Tokens of the decentralized exchange GMX surged close to an all-time high Wednesday as Binance and FTX, two of the world’s most widely used crypto exchanges, announced plans to list the project.

GMX jumped to as high as $60 from around $40, data on crypto price tracker CoinGecko shows, the highest since January, when the price hit $62. The token has since pared some of its gains, changing hands at $48 at press time. Trading volume exploded, reaching $150 million in the last 24 hours, almost 20 times larger than the previous day, CoinGecko data shows.

GMX is a decentralized exchange (DEX), meaning that investors can buy and sell tokens without an intermediary using smart contracts. The platform offers low fees and so-called zero price impact trading, which allows more capital efficient trading without slippage.

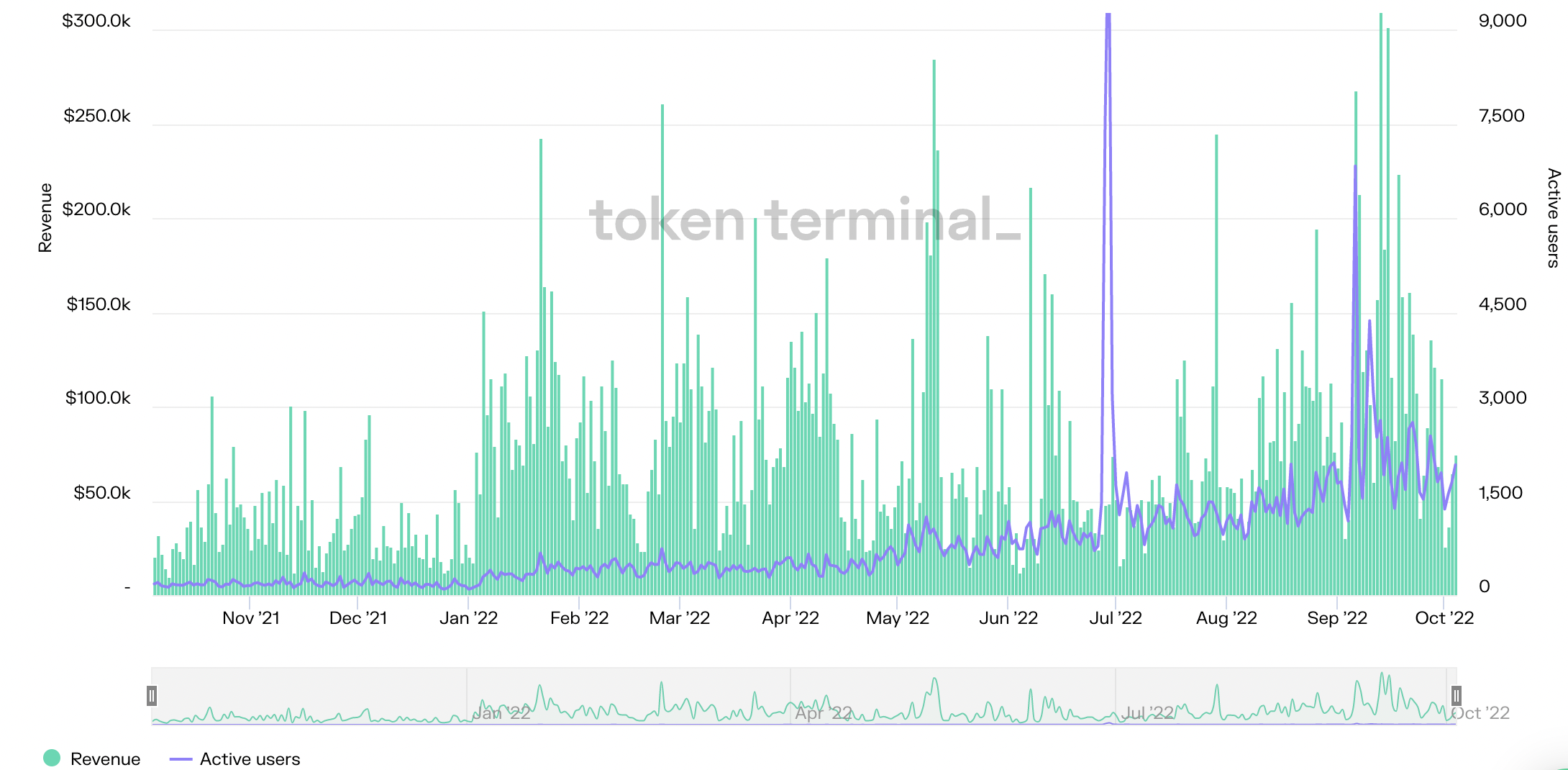

The protocol gained popularity among cryptocurrency traders as it defied this year’s market rout. As other decentralized finance protocols saw their total value locked (TVL) – an important metric for how much capital a platform can capture – deflate, GMX’s TVL has grown consistently; it currently stands at a record-high $455 million, according to crypto data provider DefiLlama. Holders of the GMX token earn 30% of all the trading fees accrued on the exchange.

Notoriously, in early September, a savvy trader exploited a loophole on GMX’s smart contract code to manipulate the price of AVAX, the Avalanche blockchain’s native token, netting over $500,000 to $700,000 in profits, CoinDesk reported.

Traders could deposit GMX and trade against BTC, USDT and BUSD pairs on Binance starting Wednesday at 10:00 UTC, the exchange said in a statement. FTX said it would allow trading in the token starting at 14:00 UTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。