as a Trustee to act on behalf of the DAO and investors, protecting the interests of the DAO and ensuring the independence of the assets. In extreme cases of default, the Trustee can handle and distribute the assets, removing control from the issuer or liquidator.

The introduction of the LockBox concept, which means that the assets are held in an isolated account outside the control of the asset issuer and the SPV. This structure ensures that the SPV assets are no longer controlled by the asset issuer but by the Trustee. The Trustee's responsibility is to receive and handle funds in the isolated account and ensure that the correct party (such as MakerDAO) receives the funds. This means that the asset issuer no longer controls the flow of funds from the borrower to the MakerDAO reserve, reducing the risk of the issuer's fund loss or misuse.

(Source: https://forum.makerdao.com/t/progress-update-on-the-legal-structure-for-centrifuge-rwa-vaults/13307)

In this improved RWA implementation path, the underlying assets are first sold to the SPV, which then enters into an agreement with the Trustee to pledge the underlying assets. The SPV then issues DROP and TIN tokens to MakerDAO based on the Tinlake protocol. When cash flow payments occur for the underlying assets, the funds are directly deposited into an isolated account called LockBox, independent of the SPV and MakerDAO. Upon receipt of the funds, the Trustee initiates instructions to the LockBox to pay DROP and TIN to MakerDAO, which is then completed through the Tinlake protocol.

It is important to note that MakerDAO and the SPV have no opportunity to access DAI or USD cash flows, as all cash flows are processed through the LockBox and Tinlake protocol. The only role of MakerDAO and the SPV is to sign subscription agreements and make decisions as token holders.

This structure better protects investors and asset issuers from potential litigation claims and provides a consistent and coherent solution for discussions with third-party service providers such as regulatory authorities and custodian banks. Once this structure is widely accepted in the industry and embraced by many traditional financial industry participants, it should make it easier to bring traditional financial industry participants into DeFi, thereby expanding the types and quantities of real-world assets available for Maker's use and reducing the volatility of DAI.

3.2.3 Exemption Path of Ondo Finance and Flux Finance (DeFi Lending Protocol)

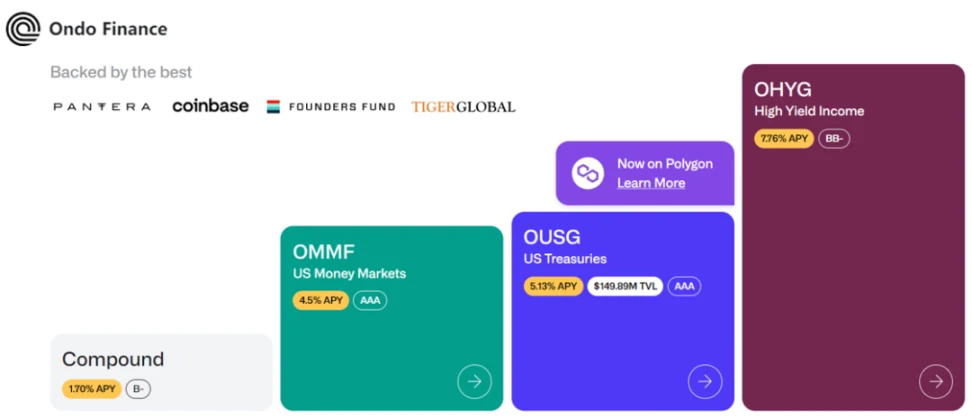

Ondo Finance launched tokenized funds in January 2023, aiming to provide institutional-grade investment opportunities and services to on-chain professional investors. It brings risk-free/low-risk rate funds to the chain, allowing stablecoin holders to invest in government bonds and U.S. Treasury bonds on-chain. Meanwhile, Ondo Finance collaborates with the DeFi protocol Flux Finance to provide on-chain stablecoin lending services to OUSG token holders.

According to DeFiLlama's data, as of August 1st, Ondo Finance's TVL is $162 million, and the TVL of its lending protocol Flux Finance reaches $42.78 million, with borrowing amounting to $280.2 million.

Ondo Finance has introduced four tokenized fund products: (1) U.S. Money Market Fund (OMMF); (2) U.S. Treasury Bonds (OUSG); (3) Short-Term Bonds (OSTB); (4) High-Yield Bonds (OHYG). The most popular fund among investors is OUSG, which holds BlackRock iShares Short Treasury Bond ETF as its underlying asset. OUSG is pegged to the USD stablecoin, and investors in the OUSG fund receive OUSG tokens backed by short-term U.S. Treasury bonds. OUSG token holders can also collateralize OUSG through Flux Finance, a decentralized lending protocol developed by Ondo Finance, to borrow stablecoins such as USDC and DAI.

