In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

As the cryptocurrency market continued its downward trend throughout the week, Bitcoin fell below $61,000 on Thursday and then began to rebound on Friday. In terms of ETFs, the outflow trend continued, with Grayscale's outflow impact decreasing as its management scale continued to decline. With the positive news of NOT being listed on Binance, the pre-market trading price surged significantly, rising by 68.77% in 24 hours. Bitget will also launch the notcoin pre-market today, and users may consider positioning themselves early and wait for the opening.

Strong wealth creation sectors: Ton ecosystem tokens, DeFi sector;

User hot search tokens & topics: UXUY, Space Nation;

Potential airdrop opportunities: Grass, Movement;

Data Statistics Time: May 10, 2024, 4:00 (UTC+0)

I. Market Environment

As the cryptocurrency market continued its downward trend throughout the week, Bitcoin fell below $61,000 on Thursday and then began to rebound on Friday. As of 4:00 UTC on May 10, the price of Bitcoin had rebounded to above $62,800.

In terms of trading markets, according to DeFiLlama data, the trading volume on the Solana chain's DEX reached $1.314 billion yesterday, surpassing the $1.297 billion trading volume on Ethereum's DEX.

In terms of ETFs, the outflow trend continued, with a net outflow of $11 million for Bitcoin spot ETFs yesterday. Among them, Belad IBIT had a net inflow of $14 million, while Grayscale GBTC had a net outflow of $43 million. Unlike previous weeks, this week, except for Grayscale, other spot ETFs remained in a net inflow state, and the outflow impact of Grayscale also decreased as its management scale continued to decline.

II. Wealth Creation Sectors

1) Sector Movement: Ton Ecosystem Tokens (TON, FISH, GRAM, NOT)

Main reasons: Binance's new coin mining launched the 54th project, using BNB, FDUSD for mining Notcoin (NOT), and the Ton ecosystem received short-term positive news.

Price increase: TON, FISH, GRAM token prices increased by 8.62%, 22.1%, 17.03% respectively in the past 24 hours.

Factors affecting future market:

Future price performance of NOT: With the positive news of NOT being listed on Binance, the pre-market trading price surged significantly, rising by 68.77% in 24 hours. Bitget will also launch the notcoin pre-market today, and users can position themselves early and wait for the opening.

Future support for the Ton ecosystem by Pantera: Dan Morehead, founder of Pantera Capital, mentioned on social media that Pantera recently made the largest investment in the history of the fund in Telegram's TON blockchain project, increasing attention to the Ton ecosystem. If project financing and product launches and other support can be timely implemented, the prosperity of the Ton ecosystem will come faster.

2) Sector Movement: DeFi Sector (VRTX, LBR)

Main reasons: Vertex Edge implemented a new fee structure and will start increasing the staking rewards for $VRTX to earn cross-chain fees. Due to the significant increase in VRTX's earnings, the token price received positive news and rose. Meanwhile, after the whale sold tokens, the price of LBR began to recover, and on-chain prices started to rise.

Price increase: VRTX, LBR increased by 65.51%, 30.61% in the past 24 hours;

Factors affecting future market:

Future market conditions: Trading DeFi projects are more dependent on on-chain trading activity. When the market rises or in high volatility, traders and trading volume increase. If the market turns bearish, the relative trading volume will shrink. DeFi project token prices will also be affected by the decrease in total project business volume.

New projects in the DeFi race continue to emerge, and new projects are valued relatively high, with limited potential funds available in the market. Investors should keep an eye on the current competitive landscape, lock in leading projects, and dissipate the heat of most projects that have already issued tokens or have stagnated development.

3) Sectors to Focus on in the Future: SocialFi Sector

Main reasons: Base has achieved great success in the SocialFi field, with multiple top cryptocurrency-based social applications built on Base. 46% of the transactions related to SocialFi occur on the Base chain. Meanwhile, socialfi projects such as Friend and Degen have brought a lot of wealth effects. DEGEN completed the myth of reaching a market value of $1 billion in three months.

Specific project list:

Friend: Friend.tech is a decentralized social platform built on the second-layer network Base chain launched by Coinbase, which allows users to monetize their Web2 identity based on their strong ties to Twitter. In this product, each user can be tokenized, and their influence can be directly priced by the market. The project has already issued tokens, with a daily trading volume exceeding $21 million.

Degen: After the launch of the Degen channel on Farcaster, this project issued tokens, mainly allowing users to reward high-quality content creators with Degen. The decentralized social protocol Farcaster's total revenue has exceeded $1.2 million, with a user base of over 300,000, making it one of the most anticipated projects on the Base chain.

III. User Hot Searches

1) Popular Dapp

UXUY:

The next-generation decentralized multi-chain trading platform UXUY, incubated by Binance Labs, completed a $7 million Pre-A round of financing, with participation from institutions from Asia, North America, and Europe, including Binance Labs, JDI Ventures, NGC Ventures, Metalpha, and GSR. The total financing amount for UXUY has exceeded $10 million. This round of financing will be used to build the Bitcoin ecosystem infrastructure, aiming to promote efficient, low-cost transactions for assets such as Lightning Network Taproot Assets, Ordinals BRC-20, and Runes.

