LeverFi's layout in the Bitcoin ecosystem is also very obvious: it focuses on both technology and asset issuance, leveraging the liquidity and attention of different parties.

By: TechFlow

When it comes to the Bitcoin ecosystem, people may first think of inscriptions like Ordi or BTC L2 solutions like Stack. However, beyond the public eye, the veteran DeFi project LeverFi has achieved a 240% increase in the token $LEVER within three months, thanks to its new layout in the Bitcoin ecosystem.

Although the phenomenon of "old coins thriving in a bull market" is not particularly novel, compared to other projects in the same period, $Lever's price performance shows a determined upward momentum.

Behind the rapid rise is LeverFi's shift in business focus towards the Bitcoin-related narrative. From old business to new tracks, from infrastructure to application scenarios, what kind of layout has LeverFi made?

OmniZK: Exploring BTC Performance Enhancement

Currently, the market's focus on the BTC ecosystem mainly revolves around new asset issuance and BTC network performance improvement, both of which LeverFi has ventured into.

In response to the low scalability and poor computational capabilities of the BTC network, LeverFi has introduced a modular zero-knowledge proof protocol called OmniZK.

In simple terms, OmniZK uses cross-chain technology to "outsource" data belonging to the BTC network to the EVM (Ethereum Virtual Machine). After the EVM processes complex calculations, the data is then packaged and sent to the BTC network in encrypted form through ZK, ultimately achieving settlement on the BTC chain.

To make an analogy:

OmniZK is similar to an efficient international express delivery company. You (the developer) need to send a heavy item from point A (requiring complex calculation data and instructions) to a company at point B (the Bitcoin network). However, this item is too heavy for regular delivery companies to handle and pack.

So, you choose OmniZK, a company with specialized handling equipment (EVM), which specializes in transporting such large items and can provide a dedicated container for packaging (zero-knowledge proof). The container displays all the necessary information about the item to prove its safety, without revealing the specific contents.

Finally, the package successfully passes through customs at point B and is safely delivered to the company (completing the transaction settlement on the Bitcoin blockchain).

Applied to specific technical implementation:

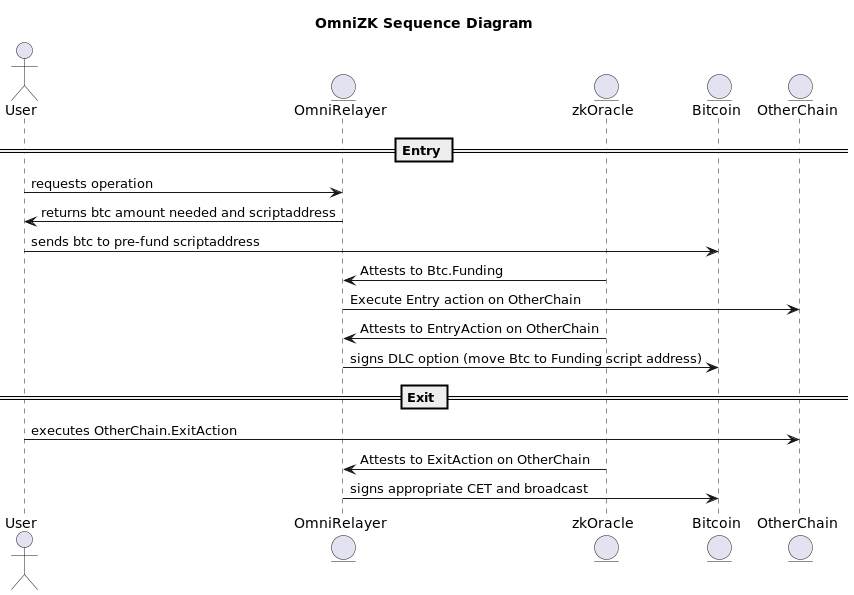

OmniZK has service provider nodes, OmniRelayer, distributed around the world, ready to undertake "freight" services for users at any time. Upon receiving the user's freight demand, OmniRelayer first calculates the amount of BTC required for this service, and the user locks the funds by sending BTC to a pre-provided BTC script address.

Once the funds are confirmed, OmniRelayer immediately begins the secure inspection of the freight, uses zkOracle to synchronize various information during the entire shipping process, and applies encrypted packaging (ZK encryption) through L0 Endpoints for cross-chain transportation.

Upon successful delivery and confirmation of information by zkOracle, OmniRelayer signs a discrete logarithm contract (DLC) and officially sends the previously locked BTC to the formal BTC address.

With this, the transaction is completed.

The introduction of OmniZK does not necessarily mean a market takeover of existing BTC L2 solutions, but rather provides a possible avenue for value addition.

OmniZK supports a wide range of cross-chain Bitcoin use cases, including but not limited to: non-custodial BTC liquidity pledging, cross-chain Bitcoin DeFi markets, decentralized asset bridges, and comprehensive chain liquidity management.

Applications built using OmniZK are independent of the Bitcoin Layer 2 network but complement it. By providing zero-knowledge proofs and the ability to verify complex logic, OmniZK enhances the settlement capabilities and privacy protection of BTC L2, offering a better solution for users and developers with higher demands for privacy and security.

LeverPro: BTC Asset Issuance Platform

In the asset issuance aspect of the Bitcoin ecosystem, LeverFi has launched the BRC20 asset issuance platform LeverPro, where users participate in new project launches within the platform by pledging their $LEVER tokens.

Since the launch of LeverPro, two projects have successfully been issued within the platform: Orange Crypto, a DeFi protocol that provides asset management for the BTC ecosystem, and Flash Protocol, which implements BTCFi functions such as pledging, exchanging, and borrowing native BTC assets.

Both projects saw excess returns of 5-13 times at their peak prices.

According to the platform's rules, not all users participating in the pledge can obtain token shares. Addressing this pain point, LeverPro is preparing to launch the latest project: $LEVP, Launchpad privilege points.

The use case of $LVEP can be simply explained as a PASS CARD within the platform. Users who pledge LEVER and hold LEVP will gain special access rights, including but not limited to guaranteed/priority allocation of golden tickets and top-tier allocation scales newly launched on LeverPro.

Whenever a user claims their guaranteed allocation, a certain proportion of LEVP will be destroyed, leading to a continuous reduction in the circulating supply.

In fact, whether it is OmniZK enhancing BTC performance or LeverPro issuing new assets, LeverFi is to some extent replicating the path of the Ethereum DeFi ecosystem: faster performance and more asset issuance.

These are the advantages of LeverFi as a veteran DeFi project. By starting with BRC20 asset issuance and leveraging its own resources in decentralized finance, it gradually introduces the entire set of DeFi gameplay into the BTC ecosystem.

Conclusion

In the current market consensus of not promoting old projects and not picking up each other's projects, LeverFi, by actively turning to the construction of popular market narratives using its own advantages, may provide a neutral reference for some old projects that do not want to be left behind by the times.

At the same time, LeverFi's layout in the Bitcoin ecosystem is also very obvious: it focuses on both technology and asset issuance, leveraging the liquidity and attention of different parties.

Projects like LeverFi, which actively seek change to reinvigorate the ecosystem through technological innovation and financial expansion, while empowering tokens, increase confidence for community members who believe in and support the project.

Of course, as the market sentiment shifts and market hotspots continue to evolve, whether LeverFi's development in the BTC ecosystem will be abandoned halfway or will endure, it is worth continuing to pay attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。