The world is bustling, all for profit; the world is often moving, all for profit! Hello everyone, I am your friend Lao Cui Shuobi, focusing on the analysis of digital currency market trends, striving to deliver the most valuable market information to the majority of coin friends. Welcome the attention and likes of the majority of coin friends, and refuse any market smokescreen!

In the case of the exchange rate downturn, the coin circle still ushered in a short-term pullback, causing many users to start questioning the impact of the exchange rate on the coin circle. For the time being, it seems that the exchange rate does not have a strong impact on the coin circle, but it has made many users wonder about Lao Cui's intentions. Many even hope that Lao Cui can notify everyone before the exchange rate falls, which is a bit of an overestimation of Lao Cui. The operating conditions of the exchange rate are based on adjustments made at the national strategic level, which is beyond Lao Cui's ability. It's like the domestic oil price adjustment, no one knows whether it will rise or fall until the day of the adjustment. We can only make a rough guess. As for the exchange rate issue, everyone can pay more attention to the import and export data of foreign trade, which may help everyone judge the overall trend of the exchange rate.

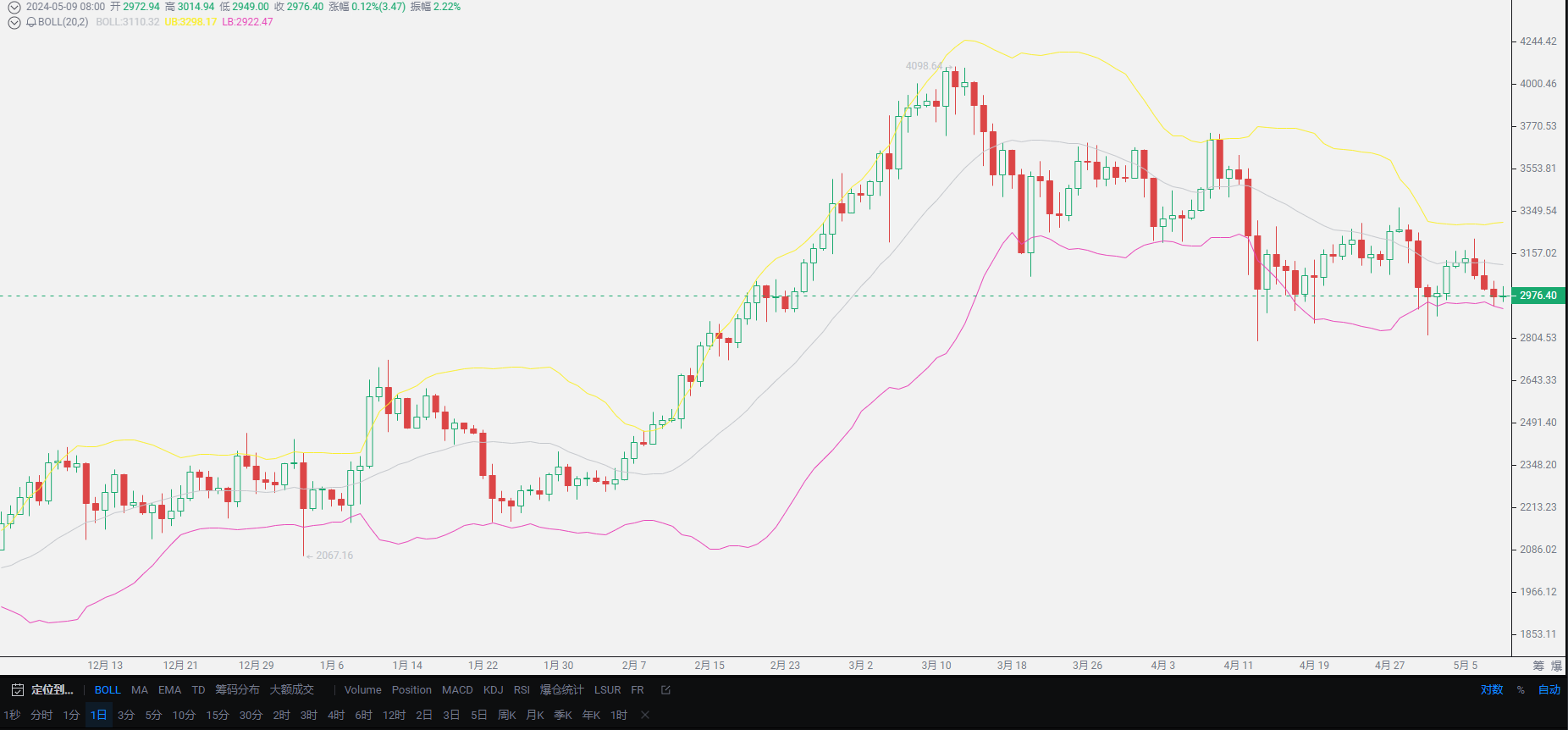

Through this round of pullback, many friends began to question why the U price drop did not lead to a market reversal. Today, Lao Cui gives everyone an explanation. The drop in U price can only indicate the arrival of a signal for a market reversal. Currently, the overall environment does not support the arrival of a bull market. It is certain that the price of U can only determine the upper limit of the coin circle, and for the lower limit, it can only play a supporting role. Simply put, if the price does not decline, the current drop may be deeper, even reaching near the 2900 for Ethereum and 60000 for Bitcoin. Overall, the current trend is still maintaining a wide downward trend, with the low points getting lower and lower. In April, it was still competing for the 70,000 mark for Bitcoin, but now it has started to run near 60,000. The current downward trend is higher than the bullish trend, but the wide oscillation has made everyone overlook this issue.

You can check the historical data. Almost all bull markets were initiated when the U price remained below 7. Breaking through this threshold, it is difficult for a large amount of funds to enter the coin market. For ordinary users, focusing on this threshold can give a sense of the arrival of a bull market. Only by making early arrangements can one catch a wave of bull market. It is difficult for anyone to get on board after the bull market starts, not to mention those who are not very familiar with the coin circle. Even Lao Cui dares not get on board after the start. Currently, the downward trend of the exchange rate can be considered as providing a bottoming situation for us, so the depth of this round of pullback may not be as severe as before, and the rebound may come earlier.

