ChainCatcher 消息,BiFi 新协议 UTXOSwap 发布轻皮书并计划于 5 月下旬开启公测。UTXOSwap 团队在 Bitcoin Devcon 黑客松比赛中获得 CKB 生态第一名,现已与 CKB Eco Fund 达成战略合作。

据悉,UTXOSwap 是一个基于 CKB 的去中心化交易(DEX)协议,旨在定义 Bitcoin Finance 交易新范式。UTXOSwap 采用以意图为中心的交易模式,利用 UTXO 编程模型的优势。目前支持 RGB++ 和 CKB 生态资产的交易,并计划未来扩展到包括 Ordinals、Runes 在内的其他 BTC 生态资产。

UTXOSwap 实现了基于意图的混合交易模型,同时支持自动做市商(AMM)机制和链外订单簿(Order book)撮合。此外,利用 CKB 底层技术,如密码源语等链级设计,UTXOSwap 具备 Swap 交易几乎 0 Gas 且可使用任意代币支付、支持用户自定义 AMM 曲线和手续费率、以及 dApp 原生兼容多链钱包和L1/L2 无感操作等优势。

以下内容来自《UTXOSwap 轻皮书》,原文链接:

https://utxoswap.gitbook.io/zh

UTXOSwap 轻皮书:定义 Bitcoin Finance 交易新范式

UTXOSwap 概述

UTXOSwap 是基于 BTC 生态的去中心化交易所(DEX)协议,旨在通过基于意图的(Intent-based)交易为用户提供更优质的交易体验和更好的成交价格。目前 UTXOSwap 会支持 RGB++ 和 CKB 生态的资产进行交易,未来还将扩展支持 Runes 等其他 BTC 生态资产。

目前常见的 DEX 主要有订单簿(Order book)和自动化做市商(AMM)两种形式,其中订单簿 DEX 受限于链上交易的高成本,并没有获得像中心化交易所那样的成功,AMM 则凭借其简单直接的交易理念获得了更为广泛的认可。然而,随着链上交易量和流动性的爆发,AMM 的问题也逐渐显现,比如效率低下,gas fee 竞争,MEV 横行等。于是,基于意图的(Intent-based)交易模型开始出现,它融合了订单簿和 AMM 的优势,让用户和做市商的体验和效益最大化。UTXOSwap 正是采用了基于意图的模式作为其核心,利用 UTXO 编程的优势全新设计的 DEX。

得益于 UTXO 的特性,UTXOSwap 有很多创新和优势:在交易模式上,UTXOSwap 能够做到链下撮合、链上验证,从而在撮合阶段可以接入 AMM 之外的流动性供应商;在性能上,UTXO 的并行特点也能让交易效率获得成倍地提升;在 gas fee 上,没有成交的意图不会产生 gas fee,正常成交的 gas 也低到可以忽略不计,如果有的交易对过于火爆,还可以采用 local fee 的模式隔离它们对其他交易对的影响。

UTXOSwap 是 BTC 生态非常重要的基础设施,能够很好地解决目前 BTC 生态资产流动性差、交易成本高的问题,降低资产发行和交易的成本并提供更多新玩法。UTXOSwap 将基于 UTXO 模型探索 Bitcoin Finance 独有的特点,致力于成为比特币生态的流动性基础设施,促进比特币生态的繁荣。

