Who is buying and being hyped? It's you.

Written by: Duo Nine⚡YCC

Translated by: DeepTechFlow

I unexpectedly became a KOL, which was a lucky coincidence that gave me a deeper understanding of how this field operates. There are many things happening behind the scenes, and this is a window for you to understand it.

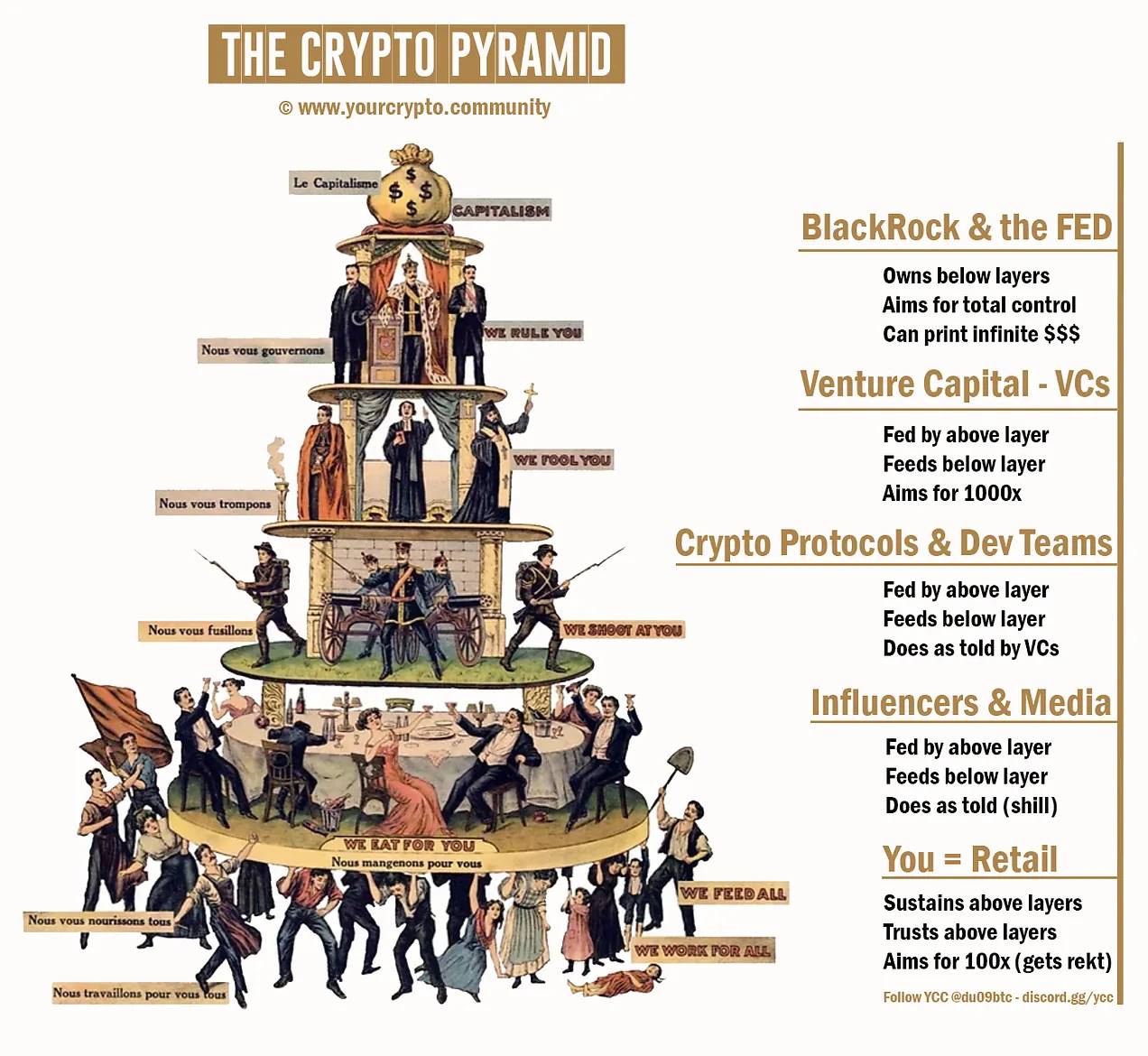

The operation of cryptocurrency is layered, just like a classic pyramid. The higher the level you are at, the more lucrative the returns. You, or the retail investors, are at the bottom of the pyramid. Here's how it operates.