As long as the U price maintains its current stability, a rebound will come soon. However, this does not change the fact that we are currently in a wide pullback phase, which means that it is still bearish in the short term. Spot users still have the opportunity to operate in a short-term profit-taking manner, and should not be fixated on the amount of profit. Currently, the ability for spot users to maintain stable profits has already surpassed the vast majority of users. One must not focus on the profits of a bull market. Short-term profit-taking may pave the way for the next bull market. In simpler terms, spot users are no longer suitable for long-term operations. Currently, long-term operations will result in losses, and the bulls do not belong to the strong side at this stage.

As for contract users, it is almost unnecessary to emphasize that the wide oscillation situation is the world of contract users. This situation can be said to be even better for contract users than the arrival of a bull market. Many friends may hesitate or even dare not get on board in the face of a unilateral market in a bull market, leading to a situation where they only realize it after a bull market has passed. However, the current situation is actually easier for the majority of users to operate, because the current market trend means that as long as you hold, regardless of long or short, you will not incur losses. Even if you do not make a profit, as long as the timeline is extended, you will still return to your entry point. Therefore, what contract users need to do is to adjust their own mentality. As long as they do not have doubts after making a wrong move, they will not incur major losses. In the current situation, if contract users incur losses, there are only two reasons: either the position size is too large, or their own minds are not firm. After recharging their faith, overcoming these two situations can turn losses into gains!

In summary: the drop in U price proves that a market reversal is highly likely. It is not very helpful for the current market situation, but an increase in U price will definitely cause a downward trend in the coin circle. The current trend is still in the bearish range, so everyone who wants to enter the market can focus on the bearish trend. The signal for a reversal lies in the accumulation of funds. The arrival of a bull market only requires the appearance of an interest rate cut signal from the Fed. This year will definitely see the emergence of a bull market. For short-term users, the idea is to focus on the bearish trend and be ready to welcome the arrival of a bull market at any time. Spot users need to improve their operating methods and can engage in short-term swing trading. In the end, it is still Lao Cui's consistent old saying that the overall trend is definitely in favor of the bull market, but in the short term, everyone must follow the trend.

Lao Cui's message: Investment is like playing chess. A master can see five, seven, or even a dozen moves ahead, while a novice can only see two or three moves. The master focuses on the overall situation and the big trend, not just on individual moves, with the goal of ultimately winning the game. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only fighting for short-term gains, and often ends up in trouble.

Original article created by public account: Lao Cui Shuobi. If there is any infringement, please contact the author to delete it.

This material is for learning and reference only and does not constitute investment advice. Buying and selling based on this material is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。