技术实现

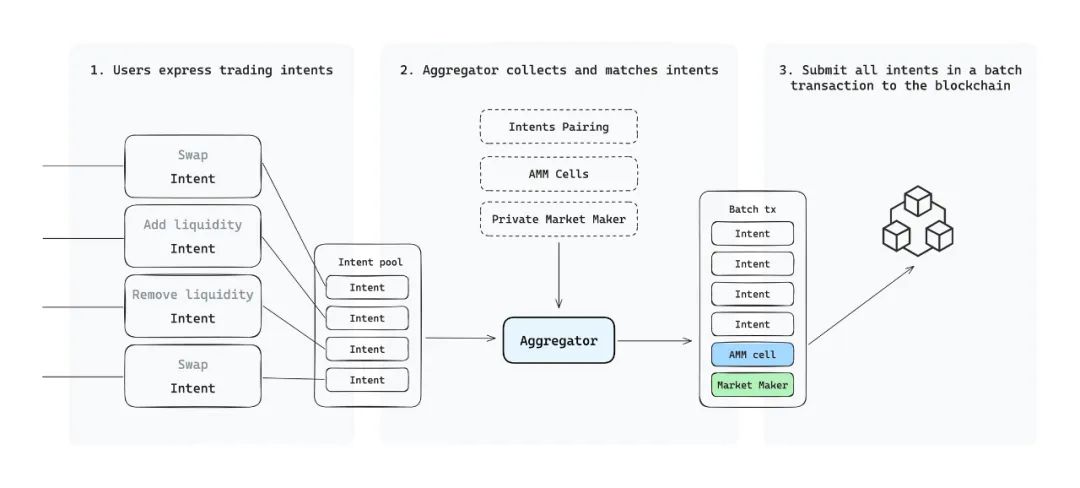

在 UTXOSwap 上,用户进行 swap 交易时,主要包括以下三个步骤:

- 意图表达:用户通过签署一个包含交易资产类型、金额以及其他参数的消息,来表达他们的交易意图。

- 聚合与匹配:聚合器收集所有用户的交易意图,搜索链上和链下的流动性资源,并进行意图匹配。

- 交易提交:聚合器将所有符合条件的交易组装好,并提交至链上。

聚合器可以利用的流动性来源包括:

- 直接匹配的用户意图

- AMM cells(CKB 链上构建的各类 AMM 流动性池)

- 第三方做市商提供的流动性

Intent Cell

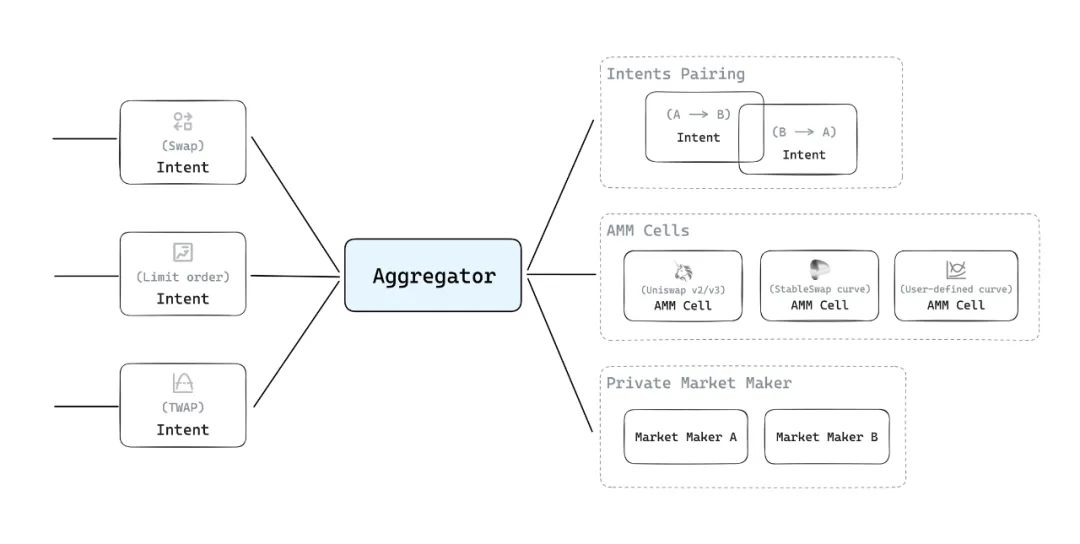

Intent cell 用于记录用户的交易意图,并确保其在消费时满足特定条件。对于 AMM 操作,意图可以分为三种类型:Swap、AddLiquidity 和 RemoveLiquidity。

用户在使用 UTXOSwap 时,首先需要发起一笔 CKB 交易,并在 intent cell 中详细记录其交易意图。例如,用户设定滑点并选择特定的资金池进行交易时,这些参数将被写入 intent cell。当 intent cell 被解锁时,脚本会验证输出中返回给用户的资产是否满足滑点要求,并检查是否包含指定的资金池 cell。

Intent cell 支持多种交易形式,除了标准的 swap 交易外,还将支持 limit order 和 twap(时间加权平均价格)交易等。这使得 UTXOSwap 平台能够满足用户的复杂交易需求并增强策略灵活性。用户可以通过详细设定 intent cell 中的参数,精确控制交易执行的条件和时机,优化交易效率和结果。

