Prices and Charts

After last month’s extreme market plunge as Sam Bankman-Fried’s FTX exchange collapsed, some traders might be grateful for a bit of respite – in the form of a sideways-trading market.

Both bitcoin (BTC) and ether (ETH) were essentially flat over the last week, with the two largest cryptocurrencies trading .005% and .006% higher than the last recorded price on Dec. 2. Volume for both has been stable, with trading activity falling slightly below their respective 20- day moving averages.

BTC appears to be bumping up against potential resistance at current levels. A look at the asset’s Volume Profile Visible Range (VPVR) indicator indicates high levels of price agreement at current levels, which can lead to static price movement. If BTC breaks above this level, the next high volume node appears at the $20,000 level.

ETH prices, since hitting a short-term bottom on Nov. 22 are showing the early makings of a potential uptrend, with prices up 12% since that day. A distinction between ETH and BTC’s recent price action is that ETH has pushed past a high volume node at $1,200 with the next stop above being at $1,340.

Top 90-day performers

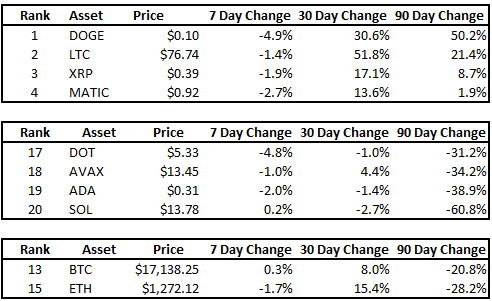

Among the top 20 cryptocurrencies by market capitalization, your 90-day winners are dogecoin (DOGE), litecoin (LTC), XRP (XRP) and Polygon's MATIC.

The laggards are polkadot (DOT), avalanche (AVAX), cardano (ADA) and solana (SOL).

Bitcoin and ether are near the middle of the range, ranking 13th and 15th respectively.

Each leader is down versus the USD over the last seven days, as are the laggards, except for SOL.

Correlations

Bitcoin and ether prices remain tightly correlated at 0.96. Despite the differences between the two assets in supply, consensus mechanism, and utility, their prices continue to move in tandem. Other bitcoin correlations of note include:

The week ahead…

The upcoming week will have its share of headline-worthy moments.

On Dec. 13, the U.S. House Financial Services Committee will hold “Part 1” of a hearing titled “Investigating the Collapse of FTX.” Embattled former CEO of FTX, Sam Bankman-Fried has agreed to testify before the committee, following the threat of subpoena.

The Senate Banking Committee will be holding its own FTX hearing the following day. Whether Bankman-Fried appears remains unclear.

The threat of a Senate subpoena may have a similar effect to the House Financial Service Committee’s action.

The impact of these events on crypto prices will be long-term and connected to legislation arising from each committee’s findings.

The Federal Reserve’s Federal Open Market Committee (FOMC) meeting on Dec. 14 may have a more immediate effect, although markets seem to have already priced in a 50-basis point rate hike. Investors will likely be eyeing the Fed funds futures rate curve following the meeting.

Currently, markets anticipate that rates will reach 5% during the second and third quarters of 2023.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。