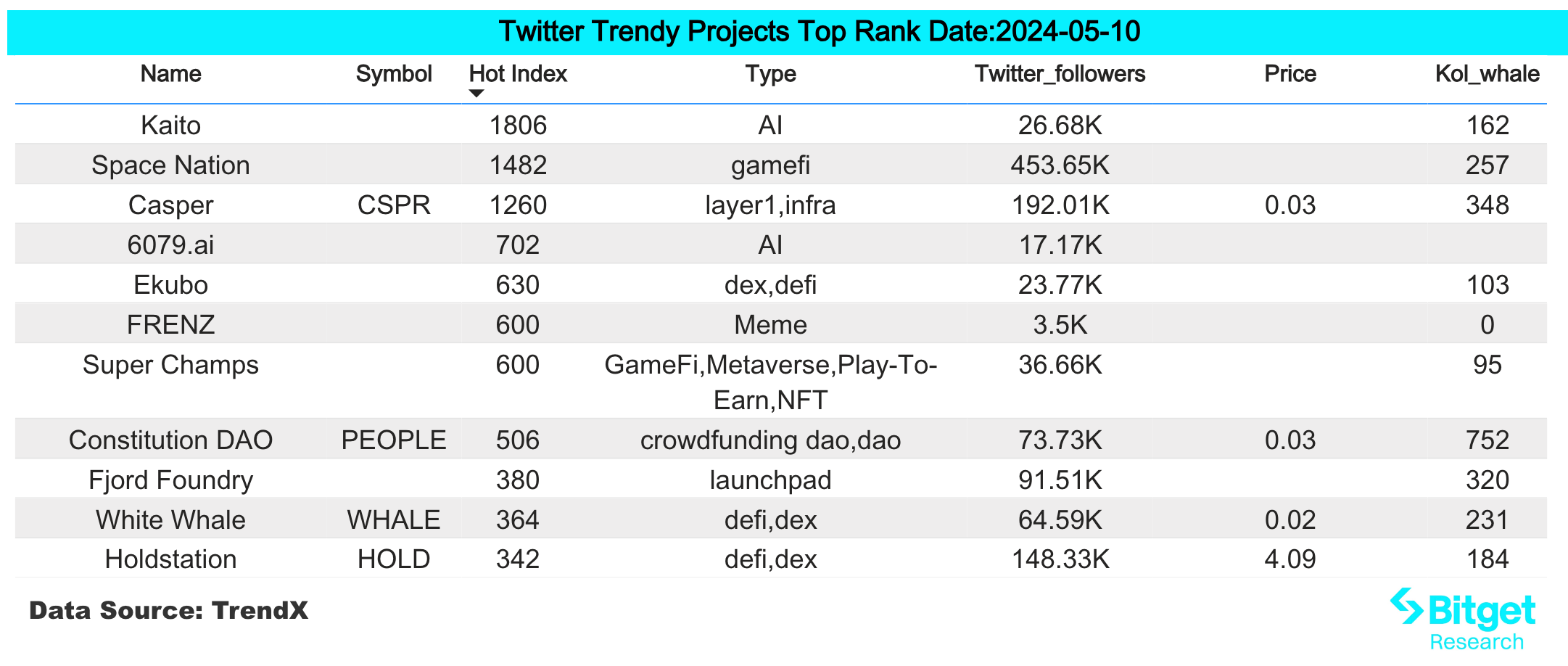

2) Twitter

Space Nation:

Space Nation is the developer of a AAA space epic-themed Web3 MMORPG. It was created by senior Blizzard game producers, experienced MMORPG developers, and Hollywood's famous producer and Oscar-winning director Roland Emmerich. Space Nation Inc. has also received strong support from partners and venture capital institutions, with a total investment of up to $50 million being poured into the game's development. Yesterday, OKX Web3 and Space Nation launched a limited edition collaborative spaceship NFT "Bering X-Pioneer Edition," limited to 1155 ships, with unique design elements from OKX, attracting high community attention.