比特币还有一个独特功能是支持 PSBT(部分签名的比特币交易),这允许多方通过部分签名参与构建同一个交易。在 CKB 中,相应的 PSBT 扩展功能是 Open Transaction。在 UTXOSwap 集成 Open Transaction 后,用户可以通过链下签名方式直接构建交易意图,其他人则可以通过补充输入和输出来满足这些意图,可以提供更优的交易体验。

AMM Cell

AMM cell 负责与 AMM 相关的全部验证逻辑,包括意图交易的验证,流动性池中资产的管理,以及流动性凭证的生成和销毁。

在交易执行过程中,AMM cell 会验证每一笔交易意图,确保用户需求得到满足。同时,它还会检查流动性池的状态变化是否严格按照预设的 AMM 曲线进行,以确保整个资金池的安全性。

产品优势

Intent-based 混合交易模型

在传统的 AMM 交易模式中,每次交易只有用户和流动性池两个交易角色参与,用户要交易就只能接受当前流动性池的报价。站在用户角度,这个模式虽然提升了交易的便利性,但是损失了获得更好的成交价格的可能性,用户只能在两者之间做出取舍;站在做市商角度,创建流动性池被动做市会带来无常损失并丧失定价能力,而主动成交又会有滑点、MEV 等带来的不确定性。

为了解决上面的问题,基于意图的(Intent-based)交易模型出现了。在这种模型里,用户不再被动接受价格,而是主动给出自己的交易意图,比如“用 10 个 A Token 换到至少 20 个 B Token”。流动性供给侧也发生了变化,AMM 流动性池只是流动性供给的一种选择,如果有利可图,做市商可以根据用户意图直接成交;即便没有做市商撮合,如果 AMM 流动性池的价格符合用户意图的区间,交易也可以顺利完成,这时的交易流程就变成了限价单模式。

UTXOSwap 利用 UTXO 编程模型中链上验证的特点,做到了链下撮合、链上成交,很好地实现了上述基于意图的混合交易模型。在未来,我们还会对用户表达意图的能力进行拓展,比如实现类似荷兰拍的逻辑:价格在一定区间内随时间下降,这个过程中做市商根据自己的成本互相竞争,最后可以由 AMM 进行保底成交。

支持自定义曲线和手续费率

在 UTXOSwap 的 AMM 模型中,交易对创建者可以根据资产的特点对定价曲线进行自定义,比如针对稳定币类型的交易对可以采用 curve 类型的曲线。此外,交易池还有一些可选的手续费率,能够让不同的 LP 自由选择,最大化收益。

超低 Gas Fee,可用任意代币支付

UTXOSwap 单笔交易的 gas fee 成本约为 1/10000 CKB,按照当前的 CKB 价格计算,不到 0.000002(百万分之二)美元,几乎可以忽略不计。此外,得益于 UTXO 链下计算的特点,用户的交易意图在链下就可以进行可行性验证,如果无法成交则不会上链,用户也就不需要支付手续费。

另一方面,得益于 UTXOSwap 的设计,无论是 gas fee 还是状态空间占用,所需 CKB 都不需要用户感知,用户可以用任意 token 来无感支付这些成本,UTXOSwap 会自动将用户支付的 token 进行转换,并帮助用户进行 gas fee 的支付或者新 cell 的创建。

兼容多链钱包,L1/L2 无感操作

UTXOSwap 的用户无需下载使用专门的 CKB 钱包,而是可以直接使用熟悉的 BTC 钱包完成 L1/L2 的 Leap,L2 的交易以及转账等操作。体验上,用户的 BTC 地址会对应一个固定的 CKB 地址,而且 CKB 地址的控制权只属于这个 BTC 地址。这个对应关系是链级别的,因此在其他兼容多链钱包的 CKB 应用里,同一个 BTC 地址对应的 CKB 地址也能保持统一。

除了 BTC 之外,技术上还能支持 ETH / Solana / Tron 等多条主流公链钱包直接使用,如果未来有相应的资产协作场景,例如 CKB 到 Solana 的跨链,我们也会同步进行对应钱包的支持。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。