(Source: https://ondo.finance/)

For regulatory compliance reasons, Ondo Finance strictly implements a whitelist system for investors, only allowing Qualified Purchasers to invest. The SEC defines Qualified Purchasers as individuals or entities investing at least $5 million. Investors need to undergo Ondo Finance's official KYC and AML verification process before signing subscription documents. Eligible investors deposit stablecoins into Ondo Finance's OUSG fund, then conduct fiat currency deposits and withdrawals through Coinbase Custody, and execute U.S. bond ETF trades through compliant broker Clear Street.

It is important to note that the concepts of Qualified Purchaser and Accredited Investor are not the same, with the latter requiring an annual income exceeding $200,000 or a net worth exceeding $1 million, excluding the primary residence.

3.2.4 Matrixdock and T Protocol (Permissionless On-Chain U.S. Treasury Bonds)

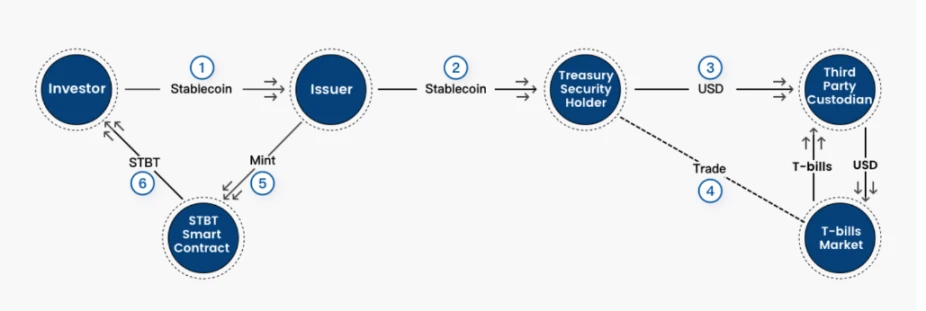

Matrixdock is an on-chain bond platform launched by the Singaporean asset management company Matrixport, and Short-term Treasury Bill Token (STBT) is a product based on U.S. Treasury bonds introduced by Matrixdock. Only KYC-verified Qualified Investors can invest in Matrixdock's products. Investors deposit stablecoins into the whitelist address and mint STBT, which is backed by 6-month U.S. Treasury bonds and repurchase agreements collateralized by U.S. Treasury bonds. STBT can only be transferred between whitelisted users, including within the Curve pool.

(Source:https://www.matrixdock.com/stbt/home)

The implementation path of STBT is as follows: (1) Investors deposit stablecoins into the STBT issuer, and the issuer mints the corresponding STBT through a smart contract; (2) The STBT issuer exchanges stablecoins for fiat currency through Circle; (3) The fiat currency is placed under the custody of a qualified third party and used by the qualified third party to purchase short-term bonds maturing within six months or to enter the overnight repurchase market of the Federal Reserve through a traditional financial institution.

3.2.5 Summary

In the case of MakerDAO, for the purpose of asset management, it needs to convert some of its stablecoin assets in the treasury into RWA assets. In terms of implementation paths, compared to the large-scale purchase of U.S. Treasury bonds through the Monetalis trust legal structure path, the RWA asset pools from Centrifuge currently adopted by MakerDAO are relatively small in size, with the largest-scale BlockTower S4 just reaching over one billion USD. The advantage of Centrifuge's RWA solution lies in its simple process and the fact that MakerDAO does not need to build a complex legal structure itself.

Matrixdock's RWA implementation path is similar to Ondo Finance, and due to compliance requirements, it needs to implement a strict whitelist system. Given the high threshold of the whitelist system, after implementing RWA on-chain, Ondo Finance can improve liquidity by linking with Flux Finance's DeFi lending protocol, allowing for borrowing against OUSG. Meanwhile, Matrixdock can achieve permissionless circulation of U.S. Treasury bond RWAs through the T protocol.

4. RWA and the Collision of DeFi Lego

We believe that the application logic of RWA interest-bearing assets based on the U.S. dollar standard and the DeFi application logic of LSD interest-bearing assets based on the ETH standard are consistent. Mapping interest-bearing assets to the chain with RWA is just the first step (Staked US Dollar), and the subsequent integration with DeFi and the integration of DeFi Lego will become very interesting.