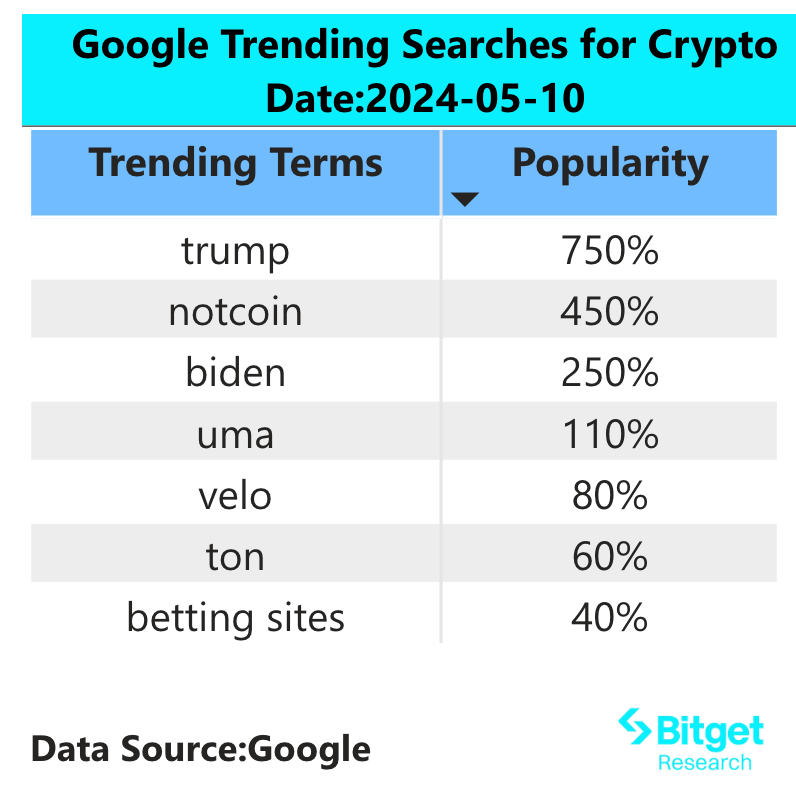

3) Google Search & Region

From a global perspective:

Notcoin (NOT): Notcoin is a Telegram-based game where users can earn in-game tokens by clicking on a coin image. Similar to the concept of "Tap to Earn." Before the Notcoin TGE, "vouchers" were used to represent the in-game Notcoin currency, which can be exchanged for $NOT after the TGE. The project has its own pre-market trading market: https://getgems.io/notcoin, and data shows that 640,000 users hold NOT pre-market tokens. It is currently confirmed to be listed on Binance Launchpool and OKX.

From the hot searches in various regions:

(1) In various regions of Asia, yesterday's hot search focus was mainly on RWA Crypto:

The RWA track currently mainly includes U.S. bond products, and with the Federal Reserve continuously signaling to maintain high interest rates, RWA assets are also seen by the market as a long-term hedge against current risk market asset types. In addition, recently, HashKey Group joined the Hong Kong Monetary Authority's Ensemble project architecture working group. HashKey Group will integrate its practical experience in various aspects such as virtual asset custody, trading, digital payments, STO technology solutions, and tokenization of RWA assets, providing comprehensive Web3 new financial infrastructure support for financial assets such as bank deposits and green bonds. It has a certain level of popularity in the Asia-Pacific region.

(2) There are no significant hotspots in Africa, CIS, and English-speaking regions:

The regional heat in this area shows a relatively scattered performance, with BTC, ETH, Solana mainly appearing frequently in hot searches. Some users may focus on narratives related to AI and Meme, and the overall market shows thematic differentiation.

IV. Potential Airdrop Opportunities

Grass

Grass is the flagship product launched by Wynd Network, which allows users to profit from the internet connection by selling unused network resources. For individuals, it will appear as a network extension, downloaded, retained, and forgotten. It will work behind the scenes to help others access public network data in exchange for payment in the protocol's native token. Grass focuses on transforming public network data into artificial intelligence datasets, making it easier for open-source artificial intelligence projects to access public network data.

Wynd Network completed a $3.5 million seed round of financing, led by Polychain Capital and Tribe Capital, with participation from Bitscale, Big Brain, Advisors Anonymous, Typhon V, Mozaik, and others. Wynd's total financing amount has reached $4.5 million.

Specific participation method: After registering on the Grass official website, install the web plugin, wait to complete the network connection, click on opendashbord, enter your control panel to see your connection status, and contribute bandwidth by hanging up to earn points. On the control panel page, you can see your daily hanging points income and network status.

Movement

The blockchain development team Movement Labs was founded in 2022 and previously completed a $3.4 million seed round of financing in September 2023. In addition to the flagship product Movement L2, Movement Labs will also launch Move Stack, which is an execution layer framework compatible with rollup frameworks such as Optimism, Polygon, and Arbitrum.

The blockchain development team Movement Labs was founded in 2022 and previously completed a $3.4 million seed round of financing in September 2023. In addition to the flagship product Movement L2, Movement Labs will also launch Move Stack, which is an execution layer framework compatible with rollup frameworks such as Optimism, Polygon, and Arbitrum.

Recently, Movement Labs completed a $38 million Series A financing round, led by Polychain Capital, with participation from Hack VC, Foresight Ventures, Placeholder, and many other well-known institutions.

Specific participation method: Enter the Movement zealy task interface (Note: social tasks have time periods and continuously updated tasks), and you can interact with DEX, interact with a few test transactions, and wait for subsequent actions on the official website.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。