Around 2020, I started posting my technical analysis on Twitter, and unexpectedly, my content quickly gained popularity. Today, four years later, I have built a great community that I call home.

I started getting involved with Bitcoin in 2014, and for a long time, I felt very confused. Most of the places I went to were very bad, and in most cases, it was very easy to be scammed, manipulated, or similar things to happen.

Let me introduce you to the other side of cryptocurrency, which most retail investors cannot see.

Overview of the cryptocurrency pyramid and its levels

Level One: You, the retail investors

Naive and easily trusting, retail investors are often abused and exploited. They are attracted to participate in the game by promises of 100x returns. Few people actually achieve this, and those who do quickly lose everything in the crypto gambling due to newfound greed.

This is the foundational layer of cryptocurrency. It sustains and supports all the higher levels. When venture capitalists earn 1000x returns on an investment, that money comes from retail investors. Every time a token is released through TGE (token generation event), IDO (initial Dex offering), or other methods, it is a time for all the levels above you to profit. This includes KOLs, media partners, development teams, exchanges, and venture capitalists.

Who is buying and being hyped? It's you.

This is the purpose of the people at the higher levels, to make you believe this narrative. If a big KOL says it's a good investment, it must be true, right?

Wrong.

They just want your money. It's that simple.

People at the higher levels buy tokens at a significant discount before TGE/IDO, or the development team can simply generate them out of thin air with a few lines of code.

Your purchase is giving value to that token, or in other words, you are transferring value to the upper levels. This is your key function in the pyramid, being exploited to provide value for something created out of thin air.

Level Two: KOLs and Media

KOLs and media companies in the crypto space serve the upper levels. They say and do anything they are paid to do. They get their sustenance from the upper levels and then pass on any content that retail investors want to hear (e.g., a new token that will increase by 100x).

Most KOLs cannot be trusted by retail investors because of conflicting interests, and the bigger the influence, the more you should be suspicious.

Why?

They may be sponsored by any party at the upper levels, promoting narratives that may not align with your interests. That new token is likely just a copy-paste project from the previous cycle with a new name. Don't be fooled, always do your own research. Most memes are like this.

Media companies may also collaborate with one or a group of KOLs to create "organic" engagement around tokens or topics, which is not a new thing. Crypto protocols and venture capitalists have marketing budgets, and they will use it.

You are their target, and the role of this level is to sell it to retail investors.

Whenever you see a KOL listing a series of new crypto projects in a post, most of these projects are promotional pieces mixed with genuine tokens, making uninformed readers believe it's a legitimate research article. In reality, they haven't discovered any good projects, they are just paid to do this.

Over time, you will be able to distinguish who is real and who is not, but if you are new to the crypto space, assume that everyone is eyeing your money, and then work backward, only trust Bitcoin because it is the most decentralized and difficult to control.

Level Three: Crypto Protocols and Development Teams

The most honest developer is Satoshi Nakamoto. Everything after him has been distorted. That's why there are over 13,000 shitcoins in 2024. 99% of them are shameless money grabs, with no technology or innovation, mostly hyped to make money from retail investors.

Every time a development team releases a new crypto protocol or blockchain and its related tokens or coins, they are actually conducting an unregistered securities offering.

This is mostly illegal in the US, but unregulated in most parts of the world. This is the fastest and easiest way to make money. The advantages of that new protocol or network are not important. Terms like DeFi, RWA, DePIN, SocialFI, or GameFI are used to confuse you, mostly to cover up the truth.

That's why when you read a new project's documentation, the most prominent parts are related to their tokens or the functionality of useless tokens. Note that some teams do this with a new name or brand in each cycle, and they have received a lot of funds from the previous cycle, which they can use to pay KOLs lower than them to work for them.

If developers can raise funds with just a promise, then they have already succeeded. Fulfilling that promise is not the focus. The only reason they exist is to make money for themselves and the higher levels. Venture capitalists sponsoring these teams expect to profit from their investments, not innovation.

This is the main purpose of most shitcoins. They are not here to help you or solve any problems. They are here to make quick money because the bull market is short-lived, and it's like a forest after the rain, with new mushrooms or shitcoins everywhere. But be careful—some are toxic!