In the cases mentioned above, we also see the combination of Ondo Finance and Flux Finance, as well as MatrixDock and T protocol and Curve. The following will list the "Web3 Yu'ebao" product in the TRON ecosystem - stUSDT, to further understand the application of bringing interest-bearing assets to the chain with RWA, and then compare it with the Pendle project based on the LSD track, to further understand the possible application scenarios of RWA+DeFi.

4.1 stUSDT - Web3 Yu'ebao

On July 3, 2023, the TRON ecosystem officially launched the RWA stable collateral product stUSDT, positioning it as the "Web3 version of Yu'ebao," allowing users to collateralize USDT to obtain real-world RWA returns. The collateral certificate stUSDT will also become an important building block in the DeFi Lego world built on the TRON ecosystem.

Specifically, when users collateralize USDT, they can mint collateral certificates stUSDT at a 1:1 ratio. stUSDT will be anchored to real-world assets (such as government bonds), and the stUSDT-RWA smart contract will distribute returns to holders through a Rebase mechanism. Designed with reference to Lido stETH, stUSDT is also a wrapped TRC-20 token, which will further enhance its composability in the TRON ecosystem, integrating with DeFi Lego and unlocking the infinite potential of assets.

In an interview with Foresight News, Justin Sun stated, "stUSDT has strong composability. It can exist in various DeFi lending, yield, and contract protocols, and can also be listed on exchanges for user trading. In the future, stUSDT will become a fundamental anchor for the $50 billion in assets on the entire TRON chain, which is also very important for the entire DeFi Lego."

4.2 Pendle - Interest Rate Derivative Protocol

Pendle is an interest-bearing asset-based interest rate derivative protocol that allows users to execute various principal and interest-based yield management strategies according to their risk preferences. Since Ethereum transitioned to proof of stake (POS), the popularity of the ETH liquidity staking (LSD) track has brought Pendle's TVL to over $145 million.

First, Pendle defines "Yield-Bearing Tokens" (SY) as any token that can generate returns, such as stETH obtained by staking ETH on Lido. Pendle then splits the Yield-Bearing Tokens (SY) into "Principal Tokens" (PT) and "Yield Tokens" (YT), where P (PT) + P (YT) = P (SY). PT represents the principal portion of the underlying interest-bearing asset, giving users the right to redeem the principal before the maturity date, while YT represents the returns generated by the underlying interest-bearing asset, giving users the right to receive returns before the maturity date.

Subsequently, Pendle AMM (Automated Market Maker) enters the scene, setting up trading pairs of Principal Tokens (PT) / Yield Tokens (YT) in Pendle's liquidity pool. Users can use the constant formula X*Y=K to devise trading strategies based on market conditions, such as increasing yield exposure in a bull market and hedging yield decreases in a bear market.

As an interest rate derivative protocol, Pendle brings the TradFi interest derivative market (worth over $400 trillion) into DeFi, allowing everyone to use it. By creating an interest rate derivative market in DeFi, Pendle unleashes the full potential of interest rates, enabling users to execute advanced yield strategies, such as: (1) Fixed income (earning fixed income through stETH); (2) Bullish yield (betting on the increase in stETH yield by purchasing more yield); (3) Earning more yield without additional risk (providing liquidity with stETH).

5. Conclusion

Being overly fixated on the definition of RWA is meaningless. Tokens are the carriers of value, and the value of RWA depends on bringing the rights/value of underlying assets to the chain and its application scenarios.

In the short term, the driving force behind RWA comes more from the unilateral demand of DeFi protocols in the crypto world, such as asset management, diversified investment, and new asset categories. DeFi protocols capture the interest value of underlying assets through RWA projects, establishing a U.S. dollar standard with real yield-bearing assets. This logic is essentially consistent with establishing an ETH standard for interest-bearing assets in LSD. Therefore, the popularity of U.S. Treasury bond RWAs can be divided into (1) Off-Chain to On-Chain paths represented by traditional compliant funds, and (2) On-Chain to Off-Chain paths dominated by DeFi protocols, but regulatory compliance still poses significant obstacles.

Mapping interest-bearing assets to the chain with RWA is just the first step (e.g., TRON's "Web3 Yu'ebao" product - stUSDT). Exploring how to integrate with the composability of DeFi Lego in the future is very worthwhile, and it is expected to further open up the ceiling of RWA+DeFi. This can be compared to the LSD-Fi track's Pendle interest rate swap project or stablecoin projects based on LSD.

In the long term, RWA should not be one-sided, such as the current unilateral demand of DeFi for TradFi. The future will be a two-way journey, where real-world assets can be brought to the chain on one hand, and TradFi can leverage the various advantages of DeFi to further unleash its potential on the other hand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。