Very few protocols are really here to build something long-term. That's why I suggest you pay more attention to tokens that have been around for a while and truly have practical use. It's best to consider those new projects that are truly innovative, the rest are hyped by KOLs. The AI narrative in the crypto space is the latest example, 99% is hype, only 1% is a real use case.

Cryptocurrency is driven by greed, and part of the responsibility also lies with retail investors who have always dreamed of 100x returns, while the upper levels are happy to cooperate and create various crypto projects that shatter the dreams of retail investors.

Level Four: Venture Capitalists

These are the tycoons of the crypto space, they have money and power, and they control everything. They can manipulate or suppress the market, exchanges, or even kill tokens. They also drive the development of the cryptocurrency gambling by investing in various new projects proposed by crypto developers.

Undoubtedly, venture capitalists are here to make money. While retail investors dream of 100x returns, venture capitalists actually make 1000x profits during the crypto bull market. They buy at a few cents and sell to retail investors at hundreds of dollars.

They are the ones who start the bull market and sell at market highs, because they profit from these 1000x investments (smart money). Once the hype disappears, they stop the game and enter what we call a bear market.

In this game, if venture capitalists are on the wrong side, they will be crushed because it's a free competition game. In the previous cycle, there were many such examples due to the collapse of Terra Luna and FTX.

Venture capitalists receive funds from the upper levels, but if their investments succeed, they can also enjoy a large profit of their own. Just take a look at the price of Solana, and you'll know that some venture capitalists have made a fortune. Vitalik Buterin was surrounded by venture capitalists in the early days of developing Ethereum. They are all rich now.

Venture capitalists use this money to sponsor the development of new crypto projects. They promote the development of the space, which is a good thing, but they can also cause massive destruction. Venture capitalists are as greedy as retail investors, just with a few more zeros. Nevertheless, they play an important role in the crypto cycle because they are part of it.

Sometimes, development teams dislike venture capitalists, refusing to work with them or accept their bribes because they would lose their freedom. In these cases, venture capitalists have the final say, and sometimes retail investors are harmed. Some development teams care about this, while others do not.

This is also why some excellent development teams with outstanding projects have never succeeded, as they are not part of the venture capitalist club. If you hang out with members of the venture capitalist club, all levels below them will support your project, including retail investors (the dumb money) who are ready to accept anything fed to them by the upper levels.

Level Five: BlackRock and the Federal Reserve

BlackRock recently entered the crypto space in a public manner through their Bitcoin ETF. Privately, they have been deeply involved in this space for years through venture capital. They have traditional finance, and cryptocurrency is their latest expansion. The role of the Federal Reserve is quite simple, they can print dollars as needed, and they decide when the market will thrive or collapse.

BlackRock is the world's largest asset management company, and they naturally cannot ignore the latest asset causing a sensation—Bitcoin. This year, they joined the Bitcoin train in a public manner with the approval of a Bitcoin ETF, something that retail investors at the bottom of the pyramid have been trying to get approved for over a decade, but it was only truly approved when BlackRock decided to join, we call it power.

For years, BlackRock has been accumulating Bitcoin through its private trust fund (mostly secretly), and their listing was inevitable. They know the direction of Bitcoin, and they have become a part of it.

The role of the Federal Reserve in the crypto space is quite simple, they decide when to inject liquidity into the market, just like in traditional markets. Cryptocurrency is not exempt. When the Federal Reserve prints dollars out of thin air, the crypto market thrives. When they stop, the market collapses.

They effectively control the lives of everyone in all levels, and the rest is left to BlackRock. BlackRock or the Federal Reserve do not care about 1000x returns, they can print as much money as they need anytime, anywhere, money is not an issue for them.

Their main task is to control and master the power of the lower levels. They maintain this control through monetary policy and other tools. We are the victims of their decisions, with no right to influence or stop those decisions, they act as kings of the pyramid, doing as they please.

*Disclaimer

The above is just an illustrative example of how the crypto pyramid operates and the relationships between the various levels. The entities mentioned are not exhaustive or comprehensive, and there is much left unsaid.

There are some legitimate participants in this space working to advance the vision set by Satoshi Nakamoto, but they are few, and most participants are players in the crypto pyramid.

Finally, anyone who harms the upper levels will be swiftly punished, like CZ of Binance who would go to jail for it. This is why the true identity of Satoshi Nakamoto is unknown. He understood and correctly assessed the impact of his creation on the upper levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。